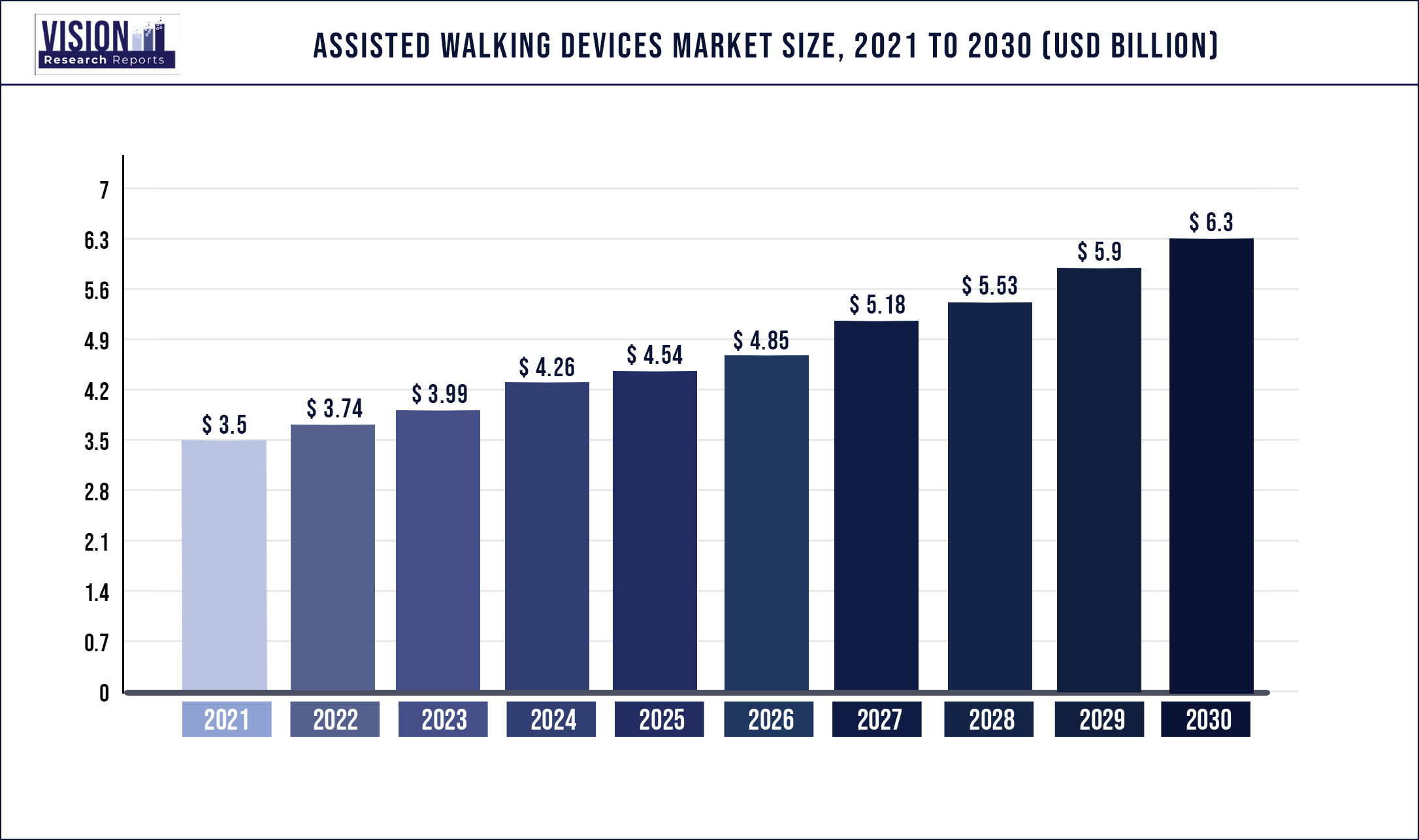

The global assisted walking devices market was surpassed at USD 3.5 billion in 2021 and is expected to hit around USD 6.3 billion by 2030, growing at a CAGR of 6.75% from 2022 to 2030.

The high growth of the market is anticipated due to the steep increase in the geriatric population, the rising prevalence of chronic disorders such as Parkinson’s disease, arthritis, tendonitis, and conversion disorder, and the rising demand for rehabilitation devices and equipment succeeding procedures.

Furthermore, apart from the government and private institution's initiatives to encourage the use of these assistive walking devices to support the physically challenged, the technology advanced innovations are also transforming the current assisted devices, which are expected to serve as a key factor for the market growth during the forecast period.

With the COVID-19 pandemic, there are massive economic suffering and health problems around the world. For instance, obesity, it has been observed that obesity represents a risk factor for a more serious and complicated course of coronavirus in adults. The outbreak has had a significant impact on the population’s health and health-related issues. Lengthy social isolation due to global restrictions, whether imposed by others or self-imposed increased the risk of developing depression, anxiety, and high stress.

These pandemic-related factors have affected two very important health-related behaviors associated with dietary behaviors, physical inactivity, and excess weight gain, leading to the major adoption of walking devices by bariatric patients. This has impacted the market to grow during the pandemic.

With the aging population on the rise, the global prevalence of arthritis is also escalating in accordance. According to the Centers for Disease Control and Prevention, by 2040, 78 million people will be suffering from arthritis in the U.S. Furthermore, due to a surging aging population, there is a higher risk factor impacting personal mobility as old age increases the susceptibility of an individual towards developing chronic conditions, hence increasing the demand for personal mobility devices such as walking devices. The rising global base of people aged 65 and above is also likely to contribute to the market growth of the market.

