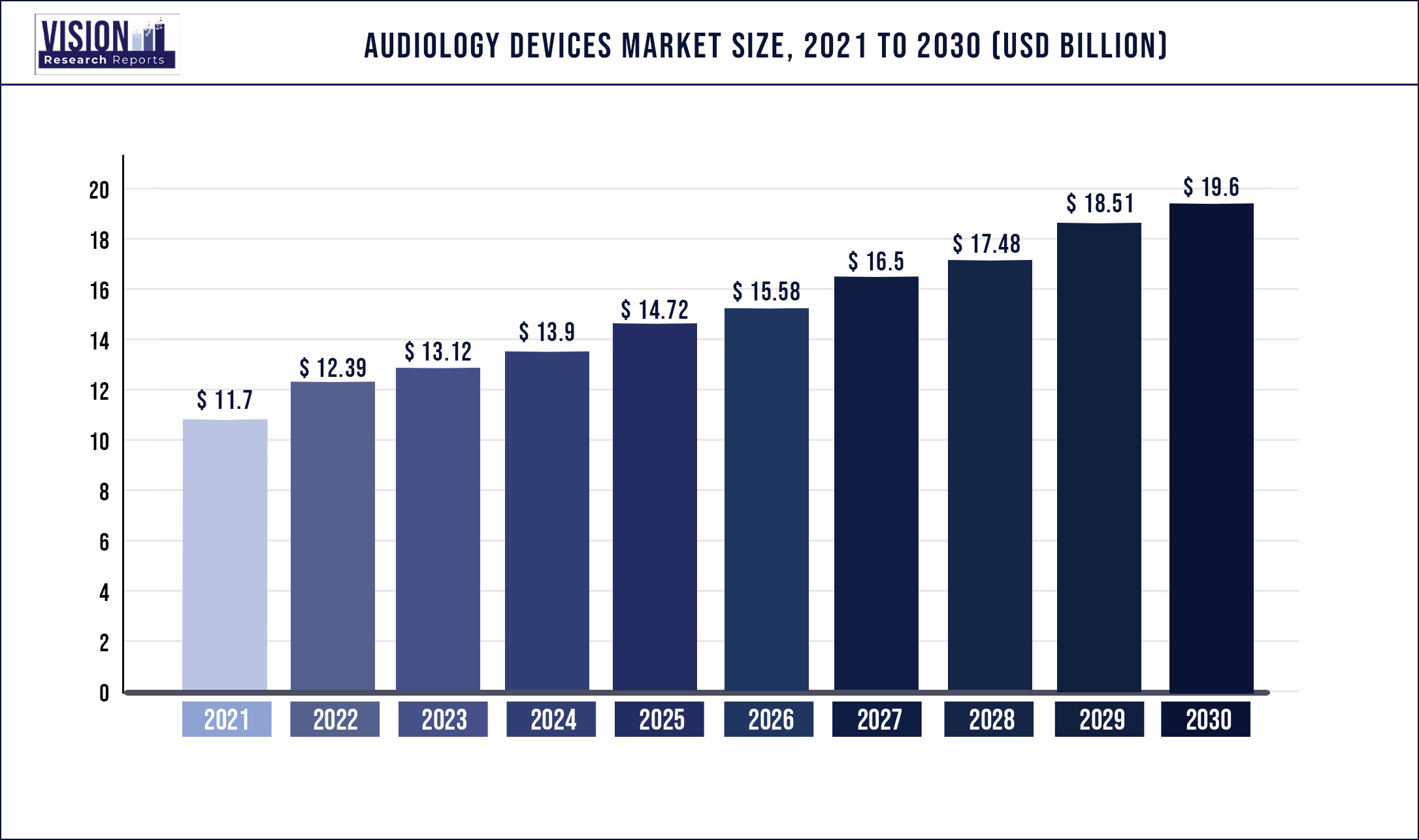

The global audiology devices market was valued at USD 11.7 billion in 2021 and it is predicted to surpass around USD 19.6 billion by 2030 with a CAGR of 5.9% from 2022 to 2030.

Increasing cases of hearing disorders, especially in geriatric population, rising purchasing capacity, investments in R&D, and government support for better healthcare infrastructure are expected to drive the market over the forecast period.

High comfort offered by newly introduced devices, improved connectivity, and better user interface are some of the factors attributing to high usage rate of audiology devices. Better quality of life along with acceptance of digital hearing aids are anticipated to further drive the market. In a study published in January 2019, it was observed that hearing aids reduce symptoms associated with dementia. However, usage is hampered due to the exclusion of hearing aids or exams for fitting hearing aids from the Original Medicare program.

