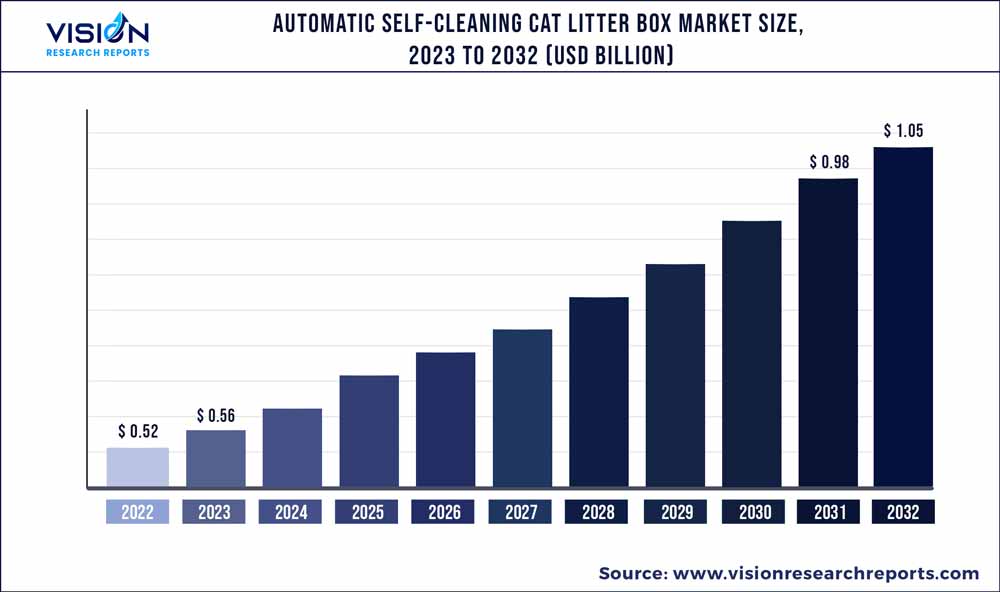

The global automatic self-cleaning cat litter box market size was estimated at around USD 0.52 billion in 2022 and it is projected to hit around USD 1.05 billion by 2032, growing at a CAGR of 7.24% from 2023 to 2032. The automatic self-cleaning cat litter box market in the United States was accounted for USD 113.2 million in 2022.

Key Pointers

Report Scope of the Automatic Self-cleaning Cat Litter Box Market

| Report Coverage | Details |

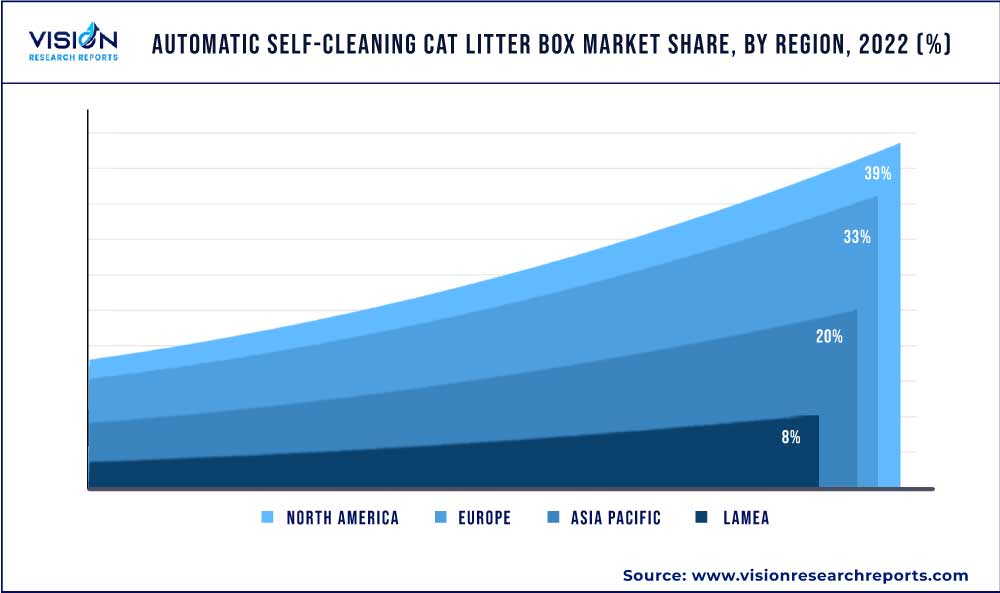

| Revenue Share of North America in 2022 | 39% |

| Revenue Forecast by 2032 | USD 1.05 billion |

| Growth Rate from 2023 to 2032 | CAGR of 7.24% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Whisker; Radio Systems Corp. (PetSafe); Spectrum Brands Holdings Inc.; Smarty Pear; iKuddle; Petree Litter Box; Cosmic Pet; Petnovations, Inc.; PETKIT; AIRROBO |

The need for convenience and odor control, coupled with increasing pet ownership rates, growing awareness about hygiene, and technological advancements in the industry are the key factors boosting the market growth. Based on the American Veterinary Medical Association report, there was a gradual increase in the proportion of households owning at least one cat from 25% in 2016 to 26% in 2020. Subsequently, this percentage further rose to 29% in 2022. The COVID-19 pandemic had a significant impact on the market.

