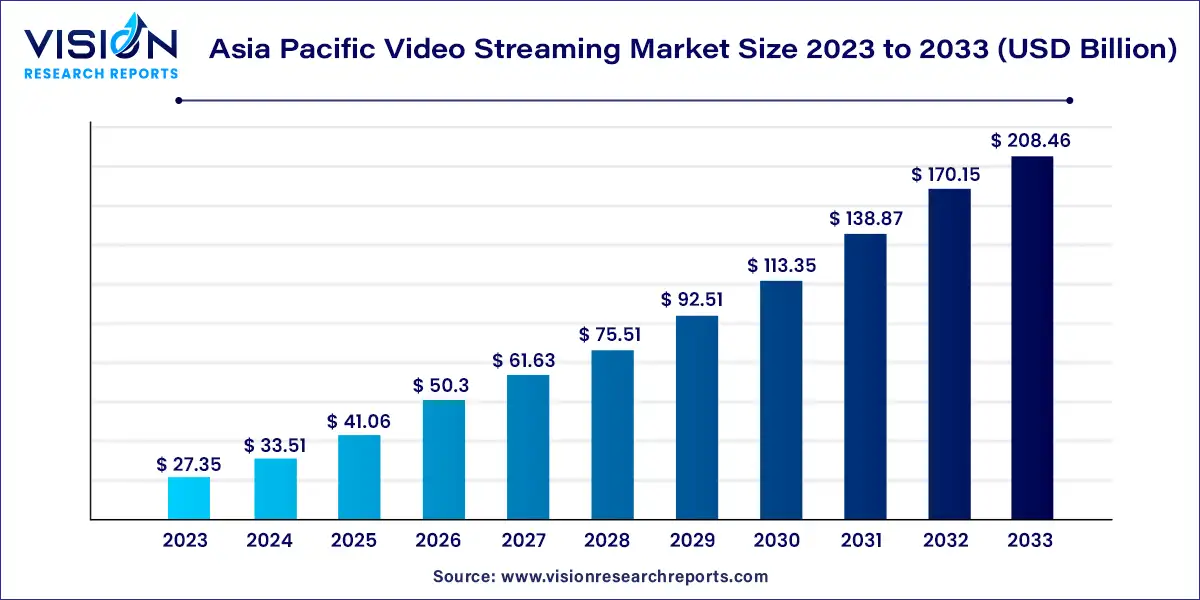

The Asia Pacific video streaming market was valued at USD 27.35 billion in 2023 and it is predicted to surpass around USD 208.46 billion by 2033 with a CAGR of 22.52% from 2024 to 2033.

The Asia Pacific region has emerged as a dynamic hub for the video streaming industry, witnessing exponential growth fueled by technological advancements, changing consumer preferences, and increasing internet penetration. This overview delves into the key trends, drivers, challenges, and opportunities shaping the video streaming market landscape in the Asia Pacific region.

The Asia Pacific video streaming market is experiencing robust growth driven by several key factors. Firstly, the rapid expansion of broadband infrastructure across the region has facilitated seamless streaming experiences, fostering increased adoption among consumers. Additionally, the proliferation of smartphones and tablets has fueled the demand for mobile video streaming, making content more accessible on-the-go. Furthermore, the rising disposable income in many Asia Pacific countries has made subscription-based streaming services more affordable, driving market expansion. Moreover, strategic partnerships and collaborations between streaming platforms, telecom operators, and content producers are enhancing market penetration and enriching content offerings. These growth factors collectively contribute to the thriving landscape of the Asia Pacific video streaming market, poised for continued expansion in the coming years.

| Report Coverage | Details |

| Market Size in 2023 | USD 27.35 billion |

| Revenue Forecast by 2033 | USD 208.46 billion |

| Growth rate from 2024 to 2033 | CAGR of 22.52% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The live video streaming segment dominates the market, with a revenue share of 65% in 2023. Live video allows creators and brands to engage with their audience in real-time, fostering a sense of immediacy and connection that on-demand content might not offer to the same extent. This factor is anticipated to bode well for the growth of the segment. Live streaming is often used to cover events, conferences, sports matches, and other time-sensitive occurrences, offering audiences a way to virtually attend and experience these events as they happen.

