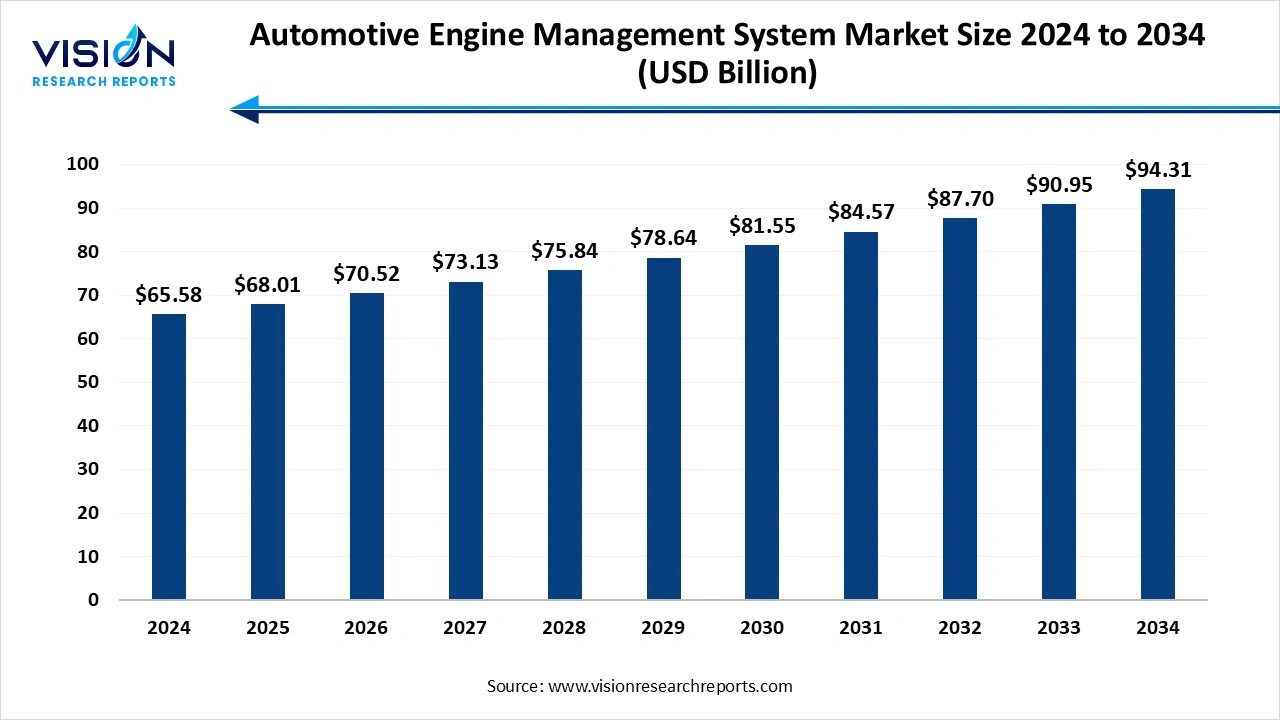

The global automotive engine management System market size was reached at around USD 65.58 billion in 2024 and it is projected to hit around USD 94.31 billion by 2034, growing at a CAGR of 3.70% from 2025 to 2034.

The automotive engine management system market plays a pivotal role in modern vehicle functionality, integrating electronic control units, sensors, and actuators to ensure optimal engine performance, fuel efficiency, and reduced emissions. As automakers continue to advance toward electrification and stricter emission standards, demand for sophisticated engine control technologies has surged. This market is witnessing consistent growth driven by increasing vehicle production, consumer demand for enhanced driving experiences, and regulatory pressures for cleaner and more efficient engines.

One of the primary growth drivers of the automotive engine management system market is the global shift toward stricter emission regulations and fuel efficiency standards. Governments and regulatory bodies across regions such as North America, Europe, and Asia-Pacific are enforcing rigorous norms that demand more advanced engine control technologies. This has prompted automakers to adopt intelligent engine management systems capable of precisely monitoring and adjusting fuel injection, ignition timing, and air intake, thereby reducing emissions and enhancing performance.

Another significant factor contributing to market growth is the rising integration of electronics and smart technologies in vehicles. As the automotive industry embraces digital transformation, engine management systems are evolving to include advanced microcontrollers, real-time monitoring sensors, and connectivity solutions. These systems not only improve engine responsiveness and diagnostics but also enhance overall driving experience and vehicle safety. The rapid adoption of hybrid and electric vehicles, which require sophisticated energy and engine control mechanisms, is also creating new opportunities for engine management system providers to expand their offerings in the evolving mobility landscape.

