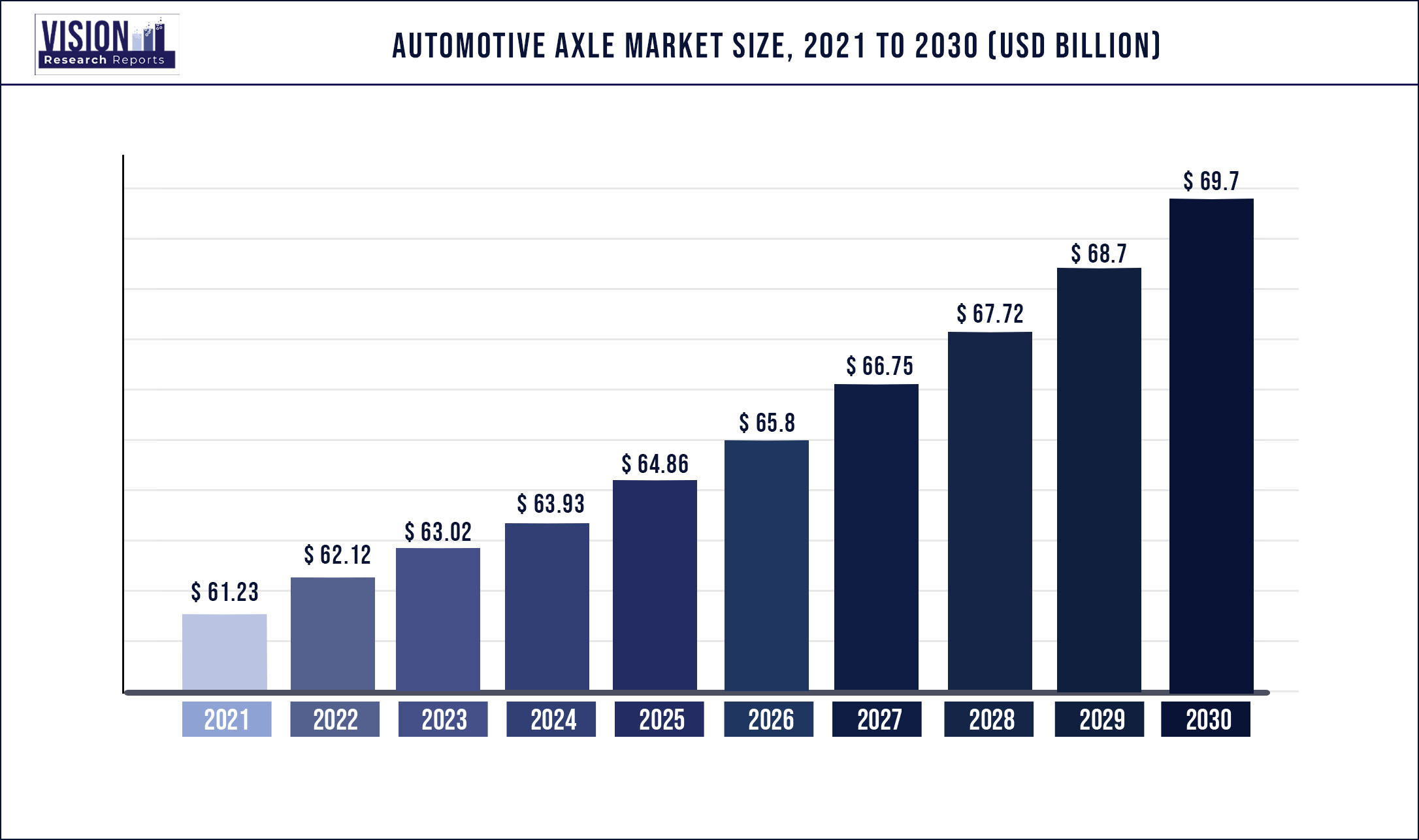

The global automotive axle market was surpassed at USD 61.23 billion in 2021 and is expected to hit around USD 69.7 billion by 2030, growing at a CAGR of 1.45% from 2022 to 2030.

Report Highlights

Factors such as increasing automobile production, a surge in the sales of heavy, light commercial, and passenger vehicles, and shifting consumer preference towards luxury vehicles with advanced features are fueling the market growth. The growing popularity of autonomous and semi-autonomous cars equipped with leading technological innovations in automobiles and their subsequent vehicle production is anticipated to further contribute to the growth of the market.

Shifting consumer preference and capitalization of advanced automotive technologies for downsizing components, reducing their weight, and making them fuel-efficient and cost-effective is driving the market globally. As a result, many manufacturers are exploring carbon fiber as an option for metals such as steel and aluminum to design and manufacture axles for powertrains. Carbon fiber boosts advantages such as a higher weight-to-strength ratio and resistance to corrosion, and these advantages enhance the axle's functional ability and life.

The rising awareness about the carbon emission caused by conventional fuel-powered vehicles has initiated a shift toward electric cars resulting in sharp sales growth of hybrid and electric vehicles worldwide. The sales trend is anticipated to drive market growth for the automotive axle. Moreover, government authorities worldwide are actively encouraging the adoption of EVs by introducing incentives such as tax benefits and subsidies to end-users and manufacturers alike. The rising environmental awareness about the adverse effects of carbon emissions and government initiatives for the adoption of EVs is expected to propel the growth of the market during the forecast period.

