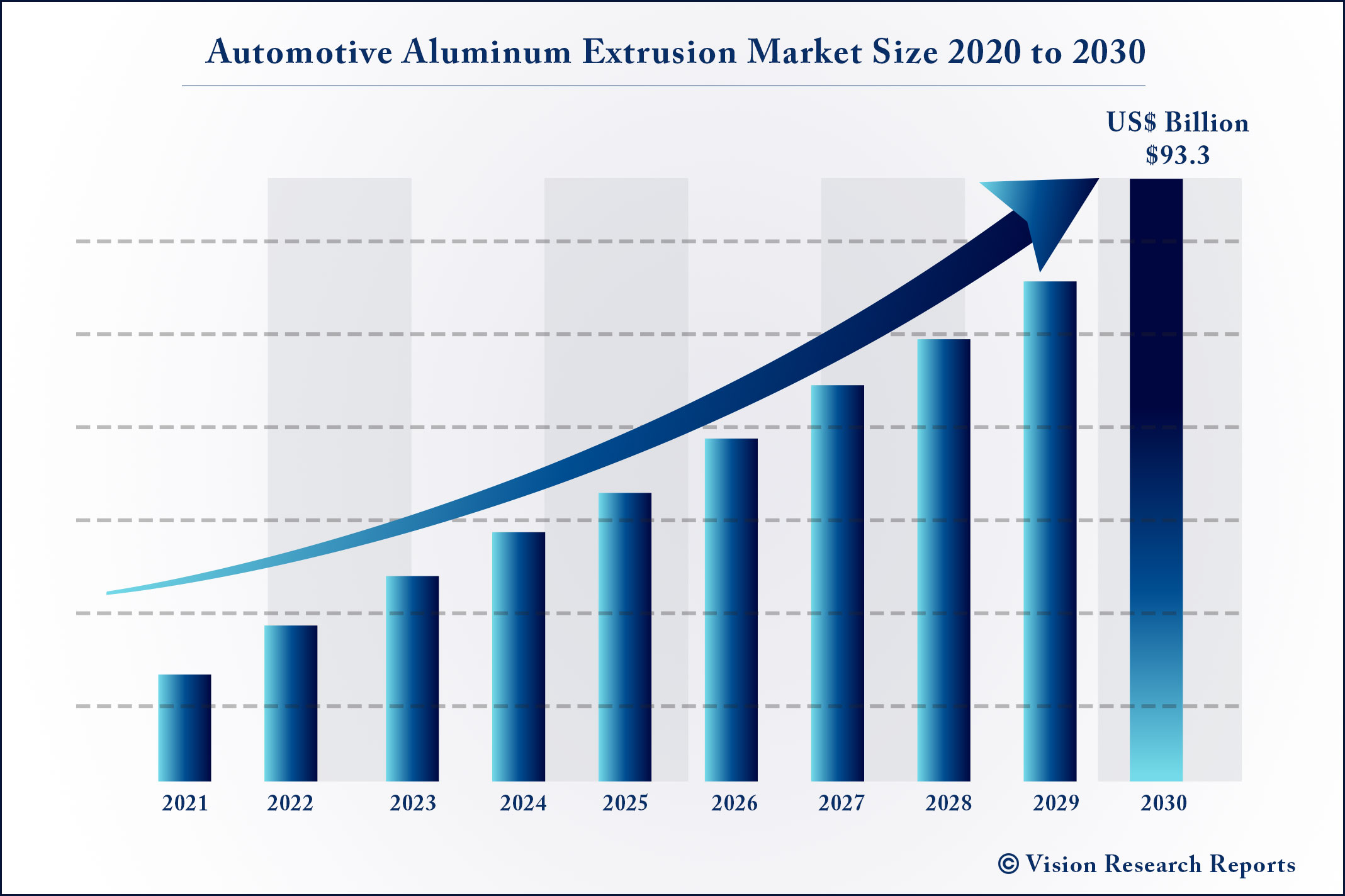

The global automotive aluminum extrusion market size is projected to hit over US$ 93.3 Bn by 2030, growing at a CAGR of 6% during the forecast period 2021 to 2030.

