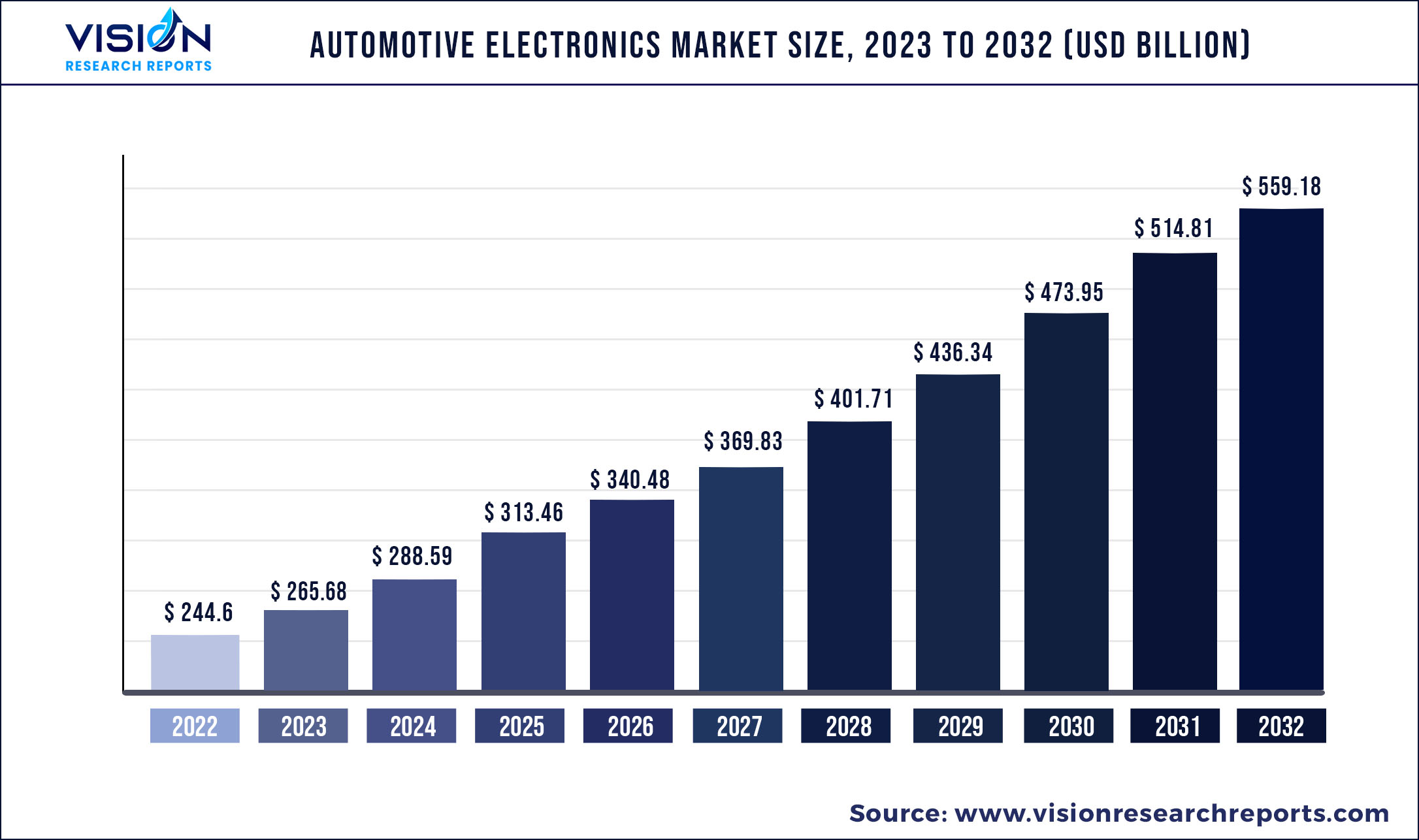

The global automotive electronics market size was estimated at around USD 244.6 billion in 2022 and it is projected to hit around USD 559.18 billion by 2032, growing at a CAGR of 8.62% from 2023 to 2032.