The non-linear video streaming segment is expected to grow at a CAGR of 21.64% from 2024 to 2033.The several advantages associated with non-linear video streaming solutions and services, such as the flexibility of watching the video anytime, video recording capability, and convenience of series linking, are expected to drive the demand for non-linear video streaming over the forecast period. Furthermore, leading streaming service providers in Asia are trying to establish their foothold in countries such as India through economic plans and offers.

The OTT segment dominates the market, with a revenue share of 46% in 2023. OTT stands for Over the Top, a service platform that delivers film and TV content through the internet, without requiring the users to subscribe to a traditional cable service or Pay TV services. Pay-TV, also known as subscription television or premium television, is a subscription-based television service that delivers content through analog or digital cable. The factor propelling the market's growth is the rising number of subscribers of the service in the region. The OTT segment is also estimated to expand at a faster pace as compared to other segments over the forecast period.

The OTT segment delivers film and TV content through the Internet without needing a traditional cable or Pay TV service subscription. Video streaming OTT services are gaining popularity in various end-use industries such as education, healthcare, and gaming. For instance, the rising subscribers of Netflix and OTT service providers such as subscription-based digital content providers such as Spotify and YouTube have also contributed significantly to the growth of audio and video streaming services in the region. Furthermore, the increasing demand for improved automation of business processes and the wide availability of broadband infrastructure is expected to drive the growth of the OTT segment over the forecast period.

The smartphones & tablets segment dominates the market, with a revenue share of 33% in 2023. The factor attributed to the segment growth is the substantial growth in the number of subscribers that use smartphones & tablets as a platform for streaming videos. The fact that India and China have the world’s largest smartphone and internet user base also favors the smartphones & tablets segment. Moreover, as mobile internet connectivity improves, users can seamlessly stream high-quality content on their devices, further promoting the dominance of this segment.

The gaming consoles segment is expected to grow with the fastest CAGR of 22.57% from 2024 to 2033. Gaming consoles are increasingly being integrated with streaming services, allowing users to access video content directly from their consoles. This convergence of gaming and streaming can attract a broader user base and drive growth in the gaming consoles segment. Moreover, modern gaming consoles often serve as all-in-one entertainment hubs, offering access to video streaming platforms alongside gaming experiences. This can make consoles more appealing to a wider audience, including those who primarily seek streaming content.

The training & support segment dominates the market, with a revenue share of 40% in 2023, and is estimated to remain the leading segment over the forecast period. This can be attributed to Asia Pacific being one of the top outsourcing destinations for several industries. Also, industries such as IT, telecom, BFSI, and healthcare have witnessed a steady rise in countries such as India, China, and Japan over the years. The resultant rise in the number of employees in these industries and the need for effective training programs will likely drive the segment.

Enterprises face multiple challenges while training employees and employ a variety of mediums to make training programs more engaging and effective. For this, organizations use live-streaming videos in their corporate training programs. Live-streaming content lends authenticity and enables more effective interaction with the audience, thus helping retain their attention and facilitating an enhanced training experience. Thus, the growing use of videos for corporate training is boosting the growth of the use of video streaming in the training & support service segment.

The subscription segment dominated the market, with a revenue share of 47% in 2023.The subscription segment, often called Subscription Video on Demand (SVOD), was a significant and growing player in the Asia Pacific video streaming market. SVOD services like Netflix, Amazon Prime Video, Disney+, and local platforms offered users access to a wide range of content for a recurring subscription fee. These services gained popularity due to their convenience, extensive content libraries, and the ability to stream on-demand across various devices. Many consumers in the APAC region were opting for SVOD platforms over traditional Pay TV due to the flexibility and personalized viewing experience they offered.

There is a growing demand for connected devices and consumer electronics that support digital media and high-speed internet technologies, allowing consumers to access video content anywhere across the globe. An access fee or a subscription is often required for online video streaming. For example, Netflix offers various subscription programs for streaming videos online. The subscription model offers access to a wide range of video content, including exclusive series. Therefore, the rising number of subscription-based services in the region is expected to lead to growth opportunities for the segment.

The cloud segment held the largest revenue share of 63% in 2023 and is estimated to remain dominant over the forecast period as well. The cloud segment is expected to witness steady growth owing to the benefit of convenience offered in watching videos and the growing need for original content. With the rising number of internet users in the Asia Pacific region, governments of different countries are collaborating with international organizations such as the International Telecommunication Union (ITU) and Global System for Mobile Communications (GSMA) to improve internet connectivity and increase the use of cloud-based applications, including video streaming. Such initiatives are expected to contribute positively to the cloud segment.

