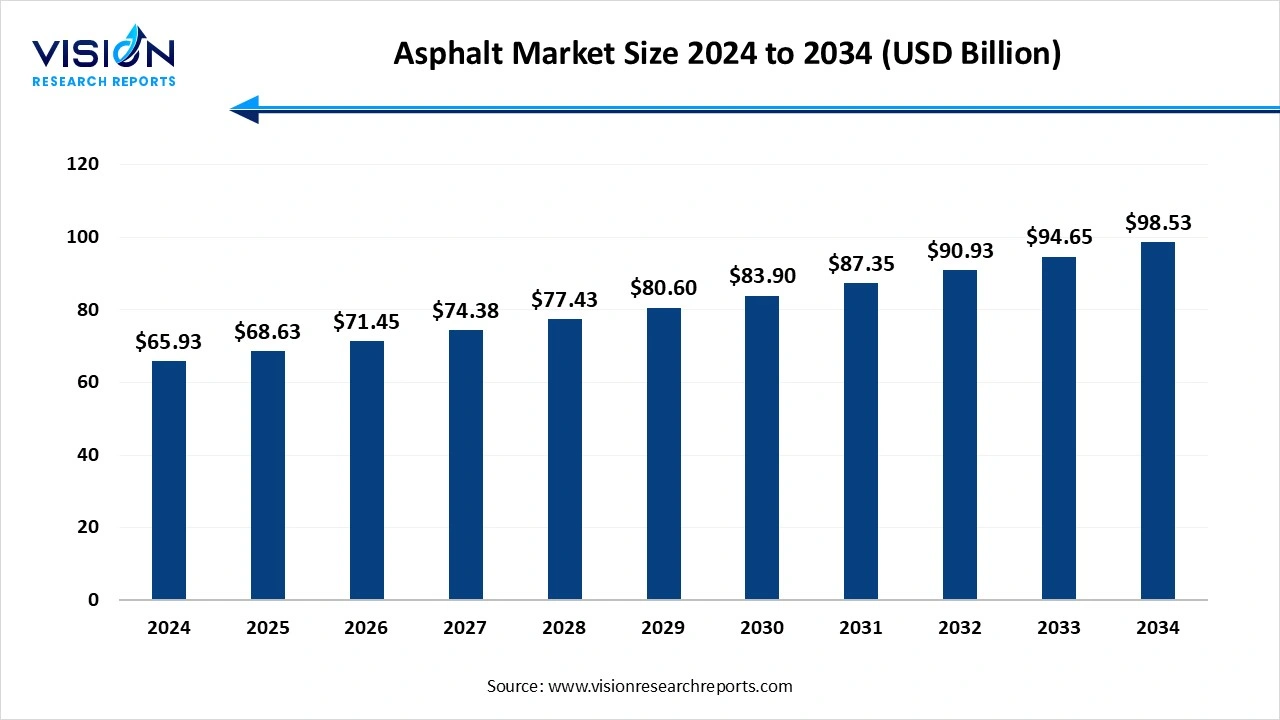

The global asphalt market size was valued at USD 65.93 billion in 2024 and is anticipated to reach around USD 98.53 billion by 2034, growing at a CAGR of 4.10% from 2025 to 2034.

The global asphalt market is experiencing steady growth, driven by increasing infrastructure development and urbanization worldwide. Asphalt, a critical material used primarily in road construction and maintenance, benefits from expanding transportation networks and government investments in public infrastructure projects. The rising demand for durable and cost-effective paving solutions, coupled with technological advancements in asphalt production and recycling, is further fueling market expansion.

The asphalt market’s growth is primarily driven by the surge in infrastructure development across both emerging and developed economies. Rapid urbanization and increasing population density are prompting governments to invest heavily in expanding and upgrading transportation networks, including highways, roads, and airports. This growing demand for reliable and durable roadways significantly boosts the consumption of asphalt. Advancements in construction technologies, such as warm-mix asphalt and polymer-modified asphalt, are enhancing the performance and lifespan of pavements, making asphalt a preferred choice for large-scale infrastructure projects.

