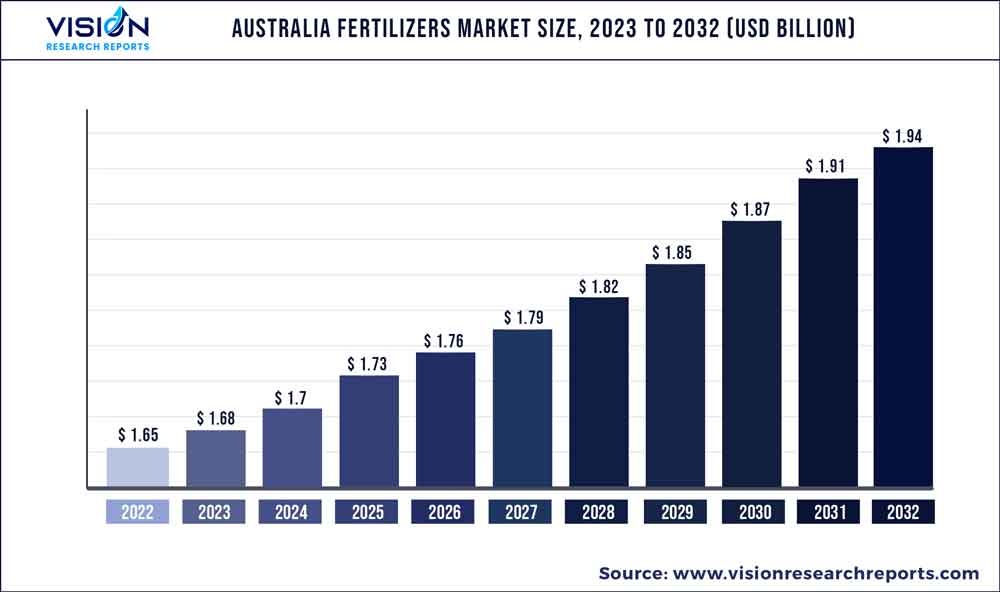

The Australia fertilizers market was surpassed at USD 1.65 billion in 2022 and is expected to hit around USD 1.94 billion by 2032, growing at a CAGR of 1.61% from 2023 to 2032.

Key Pointers

Report Scope of the Australia Fertilizers Market

| Report Coverage | Details |

| Market Size in 2022 | USD 1.65 billion |

| Revenue Forecast by 2032 | USD 1.94 billion |

| Growth rate from 2023 to 2032 | CAGR of 1.61% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Koch Fertiliser Australia Pty Ltd; Incitec Pivot Limited; Wesfarmers Limited; Spraygro Liquid Fertilizers; S.J.B. Ag-Nutri; Yara; Tradecorp APAC Pty. Ltd.; Neutrog Australia; Pacific Fertiliser Pty Ltd; Perdaman |

The industry growth is majorly driven by the rising demand for food crops coupled with shrinking arable land and the adoption of precision farming methods. New food processing, manufacturing, and packaging techniques have resulted in a flourishing food & beverages sector across the country. This has led to an increase in demand for agricultural products such as food grains, vegetables, oilseeds, and fruits, thereby driving the growth of the product market.

However, ammonia used for manufacturing fertilizers gets volatilized from nitrogen fertilizers and forms fine particles in the atmosphere, which are hazardous to human health. Also, nitrification releases nitrous oxide in small amounts, which gets mixed into the stratosphere, thereby contributing to the depletion of the ozone layer. Nitrous oxide also contributes to the greenhouse effect. Moreover, if the nitrogenous fertilizers are applied faster than the rate plants can use it, soil bacteria convert it to nitrate. Water-soluble nitrate gets flushed out of the soil in the runoff, thus polluting groundwater, estuaries, streams, and coastal oceans. Thus, all these factors are acting as restraining factors for the market.

Type Insight

Nitrogenous in type segment dominated the market with a revenue share of 57.84% in 2022. This growth is attributed to the growing production of corn, as it is a widely planted crop in Australia that requires the most nitrogen per hectare of land compared to other crops. According to the Observatory of Economic Complexity, in 2021, Australia exported corn worth USD 34.4 million, making it the 39th largest exporter in the world with South Korea, Malaysia, the UAE, and the Philippines being the major importers and accounting for USD 24.9 million, USD 1.94 million, USD 3.77 million, and USD 0.84 million, respectively.

Urea in nitrogenous fertilizer type dominated the market with a revenue share of 42.92% in 2022. If urea is applied to the bare soil surface, a significant quantity of ammonia might be lost owing to the volatilization of urea caused by its rapid hydrolysis to form ammonium carbonate. Thus, it is necessary to properly place urea fertilizers with respect to seeds. Factors such as the low cost of urea and the high level of nitrogen present in it are expected to fuel the growth of urea.

Potassic is another segment witnessing growth over the forecast period. Potash is the third-most important nutrient required by plants for proper growth and development. It helps improve water retention in plants, influences the texture, improves crop yield, and imparts nutritional value to many crops. Thus, to minimize potassium deficiency and improve productivity, farmers are switching to potassic fertilizers.

Australia Fertilizers Market Segmentations:

By Type

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on Australia Fertilizers Market

5.1. COVID-19 Landscape: Australia Fertilizers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. Australia Fertilizers Market, By Type

8.1.Australia Fertilizers Market, by Type Type, 2023-2032

8.1.1. Nitrogenous

8.1.1.1.Market Revenue and Forecast (2020-2032)

8.1.2. Phosphatic

8.1.2.1.Market Revenue and Forecast (2020-2032)

8.1.3. Potassic

8.1.3.1.Market Revenue and Forecast (2020-2032)

8.1.4. Secondary Fertilizers

8.1.4.1.Market Revenue and Forecast (2020-2032)

8.1.5. Others

8.1.5.1.Market Revenue and Forecast (2020-2032)

Chapter 9. Australia Fertilizers Market, Regional Estimates and Trend Forecast

9.1. Australia

9.1.1. Market Revenue and Forecast, by Type (2020-2032)

Chapter 10.Company Profiles

10.1. Koch Fertiliser Australia Pty Ltd

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2. Incitec Pivot Limited

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3. Wesfarmers Limited

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4. Spraygro Liquid Fertilizers

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5. S.J.B. Ag-Nutri

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6. Yara

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7. Tradecorp APAC Pty. Ltd.

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8. Neutrog Australia

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

10.9. Pacific Fertiliser Pty Ltd

10.9.1.Company Overview

10.9.2.Product Offerings

10.9.3.Financial Performance

10.9.4.Recent Initiatives

10.10. Perdaman

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others