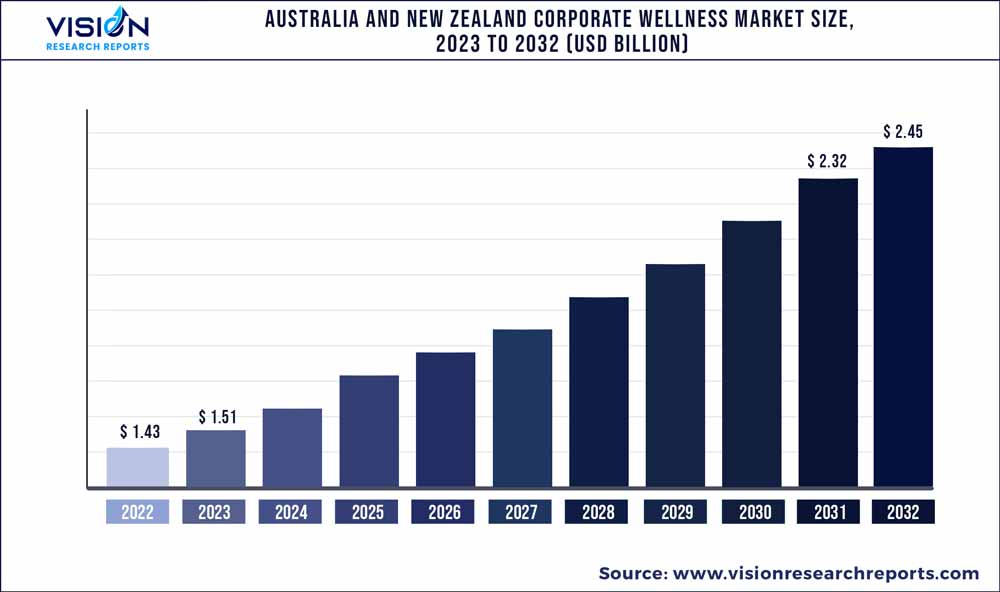

The Australia and New Zealand corporate wellness market size was estimated at around USD 1.43 billion in 2022 and it is projected to hit around USD 2.45 billion by 2032, growing at a CAGR of 5.54% from 2023 to 2032.

Key Pointers

Report Scope of the Australia And New Zealand Corporate Wellness Market

| Report Coverage | Details |

| Market Size in 2022 | USD 1.43 billion |

| Revenue Forecast by 2032 | USD 2.45 billion |

| Growth rate from 2023 to 2032 | CAGR of 5.54% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Corporate Wellness Australia; Holistic Services Group; Workplace Wellness Australia; Complete Corporate Wellness; EvolvME; Corporate Work Health Australia; Logic Health; Health At Work; Healthbox NZ |

The market growth is being aided by the rising awareness about employee health and well-being. Factors such as capital spending by the private sector, increased health awareness, and rising employee absenteeism, are also likely to contribute to the market growth. As a growing number of businesses aim to enhance their employee well-being offerings, digital employee well-being platforms will play a critical role. Moreover, the COVID-19 pandemic compelled firms and employees to increase their use of new technologies. Employees commonly suffer from health issues associated with stress, such as improper diet, insufficient sleep, alcoholism, smoking, and physical inactivity. According to a 2023 Absence management and well-being report, from 2019 overall employee absenteeism has increased by 2.5 days (23%). In 2022, the average number of sick leaves taken was 14 days. After the pre-COVID-19 2019 survey, there is a rise in the average absence days lost per employee per annum of 2.6 days.

Organizations hire professionals to implement health plans for health screening, smoking cessation, and Health Risk Assessment (HRA). Moreover, chronic conditions, such as asthma, cancer, hypertension, and diabetes, are responsible for an increase in absenteeism and loss of productivity. The prevalence of chronic diseases is high in Australia and New Zealand. According to the Australian Institute of Health and Welfare, 11.6 million people have one or more chronic conditions. 20% of people have a behavioral or mental condition for both females and males in the 15-44 age group. Obesity is a major reason for chronic ailments. Also, two of three adults are overweight. The high chronic disease prevalence is likely to drive employers to adopt employee health programs. According to the article published by New Zealand Media and Entertainment in November 2022, 1 out of 4 people have more than 2 chronic conditions which include both mental and physical health issues.

Workplace fitness activities are health-related and need to adhere to regulations. The Work Health Safety Act (WHS) and Work Health & Safety Regulation compel employers to ensure their employee’s mental, physical, and overall health safety. The act has guidelines for the safety of employees, improving employee productivity. Such government initiatives and regulations to promote positive work culture are anticipated to favor the adoption of workplace well-being programs. Providing workplace health services helps promote employee well-being and also benefits the organization by increasing employee productivity.

Small businesses can expect a high return on investment through organizational well-being initiatives for their employees. Furthermore, the provision of health programs also impacts employee onboarding and retention in the organization. For instance, a survey by Robert Walters, which included around 3,400 professionals from New Zealand and Australia, noted that around 92% of surveyed people found it was somewhat or very important for them to work for an organization that implements a workplace wellness program.

Employees’ mental health has been significantly impacted by the COVID-19 pandemic. It resulted in a work-from-home transition, which increased employee stress. In addition, it created economic crises, putting many people in financial struggle, which had a negative effect on their mental health. According to a MetLife survey, 50% of Australian employees reported that COVID-19 had a detrimental effect on their mental health. Around 37% of employees sought direct treatment or support. Around 40% of employees said that their employer did not offer any advantages that would assist them in maintaining or improving their overall well-being.

