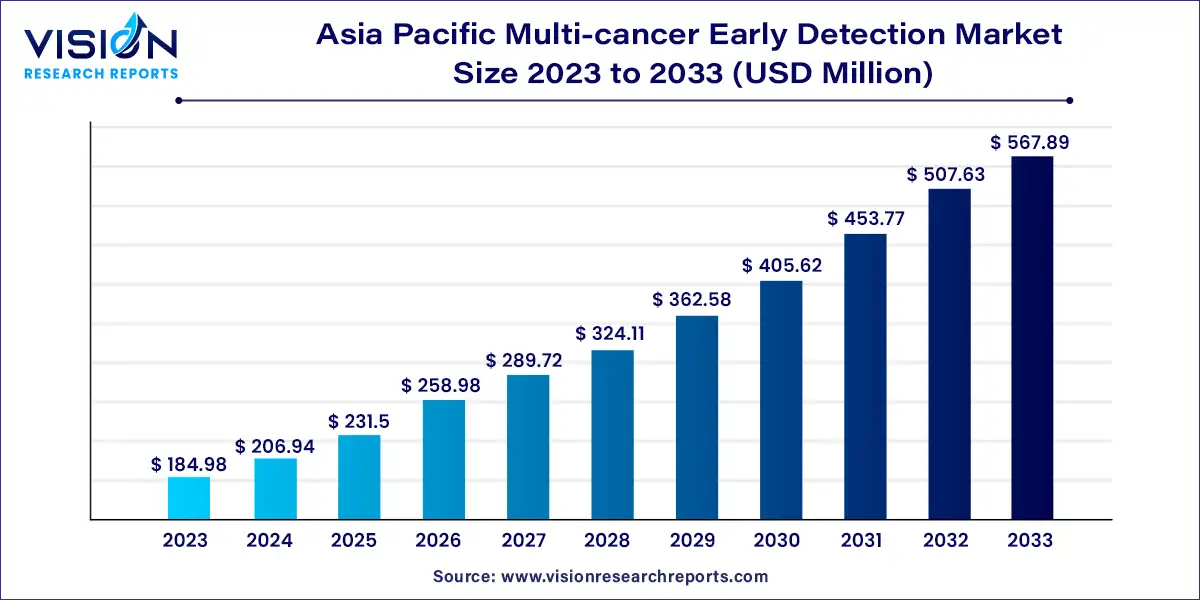

The Asia Pacific multi-cancer early detection market size was estimated at around USD 184.98 million in 2023 and it is projected to hit around USD 567.89 million by 2033, growing at a CAGR of 11.87% from 2024 to 2033.

The Asia Pacific region is witnessing a paradigm shift in cancer detection strategies, with a growing emphasis on multi-cancer early detection (MCED) approaches. As advancements in medical technology and research continue to unfold, the landscape of cancer diagnosis is evolving rapidly.

The growth of the Asia Pacific multi-cancer early detection market is propelled by an advancements in technology, particularly in genomic sequencing and liquid biopsy techniques, have revolutionized cancer diagnosis, enabling the detection of multiple cancer types at earlier stages. Secondly, the rising burden of cancer in the region underscores the urgent need for more effective screening methods to mitigate the impact of this disease. Additionally, shifting healthcare policies that prioritize preventive care and investment in early detection initiatives contribute to market expansion. These factors collectively drive the adoption of multi-cancer early detection solutions, offering significant growth opportunities for market players across the Asia Pacific region.

| Report Coverage | Details |

| Market Size in 2023 | USD 184.98 million |

| Revenue Forecast by 2033 | USD 567.89 million |

| Growth rate from 2024 to 2033 | CAGR of 11.87% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The gene panel, LDT, and others segment led the multi-cancer early detection market with the largest share of 100% in 2023. The segment’s dominance is attributed to the rising commercialization of tests. For the simple reason that they are generated and utilized in the same facility, Lab-developed Tests (LDTs) are launched into the market without FDA approval or any other independent regulatory assessment.

For instance, in May 2023, Guardant Health launched Shield, an LDT blood test, for the detection of early signs of colorectal cancer in the adult population aged above 45 years. Moreover, in December 2021, GRAIL finished recruiting participants for PATHFINDER, a prospective, multisite interventional study with 6,600 participants, which was carried out in accordance with a U.S. Food and Drug Administration Investigational Device Exemption application to assess the use of Galleri in clinical practice.

The liquid biopsy segment is expected to showcase the fastest CAGR over the forecast period owing to the expected launch of promising products post-FDA approval, which are currently being made available as LDTs. Liquid biopsy technology is one of the most evolving technologies in diagnostics. An increasing number of players are receiving funding from investors for the development of new tests.

For instance, in July 2023, Delfi Diagnostics, Inc. received funding of USD 225 million for the development of a high-performance and accessible MCED test. The company is working on reducing the cost of the test to make it more accessible to the masses. Liquid biopsy technologies have made remarkable progress in recent years, with a large increase in clinical application uptake.

The hospitals segment held the largest revenue share of 52% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. Hospitals are preferred for care due to the availability of various services under one roof. Developments in hospital laboratories are crucial to address the evolving needs of patients, and more hospitals aim to provide a wide range of services within their settings.

For instance, in September 2023, Henry Ford Health was the first medical center to provide Grail’s Galleri MCED test in Michigan to increase cancer detection and improve public health. Moreover, in December 2023, Mercy Hospital in St. Louis announced that it will begin testing for cancer that is still in its development stage with Galleri test, which can be used to detect around 50 different cancers.

The diagnostic laboratories segment is expected to show a significant growth rate over the projected period owing to increased testing and availability of resources for performing tests. There has been an improved reliance of hospitals on diagnostic laboratories for evaluation and testing, which is likely to accelerate segment growth.

Moreover, regulatory authorities are undertaking initiatives to improve clinical laboratory diagnostic services to simplify the diagnosis process. For instance, in January 2021, WHO published the first Essential Diagnostics List, a catalog of tests required to diagnose common diseases. Some of the tests mentioned in this list are especially suitable for primary healthcare facilities where laboratory services are, at times, nonexistent or poorly resourced.

By Type

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Asia Pacific Multi-cancer Early Detection Market

5.1. COVID-19 Landscape: Asia Pacific Multi-cancer Early Detection Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Asia Pacific Multi-cancer Early Detection Market, By Type

8.1. Asia Pacific Multi-cancer Early Detection Market, by Type, 2024-2033

8.1.1. Liquid Biopsy

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Gene Panel, LDT & Others

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Asia Pacific Multi-cancer Early Detection Market, By End-use

9.1. Asia Pacific Multi-cancer Early Detection Market, by End-use, 2024-2033

9.1.1. Hospitals

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Diagnostic Laboratories

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Asia Pacific Multi-cancer Early Detection Market, Regional Estimates and Trend Forecast

10.1. Asia Pacific

10.1.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. Grail, LLC (Illumina, Inc.)

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Exact Sciences Corporation

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. AnchorDx

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Guardant Health

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Burning Rock Biotech Limited

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. GENECAST

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Singlera Genomics Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Laboratory for Advanced Medicine, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. MiRXES Pte Ltd

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others