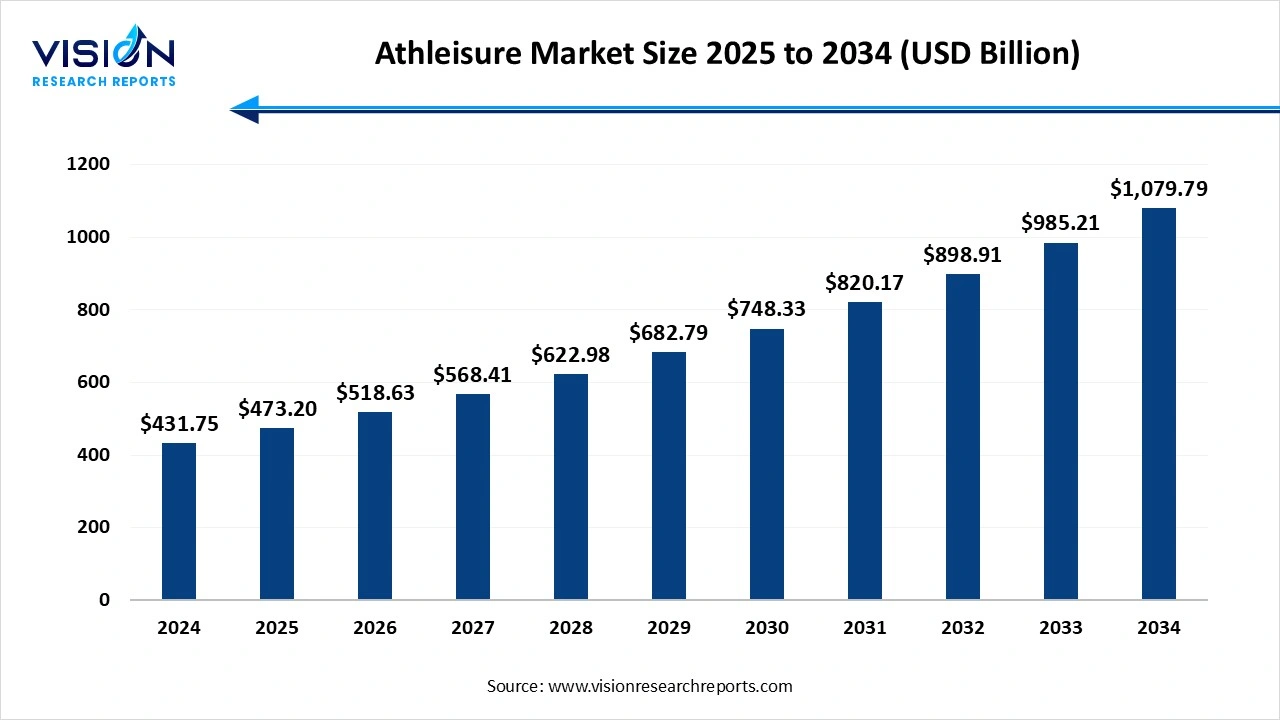

The global athleisure market is estimated at around USD 431.75 billion in 2024 and is anticipated to rise from USD 473.20 billion in 2025 to nearly USD 1,079.79 billion by 2034, registering a CAGR of 9.6% throughout the forecast period. The growing consumer demand and the shift toward an active lifestyle, comfort, and style are increasing in demand for social media and celebrity influence, remote work, and casual dress code expansion of the market growth.

The athleisure market comprises a composition of a style of clothing designed to be worn for both athletic activities and casual everyday wear. It blends comfort, functionality, and performance features of sportswear with fashionable designs suitable for social, work, or leisure settings. The rise in health and fitness culture, such as people exercising, joining gyms, doing yoga, or participating in outdoor activities. The people want clothes that are comfortable all day and look stylish, blurring the lines. The innovations in fabric and tech innovations, rising the need for social media and influencers, and online sales make premium athleisure accessible to more people and help niche brands grow rapidly.

