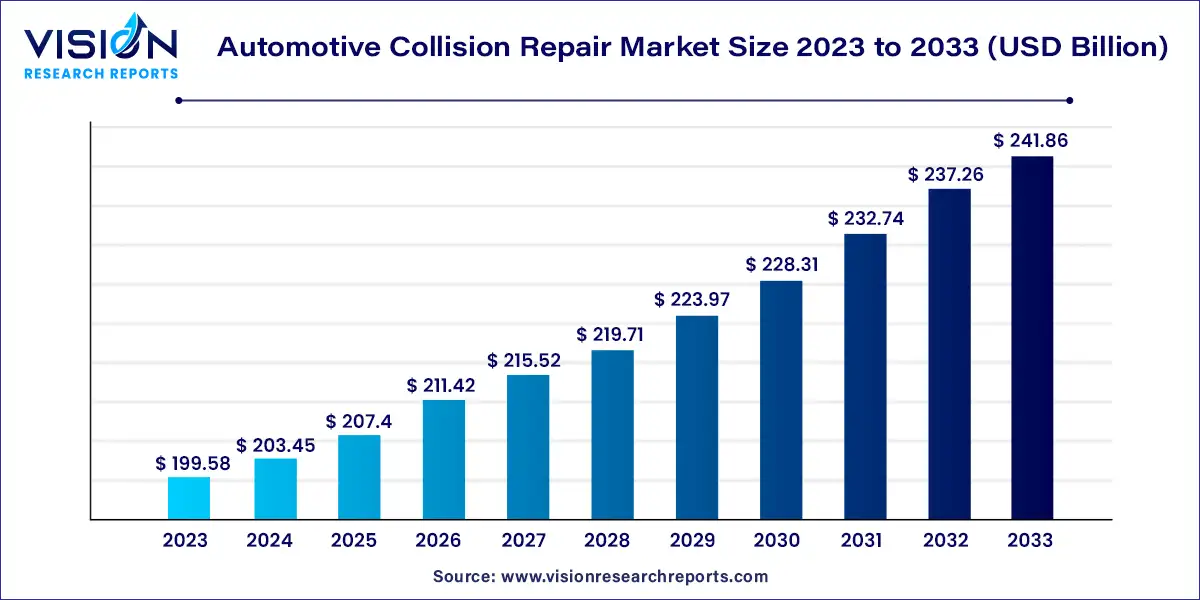

The global automotive collision repair market size was estimated at USD 199.58 billion in 2032 and it is expected to surpass around USD 241.86 billion by 2033, poised to grow at a CAGR of 1.94% from 2024 to 2033.

The automotive collision repair market is a dynamic sector within the automotive industry, characterized by its crucial role in restoring vehicles to their pre-accident condition. This market encompasses a wide range of services and products aimed at repairing damage resulting from collisions, accidents, and other forms of vehicular incidents.

At its core, the automotive collision repair market revolves around providing solutions to restore damaged vehicles, including bodywork repairs, frame straightening, painting, and refinishing. Additionally, advancements in technology and materials have led to the integration of innovative repair techniques, such as paintless dent repair and advanced diagnostics systems, further enhancing the efficiency and quality of repairs.

The growth of the automotive collision repair market is propelled by an increasing number of vehicles on the road contributes to a higher frequency of collisions and accidents, driving demand for repair services. Additionally, advancements in automotive technology have led to more complex vehicles with sophisticated safety features, necessitating specialized repair expertise and equipment. Furthermore, rising consumer awareness regarding vehicle safety and aesthetics fuels demand for high-quality collision repair services to restore vehicles to their pre-accident condition. Moreover, stringent government regulations regarding vehicle safety standards and environmental concerns drive the adoption of eco-friendly repair practices and materials, shaping the market landscape.

| Report Coverage | Details |

| Market Size in 2023 | USD 199.58 billion |

| Revenue Forecast by 2033 | USD 241.86 billion |

| Growth rate from 2024 to 2033 | CAGR of 1.94% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

The spare parts segment dominates the market, with a revenue share of 65% in 2023. The spare parts used in automobile service delivery include crash parts, repair materials, supplementary mechanical parts, restoration materials, and tools. The high number of road accidents leading to the damage of integral elements such as grilles, bumpers, fenders, dents, and scratches are fueling the demand for replacement spare parts. The increasing consumer awareness of the importance of maintenance and repair in improving vehicle performance and lifecycle is driving the growth of the spare parts segment.

