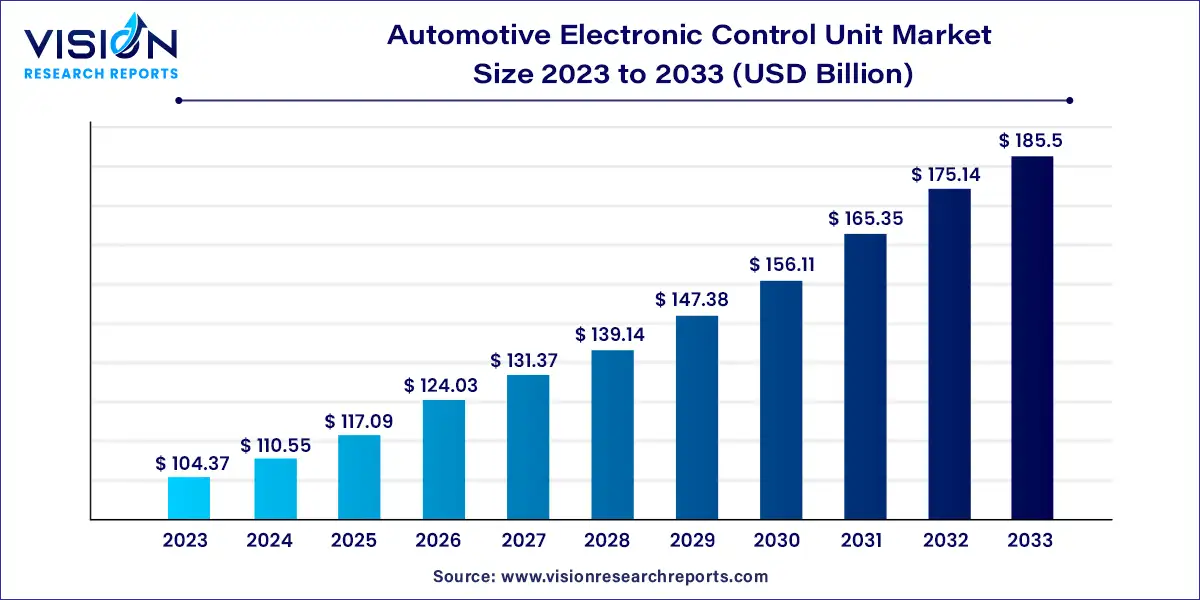

The global automotive electronic control unit market size was estimated at around USD 104.37 billion in 2023 and it is projected to hit around USD 185.5 billion by 2033, growing at a CAGR of 5.92% from 2024 to 2033.

The automotive industry is experiencing a significant shift towards electronic integration, revolutionizing vehicle functionalities and performance. At the heart of this transformation lies the Automotive Electronic Control Unit (ECU), a crucial component responsible for managing various electronic systems within vehicles.

The growth of the automotive electronic control unit (ECU) market is propelled an increasing integration of electronic systems in vehicles, driven by advancements in vehicle electrification, is driving the demand for ECUs capable of managing complex powertrain systems and optimizing energy utilization. Secondly, the rising emphasis on safety and security features in automobiles, coupled with stringent regulatory standards, is driving the adoption of advanced ECUs equipped with real-time monitoring and predictive analytics capabilities. Additionally, the pursuit of autonomous driving technologies is fueling the demand for ECUs capable of processing large volumes of sensor data and facilitating vehicle-to-vehicle communication. Furthermore, innovation in semiconductor technologies, such as System-on-Chip (SoC) solutions, presents opportunities for enhancing ECU performance and reliability. Overall, these growth factors underscore the significant opportunities in the Automotive ECU market for stakeholders to innovate, collaborate, and capitalize on emerging trends in the automotive industry.

The 32-bit segment accounted for the largest share of over 42% of the market in 2023. The rise in demand for these components can be attributed to their beneficial qualities, such as reduced design intricacy and low energy use. Furthermore, the enhanced performance provided by these 32-bit components has increased their application in engine control systems, automotive power drills, and transmission control units.

The 64-bit segment is expected to register the highest CAGR over the forecast period, owing to the improved operating system and memory support. These parts are utilized in high-tech autonomous vehicle applications such as traffic control systems, lane management systems, and ADAS. Additionally, 64-bit ECU improves transmission, which necessitates using fewer ECUs per car. Automotive electronic control unit consolidation saves vehicle weight and costs, therefore 64-bit is a high-performance electronic control unit that is frequently employed to carry out operations of several systems.

By vehicle, the passenger cars segment accounted for the largest share of over 65% in the market for automotive electric control units in 2023. The growth of this segment is attributed to the additional features provided by in-vehicle management systems, such as greater driver remote capabilities and vehicle software updates; passenger automobiles, even luxury vehicles, have a greater number of ECUs than other vehicles.

The passenger cars segment is expected to expand at the highest CAGR over the forecast period. Theindustry is experiencing increased demand for high-end vehicles due to rising purchasing power in developing countries. High levels of automotive electronic system integration are present in luxury automobiles, and automotive electronic control units are necessary to operate this system. Also, the need for ECUs is rising due to autonomous driving, IoT-controlled functions, and telematics; these factors, along with the ease of configuration and availability of various engine and transmission safety features in ECUs, are developing the passenger car segment.

The powertrain segment accounted for the largest share of over 28% of the automotive electronic control unit market in 2023. The segment growth is attributed to the demand for powertrain electronic control units that improve engine performance by managing the vehicle's warning lights, fuel injection, valve timings, and spark timing. In addition, the powertrain electric control components also offer a number of benefits, such as being lightweight, small, and simple to install; as a result, these qualities promote their application in cars and contribute to the high segment share.