In the growing consumers actively participating in sports, gym workouts, and other fitness activities. The increasing awareness of the importance of health and wellness translates to a preference for clothing that supports an active lifestyle. The shift towards fashion and lifestyle, such as remote work and more relaxed workplace environments, has led to a greater acceptance of athletic wear in casual settings. The social media platforms showcase athleisure wear through celebrities and fitness influencers, driving trends and influencing consumer preference are expansion of the market growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 23.88 billion |

| Revenue Forecast by 2034 | USD 156.71 billion |

| Growth rate from 2025 to 2034 | CAGR of 9.6% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered |

Hanes Brands, Inc., Adidas AG, Vuori, PANGAIA, Under Armour, Inc., Outerknown, EILEEN FISHER, Patagonia, Inc., Wear Pact, LLC, Lululemon Athletica |

Product offering and emerging market for the Athleisure Market

The large range of products, including yoga apparel, leggings, tops, shirts, hoodies, outerwear, and footwear brands, is continuously expanding product lines to cater to various activities and lifestyles. The consumers are increasingly prioritizing sustainable and ethically produced athleisure. This creates an opportunity for brands to differentiate themselves through eco-friendly materials responsible manufacturing process, and a transparent supply chain. The requirement of consumer brands is leveraging technologies such as 3D printing and digital knitting to offer personalized designs and a custom-fit option. The emerging fashion towards the design, wearable technology integration, and diversity is are expansion of the market growth.

Prise Sensitivity of the Athleisure Market

The high price of premium products creates an affordability barrier for consumers, especially in emerging economies and price-sensitive markets. The athleisure market is highly competitive, with a multitude of established and emerging brands vying for market share. This affects the profitability and makes it challenging for smaller or newer brands to hinder the market growth.