The key players are actively participating in the development of novel walking devices that will create a considerable impact on the quality and durability of the devices thereby influencing the market growth.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 3.5 Billion |

| Revenue Forecast by 2030 | USD 6.3 billion |

| Growth rate from 2022 to 2030 | CAGR of 6.75% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, region |

| Companies Covered | Medline Industries; Karman; Benmor Medical; Briggs Healthcare; Carex Health Brands; TOPRO; Invacare Corporation; Drive medical design; Eurovema AB; HUMAN CARE |

Product Type Insights

In 2021, the walker's segment accounted for the maximum share of nearly 62.7% and is expected to dominate the market during the forecast period. Walkers are preferred over other mobility devices due largely to enhanced stability provided by this equipment, which enables walking independently without assistance, and the provision of wider support, provided by these mobility devices as compared to other walking devices thus promoting physical activity in physically-handicapped individuals. These aforementioned factors are also responsible for the rising demand for walkers as rehabilitation equipment.

However, the gait trainers segment is expected to witness a maximum CAGR of 8.6% during the forecast period. This is due to the rising number of cerebral palsy and Parkinson’s disease, rise in the number of spinal injuries, and increase in the number of stroke cases in adults are some of the factors responsible for the growth of the gait trainer segment.

Regional Insight

In 2021, North America held the maximum revenue share of nearly 35.6% on account of the presence of a large geriatric population in this region. The presence of advanced healthcare facilities and well-developed reimbursement policies are the key factors driving the market in this region. Moreover, the high prevalence of target diseases, such as arthritis, Parkinson’s disease, and other chronic disabilities in this region is expected to act as a high impact rendering driver for the market expansion over the next nine years. Furthermore, the availability of these mobility devices at subsidized rates for disabled patients is expected to propel this market during the forecast period.

The Asia Pacific region is expected to witness the highest CAGR of nearly 7.5% during the forecast period. Key determining factors contributing to the high growth include the daunting geriatric population count in the Asia Pacific countries, such as China, India, and Japan, the increasing prevalence of chronic deformities in the population present in this region, the hike in public and private healthcare expenditures, and the rise in disposable incomes.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1.Raw Material Procurement Analysis

4.3.2.Sales and Distribution Channel Analysis

4.3.3.Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on Assisted Walking Devices Market

5.1.COVID-19 Landscape: Assisted Walking Devices Industry Impact

5.2.COVID 19 - Impact Assessment for the Industry

5.3.COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1.Market Drivers

6.1.2.Market Restraints

6.1.3.Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1.Bargaining power of suppliers

6.2.2.Bargaining power of buyers

6.2.3.Threat of substitute

6.2.4.Threat of new entrants

6.2.5.Degree of competition

Chapter 7. Competitive Landscape

7.1.1.Company Market Share/Positioning Analysis

7.1.2.Key Strategies Adopted by Players

7.1.3.Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. Global Assisted Walking Devices Market, By Product

8.1. Assisted Walking Devices Market, by Product Type, 2020-2027

8.1.1.Canes

8.1.1.1.Market Revenue and Forecast (2016-2027)

8.1.2.Crutches

8.1.2.1.Market Revenue and Forecast (2016-2027)

8.1.3.Walkers

8.1.3.1.Market Revenue and Forecast (2016-2027)

8.1.4.Gait Trainers

8.1.4.1.Market Revenue and Forecast (2016-2027)

Chapter 9. Global Assisted Walking Devices Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1.Market Revenue and Forecast, by Product (2016-2027)

9.1.2.U.S.

9.1.3.Rest of North America

9.1.3.1.Market Revenue and Forecast, by Product (2016-2027)

9.2. Europe

9.2.1.Market Revenue and Forecast, by Product (2016-2027)

9.2.2.UK

9.2.2.1.Market Revenue and Forecast, by Product (2016-2027)

9.2.3.France

9.2.3.1.Market Revenue and Forecast, by Product (2016-2027)

9.2.4.Rest of Europe

9.2.4.1.Market Revenue and Forecast, by Product (2016-2027)

9.3. APAC

9.3.1.Market Revenue and Forecast, by Product (2016-2027)

9.3.2.India

9.3.2.1.Market Revenue and Forecast, by Product (2016-2027)

9.3.3.China

9.3.3.1.Market Revenue and Forecast, by Product (2016-2027)

9.3.4.Japan

9.3.4.1.Market Revenue and Forecast, by Product (2016-2027)

9.3.5.Rest of APAC

9.3.5.1.Market Revenue and Forecast, by Product (2016-2027)

9.4. MEA

9.4.1.Market Revenue and Forecast, by Product (2016-2027)

9.4.2.GCC

9.4.2.1.Market Revenue and Forecast, by Product (2016-2027)

9.4.3.North Africa

9.4.3.1.Market Revenue and Forecast, by Product (2016-2027)

9.4.4.South Africa

9.4.4.1.Market Revenue and Forecast, by Product (2016-2027)

9.4.5.Rest of MEA

9.4.5.1.Market Revenue and Forecast, by Product (2016-2027)

9.5. Latin America

9.5.1.Market Revenue and Forecast, by Product (2016-2027)

9.5.2.Brazil

9.5.2.1.Market Revenue and Forecast, by Product (2016-2027)

9.5.3.Rest of LATAM

9.5.3.1.Market Revenue and Forecast, by Product (2016-2027)

Chapter 10. Company Profiles

10.1. Medline Industries Karman

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Benmor Medical

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Briggs Healthcare

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Carex Health Brands

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. TOPRO

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Invacare Corporation

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Drive medical design

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Eurovema AB.

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3. Financial Performance

10.8.4. Recent Initiatives

10.9. HUMAN CARE

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others