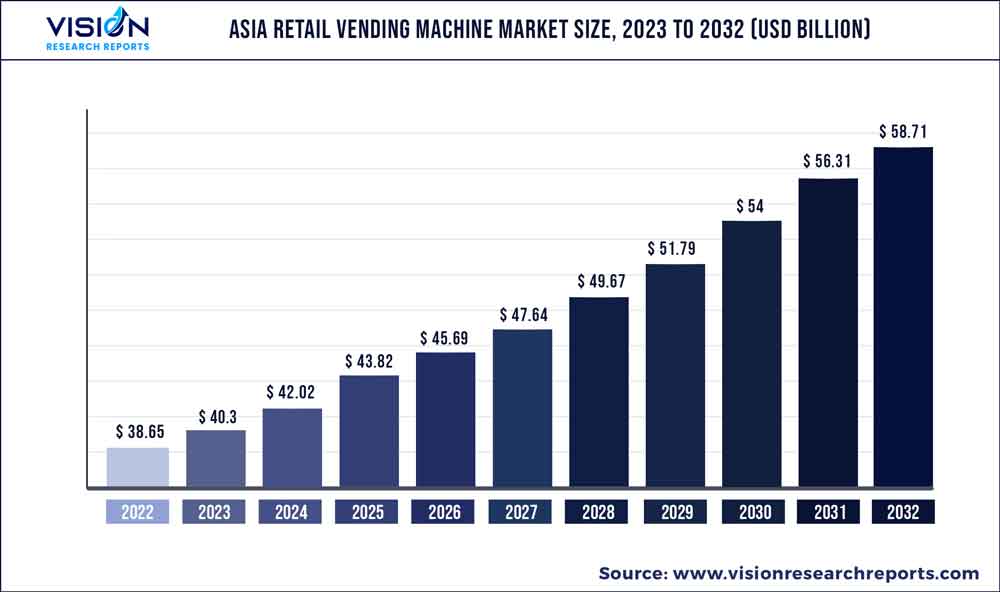

The Asia retail vending machine market was surpassed at USD 38.65 billion in 2022 and is expected to hit around USD 58.71 billion by 2032, growing at a CAGR of 4.27% from 2023 to 2032.

Key Pointers

Report Scope of the Asia Retail Vending Machine Market

| Report Coverage | Details |

| Market Size in 2022 | USD 38.65 billion |

| Revenue Forecast by 2032 | USD 58.71 billion |

| Growth rate from 2023 to 2032 | CAGR of 4.27% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Azkoyen Group; Zummo Innovaciones Mecánicas, S.A.; ETEK Automation Solutions Joint Stock Company; Sunwon; TSEvending Company; Dropfoods; Guangzhou Baoda Intelligent Technology Co., Ltd.; Shenzhen TopGood Intelligent Technology Co., Ltd.; Fuji Electric Co., Ltd.; Guangzhou Light Industry Elec Co., Ltd.; Panda Vending Ltd.; Shintoa Corp.; Roven Co., Ltd.; Luckin Coffee Inc.; Le Tach Vending Pte. Ltd. |

Increasing demand for on-the-go snacks and beverages due to the hectic lifestyles of consumers is boosting product sales through vending machines. The vending machine market growth can also be attributed to the machines’ ability to deliver goods quickly, making it an extremely convenient option for consumers. Food and beverage distribution through vending machines look promising as vending machines not only offer snacks and beverages but also sell other consumables, such as cigarettes and lottery tickets.

Hence, operators can generate significant revenue through vending machines by strategically placing them in corporate buildings, schools, malls, train stations, and airports, among others. Moreover, healthy lifestyle trends are becoming increasingly prominent across the region on account of growing consumer awareness regarding healthy food and beverage options. With rapid technological development, wireless network platforms are being integrated into vending machines to achieve remote control. With this, vending machine information request, response, and liability information can be handled with reflex information, which improves efficiency and saves enterprise personnel management costs.

This improves service efficiency, further fueling the market growth. Facial recognition technology in vending machines includes a motion sensor that knows when consumers are approaching and a camera that can recognize the user. The machine then gives a personalized menu based on the purchase history of the consumer and prevents them from buying restricted products, such as an underage user trying to purchase cigarettes. Customers that buy from vending machines are making healthier choices and as a result, industry operators are stocking healthy food & beverage items in their machines to meet consumer needs. In addition, many vending machine businesses are extending their offerings to include a number of cooked foods that are usually available at restaurants.