Certain enterprises and organizations with specific security and compliance requirements might still opt for on-premises solutions to have more control over their infrastructure and data. Even within the on-premises segment, CDNs could have played a role in optimizing content delivery. These networks help reduce latency and improve the streaming experience for viewers. While cloud-based streaming has been gaining momentum, some companies might choose hybrid solutions that combine on-premises infrastructure with cloud capabilities. This approach can provide a balance between control and scalability.

The consumer segment dominates the market, with a revenue share of 54% in 2023. The consumer segment, which refers to individual viewers or households, was indeed a dominant force in the APAC video streaming market. The rise of consumer-focused streaming platforms and services, both global and local, contributed to this dominance. Platforms like Netflix, Amazon Prime Video, Disney+, and various regional players catered to consumers’ preferences by offering a wide range of content choices, convenience, and personalized viewing experiences.

The enterprise segment is expected to grow with the fastest CAGR of 22.98% from 2024 to 2033. The segment growth factor is that businesses increasingly use video streaming platforms for employee training, communication, and collaboration. As businesses realize the effectiveness of video for conveying information and conducting remote training sessions, the demand for enterprise-focused video streaming solutions may rise. Moreover, the rise of remote work and virtual events has led to a surge in demand for webinars, conferences, and virtual meetings. Enterprises may rely on video streaming platforms to host and broadcast such events to a wider audience.

By Streaming

By Solution

By Platform

By Service

By Revenue Model

By Deployment

By User

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Asia Pacific Video Streaming Market, By Streaming

7.1. Asia Pacific Video Streaming Market, by Streaming, 2024-2033

7.1.1. Live Video Streaming

7.1.1.1. Market Revenue and Forecast (2021-2033)

7.1.2. Non-linear Video Streaming

7.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 8. Asia Pacific Video Streaming Market, By Solution

8.1. Asia Pacific Video Streaming Market, by Solution, 2024-2033

8.1.1. Internet Protocol TV

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Over the Top (OTT)

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Pay-TV

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Asia Pacific Video Streaming Market, By Platform

9.1. Asia Pacific Video Streaming Market, by Platform, 2024-2033

9.1.1. Gaming Consoles

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Laptops & Desktops

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Smartphones & Tablets

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Smart TV

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Asia Pacific Video Streaming Market, By Service

10.1. Asia Pacific Video Streaming Market, by Service, 2024-2033

10.1.1. Consulting

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Managed Services

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Training & Support

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Asia Pacific Video Streaming Market, By Revenue Model

11.1. Asia Pacific Video Streaming Market, by Revenue Model, 2024-2033

11.1.1. Advertising

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Rental

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Subscription

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Asia Pacific Video Streaming Market, By Deployment

12.1. Asia Pacific Video Streaming Market, by Deployment, 2024-2033

12.1.1. Cloud

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. On-Premises

12.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Asia Pacific Video Streaming Market, By User

13.1. Asia Pacific Video Streaming Market, by User, 2024-2033

13.1.1. Enterprise

13.1.1.1. Market Revenue and Forecast (2021-2033)

13.1.2. Commercial

13.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 14. Asia Pacific Video Streaming Market, Regional Estimates and Trend Forecast

14.1. Asia Pacific

14.1.1. Market Revenue and Forecast, by Streaming (2021-2033)

14.1.2. Market Revenue and Forecast, by Solution (2021-2033)

14.1.3. Market Revenue and Forecast, by Platform (2021-2033)

14.1.4. Market Revenue and Forecast, by Service (2021-2033)

14.1.5. Market Revenue and Forecast, by Revenue Model (2021-2033)

14.1.6. Market Revenue and Forecast, by User (2021-2033)

14.1.7. Market Revenue and Forecast, by Deployment (2021-2033)

Chapter 15. Company Profiles

15.1. Akamai Technologies

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. Amazon.com Inc.

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. Baidu Inc.

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. Brightcove Inc.

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. Comcast Corporation

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. Google LLC

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. Hulu

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. Kaltura Inc.

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

15.9. Netflix Inc.

15.9.1. Company Overview

15.9.2. Product Offerings

15.9.3. Financial Performance

15.9.4. Recent Initiatives

15.10. Roku

15.10.1. Company Overview

15.10.2. Product Offerings

15.10.3. Financial Performance

15.10.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others