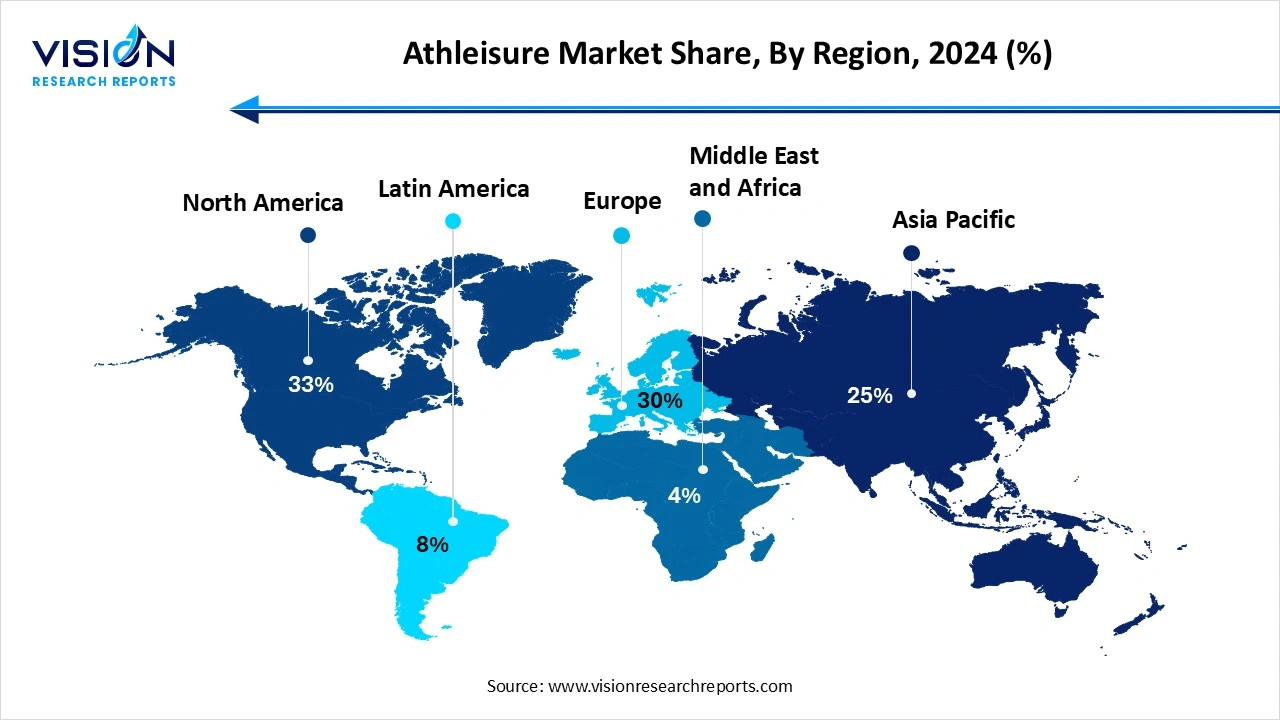

North America dominated the market by accounting for the largest share of 33% in 2024. The region in which a strong health and fitness culture, such as a high level of participation in various physical activities. The consumers appreciate the versatility and comfort of athleisure pieces, which seamlessly transition from exercise to casual outings, errands, and even some work environments. The high consumer spending and robust economy, increasing disposable income, allow them to invest in premium products and athleisure brands. Social media and celebrity endorsements play a crucial role in shaping consumer preferences and trends in the athleisure market.

United States Athleisure Market Trends

The growing actively participating in fitness activities and embracing an active lifestyle, increasing demand for athleisure wear. The rising disposable income allows them to invest in premium athleisure brands and products. The social media influencers and celebrities who showcase athleisure wear as a fashionable and comfortable choice for various occasions. The innovations in materials, such as moisture-wicking and breathable fabrics, enhance the appeal and functionality of athleisurewear, attracting consumers.

Why is Asia Pacific Significantly Growing in the Athleisure Market?

Asia Pacific expects significant growth in the athleisure market during the forecast period. The growing awareness of the importance of health and wellness is driving increased participation in fitness activities like yoga, gym workouts, and various sports across the region. The increasing urbanization in countries such as China and India is shown in a bustling lifestyle. Rising disposable income in these countries.

China Athleisure Market Trends

The growing urbanizing population with increasing population and increasing disposable income. The rising demand for comfortable and versatile clothing. The increase in e-commerce has also made athleisure products more accessible to a wider consumer base. The innovations in fabric and designs, offering features such as moisture-wicking, breathability, and enhanced comfort, are raising consumers' interest and adoption of athletic wear. The increase in population, rising consumers need, and changing lifestyle drive the market growth.

Why did the Maas Segment Dominate the Athleisure Market?

The mass segment dominated the athleisure market in 2024. The mass athleisure brands typically offer products at more accessible price points compared to premium or luxury brands, making athleisure readily available. It offers a wide range of styles, sizes, and price points through various distribution channels, including online platforms. These products prioritize comfort and versatility, allowing for seamless transitions between different activities. The growing trends towards health and wellness trends, increasing in remote work and flexible lifestyles, have significantly contributed to the market growth. Even before the full impact of the pandemic was felt, Target's launch of its new active line demonstrated the increasing demand for athleisure and its potential for high sales volume within the mass market. (Source: MBAESG)

The premium segment is the fastest-growing in the athleisure market during the forecast period. The rise in fitness culture and increased participation in activities, such as yoga, outdoor sports, is driving the market growth. T consumers are investing in the premium quality of athleisure items that are made with high-quality materials and offer performance-enhancing features such as moisture-wicking and breathability. The expansion of the athleisure trend beyond sports, trends towards the influence of social media, and celebrity endorsement drive the market growth.

How the Shirt Segment hold the Largest Share in the Athleisure Market?

The shirt segment held the largest revenue share in the athleisure market in 2024. The growing need for a relaxed dress code, comfort, and shirts delivers on this front with soft, breathable, and flexible fabrics. While the market also includes premium offerings, mass-market athleisure shirts provide comfortable and stylish options at accessible price points, appealing to a broader consumer base. Their wide availability through various distribution channels, both online and offline, further contributes to their popularity.

Large-scale athletic events, such as the Olympics, the FIFA World Cup, and the NBA finals, have historically served as launching pads for sportswear innovations and styles.

