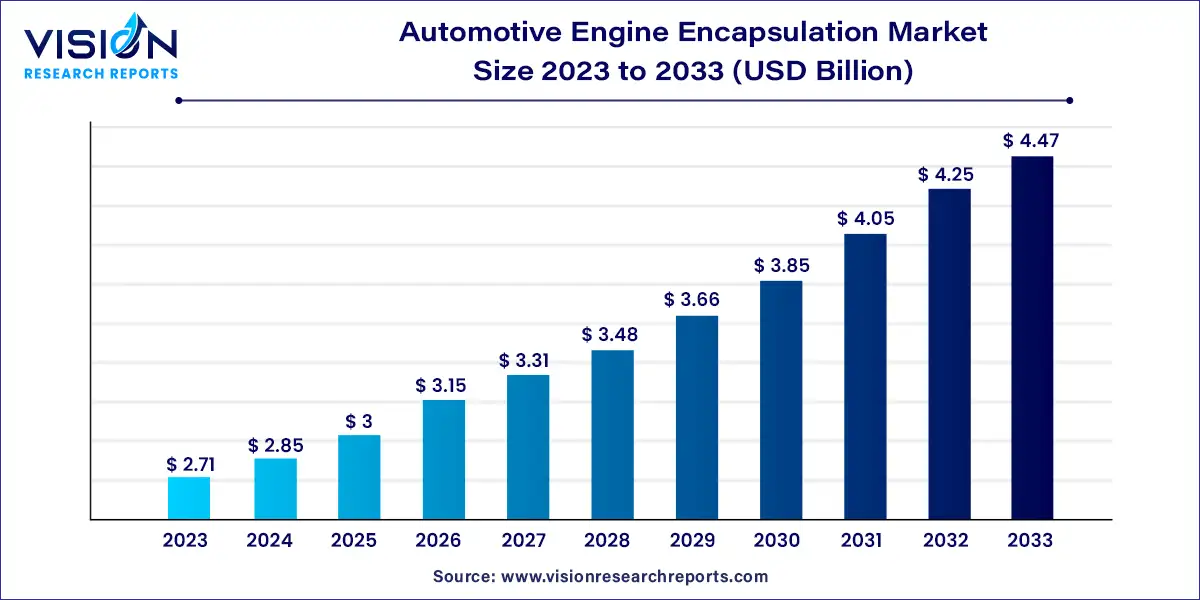

The global automotive engine encapsulation market size was estimated at around USD 2.71 billion in 2023 and it is projected to hit around USD 4.47 billion by 2033, growing at a CAGR of 5.14% from 2024 to 2033.

The automotive industry has been witnessing a significant shift towards enhancing vehicle performance, efficiency, and environmental sustainability. Engine encapsulation has emerged as a key technology in this endeavor, playing a crucial role in optimizing engine temperature, reducing noise, and improving aerodynamics. This article provides an overview of the automotive engine encapsulation market, highlighting key trends, drivers, challenges, and opportunities shaping its growth trajectory.

The growth of the automotive engine encapsulation market is driven by the stringent fuel efficiency regulations imposed by governments worldwide are compelling automakers to adopt technologies that improve vehicle performance and reduce emissions. Engine encapsulation plays a vital role in enhancing fuel efficiency by optimizing engine temperature and reducing aerodynamic drag. Secondly, the increasing demand for electric vehicles (EVs) is driving the integration of engine encapsulation technology into hybrid and electric vehicle models to enhance overall vehicle efficiency and range. Additionally, rising consumer preferences for quieter vehicles are spurring the adoption of engine encapsulation systems to reduce engine noise and vibrations, thereby improving passenger comfort.

In 2023, the polyamide segment took the lead in the market, boasting the largest revenue share, exceeding 33%. Polyamide, commonly referred to as nylon, is extensively utilized in the manufacturing of various under hood components, including engine encapsulation. This material offers a spectrum of versatile properties and robust performance, making it an essential automotive plastic for engine encapsulation. Its exceptional strength, durability, and resistance to abrasion render it suitable for a range of automotive components such as engine covers and intake manifolds.

Over the forecast period, the polypropylene segment is anticipated to witness significant growth at a notable Compound Annual Growth Rate (CAGR). Polypropylene, a thermoplastic material, is relatively cost-effective compared to alternatives like carbon fiber. Its attributes include corrosion resistance and resistance to chemical degradation, positioning it as an ideal material for automotive engine encapsulation components.

In 2023, the gasoline segment emerged as the market leader, capturing a significant share of the overall revenue. This dominance can be attributed to the substantial sales volume and widespread manufacture of gasoline engines worldwide. With a growing emphasis on fuel economy, automotive manufacturers are increasingly focusing on enhancing their gasoline engines through the implementation of engine encapsulation technology. By reducing engine noise and vibrations, engine encapsulation contributes to a quieter and more comfortable driving experience for consumers.

