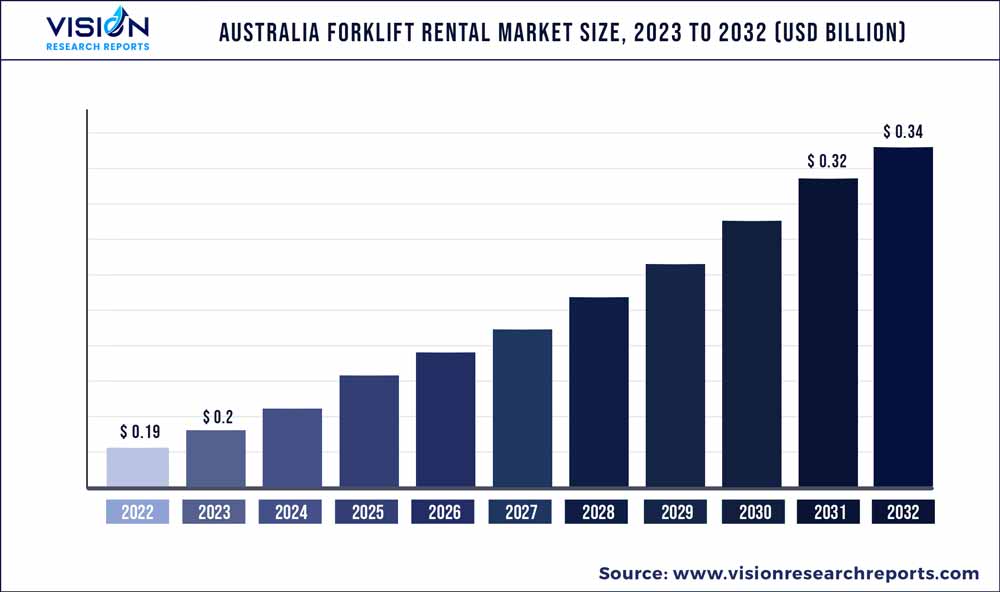

The Australia forklift rental market was surpassed at USD 0.19 billion in 2022 and is expected to hit around USD 0.34 billion by 2032, growing at a CAGR of 5.88% from 2023 to 2032.

Key Pointers

Report Scope of the Australia Forklift Market

| Report Coverage | Details |

| Market Size in 2022 | USD 0.19 billion |

| Revenue Forecast by 2032 | USD 0.34 billion |

| Growth rate from 2023 to 2032 | CAGR of 5.88% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | CLARK; Crown Equipment Corporation; Doosan Corporation; Hangcha; Hyster-Yale Materials Handling, Inc.; Jungheinrich AG; Komatsu Ltd.; Toyota Material Handling |

Australia’s warehouse and e-commerce sector has grown significantly in recent years. The rise in evolving consumer preferences and online retail sales fueled the demand for larger, more advanced warehouses. In this industry, short-term projects and seasonal fluctuations in demand are common. To address these needs, businesses have turned to rental forklifts, which offer the flexibility required to meet project-specific requirements or handle spikes in workload during busy seasons. By opting for rental forklifts, businesses can avoid long-term commitments and adopt their equipment usage to specific timeframes.

This helps reduce overall costs and optimize resource allocation for maximum efficiency. In recent years, advancements in forklift technology have influenced the market. The emergence of modern forklifts, equipped with cutting-edge features, such as electric power systems, improved ergonomics, integrated telematics, and enhanced safety features, has revolutionized the industry. Renting forklifts enables businesses to access the latest models and leverage technological innovations without making substantial capital investments. Among the notable trends, electric forklifts are gaining considerable popularity due to their eco-friendliness and operational efficiency.

These electric-powered forklifts offer businesses a sustainable alternative while maintaining high productivity levels. Furthermore, the development of autonomous forklifts is underway, aiming to augment further efficiency and safety in material handling operations. The integration of autonomous technologies in forklifts has the potential to revolutionize the industry by enhancing productivity and reducing the risk of accidents. To cater to the evolving needs of businesses and provide innovative solutions, rental forklift providers should proactively invest in these advanced technologies. By adopting electric and autonomous forklifts, rental providers can meet the demands of the market, offer environmentally friendly options, and deliver efficient and safe solutions for material handling tasks.

