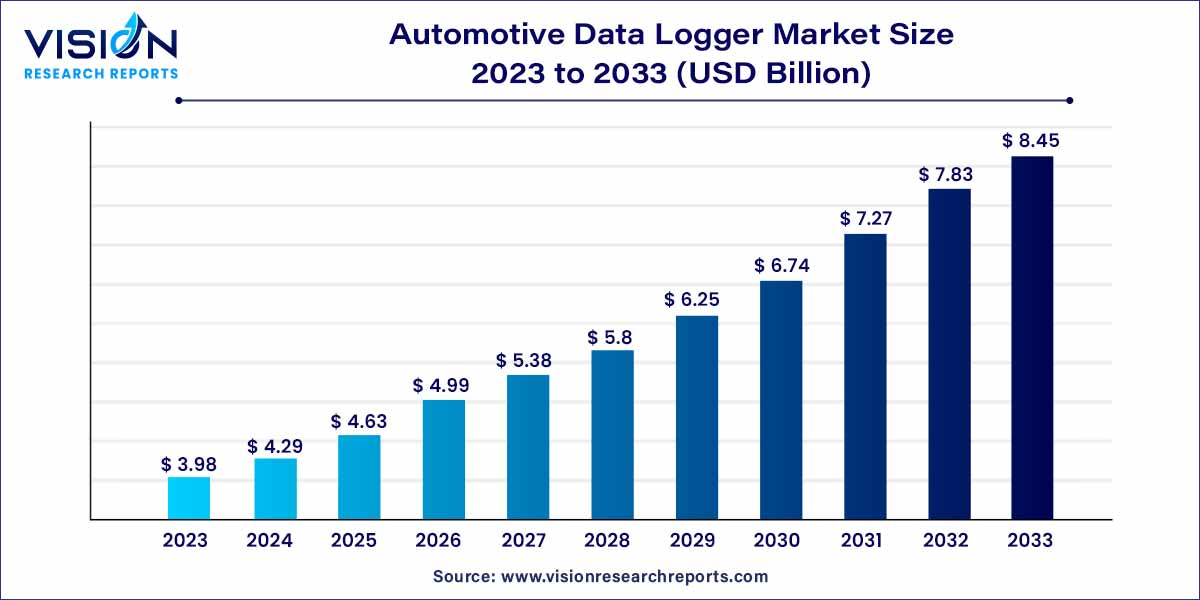

The global automotive data logger market was estimated at USD 3.98 billion in 2023 and it is expected to surpass around USD 8.45 billion by 2033, poised to grow at a CAGR of 7.82% from 2024 to 2033. The automotive data logger market in the United States was accounted for USD 3.9 billion in 2022.

The automotive industry is undergoing a profound transformation driven by technological advancements, and one such innovation making a significant impact is the Automotive Data Logger. This device plays a pivotal role in capturing, recording, and analyzing data from various vehicle components, offering valuable insights into performance, efficiency, and safety.

The automotive data logger market is witnessing robust growth, propelled by several key factors. Firstly, the increasing demand for connected vehicles has become a significant growth driver. As automotive technology advances, the integration of data loggers becomes essential for capturing, analyzing, and transmitting data required for connected car functionalities. Secondly, continuous advancements in sensor technologies contribute to the market's expansion. These innovations enhance the precision and breadth of data loggers, enabling more accurate and comprehensive data collection. Additionally, the global shift towards electric vehicles amplifies the importance of data loggers in monitoring and optimizing critical aspects such as battery performance, energy consumption, and charging patterns. Lastly, the integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies with data loggers is fostering predictive analysis and condition monitoring. This integration facilitates proactive maintenance strategies, ultimately improving vehicle reliability. The convergence of these growth factors underscores the pivotal role of automotive data loggers in shaping the future of the automotive industry.

| Report Coverage | Details |

| Market Size in 2023 | USD 3.98 billion |

| Revenue Forecast by 2033 | USD 8.45 billion |

| Growth rate from 2024 to 2033 | CAGR of 7.82% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The automotive data logger market is categorized by connection type, with segments including USB, SD card, and wireless. In the year 2023, the USB segment emerged as the dominant force in the market. USB data loggers are known for their compact design and ease of installation. Their portability allows for versatile use across different vehicles without the need for intricate setups. Moreover, USB data loggers exhibit compatibility with an extensive range of sensors and software applications. This includes seamless integration with third-party software, enabling advanced data analysis. This compatibility ensures that automotive engineers can employ their preferred analysis tools effortlessly.