The commercial places segment is anticipated to register a significant growth rate during the forecast period. Vending machines are seen as a resolution to labor shortages. Costs associated with a vending machine are less than costs incurred by an unattended retail shop. These machines can provide convenience store operators with the option to explore new avenues and opportunities in an otherwise crowded sector. These devices can accept a variety of payment cards as well as mobile payments. Retailers are offering a wide range of commodities with automated retail technologies to let consumers simply access their preferred products. Supermarkets, hypermarkets, convenience stores, restaurants, and cafés are among the places where these technologies have made an appearance.

The retail business has been struggling due to the COVID-19 pandemic, resulting in an increase in activity in the cashier-less or automated retail area. For instance, in July 2021, Hindustan Unilever Ltd. launched an in-store vending machine, Smart Fill, for its home care products. As a pilot project, the device was installed at Reliance Smart Acme Mall in Mumbai, India. Based on payment methods, the industry is categorized into cash and cashless. The cashless segment is anticipated to register the fastest CAGR during the forecast period. The cashless payment provides various advantages for both customers and companies. Some of the advantages include less cash handling losses, saving extra cost & labor time, and speed & efficiency in transactions.

In addition, consumers prefer the cashless or contactless method as it is considered a more hygienic way to make payments. For instance, according to a survey by MasterCard in April 2020, 82% of respondents worldwide said they preferred contactless and cashless payments as a cleaner way to pay. A report published by Toptal, LLC states that the countries best positioned to go cashless include the U.S., the Netherlands, Japan, Germany, France, Belgium, Spain, Czech Republic, China, and Brazil. Although cash will continue to play a prominent role in the foreseeable future, there is a slow but sure migration to a cashless society in many of these countries. Major companies focus on various strategies, such as global expansions, partnerships, acquisitions & mergers, developments & new product launches, to gain a higher industry share.

Application Insights

Offices dominated the market with a share of over 40.05% in 2022. Vending machines are installed in workplaces to offer employees a convenient, affordable, and quick option for buying food. The introduction of vending machines has aided businesses in easily and automatically distributing things directly at the workplace. Employees dining at the workplace often have to spend time preparing food, going out purchasing ingredients, or ordering food. Employees can buy things on the spot in the most convenient way if such machines are provided at office premises. For example, healthy snack vending machines can provide employees with an easily accessible healthy snack or beverage that will allow them to recoup energy and increase productivity at the workplace.

Commercial places will grow at a CAGR of 4.15% over the forecast period from 2023 to 2032. Vending machines are seen as a resolution to labor shortages. Costs associated with a vending machine are less than costs incurred by an unattended retail shop. Vending machines can provide convenience store operators with the option to explore new avenues and opportunities in an otherwise crowded sector. These devices can accept a variety of payment cards as well as mobile payments. Retailers are offering a wide range of commodities with automated retail technologies to let consumers simply access their preferred products.

Payment Mode Insights

The cash segment dominated the industry with a revenue share of over 55.06% in 2022. Cash and credit cards can be used interchangeably at vending machines. Customers can utilize either of the methods depending on the availability of resources as these machines often contain a slot for cash as well as cards. It is ultimately up to the buyer to select a payment method. However, the cash segment is expected to decline as there are hidden charges while using cash payments.

The hidden cost of cash payment includes the cost of equipment & processing and opportunity cost. According to an article published by YFS Magazine in June 2020, although global vending machine businesses are still largely cash-based, 59% of vending machines now accept cashless payments, such as credit cards or mobile wallets. This indicates that vending machines are rapidly being driven by digitalization and technological advancements.

Asia Retail Vending Machine Market Segmentations:

By Application

By Payment Mode

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Asia Retail Vending Machine Market

5.1. COVID-19 Landscape: Asia Retail Vending Machine Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Asia Retail Vending Machine Market, By Application

8.1. Asia Retail Vending Machine Market, by Application, 2023-2032

8.1.1. Commercial Places

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Offices

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Public Places

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Asia Retail Vending Machine Market, By Payment Mode

9.1. Asia Retail Vending Machine Market, by Payment Mode, 2023-2032

9.1.1. Cash

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Cashless

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Asia Retail Vending Machine Market, Regional Estimates and Trend Forecast

10.1. Asia

10.1.1. Market Revenue and Forecast, by Application (2020-2032)

10.1.2. Market Revenue and Forecast, by Payment Mode (2020-2032)

Chapter 11. Company Profiles

11.1. Azkoyen Group

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Zummo Innovaciones Mecánicas, S.A.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. ETEK Automation Solutions Joint Stock Company

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Sunwon

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. TSEvending Company

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Dropfoods

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Guangzhou Baoda Intelligent Technology Co., Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Shenzhen TopGood Intelligent Technology Co., Ltd.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Fuji Electric Co., Ltd.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Guangzhou Light Industry Elec Co., Ltd.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others