Report Coverage

| Report Scope | Details |

| Market Size | USD 93.3 Bn by 2030 |

| Growth Rate | CAGR of 6% From 2021 to 2030 |

| Base Year | 2020 |

| Historic Data | 2017 to 2020 |

| Forecast Period | 2021 to 2030 |

| Segments Covered | Type, Vehicle, Aluminum Grade |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Mentioned | BENTLER International, Bonnell Aluminum Extrusion Company, CAPALEX, Constellium SE, Innoval Technology, Kaiser Aluminum Corp, KOBE STEEL Ltd., Norsk Hydro ASA, Novelis Inc. OmniMax International, ProfilGruppen Extrusions AB, SMS Schimmer, UACJ Automotive Whitehall Industries, Inc., and Walter Klein GmbH & Co. KG. |

Rise in the demand for lightweight vehicles across the globe is likely to propel the automotive aluminum extrusion market. For instance, after a global slowdown in the automobile industry, several governments have reduced taxes on automobiles to encourage sale of vehicles. The enactment of stringent regulations regarding exhaust gas emission across the globe is prompting vehicle industries to develop lightweight vehicles, which is likely to propel the automotive aluminum extrusion market across the globe.

Expansion of Global Automotive Aluminum Extrusion Market

The surge in trade volume owing to rising bilateral trade among countries is projected to boost the automotive aluminum extrusion market during the forecast period. China witnessed an increase in both general trade volume and proportion, escalating to 15.66 trillion Yuan. China trade volume accounted for 56.4% of the total foreign trade. Major trading partners of China are the U.S., the European Union, and ASEAN.

Based on vehicle, the global automotive aluminum extrusion market has been segmented into minicompact (A Segment), supermini (B Segment), compact (C Segment), mid-size (D Segment), executive (E Segment), luxury (F Segment), utility vehicles, light commercial vehicles, heavy commercial vehicles, and buses & coaches. Utility vehicles is likely to be a highly lucrative segment during the forecast period. This is primarily due to rise in demand for SUVs across the globe. The increase in demand for light commercial vehicles across the globe due to an increase in transportation of goods and commodities across the globe is projected to fuel the demand for light commercial vehicles globally.

Based on type, the sub-structure segment accounted for a significant share of the global automotive aluminum extrusion market. Rise in demand for electric vehicles where aluminum sub-structure is widely used to increase vehicle range is anticipated to boost the automotive aluminum extrusion market across the globe.

Electric Vehicles Set Pace for New Mobility Standards

Aluminum is gaining popularity as the fastest growing automotive material. Electric vehicles (EVs) are driving the automotive aluminum extrusion market. The growing use of aluminum in chassis applications, vehicle closure parts, and body-in-white parts are bolstering market growth. As such, automakers are adapting to new mobility standards, and are bullish on the growth of aluminum in the EV sector.

Analysts at the Vision Research Reports are anticipating Y-O-Y growth for the automotive aluminum extrusion market, as EVs are becoming readily available for customers. Moreover, aluminum extruded structures help to offset the battery weight and lead to fuel savings. Improved vehicle performance is the key advantage of automotive aluminum extruded components.

Drivers of Automotive Aluminum Extrusion Market

Challenges for Automotive Aluminum Extrusion Market

New Aluminum Alloys with Thermal Deformation Suit Lightweight Applications

The automotive aluminum extrusion market is anticipated to grow at a favorable CAGR of 6% throughout the assessment period. This can be attributed to manufacturers being keen on using aluminum alloys in lightweight applications. However, the connection mode is limited in the case of aluminum alloys, which leads to problems in riveting and welding, resulting in poor static performance. Hence, companies in the automotive aluminum extrusion market should collaborate with researchers to develop new aluminum alloys using cost-efficient methods such as thermal deformation, micro alloying, and heat treatment.