The ADAS & safety system segment is expected to witness considerable growth over the forecast period. Growing consumer awareness of the need for driver and passenger safety and declining prices for in-car electronic safety systems are propelling segment expansion. The need for ADAS safety systems and associated regulations in the automobile electronic control unit market is further fueled by the fact that major auto manufacturers are embracing ADAS solutions by adding them to raise the safety rating of their vehicles and attract consumers.

The internal combustion engine segment accounted for the largest share of over 73% in the automotive ECU market in 2023. This is due to the growing automobile manufacturing in emerging economies such as India and China. For instance,in December 2023,Stellantis NV partnered with Qinomic to develop an e-drivetrain retrofit solution for converting light commercial vehicles with ICEs to electric drivetrains while enhancing OEM quality and requirements, such as safety, longevity, and type approval. With an economical option that satisfies customer desires to prolong the life of their vehicles and maintain business operations while entering Low Emissions Zones (LEZ) in localities, the electric retrofit solution strives to protect freedom of mobility.

The battery-powered propulsion segment is expected to witness considerable growth over the forecast period. The growth of this segment is owing to the increased government efforts to reduce pollution, along with the increasing acceptance of vehicles that use less energy. The development of battery-powered vehicles is also being fueled by government incentives encouraging the use of EVs and infrastructure investments to establish EV charging and hydrogen fueling stations. Lower battery costs for personal and commercial vehicles are driving the expansion of the automotive ECU market.

In 2023, Asia Pacific held the largest market share of around 51% in terms of revenue, owing to the increase in demand for passenger-car entertainment and communication apps. The automobile industry is expanding rapidly in countries such as South Korea, India, and China, which creates several opportunities to integrate ECUs into new cars. Moreover, rising demand for personal vehicles is fueling automobile production and creating new opportunities for the market growth of automotive electronic control units in this region.

North America is projected to emerge as one of the most lucrative regions for the market in terms of revenue during the forecast period, expanding at a significant CAGR. The region's dominance can be attributed to the increase in the installation of electronic systems in light commercial vehicles, passenger cars, and SUVs. The demand for energy-efficient automobiles and stringent government regulations to reduce carbon emissions are also propelling the growth of the automotive electronics industry. Moreover, the rising demand for luxury cars also contributes to the regional automotive electronic control unit (ECU) market growth.

By Capacity Type

By Vehicle Type

By Application

By Propulsion Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive Electronic Control Unit Market

5.1. COVID-19 Landscape: Automotive Electronic Control Unit Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive Electronic Control Unit Market, By Capacity

8.1. Automotive Electronic Control Unit Market, by Capacity, 2024-2033

8.1.1. 16-Bit

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. 32-Bit

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. 64-Bit

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Automotive Electronic Control Unit Market, By Vehicle

9.1. Automotive Electronic Control Unit Market, by Vehicle, 2024-2033

9.1.1. Passenger Cars

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Commercial Vehicle

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Automotive Electronic Control Unit Market, By Application

10.1. Automotive Electronic Control Unit Market, by Application, 2024-2033

10.1.1. ADAS & Safety System

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Body Electronics

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Powertrain

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Infotainment

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Others

10.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Automotive Electronic Control Unit Market, By Propulsion

11.1. Automotive Electronic Control Unit Market, by Propulsion, 2024-2033

11.1.1. Battery Powered

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Hybrid

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Internal Combustion Engine (ICE)

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Automotive Electronic Control Unit Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Capacity (2021-2033)

12.1.2. Market Revenue and Forecast, by Vehicle (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by Propulsion (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Capacity (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Vehicle (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Propulsion (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Capacity (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Vehicle (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Propulsion (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Capacity (2021-2033)

12.2.2. Market Revenue and Forecast, by Vehicle (2021-2033)

12.2.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.4. Market Revenue and Forecast, by Propulsion (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Capacity (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Vehicle (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Propulsion (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Capacity (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Vehicle (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Propulsion (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Capacity (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Vehicle (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Propulsion (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Capacity (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Vehicle (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Propulsion (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Capacity (2021-2033)

12.3.2. Market Revenue and Forecast, by Vehicle (2021-2033)

12.3.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.4. Market Revenue and Forecast, by Propulsion (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Capacity (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Vehicle (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Propulsion (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Capacity (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Vehicle (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Propulsion (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Capacity (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Vehicle (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Propulsion (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Capacity (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Vehicle (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Propulsion (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Capacity (2021-2033)

12.4.2. Market Revenue and Forecast, by Vehicle (2021-2033)

12.4.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.4. Market Revenue and Forecast, by Propulsion (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Capacity (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Vehicle (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Propulsion (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Capacity (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Vehicle (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Propulsion (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Capacity (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Vehicle (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Propulsion (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Capacity (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Vehicle (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Propulsion (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Capacity (2021-2033)

12.5.2. Market Revenue and Forecast, by Vehicle (2021-2033)

12.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.4. Market Revenue and Forecast, by Propulsion (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Capacity (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Vehicle (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Propulsion (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Capacity (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Vehicle (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Propulsion (2021-2033)

Chapter 13. Company Profiles

13.1. Robert Bosch GmbH

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. ZF Friedrichshafen AG

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Autoliv Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Continental AG

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Delphi Technologies

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Denso Corporation

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Hella KGaA Hueck & Co. (Hella)

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Panasonic Corporation

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Hitachi Automotive Systems, Ltd.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others