The market faced challenges due to supply chain disruptions and economic uncertainties. The product demand increased due to factors, such as high pet adoption and hygiene concerns, during the pandemic. The American Pet Products Association reported that approximately 11.38 million households in the United States acquired pets during the pandemic. Similarly, during the lockdown, almost half of the British households that already had a pet decided to add another one to their family. Lockdowns and stay-at-home measures limited pet owners’ mobility and access to pet care services. Automatic self-cleaning litter boxes offered a convenient solution for owners that are unable to clean the litter box regularly or rely on professional pet sitters.

Over the years, there has been a growing trend toward pet ownership, with pets being considered more like family members and companions. This trend is evident in Australia, where in 2021, Animal Medicines Australia reported that Australians spent USD 30.7 billion on their pets. Automatic self-cleaning litter boxes play a vital role in promoting a cleaner and more sanitary environment for both cats and their owners. By regularly removing waste, these litter boxes help reduce the risk of bacterial growth, benefiting cats’ health and minimizing odor-related health concerns for humans. As pet owners prioritize their cats’ comfort, health, and overall well-being, product demand is expected to increase.

Technological advancements have brought forth more advanced and efficient products. These innovations include sensors, timers, programmable settings, and self-flushing capabilities. The integration of app control, Bluetooth connectivity, and mobile control features has transformed the market by providing improved convenience, customization, data tracking, and compatibility with smart home systems. One example is Whisker, a U.S. brand known for its Litter-Robot series of connected automatic cat litter boxes. Through their application, pet owners can receive usage data and reminders about waste drawer fullness with just a click. Automatic self-cleaning cat litter boxes are vital in disease prevention.

Unclean litter boxes can cause cat health problems, such as UTI, feline interstitial cystitis, and bladder stones. Unlike traditional litter boxes that involve manual scooping and handling of waste, these innovative solutions minimize direct contact with cat waste. By reducing the risk of cross-contamination and disease transmission, automatic self-cleaning litter boxes help keep both cats and their owners healthier. Cat owners with multiple cats often face greater litter box maintenance challenges. Automatic self-cleaning litter boxes can accommodate multiple cats and provide efficient waste removal, reducing the likelihood of litter box-related conflicts or health issues among cats.

Several players in the market, such as Spectrum Brands Holdings Inc., Smarty Pear, iKuddle, and Petree Litter Box, offer products, which can be used by multiple cats. Pet owners’ prioritization of cat safety has driven advancements in the market. Manufacturers have responded by incorporating safety features like motion sensors to prevent unintended activation when a cat is inside the litter box. Furthermore, they have implemented mechanisms to prevent entrapment or injury. The Petree Automatic Self-Cleaning Cat Litter Box 2023 Wi-Fi Version, for example, includes a four-point high-precision gravity sensor that promptly deactivates the machine upon sensing the cat’s weight. Its design also mitigates the risk of cat trapping, ensuring the safety of cats using the product.

Product Insights

The single-cat automatic self-cleaning cat litter boxes segment dominated the market with a 79% revenue share in 2022. This can be attributed to the fact that many cat owners opt for a single cat as their primary companion or the sole feline in their household. This segment includes individuals or families who choose to have a single pet based on factors, such as available living space, personal preference, etc. The American Veterinary Medical Association’s 2020 report indicated that 56% of cat-owning households had a single cat, marking an increase from the 53% recorded five years earlier. With the continuous rise in cat ownership worldwide, the demand for the single-cat automatic self-cleaning litter boxes segment is expected to maintain its dominance.

The multi-cat category is estimated to grow at a significant CAGR of about 8.22% during the forecast period. Automatic self-cleaning litter boxes offer convenience and time-saving benefits, which are particularly appealing for multi-cat households. Managing multiple litter boxes manually can be challenging and time-consuming. Automatic solutions that can handle the waste volume of multiple cats simultaneously provide a more efficient and hassle-free solution, making them increasingly attractive to multi-cat owners.