Manufacturers are tapping value-grab opportunities in North America. For instance, Norsk Hydro ASA— a Norwegian aluminum and renewable energy company, is investing in output capacities for approx. 23 locations in North America with its enormous competency in design and technical support. Manufacturers are adopting latest technologies in metallurgy and application engineering to gain market recognition.

Collaboration with Universities Helps to Narrow Gap in R&D and Production

Groundbreaking innovations in extrusion equipment are contributing toward the growth of the automotive aluminum extrusion market. For instance, manufacturers should take cues from the Constellium University Technology Center at Brunel University London to develop one-of-its-kind extrusion equipment, which deploys rapid prototyping of automotive components. Automakers should use industry-standard extrusion equipment to significantly reduce development times while manufacturing components using advance aluminum alloys.

Companies in the automotive aluminum extrusion market need to increase R&D muscle to innovate in new alloy processing technologies meant for lightweight applications. They are setting their collaboration wheels in motion with R&D centers at leading universities to develop extruded components as per the automaker’s specifications. Rapid prototyping is the key to reduce development time of vehicles. R&D centers are conducting simulation and precision testing for crash, towing, and assembly processes.

Regional Analysis of Automotive Aluminum Extrusion Market

The global automotive aluminum extrusion market has been segregated into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Asia Pacific dominated the global automotive aluminum extrusion market in 2019. It is anticipated to hold a leading share during the forecast period due to rise in the production and sale of vehicles in China and countries in ASEAN. Followed by Asia Pacific, Europe also held a significant share of the global automotive aluminum extrusion market due to increase in the demand for utility vehicles in the region. The surge in the demand for electric vehicles due to an enactment of stringent emission norms across Europe and Asia Pacific is likely to propel the aluminum extrusion market across Europe and Asia Pacific.

Key Players in Automotive Aluminum Extrusion Market

Prominent players operating in the global automotive aluminum extrusion market include BENTLER International, Bonnell Aluminum Extrusion Company, CAPALEX, Constellium SE, Innoval Technology, Kaiser Aluminum Corp, KOBE STEEL Ltd., Norsk Hydro ASA, Novelis Inc. OmniMax International, ProfilGruppen Extrusions AB, SMS Schimmer, UACJ Automotive Whitehall Industries, Inc., and Walter Klein GmbH & Co. KG.

Global Automotive Aluminum Extrusion Market: Segmentation

Scope of the Report

Vision Research Reports recent report on the automotive aluminum extrusion market, with the help of a comprehensive outlook, provides readers with an assessment of the global market landscape. This study on the automotive aluminum extrusion market analyzes the scenario for the period of 2020 to 2030, wherein, 2020 is the base year and 2019 and before is historical data. This report enables readers to make important decisions with regard to their business, with the help of a wealth of Information enclosed in the study.

This VRR study on the automotive aluminum extrusion market also provides data on the developments made by important players and stakeholders in the market, along with a competitive analysis. The report also provides an understanding of strengths, weaknesses, threats, and opportunities, along with the trends and restraints in the market landscape. Presented in a clear sanctioned manner, this report on the automotive aluminum extrusion market gives readers an individual understanding of the market.

Key Questions Answered in This Report on Automotive Aluminum Extrusion Market

This report answers these questions and more about the automotive aluminum extrusion market, aiding major stakeholders and key players in making the right decisions and strategizing for the advancement of their business.

Automotive Aluminum Extrusion Market – Research Methodology

This VRR report on the automotive aluminum extrusion market is based on a complete and comprehensive evaluation of the market backed by secondary and primary sources. Market volume is determined by country wise model mapping of vehicle through internal & external proprietary databases, and relevant patent and regulatory databases. The competitive scenario of the automotive aluminum extrusion market is supported by an assessment of the different factors that influence the market on a minute and granular level. By thoroughly analyzing the historical data, current trends and announcement by the key players, researchers of the automotive aluminum extrusion market arrive at predictions and estimations, and calculate the forecast for the market.