Based on application, the market is segmented into on-board diagnostics, ADAS & safety, fleet management, and automotive insurance. In 2023, the ADAS & safety segment emerged as the market leader. The dominance of this segment can be attributed to the critical role data loggers play in supporting Adaptive Cruise Control (ACC) systems. ACC systems rely on precise data regarding surrounding vehicles, speeds, and distances to function effectively. Data loggers contribute by providing real-world data for testing these systems across diverse conditions.

With a growing awareness among consumers regarding safety features, there is an increasing demand for vehicles equipped with advanced ADAS technologies. This surge in demand includes features like lane-keeping assistance and automatic emergency braking systems. As a response, automakers are investing in data loggers to test and refine these features before mass production. Notably, in February 2023, Continental AG, a leading automotive parts manufacturer, announced its collaboration with Tata Motors Limited and Maruti Suzuki India Limited to develop advanced driving assistance systems technologies. This collaboration includes the creation of features such as emergency brake assist, blind spot detection, and rear cross-traffic alert. This highlights the pivotal role of data loggers in advancing safety technologies within the automotive industry.

The market is segmented on the basis of sales channels into OEMs and aftermarket. The OEM segment held the largest revenue share in 2023. Data loggers integrated by Original Equipment Manufacturers (OEMs) are seamlessly incorporated into the vehicle's electronic systems during the manufacturing process. This integration is designed to ensure the smooth functioning of the data logger alongside other vehicle components, ultimately leading to precise and reliable data collection.

OEM-fitted data loggers adhere to industry standards and regulations. The use of standardized data collection methods ensures consistency and compatibility. This, in turn, facilitates easier analysis and comparison across different vehicle models and brands. The emphasis on industry standards enhances the overall quality and reliability of data collected through OEM channels, solidifying its position as the leading sales channel in the automotive data logger market.

In 2023, the North America region asserted its dominance in the market. The region's leading position is attributed to the widespread adoption of safety systems in standard vehicles and the increasing integration of electronic systems in passenger cars, light commercial vehicles, and SUVs. This trend is expected to be a key driver for regional growth.

Furthermore, the surge in demand for energy-efficient vehicles aligns with government regulations aimed at reducing carbon emissions, providing additional impetus for market expansion in North America. The regional market is also positively influenced by the growing preference for connected cars. As an illustration, in August 2022, the Californian government outlined an ambitious goal of producing 1.5 million zero-emission vehicles by the year 2035. This commitment to environmentally friendly initiatives underscores the region's commitment to sustainable transportation practices and contributes to the overall growth of the automotive data logger market in North America.

By Connection Type

By Application

By Sales Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Connection Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive Data Logger Market

5.1. COVID-19 Landscape: Automotive Data Logger Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive Data Logger Market, By Connection Type

8.1. Automotive Data Logger Market, by Connection Type, 2024-2033

8.1.1 USB

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. SD card

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Wireless

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Automotive Data Logger Market, By Application

9.1. Automotive Data Logger Market, by Application, 2024-2033

9.1.1. On-board diagnostics

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. ADAS & safety

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Fleet Management

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Automotive Insurance

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Automotive Data Logger Market, By Sales Channel

10.1. Automotive Data Logger Market, by Sales Channel, 2024-2033

10.1.1. OEMs

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Aftermarket

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Automotive Data Logger Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Connection Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Connection Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Connection Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Connection Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Connection Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Connection Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Connection Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Connection Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Connection Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Connection Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Connection Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Connection Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Connection Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Connection Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Connection Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Connection Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Connection Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Connection Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Connection Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Connection Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Connection Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

Chapter 12. Company Profiles

12.1. Robert Bosch GmbH

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Vector Informatik GmbH

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Continental AG

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. National Instruments Corp.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Danlaw Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Keysight Technologies

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Racelogic

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. HORIBA Ltd.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Xylon

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Influx Technology

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others