Key Pointers

Report Scope of the Automotive Electronics Market

| Report Coverage | Details |

| Market Size in 2022 | USD 244.6 billion |

| Revenue Forecast by 2032 | USD 559.18 billion |

| Growth rate from 2023 to 2032 | CAGR of 8.62% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Continental AG; DENSO Corporation; Hella GmbH & Co. Kgaa; Infineon Technologies AG; Robert Bosch GmbH; Valeo Inc.; ZF Friedrichshafen AG; Hitachi Automotive Systems, Ltd.; Visteon Corporation; Xilinx, Inc. |

The increasing integration and implementation of advanced safety systems such as automatic airbags, parking assistance systems,emergency braking, and lane departure warning to decrease road accidents are expected to favor demand over the forecast period. Moreover, features such as, alcohol ignition interlocks,emergency call systems, and accident data recorder systems are rapidly adopted to safeguard in-vehicle passengers and are expected to drive the industry’s growth over the forecast period.

The COVID-19 pandemic has had a catastrophic impact on the global economy and the production of automobiles. The COVID-19 aftermath has caused supply chain problems and the shutdown of various production sites. Sales of both passenger and commercial vehicles have suffered as a result of the pandemic, which has also affected consumer demand in the automobile industry.

In the past, the EU market dominated the sales of automotive electronic components; however, more recently, the adoption rate has decreased as a result of a reduction in automobile sales in the area. Because of municipal limits and economic stimulus packages, Europe is likely to experience a broad range of recovery cycles. According to the German Association of the Automotive Industry (VDA), in Europe, 5.1 million passenger cars were registered in the first half of 2020, 39% less than in 2019. Moreover, sales of passenger vehicles in the U.S. declined by around 26% in 2020 compared to the previous year.

The automotive industry is investing a significant amount of resources in research and development to create high-performance electronics and energy storage technology at a competitive price. Moreover, OEMs are relying more on electronics to achieve a high degree of safety. However, the automotive industry is transitioning away from hardware-driven vehicles and towards software-driven vehicles.

The average number of electronic and software components per vehicle is quickly rising, which has an impact on the market's expansion. According to automotive electronic market demand, factors such as the incorporation of IoT and AI into autos, the availability of automated vehicles, the desire for in-vehicle safety features, and a rise in the demand for entertainment features are fueling the demand.

The growing adoption of Hybrid Electric Vehicles (HEV) and Electric Vehicles (EV) is also expected to drive the demand for automotive electronics components. Moreover, the substitution of mechanical components with electronic components, such as the use of electronic switches instead of a relay, is another means through which electronics can address the numerous needs of the automotive industry, simultaneously increasing reliability and reducing the weight of wire harnesses. Technological advancements related to in-vehicle safety and government regulations to minimize road accidents are also expected to boost the demand over the forecast period.

The demand for in-vehicle data storage to support advanced in-vehicle features is being driven by the expanding demand for in-car infotainment systems due to their increased comfort, efficiency, and convenience. However, the low adoption of automotive electronics in newly industrialized nations and a rise in overall end-product prices as a result of the integration of vehicle electronics coupled with high maintenance and replacement expenses restrain the automotive electronics market’s growth.

Automotive Electronics Market Segmentations:

| By Component | By Application | By Sales Channel |

|

Electronic Control Unit Sensors Current Carrying Devices Others |

ADAS Infotainment Body Electronics Safety Systems Powertrain Electronics |

OEM Aftermarket |

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Component Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive Electronics Market

5.1. COVID-19 Landscape: Automotive Electronics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive Electronics Market, By Component

8.1. Automotive Electronics Market, by Component, 2023-2032

8.1.1 Electronic Control Unit

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Sensors

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Current Carrying Devices

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Automotive Electronics Market, By Application

9.1. Automotive Electronics Market, by Application, 2023-2032

9.1.1. ADAS

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Infotainment

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Body Electronics

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Safety Systems

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Powertrain Electronics

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Automotive Electronics Market, By Sales Channel

10.1. Automotive Electronics Market, by Sales Channel, 2023-2032

10.1.1. OEM

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Aftermarket

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Automotive Electronics Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Component (2020-2032)

11.1.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.3. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Component (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Component (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Component (2020-2032)

11.2.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.3. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Component (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Component (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Component (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Component (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Component (2020-2032)

11.3.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.3. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Component (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Component (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Component (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Component (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Component (2020-2032)

11.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.3. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Component (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Component (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Component (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Component (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Component (2020-2032)

11.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.3. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Component (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Component (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Sales Channel (2020-2032)

Chapter 12. Company Profiles

12.1. Continental AG

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. DENSO Corporation

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Hella GmbH & Co. Kgaa

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Infineon Technologies AG

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Robert Bosch GmbH

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Valeo Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. ZF Friedrichshafen AG

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Hitachi Automotive Systems, Ltd.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Visteon Corporation

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Xilinx, Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others