The yoga segment is experiencing the fastest growth in the market during the forecast period. With the growing yoga participation and wellness trends worldwide, consumers are increasingly adopting a healthier lifestyle, including yoga, for physical and mental well-being, driving demand for comfortable and functional activewear. The increase in trends of athleisure wear, emphasis on comfort and functionality, and product innovations and their features drive the market growth.

Puma's yoga wear collection is made with recycled materials. Lululemon, an activewear retailer based in Canada, partnered with Bolt Threads to produce eco-friendly yoga clothing products created from mushroom mycelium leather. Girlfriend Collective's activewear is made from recycled nylon and polyester fibers.

How the Women Segment Held the Dominant Share in the Athleisure Market?

The women segment dominated the Athleisure market in 2024. The increasing popularity of activities such as yoga, pilates, and other exercises among women has driven the demand for specialized apparel that blends performance with style. The increase in modern women seeking clothing that seamlessly transitions from workout to casual outing or everyday routines. The growing sports participation of women has increased, and female celebrities and social media influencers play a major role in promoting market growth.

The children's segment is the fastest-growing in the market during the forecast period. The increasing participation in sports is significantly driving the market growth. Parents are increasingly prioritizing an active lifestyle for their children, leading to demand for functional and comfortable clothing that can support various physical activities. The growing influence of social media and celebrity endorsements, technological advancement in fabric and design, are driving the market growth.

How Offline Segment Held the Dominant Share in the Athleisure Market?

The offline segment dominated the athleisure market in 2024. The offline storage offers consumers the ability to physically interact with products, trying on clothes, feeling the fabric quality, and assessing the fit before making a purchase. The instant gratification of purchasing an item and walking out with it is a key draw for many consumers, particularly those needing athleisure wear for immediate use. The building brand relationship and experience, storage allows brands to create immersive shopping environments, interactive displays, and community events that foster stronger brand loyalty and consumer connections. The pop-up shops provide brands with a low-investment strategy to engage with customers, test new products, and build brand buzz.

The online segment is the fastest-growing in the market during the forecast period. The online platforms offer the ultimate convenience of browsing and purchasing athleisure products from the comfort of one's home, eliminating the need to visit physical stores. Online retailers can showcase a much wider range of athleisure brands and products compared to brick-and-mortar stores, providing consumers with more choices and options. The personalized shopping experience, increased satisfaction, and conversion rates. The trends towards digital marketing and social media influencers, rising brand awareness, shape consumer preference, and boost market growth.

By Type

By Product

By End-user

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Athleisure Market

5.1. COVID-19 Landscape: Athleisure Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Athleisure Market, By Type

8.1. Athleisure Market, by Type

8.1.1. Mass

8.1.1.1. Market Revenue and Forecast

8.1.2. Premium

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global Athleisure Market, By Product

9.1. Athleisure Market, by Product

9.1.1. Yoga Apparels

9.1.1.1. Market Revenue and Forecast

9.1.2. Shirts

9.1.2.1. Market Revenue and Forecast

9.1.3. Leggings

9.1.3.1. Market Revenue and Forecast

9.1.4. Shorts

9.1.4.1. Market Revenue and Forecast

9.1.5. Others

9.1.5.1. Market Revenue and Forecast

Chapter 10. Global Athleisure Market, By End-user

10.1. Athleisure Market, by End-user

10.1.1. Men

10.1.1.1. Market Revenue and Forecast

10.1.2. Women

10.1.2.1. Market Revenue and Forecast

10.1.3. Children

10.1.3.1. Market Revenue and Forecast

Chapter 11. Global Athleisure Market, By Distribution Channel

11.1. Athleisure Market, by Distribution Channel

11.1.1. Online

11.1.1.1. Market Revenue and Forecast

11.1.2. Offline

11.1.2.1. Market Revenue and Forecast

Chapter 12. Global Athleisure Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type