This report uses an analytical triangulation method to estimate the numbers and figures of the automotive aluminum extrusion market, with both a bottom-up and top-down approach.

This detailed assessment of the automotive aluminum extrusion market, along with an overview of the landscape, is provided based on a careful examination of the avenues related to this industry. Analysts’ conclusions on how the automotive aluminum extrusion market is estimated to expand are based on carefully vetted primary and secondary sources.

Automotive Aluminum Extrusion Market – Segmentation

This report on the automotive aluminum extrusion market provides information on the basis of type, vehicle, aluminum grade, and region.

This study also discusses the underlying trends and impact of various factors that are driving the automotive aluminum extrusion market, along with their influence on the evolution of the market.

This study also offers Porter’s Five Point Analysis, value chain analysis, regulatory scenario, and a SWOT analysis of the automotive aluminum extrusion market in order to elaborate the crucial growth tactics and opportunities for market players contributing to the market.

Table of Contents

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Automotive Aluminum Extrusion Market, By Product

7.1. Automotive Aluminum Extrusion Market, by Product Type, 2021-2030

7.1.1. Sub-structures

7.1.1.1. Market Revenue and Forecast (2017-2030)

7.1.2. Door Beam

7.1.2.1. Market Revenue and Forecast (2017-2030)

7.1.3. Bumpers

7.1.3.1. Market Revenue and Forecast (2017-2030)

7.1.4. Pillars

7.1.4.1. Market Revenue and Forecast (2017-2030)

7.1.5. Sub Frames

7.1.5.1. Market Revenue and Forecast (2017-2030)

7.1.6. Seat Back Bar

7.1.6.1. Market Revenue and Forecast (2017-2030)

7.1.7. Front Side Rail

7.1.7.1. Market Revenue and Forecast (2017-2030)

7.1.8. Space Frames

7.1.8.1. Market Revenue and Forecast (2017-2030)

7.1.9. Body Panels

7.1.9.1. Market Revenue and Forecast (2017-2030)

7.1.10. Others

7.1.10.1. Market Revenue and Forecast (2017-2030)

Chapter 8. Global Automotive Aluminum Extrusion Market, By Vehicle

8.1. Automotive Aluminum Extrusion Market, by Vehicle, 2021-2030

8.1.1. Minicompact (A Segment)

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Supermini (B Segment)

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Compact (C Segment)

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Mid-Size (D Segment)

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Executive (E Segment)

8.1.5.1. Market Revenue and Forecast (2017-2030)

8.1.6. Luxury (F Segment)

8.1.6.1. Market Revenue and Forecast (2017-2030)

8.1.7. Utility Vehicles

8.1.7.1. Market Revenue and Forecast (2017-2030)

8.1.8. Light Commercial Vehicles

8.1.8.1. Market Revenue and Forecast (2017-2030)

8.1.9. Heavy Commercial Vehicles

8.1.9.1. Market Revenue and Forecast (2017-2030)

8.1.10. Buses & Coaches

8.1.10.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Automotive Aluminum Extrusion Market, By Aluminum Grade

9.1. Automotive Aluminum Extrusion Market, by Aluminum Grade, 2021-2030

9.1.1. 5000 Series

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. 6000 Series

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. 7000 Series

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Automotive Aluminum Extrusion Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.2. Market Revenue and Forecast, by Vehicle (2017-2030)

10.1.3. Market Revenue and Forecast, by Aluminum Grade (2017-2030)

10.1.4. U.S.

10.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Vehicle (2017-2030)

10.1.4.3. Market Revenue and Forecast, by Aluminum Grade (2017-2030)

10.1.5. Rest of North America

10.1.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.5.2. Market Revenue and Forecast, by Vehicle (2017-2030)

10.1.5.3. Market Revenue and Forecast, by Aluminum Grade (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.2. Market Revenue and Forecast, by Vehicle (2017-2030)