The paints & coatings segment is expected to grow at the fastest CAGR of 2.72% from 2024 to 2033. The rapidly evolving paints & coatings technology, which meets the latest protective automobile materials and aesthetic demands, is the key reason for the growth of the segment in the automotive industry. Paints & coatings are anticipated to witness higher adoption in high-volume markets over the forecast period, owing to the surging environmental concerns about the use of detrimental synthetic coatings and refinishing materials. The paints and coatings segment is projected to grow steadily during the forecast period because of the environmental and health risks associated with automotive body paint materials.

The OE (handled by OEM's) segment dominates the market in terms of revenue share in 2023. The DIY (Do It Yourself) segment, on the other hand, is expected to grow at the fastest CAGR of 2.53% from 2024 to 2033. Globally, people have been retaining their car usage for longer periods, which has supported the demand for replacement parts. The automotive collision repair industry will continue to significantly grow, which is attributed to its robust demand from emerging economies. The DIY segment is expected to grow at the highest CAGR in the Asia Pacific region from 2024 to 2033, followed by South America. Manufacturers in the automotive industry are gradually shifting their focus to vehicle modification, where they can customize the vehicle to meet the needs of the customer rather than purchasing new vehicles.

The future of the collision repair industry is with DIY kits. Thus, several companies have initiated the production of complete kits that provide DIY solutions to users. The increased preference of customers for warranty is one of the major factors that support the dominance of OE in the market. OEMs offer products with benefits such as longer product lifecycles, reliability, and better performance. The abovementioned factors are expected to strengthen the position of OEMs in the market from 2024 to 2033.

The light-duty segment dominated the market in 2023. The light-duty vehicles segment comprises hatchbacks, sedans, SUVs, and crossover cars. The demand for alternative transportation options, government initiatives for improving fuel economy, and the availability of alternative fuel vehicles are expected to increase the sales of light-duty vehicles in the coming years. Furthermore, vehicle sales in the industry are anticipated to be primarily driven by the adoption of vehicles that require alternative fuels and vehicles with several levels of drivetrain electrification.

The heavy-duty vehicles segment is expected to grow at a CAGR of 1.54% from 2024 to 2033. The heavy-duty vehicles segment includes commercial and multi-axle vehicles such as trucks and buses. Heavy-duty vehicles are anticipated to be used for the transportation of bulk products within any country or region. Increasing trade activities are expected to augment the demand for heavy-duty vehicles equipped with the latest technologies for hauling and loading.

North America accounted for a significant revenue share of the global market in 2023. The region has a higher technology adoption rate, which will result in the faster and higher adoption of hybrid electric automobiles in the region as compared to other geographies. Due to this trend, the region is anticipated to witness a growing proportion of specialized automotive collision repair centers that are dedicated to servicing the vehicles of a particular make, such as alternate fuel powered vehicles

Asia Pacific is expected to grow at the fastest CAGR of 3.53% from 2024 to 2033. The increasing number of vehicle sales is leading to significant growth of the regional industry. An upsurge in vehicular damage due to lack of stringent driving regulations in Asia Pacific is further driving the regional market growth. The region is perceived to be a source of components for local companies and multinationals, who aim to supply low-cost components to prominent vehicle manufacturers.

By Product

By Vehicle Type

By Service channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive Collision Repair Market

5.1. COVID-19 Landscape: Automotive Collision Repair Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive Collision Repair Market, By Product

8.1. Automotive Collision Repair Market, by Product, 2024-2033

8.1.1 Paints & coatings

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Consumables

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Spare parts

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Automotive Collision Repair Market, By Vehicle Type

9.1. Automotive Collision Repair Market, by Vehicle Type, 2024-2033

9.1.1. Light-duty vehicle

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Heavy-duty vehicle

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Automotive Collision Repair Market, By Service channel

10.1. Automotive Collision Repair Market, by Service channel, 2024-2033

10.1.1. DIY

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. DIFM

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. OE

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Automotive Collision Repair Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.1.3. Market Revenue and Forecast, by Service channel (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Service channel (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Service channel (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.3. Market Revenue and Forecast, by Service channel (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Service channel (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Service channel (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Service channel (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Service channel (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.3. Market Revenue and Forecast, by Service channel (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Service channel (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Service channel (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Service channel (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Service channel (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.3. Market Revenue and Forecast, by Service channel (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Service channel (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Service channel (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Service channel (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Service channel (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.5.3. Market Revenue and Forecast, by Service channel (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Service channel (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Service channel (2021-2033)

Chapter 12. Company Profiles

12.1. 3M

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Automotive Technology Products LLC

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Continental AG

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Denso Corporation

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Faurecia

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Federal-Mogul LLC

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Honeywell International, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. International Automotive Components Group

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Johnson Controls, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Magna International Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others