The market is facing a significant challenge as alternative options, including leasing and the availability of both used and new forklifts, have emerged. The lower upfront costs of purchasing used forklifts have made them a preferred choice for many businesses. In addition, the availability of both used and new forklifts enables companies to acquire their own equipment directly, potentially reducing their reliance on rentals altogether. This is causing a decline in the customer base of rental forklift providers. Leasing offers businesses the flexibility to access forklifts without being tied down by long-term commitments typically associated with rentals.

The industrial sector presents significant growth opportunities for the market over the forecast period. As Australia's manufacturing, logistics, and construction industries continue to grow, there will be a greater need for flexible and cost-effective material handling solutions. Rental forklifts allow businesses to scale their operations according to their specific requirements without the burden of heavy capital investments. This enables companies to enhance productivity and efficiency while reducing maintenance and ownership costs. With the industrial sector poised for expansion, the market is well-positioned to benefit from the increasing demand for reliable and adaptable equipment.

Tonnage Capacity Insights

Based on tonnage capacity, below 5 tons accounted for the market share of over 50% in 2022 and is also expected to register the highest CAGR over the forecast period. The segment is influenced by factors catering to businesses' wide-ranging requirements. Their small size and agility make them perfectly suited for navigating tight spaces and narrow passageways, allowing for efficient operations in warehouses, factories, and distribution centers. Furthermore, their ability to handle different types of loads, ranging from pallets to containers, makes them versatile and adaptable across the logistics, construction, and manufacturing sectors.

The 6-30 ton forklifts segment is expected to grow at a significant CAGR over the forecast period. The increasing expansion of the industrial sector, encompassing manufacturing, warehousing, and logistics, is expected to generate a surge in the need for high-performing and dependable material handling equipment in the foreseeable future. Forklifts, with their versatility, play an essential role in numerous applications, including the loading and unloading of heavy cargo, pallet stacking, and transportation of goods within expansive facilities. As businesses place a growing emphasis on cost-effective solutions and operational adaptability, they are opting for rental alternatives to fulfill their forklift requirements without enduring long-term bonds.

End-use Insights

Based on end-use, the warehouse & logistics segment accounted for the largest share exceeding 37% in 2022 and is also anticipated to register the highest CAGR over the forecast period. Warehouse and logistics operations frequently face varying demands, seasonal surges, or temporary projects. The utilization of rented forklifts enables businesses to adjust their equipment requirements according to the current demand, whether scaling up or down. Moreover, warehouse and logistics operations come with inherent risks, necessitating the safe operation of forklifts and adherence to relevant regulations. In Australia, providers of forklift rentals ensure that their fleet meets safety standards and complies with industry regulations.

They offer meticulously maintained and inspected forklifts equipped with essential safety features. The construction sector is expected to grow at a significant CAGR over the forecast period. Robust infrastructure development demands efficient material handling solutions, including commercial buildings, residential projects, and transportation networks. Australia’s thriving mining and resources sector and ongoing construction projects require reliable forklift rentals to support material handling and logistics in these demanding environments. Moreover, the focus on workplace safety and compliance regulations underscores the importance of well-maintained and modern forklift fleets. This presents an opportunity for rental companies to offer specialized equipment that meets industry standards.

Australia Forklift Market Segmentations:

By Tonnage Capacity

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Australia Forklift Market

5.1. COVID-19 Landscape: Australia Forklift Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Australia Forklift Market, By Tonnage Capacity

8.1. Australia Forklift Market, by Tonnage Capacity, 2023-2032

8.1.1. Below 5 Ton

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. 6-30 Ton

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Above 30 Ton

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Australia Forklift Market, By End-use

9.1. Australia Forklift Market, by End-use, 2023-2032

9.1.1. Construction

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Automotive

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Aerospace & Defense

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Warehouse & Logistics

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Australia Forklift Market, Regional Estimates and Trend Forecast

10.1. Australia

10.1.1. Market Revenue and Forecast, by Tonnage Capacity (2020-2032)

10.1.2. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 11. Company Profiles

11.1. CLARK

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Crown Equipment Corporation

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Doosan Corporation

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Hangcha

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Hyster-Yale Materials Handling, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Jungheinrich AG

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Komatsu Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Toyota Material Handling

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others