Environmental sustainability is also becoming a major growth factor in the asphalt market. With increasing awareness about reducing carbon footprints, there is a growing trend towards recycling asphalt materials and using eco-friendly binders. Governments and regulatory bodies are encouraging the use of recycled asphalt pavement (RAP) and warm-mix asphalt technologies that reduce energy consumption and emissions during production and application.

The Asia Pacific region led the global asphalt market, capturing the largest revenue share of approximately 39% in 2024. This growth is driven by rapid urbanization and ongoing infrastructure investments in key economies such as India, Japan, South Korea, and Southeast Asian nations. Large-scale government initiatives, including road expansion projects, smart city developments, and airport modernization efforts, are significantly boosting asphalt demand. The region's thriving construction industry, propelled by population growth, industrial expansion, and rising mobility requirements, further fuels asphalt consumption.

The North American asphalt market is fueled by significant public infrastructure investments and the need to maintain and resurface aging transportation networks. Key initiatives such as the U.S. Infrastructure Investment and Jobs Act, along with various provincial and state programs in Canada, provide substantial funding for road rehabilitation and expansion projects.

The hot mix asphalt segment dominated the market in 2024, capturing the largest revenue share at 73%. The global asphalt market is predominantly driven by the widespread use of hot mix asphalt (HMA), which remains the most common type of asphalt utilized in road construction due to its proven durability and strong performance under heavy traffic conditions. Hot mix asphalt is produced by heating asphalt binder to reduce its viscosity and drying the aggregate to remove moisture before mixing. This high-temperature process allows for a dense, long-lasting pavement surface that can withstand significant stress and varying weather conditions.

The warm mix asphalt segment is projected to experience substantial growth, with a compound annual growth rate (CAGR) of 4.7% during the forecast period 2025 to 2034. Produced at temperatures substantially lower than hot mix asphalt, WMA reduces energy consumption and greenhouse gas emissions during manufacturing and application. This technology also improves working conditions by reducing fumes and allowing for longer haul distances and extended paving seasons, especially in cooler climates. As governments and industries increasingly prioritize sustainability and seek to minimize carbon footprints, the adoption of warm mix asphalt is gaining momentum globally.

The infrastructure segment led the market in 2024, capturing the highest revenue share at 71%. Asphalt is the preferred material for these projects due to its durability, cost-effectiveness, and ease of maintenance. As urbanization accelerates and the need for efficient logistics grows, countries are prioritizing the modernization and expansion of their infrastructure to support economic development. This trend fuels continuous demand for asphalt in large-scale public works, making infrastructural applications the backbone of the market.

The commercial segment is expected to grow significantly at a CAGR of 4% over the forecast period, Commercial applications require asphalt for its quick installation and ability to withstand moderate traffic loads, offering flexibility and aesthetic appeal to property developers and businesses. With rising urban populations and expanding retail and office spaces, demand from the commercial sector is steadily increasing.

By Product

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Asphalt Market

5.1. COVID-19 Landscape: Asphalt Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Asphalt Market, By Product

8.1. Asphalt Market, by Product

8.1.1. Hot Mix Asphalt

8.1.1.1. Market Revenue and Forecast

8.1.2. Warm Mix Asphalt

8.1.2.1. Market Revenue and Forecast

8.1.3. Cold Mix Asphalt

8.1.3.1. Market Revenue and Forecast

8.1.4. Others

8.1.4.1. Market Revenue and Forecast

Chapter 9. Asphalt Market, By End Use

9.1. Asphalt Market, by End Use

9.1.1. Residential

9.1.1.1. Market Revenue and Forecast

9.1.2. Commercial

9.1.2.1. Market Revenue and Forecast

9.1.3. Industrial

9.1.3.1. Market Revenue and Forecast

9.1.4. Infrastructural

9.1.4.1. Market Revenue and Forecast

Chapter 10. Asphalt Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product

10.1.2. Market Revenue and Forecast, by End Use

Chapter 11. Company Profiles

11.1. CRH plc

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Vicat Group

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Oldcastle Materials Inc. (a division of CRH)

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Colas Group

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Cemex S.A.B. de C.V.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. LafargeHolcim Ltd.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Martin Marietta Materials, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Hanson UK (a part of HeidelbergCement Group)

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Eurovia Group

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Jiangsu Sikai Group Co., Ltd.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others