Service Insights

The HRA segment accounted for the largest revenue share of 21% in 2022 owing to the high adoption of HRA services by employers while offering employee health services. Employers are increasingly investing in HRA. HRA is an important component of corporate wellness programs as it involves the evaluation of health status, lifestyle choices, and risk factors of employees within an organization. HRA identifies employee’s health risks such as chronic diseases and other factors impacting their well-being. It gives a picture of the health status of employees and allows employers to design proper wellness interventions. HRA involves data collection of personal and family medical history, lifestyle behaviors such as nutrition, smoking, physical activity, biometric measurements such as blood pressure and cholesterol levels, and psychological factors such as mental health and stress levels. By understanding the employee’s health risks and preferences, organizations provide interventions such as fitness programs, health education, stress management, nutrition, smoking cessation support, and counseling. In December 2022, New Zealand passed a law stating a lifetime ban on young people buying cigarettes. The health authorities declared, by 2025 New Zealand would be smoke-free. Based on service, the market is segmented into HRA, fitness, smoking cessation, health screening, nutrition and weight management, stress management, and others.

The stress management segment is expected to expand at the fastest rate of 6.33% during the forecast period due to increased workplace stress and the availability of high-quality stress management programs. The different corporate programs focus on raising awareness about stress and its impact on employee’s physical and mental health. The corporate wellness programs provide different stress reduction techniques such as mindfulness, meditation, relaxing exercise, yoga classes, and breathing techniques which promote relaxation, reduction in anxiety, and improve overall well-being. According to a Heads-up survey on the State of Employee Health, 1 in 5 Australian employees have taken time off work due to feeling mentally sick over the last 12 months.

Category Insights

The organization/employers segment accounted for the largest revenue share of around 51% in 2022. Corporate wellness is becoming a major avenue of interest for organizations in Australia. Increasing work stress, long work hours, and health issues among Australians are expected to drive the need for employee well-being practices by employers. Employers are conducting wellness programs, consulting external service providers, and conducting health screening, stress management, & fitness campaigns & workshops. The rise in personalized health programs along with the expansion of digital wellness and well-being tools is expected to drive the segment. Holistic Services Group is running, workplace well-being programs for organizations in Australia for the last 2 decades in the field of fitness, yoga, stress management, corporate massage, team building, resiliency training, meditation & mindfulness, and ergonomic assessments. On the basis of category, the market is segmented into fitness and nutrition consultants, psychological therapists, and organizations/employers.

The fitness and nutrition consultants segment is estimated to register the fastest CAGR of 6.03% over the forecast period owing to the rise in the accessibility of fitness services, such as massage, nutrition consultation, and yoga among others. Nutrition Australia is one of the key providers of fitness and nutrition services for employees. Nutrition Australia contributes to reducing the social, economic, and health impacts of nutrition-related diseases by implementing and designing Nutrition education programs, publications, presentations, awareness, and resource campaigns. It offers seminars, cooking demonstrations, one-on-one health consultations, customized programs for organizations, and access to NSW Health’s Get Healthy initiative. The majority of large-scale and a few medium-sized businesses contemplate hiring dietitians to provide one-on-one coaching. In addition, some workplaces offer a variety of activities and gym services. This is propelling the growth of the segment.

End-use Insights

The large-scale organization’s segment held the largest revenue share of 54% in 2022. According to the Australian Government, companies with revenue of more than USD 250 million & over 200 workers are large-scale organizations. Larger corporations typically join with independent wellness companies to assist with program administration; these partner companies are a good method to keep staff fit and healthy. In addition, programs at large organizations often include incentives for participating, such as reduced deductibles and fitness tracking devices. These companies typically have large budgets allocated for workplace well-being programs. For instance, Hilton has tie-ups with high-quality workplace wellness service providers. In addition, the career pathing tool at Hilton drives its employees for career planning & focused work, reducing stress & keeping a healthy mindset.

The medium-scale organization’s segment is expected to expand at the fastest CAGR of 5.93% over the forecast period due to the quick adoption of employee health services. These organizations are generally at a growing stage, which leads to the faster adoption of employee well-being programs. The medium-scale organizations typically have employee-led health campaigns, stress management programs, detailed health screening, and others. Thus, workplace wellness services have a major scope in medium-scale companies in Australia and New Zealand.

Delivery Model Insights

The onsite segment held the largest revenue of 56% market share in 2022. According to the Human Resources Director, around 64% of organizations in Australia are adopting wellness programs for employees and 92% of employees believe in the importance of programs. Longer working hours with higher levels of stress are propelling the need for employee well-being programs in the country. Also, workplace wellness plays an important role in giving job satisfaction and value to employees. The key providers in the market, such as Corporate Wellness Australia, Workplace Wellness, and others, provide detailed health assessments, seminars, group exercise sessions, response training, critical incident response support, and others.

The offline segment is expected to expand at the fastest CAGR of 6.06% over the forecast period. The COVID-19 pandemic and technological advancements are expected to drive the segment growth over the forecast period. The increasing adoption of technology since the pandemic has resulted in companies preferring offsite programs, primarily ones being conducted online. Online webinars are the most commonly adopted activity by wellness providers. HealthyME Digital offers an online platform to support employees with stress management, mental health, and personal development programs through tips by experts via live webinars, video guides, presentations, and audio exercises. & 24/7 online support.

Australia And New Zealand Corporate Wellness Market Segmentations:

By Service

By Category

By Delivery Model

By End-use

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others