Based on Vehicle type passenger segment is expected to dominate the market share. The demand for passenger vehicles is rising across countries such as China, India, South Africa, and Thailand, owing to an increase in disposable income, and urbanization is acting as a favorable condition for market growth. In addition to this, the surge in demand for the all-wheel-drive system for passenger cars is also pushing the demand for automotive axles.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 61.23 billion |

| Revenue Forecast by 2030 | USD 69.7 billion |

| Growth rate from 2022 to 2030 | CAGR of 1.45% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Type, application, vehicle type, region |

| Companies Covered |

American Axle & Manufacturing, Inc. Dana Incorporated; Daimler AG; GNA Group; Meritor Inc.; ZF Friedrichshafen AG; Melrose Industries PLC; Talbros Engineering Limited |

Type Insight

The drive axle type segment dominated the market and accounted for the highest revenue share of over 65.1% in 2021. All-wheel and front-wheel drive axle are gaining popularity among manufacturers and consumers due to their ability to have better traction in different terrains. Moreover, the growing demand for passenger and commercial vehicles in the Asia Pacific, Europe, and North America will further boost the demand for different drive-type axles.

The lift axle type is expected to experience the highest CAGR of 1.92% during the forecast period. Lift axles are considered ideal for long-haul vehicles used for logistics and carrying a heavy load. The lift axle helps extend the life cycle of brake shoes and tiers, improves the fuel efficiency of the vehicles and reducing the rolling resistance. The lift axle also distributes the weight of the cargo evenly. These factors of lift axle for heavy-duty cargo vehicles is expected to drive its demand for the market. According to the European Economic Community (EEC), the determined load carried by each axle is limited and the suitable liftable axles should automatically be dropped to obtain an adequate load distribution.

Application Insights

The front application axle segment will dominate the market with the highest market share of over 51% in 2021. The front axle is generally installed in passenger vehicles owing to lesser complexities during the assembly of mid and economy-range segment cars. Furthermore, the increasing usage of all-wheel-drive vehicles like four-wheel-drive, six-wheel-drive, and eight-wheel-drive is expected to encourage the growth of front axle market.

The rear axle segment also held the highest CAGR of 2.2% over the forecast period. The rising demand for commercial, heavy-duty, and passenger vehicles in Europe and the Asia Pacific, is driving the demand for rear axles in these regions. The player manufacturing rear axle is focusing on providing enhanced cost advantages, safety, and comfort. Moreover, the increasing roadway logistic activities across countries are also favoring the demand for rear axle segment growth.

Vehicle Type Insights

The passenger car segment dominated the market and accounted for the largest revenue share of over 50.11% in 2021. Factors such as increasing urbanization, growing population, and increasing disposable income worldwide are driving the demand for passenger vehicles. The surge in passenger car production in economies such as Indonesia, India, China, and South Africa is influencing market growth. Furthermore, the application of front-wheel-drive, rear-wheel-drive, and all-wheel drive in many segments of luxury and hybrid passenger cars is expected to provide rapid growth to the segment.

The heavy commercial vehicle segment is projected witness the highest CAGR of 2.06% during the forecast period. The growth of the HCV segment is attributed to the growing logistics industry, especially in the North American and European regions. Moreover, heavy commercial vehicles generally use lift axles, which is another factor favoring the market growth. Many heavy commercial vehicles use six or eight wheel-drive or a larger wheel drive creating prospects for market growth.

Regional Insights

Asia Pacific dominated the automotive axle market and accounted for the largest revenue share of 50.6% in 2021. The Asia Pacific is home to major automobile markets such as China, India, and Japan, where the demand is increasing for passenger and commercial vehicles driving the market growth of automotive axles. Technologically advanced axle, which is lightweight, has more traction, is fuel-efficient, and uses different material such as carbon fiber, are being installed in vehicles to improve their performance further driving the market growth. There is a strong presence of major automotive axle manufacturers such as Hyundai Transys Inc., which will also boost market growth in the Asia Pacific region.

In North America, the market is expected to exhibit the highest CAGR of 2.03% during the forecast period. The growth of the axle market in the North America can be credited to the growing demand for commercial and luxury vehicles in the region. The presence of key manufacturers such as DANA Incorporated, Meritor Inc and American Axle & Manufacturing, Inc., and the widespread adoption of All-Wheel-Drive is further driving the market growth in the region.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive Axle Market

5.1. COVID-19 Landscape: Automotive Axle Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive Axle Market, By Type

8.1. Automotive Axle Market, by Type, 2022-2030

8.1.1 Drive

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Dead

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Lift

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Automotive Axle Market, By Application

9.1. Automotive Axle Market, by Application, 2022-2030

9.1.1. Front

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Rear

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Automotive Axle Market, By Vehicle Type

10.1. Automotive Axle Market, by Vehicle Type, 2022-2030

10.1.1. Passenger Cars

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Light Commercial Vehicle (LCV)

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Heavy Commercial Vehicle (HCV)

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Automotive Axle Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.4.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.4.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.4.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.4.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.4.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Vehicle Type (2017-2030)

Chapter 12. Company Profiles

12.1. American Axle & Manufacturing, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Dana Incorporated

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Daimler AG

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. GNA Group

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Meritor Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. ZF Friedrichshafen AG

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Melrose Industries PLC

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Talbros Engineering Limited

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others