12.1.2. Market Revenue and Forecast, by Product

12.1.3. Market Revenue and Forecast, by End-user

12.1.4. Market Revenue and Forecast, by Distribution Channel

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type

12.1.5.2. Market Revenue and Forecast, by Product

12.1.5.3. Market Revenue and Forecast, by End-user

12.1.5.4. Market Revenue and Forecast, by Distribution Channel

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type

12.1.6.2. Market Revenue and Forecast, by Product

12.1.6.3. Market Revenue and Forecast, by End-user

12.1.6.4. Market Revenue and Forecast, by Distribution Channel

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type

12.2.2. Market Revenue and Forecast, by Product

12.2.3. Market Revenue and Forecast, by End-user

12.2.4. Market Revenue and Forecast, by Distribution Channel

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type

12.2.5.2. Market Revenue and Forecast, by Product

12.2.5.3. Market Revenue and Forecast, by End-user

12.2.5.4. Market Revenue and Forecast, by Distribution Channel

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type

12.2.6.2. Market Revenue and Forecast, by Product

12.2.6.3. Market Revenue and Forecast, by End-user

12.2.6.4. Market Revenue and Forecast, by Distribution Channel

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type

12.2.7.2. Market Revenue and Forecast, by Product

12.2.7.3. Market Revenue and Forecast, by End-user

12.2.7.4. Market Revenue and Forecast, by Distribution Channel

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type

12.2.8.2. Market Revenue and Forecast, by Product

12.2.8.3. Market Revenue and Forecast, by End-user

12.2.8.4. Market Revenue and Forecast, by Distribution Channel

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type

12.3.2. Market Revenue and Forecast, by Product

12.3.3. Market Revenue and Forecast, by End-user

12.3.4. Market Revenue and Forecast, by Distribution Channel

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type

12.3.5.2. Market Revenue and Forecast, by Product

12.3.5.3. Market Revenue and Forecast, by End-user

12.3.5.4. Market Revenue and Forecast, by Distribution Channel

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type

12.3.6.2. Market Revenue and Forecast, by Product

12.3.6.3. Market Revenue and Forecast, by End-user

12.3.6.4. Market Revenue and Forecast, by Distribution Channel

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type

12.3.7.2. Market Revenue and Forecast, by Product

12.3.7.3. Market Revenue and Forecast, by End-user

12.3.7.4. Market Revenue and Forecast, by Distribution Channel

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type

12.3.8.2. Market Revenue and Forecast, by Product

12.3.8.3. Market Revenue and Forecast, by End-user

12.3.8.4. Market Revenue and Forecast, by Distribution Channel

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type

12.4.2. Market Revenue and Forecast, by Product

12.4.3. Market Revenue and Forecast, by End-user

12.4.4. Market Revenue and Forecast, by Distribution Channel

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type

12.4.5.2. Market Revenue and Forecast, by Product

12.4.5.3. Market Revenue and Forecast, by End-user

12.4.5.4. Market Revenue and Forecast, by Distribution Channel

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type

12.4.6.2. Market Revenue and Forecast, by Product

12.4.6.3. Market Revenue and Forecast, by End-user

12.4.6.4. Market Revenue and Forecast, by Distribution Channel

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type

12.4.7.2. Market Revenue and Forecast, by Product

12.4.7.3. Market Revenue and Forecast, by End-user

12.4.7.4. Market Revenue and Forecast, by Distribution Channel

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type

12.4.8.2. Market Revenue and Forecast, by Product

12.4.8.3. Market Revenue and Forecast, by End-user

12.4.8.4. Market Revenue and Forecast, by Distribution Channel

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type

12.5.2. Market Revenue and Forecast, by Product

12.5.3. Market Revenue and Forecast, by End-user

12.5.4. Market Revenue and Forecast, by Distribution Channel

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type

12.5.5.2. Market Revenue and Forecast, by Product

12.5.5.3. Market Revenue and Forecast, by End-user

12.5.5.4. Market Revenue and Forecast, by Distribution Channel

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type

12.5.6.2. Market Revenue and Forecast, by Product

12.5.6.3. Market Revenue and Forecast, by End-user

12.5.6.4. Market Revenue and Forecast, by Distribution Channel

Chapter 13. Company Profiles

13.1. Hanes Brands, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Adidas AG

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Vuori

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. PANGAIA

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Under Armour, Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Outerknown

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. EILEEN FISHER

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Patagonia, Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Wear Pact, LLC

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Lululemon Athletica

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others