10.2.3. Market Revenue and Forecast, by Aluminum Grade (2017-2030)

10.2.4. UK

10.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Vehicle (2017-2030)

10.2.4.3. Market Revenue and Forecast, by Aluminum Grade (2017-2030)

10.2.5. Germany

10.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Vehicle (2017-2030)

10.2.5.3. Market Revenue and Forecast, by Aluminum Grade (2017-2030)

10.2.6. France

10.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Vehicle (2017-2030)

10.2.6.3. Market Revenue and Forecast, by Aluminum Grade (2017-2030)

10.2.7. Rest of Europe

10.2.7.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.7.2. Market Revenue and Forecast, by Vehicle (2017-2030)

10.2.7.3. Market Revenue and Forecast, by Aluminum Grade (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.2. Market Revenue and Forecast, by Vehicle (2017-2030)

10.3.3. Market Revenue and Forecast, by Aluminum Grade (2017-2030)

10.3.4. India

10.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Vehicle (2017-2030)

10.3.4.3. Market Revenue and Forecast, by Aluminum Grade (2017-2030)

10.3.5. China

10.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Vehicle (2017-2030)

10.3.5.3. Market Revenue and Forecast, by Aluminum Grade (2017-2030)

10.3.6. Japan

10.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Vehicle (2017-2030)

10.3.6.3. Market Revenue and Forecast, by Aluminum Grade (2017-2030)

10.3.7. Rest of APAC

10.3.7.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.7.2. Market Revenue and Forecast, by Vehicle (2017-2030)

10.3.7.3. Market Revenue and Forecast, by Aluminum Grade (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.2. Market Revenue and Forecast, by Vehicle (2017-2030)

10.4.3. Market Revenue and Forecast, by Aluminum Grade (2017-2030)

10.4.4. GCC

10.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Vehicle (2017-2030)

10.4.4.3. Market Revenue and Forecast, by Aluminum Grade (2017-2030)

10.4.5. North Africa

10.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Vehicle (2017-2030)

10.4.5.3. Market Revenue and Forecast, by Aluminum Grade (2017-2030)

10.4.6. South Africa

10.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Vehicle (2017-2030)

10.4.6.3. Market Revenue and Forecast, by Aluminum Grade (2017-2030)

10.4.7. Rest of MEA

10.4.7.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.7.2. Market Revenue and Forecast, by Vehicle (2017-2030)

10.4.7.3. Market Revenue and Forecast, by Aluminum Grade (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.2. Market Revenue and Forecast, by Vehicle (2017-2030)

10.5.3. Market Revenue and Forecast, by Aluminum Grade (2017-2030)

10.5.4. Brazil

10.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Vehicle (2017-2030)

10.5.4.3. Market Revenue and Forecast, by Aluminum Grade (2017-2030)

10.5.5. Rest of LATAM

10.5.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.5.2. Market Revenue and Forecast, by Vehicle (2017-2030)

10.5.5.3. Market Revenue and Forecast, by Aluminum Grade (2017-2030)

Chapter 11. Company Profiles

11.1. BENTLER International

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Bonnell Aluminum Extrusion Company

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. CAPALEX

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Constellium SE

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. Innoval Technology

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Kaiser Aluminum Corp

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. KOBE STEEL Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Norsk Hydro ASA

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Novelis Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. OmniMax International

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

11.11. ProfilGruppen Extrusions AB

11.11.1. Company Overview

11.11.2. Product Offerings

11.11.3. Financial Performance

11.11.4. Recent Initiatives

11.12. SMS Schimmer

11.12.1. Company Overview

11.12.2. Product Offerings

11.12.3. Financial Performance

11.12.4. Recent Initiatives

11.13. UACJ Automotive Whitehall Industries, Inc.

11.13.1. Company Overview

11.13.2. Product Offerings

11.13.3. Financial Performance

11.13.4. Recent Initiatives

11.14. Walter Klein GmbH & Co. KG.

11.14.1. Company Overview

11.14.2. Product Offerings

11.14.3. Financial Performance

11.14.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others