Hearing aids segment led the market in 2018 and will hold its leading position in future. However, cochlear implants is expected to be the fastest-growing segment over the forecast period. Cochlear implants are widely used owing to their high effectiveness, in terms of sentence understanding.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 11.7 billion |

| Revenue Forecast by 2030 | USD 19.6 billion |

| Growth rate from 2022 to 2030 | CAGR of 5.9% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, technology, sales channel, region |

| Companies Covered | William Demant Holdings A/S; GN ReSound Group; Starkey Hearing Technologies; Widex A/S; Sonova Holdings AG; Phonak, Audioscan; MedRx; NHC/Amplifon |

Product Insights

The product segment is categorized into hearing aids, BAHA/BAHS, cochlear implants, and diagnostic devices. Hearing aids dominated the product segment while cochlear implants are anticipated to witness the fastest growth in the forecast period. Diagnostic devices include otoscopes, audiometers, and tympano meters.

Innovation in implantation techniques reduces the risk of infection, complications, operating time, and improves the patient's ability to hear. Demand for invisible-in-canal hearing aids and complete-in-canal hearing aids are expected to boost the industry's growth.

Sales Channel Insights

Based on the sales channel, the market is categorized into retail stores, government programs, and e-commerce. Retail stores dominated the market due to the presence of big retail store chains in countries such as the U.S.

In 2016, around 3.35 to 3.7 million hearing aids were sold in the U.S. market, consisting of 79% sold in the private market and 23.6% sold via the Veterans Administration (VA) hearing aid program. Many market players are adopting e-commerce to sell hearing aids products along with online service support and specialist consultation.

Technology Insights

Based on technology, the market is segmented into digital and analog hearing aids. Digital hearing aids dominated the technology segment owing to fast adaptability. Analog hearing aids use an amplifier, and microphone to intensify the sound. Some analog hearing aids are programmable and include a microchip allowing program settings for the different listening environments. Such analog devices are preferred over digital technology due to the delivery of unadulterated sound at an affordable cost.

Many manufacturers offer digital hearing aids with Bluetooth connectivity integrated with in-the-ear (ITE) and behind-the-ear (BTE) models. The Open hearing aid range from Oticon can be connected with iPhone, iPad, and iPod touch devices and it allows users to stream audio directly into their hearing aids.

Regional Insights

North America dominated the overall market in terms of revenue share in the year 2018. The U.S. market growth can be attributed to the advancement in the audiology systems, an increase in the number of audiologists, and the introduction of innovative digital platforms by current providers. The launch of patient-centric audiology systems that facilitate easy product handling results in patient compliance further leading to market growth.

The Asia Pacific region is anticipated to expand at the highest CAGR over the forecast period. The market growth can be attributed to the increasing geriatric population and age-related hearing problems, constantly improving healthcare infrastructure, rising health care expenditures, and increasing product awareness.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Audiology Devices Market

5.1. COVID-19 Landscape: Audiology Devices Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Audiology Devices Market, By Product

8.1. Audiology Devices Market, by Product, 2022-2030

8.1.1 Hearing Aids

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Cochlear Implants

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. BAHA/BAHS

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Diagnostic Devices

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Audiology Devices Market, By Technology

9.1. Audiology Devices Market, by Technology, 2022-2030

9.1.1. Digital

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Analog

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Audiology Devices Market, By Sales Channel

10.1. Audiology Devices Market, by Sales Channel, 2022-2030

10.1.1. Retail Sales

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. E-commerce

10.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Audiology Devices Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.2. Market Revenue and Forecast, by Technology (2017-2030)

11.1.3. Market Revenue and Forecast, by Sales Channel (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.1.4.3. Market Revenue and Forecast, by Sales Channel (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Sales Channel (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.3. Market Revenue and Forecast, by Sales Channel (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.4.3. Market Revenue and Forecast, by Sales Channel (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Sales Channel (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Sales Channel (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Sales Channel (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.3. Market Revenue and Forecast, by Sales Channel (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.4.3. Market Revenue and Forecast, by Sales Channel (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Sales Channel (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Sales Channel (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Sales Channel (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.3. Market Revenue and Forecast, by Sales Channel (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.4.3. Market Revenue and Forecast, by Sales Channel (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Sales Channel (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Sales Channel (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Sales Channel (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.5.3. Market Revenue and Forecast, by Sales Channel (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.5.4.3. Market Revenue and Forecast, by Sales Channel (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Sales Channel (2017-2030)

Chapter 12. Company Profiles

12.1. William Demant Holdings A/S

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. GN ReSound Group

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Starkey Hearing Technologies

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Widex A/S

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Sonova Holdings AG

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Phonak, Audioscan

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. MedRx

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. NHC/Amplifon

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others