Distribution Channel Insights

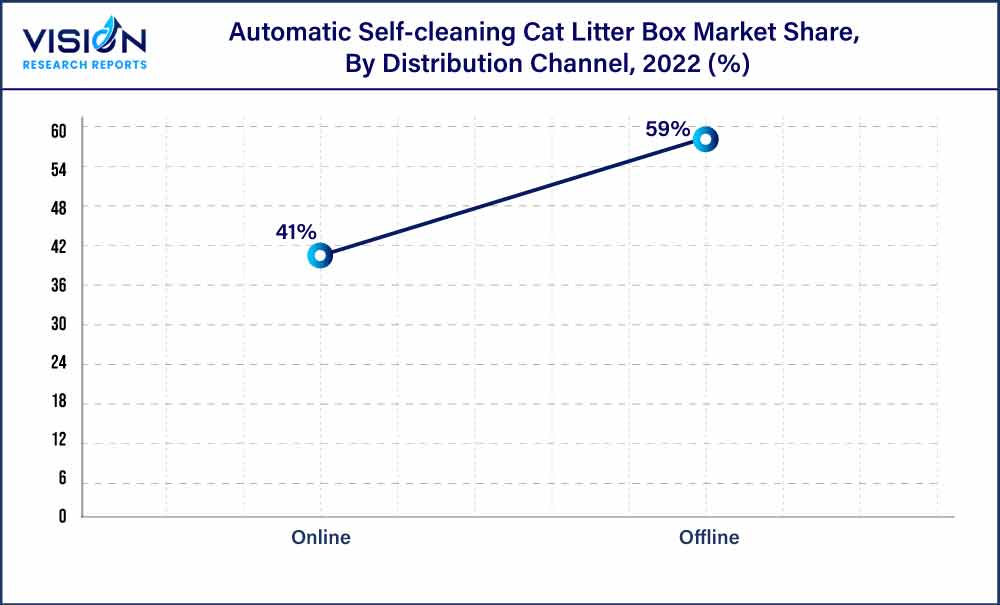

In 2022, the offline channel segment emerged as the dominant sales platform, capturing approximately 59% of the market share. Offline distribution channels, including pet stores and veterinary clinics, are commonly favored when purchasing automatic self-cleaning cat litter boxes due to various advantages. These include access to expert advice from knowledgeable personnel, the opportunity to test the product in person, immediate availability, and the reliability associated with trustworthy sources. Within an offline setting, consumers can benefit from the guidance provided by trained professionals, such as veterinarians or pet store staff, who can offer recommendations tailored to their pet’s requirements.

The online distribution channel segment is estimated to grow at a CAGR of 8.13% during the forecasted period. Online stores offer the convenience of shopping from anywhere, at any time. This is especially important for consumers who live in remote areas or have busy schedules that make it difficult to visit offline stores during business hours. In addition, factors, such as variety, product discounts, price comparisons, and customer reviews, will fuel the market growth further.

Regional Insights

The North America region dominated the industry with a share of over 39% in 2022. With rapid pet ownership trends in the region, the demand for pet-related products is on the rise. A blog by Lemonade suggests that 70% of households in the U.S. owned a pet in 2022. In addition , pet owners in this country spent about USD 31.4 billion on vet care and product sales. Rapid urbanization and hectic schedules, coupled with awareness and education about automatic cat litter boxes are major factors propelling the market growth in this region. The Asia Pacific region is expected to register the highest CAGR of approximately 8.9% from 2023 to 2032.

This growth can be attributed to the younger population's inclination to delay marriage and starting families. A 2022 article from the South China Morning Post highlights the rising living expenses and demands of modern work environments, which have led more young individuals in China to postpone or forgo marriage and parenthood. Instead, they are choosing to raise pets, leading to a thriving pet economy in the region. As per the 2021 China Pet Industry White Paper, the population of cats in China has exceeded that of dogs, establishing them as the preferred pet choice in the country.

Automatic Self-cleaning Cat Litter Box Market Segmentations:

By Product

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automatic Self-cleaning Cat Litter Box Market

5.1. COVID-19 Landscape: Automatic Self-cleaning Cat Litter Box Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automatic Self-cleaning Cat Litter Box Market, By Product

8.1. Automatic Self-cleaning Cat Litter Box Market, by Product, 2023-2032

8.1.1. Single Cat

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Multi Cat

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Automatic Self-cleaning Cat Litter Box Market, By Distribution Channel

9.1. Automatic Self-cleaning Cat Litter Box Market, by Distribution Channel, 2023-2032

9.1.1. Offline

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Online

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Automatic Self-cleaning Cat Litter Box Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 11. Company Profiles

11.1. Whisker

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Radio Systems Corp. (PetSafe)

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Spectrum Brands Holdings Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Smarty Pear

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. iKuddle

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Petree Litter Box

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Cosmic Pet

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Petnovations, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. PETKIT

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. AIRROBO

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others