Encapsulation technology not only aids manufacturers in improving fuel efficiency and reducing emissions but also enhances environmental sustainability. Furthermore, advancements in materials and manufacturing processes have facilitated the development of lighter, stronger, and more efficient encapsulation designs, thereby driving increased adoption within the gasoline fuel sector.

In 2023, the passenger cars segment emerged as the market leader, commanding the largest revenue share at 49%. Engine encapsulation systems find extensive use in passenger cars, contributing significantly to this segment's dominance. The growth of this market segment is primarily fueled by the substantial sales and production volume of passenger cars, notably in the Asia Pacific and European regions.

Moreover, the increasing adoption and innovation aimed at meeting regulatory requirements, addressing customer preferences, and responding to competitive pressures are anticipated to further drive the demand for engine encapsulation in passenger cars. For instance, in January 2023, Roechling Group, a leading producer of lightweight solutions, introduced a new engine encapsulation system designed specifically for electric vehicles. This innovative system aims to enhance the thermal management of electric vehicles and prolong battery life, reflecting the ongoing efforts to advance engine encapsulation technology within the passenger car segment.

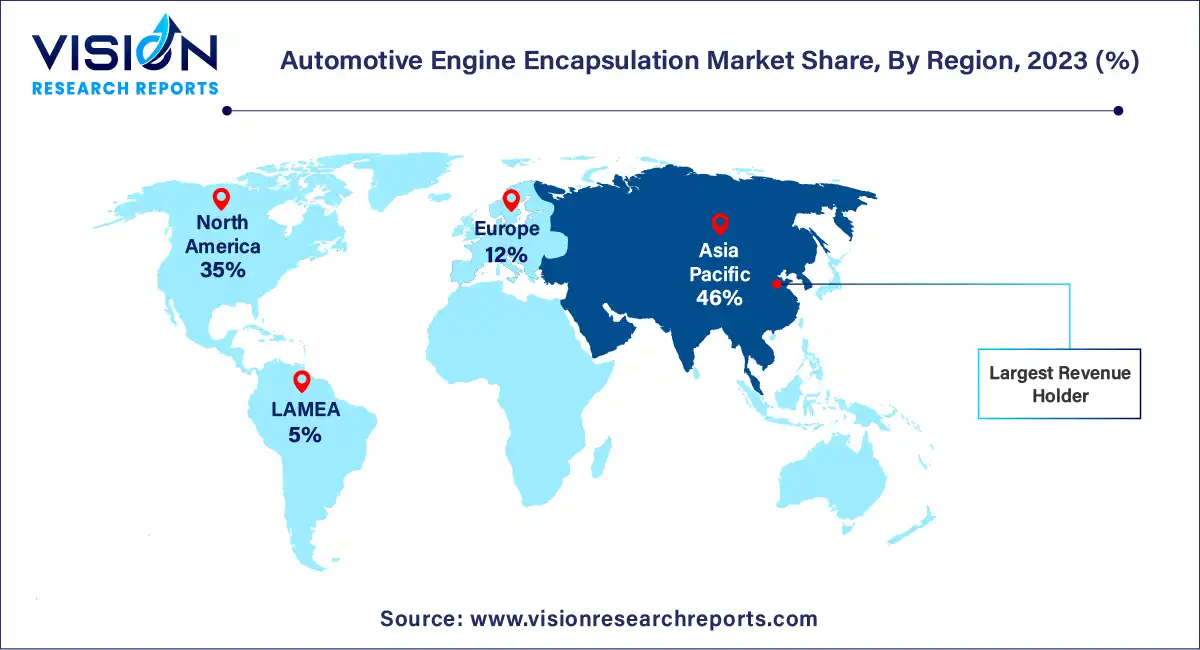

In 2023, Asia Pacific emerged as the dominant force in the automotive engine encapsulation market, capturing a substantial revenue share of 46%. This growth can be attributed to the rapid economic expansion in the region, which has led to an increase in disposable income and automobile ownership. Moreover, there is a growing demand for innovations that enhance vehicle performance, comfort, and efficiency, driving the development of engine encapsulation systems and subsequently propelling market growth across the region.

Meanwhile, North America accounted for the largest revenue share of 18% in the automotive engine encapsulation market in 2023. The region is poised for significant growth at a notable Compound Annual Growth Rate (CAGR) over the forecast period, buoyed by the presence of advanced manufacturing facilities and the burgeoning automotive industry. Additionally, the increasing emphasis on improving fuel efficiency throughout North America is expected to further fuel the demand for engine encapsulation in automobiles. Engine encapsulation plays a critical role in improving aerodynamics, reducing drag, and optimizing thermal management, all of which contribute to enhanced fuel economy and compliance with stringent fuel efficiency standards.

By Material

By Fuel Type

By Vehicle Type

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others