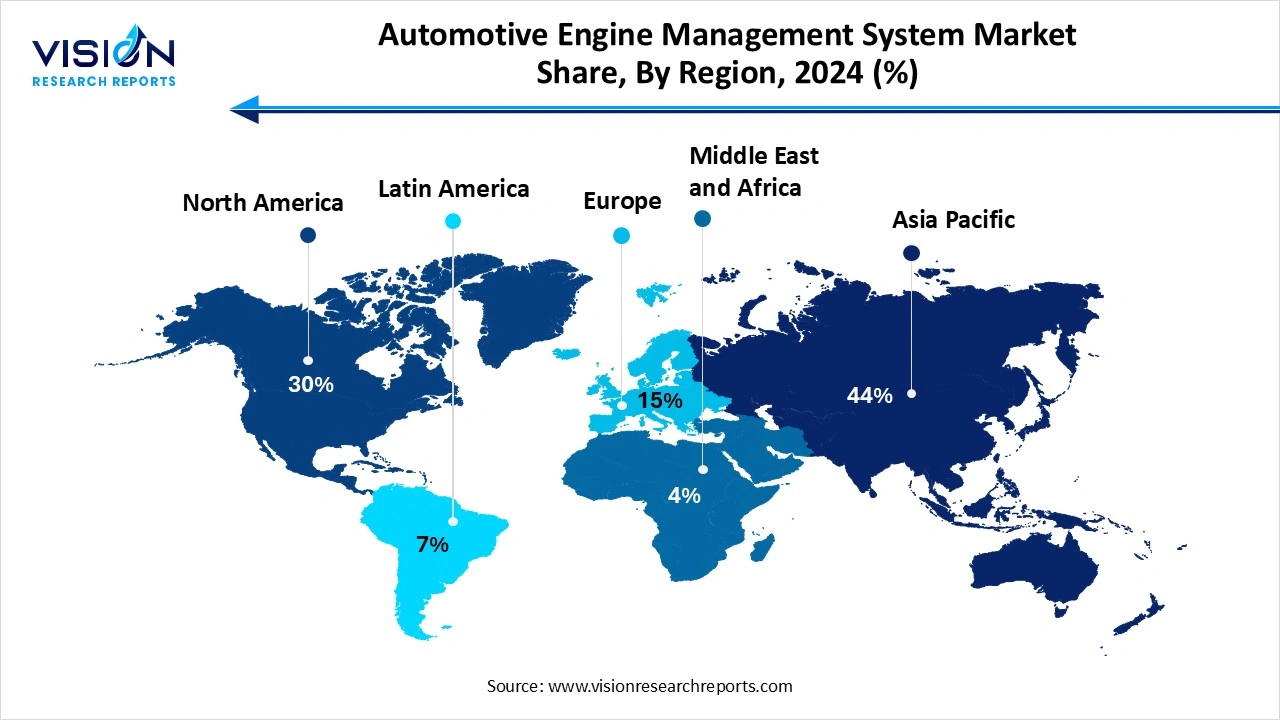

The Asia Pacific region dominated the global market with highest share of 44% in 2024. The Asia Pacific region is witnessing a swift rise in the adoption of engine management systems (EMS), fueled by rapid urbanization, escalating pollution concerns, and the accelerating shift toward vehicle electrification. Countries such as Japan, China, and India are proactively enhancing their emission standards and investing in EMS-integrated technologies to align with both international and domestic regulatory frameworks. These advancements are primarily driven by national policies focused on industrial transformation and environmental compliance. For instance, APAC governments are enforcing more rigorous vehicle inspection protocols and promoting research and development aimed at cleaner internal combustion engines equipped with intelligent EMS solutions.

Europe emerged as a highly lucrative market for the automotive engine management system (EMS) industry in 2024. The region is at the forefront of enforcing stringent emission regulations, particularly with the introduction of the Euro 7 standards set to take effect in 2025. These new standards go beyond limiting tailpipe emissions they also mandate real-time monitoring of brake and tire particle emissions. As a result, EMS technologies in Europe are evolving from conventional fuel and ignition management to integrated systems that support full-spectrum emission control.

Europe emerged as a highly lucrative market for the automotive engine management system (EMS) industry in 2024. The region is at the forefront of enforcing stringent emission regulations, particularly with the introduction of the Euro 7 standards set to take effect in 2025. These new standards go beyond limiting tailpipe emissions they also mandate real-time monitoring of brake and tire particle emissions. As a result, EMS technologies in Europe are evolving from conventional fuel and ignition management to integrated systems that support full-spectrum emission control.

The Electronic Control Unit (ECU) segment captured the highest revenue share, reaching 39% in 2024. With advancements in automotive electronics and software, modern ECUs have evolved into high-performance computing units capable of processing large volumes of data rapidly and accurately. Their role in ensuring compliance with stringent emission standards and optimizing engine efficiency has made them indispensable in both conventional and electrified vehicles.

The sensors segment is projected to register substantial growth at a notable CAGR throughout the forecast period. These include oxygen sensors, temperature sensors, pressure sensor, and airflow sensors, all of which contribute to monitoring engine health and performance. The demand for precise and reliable sensor technology has surged as automakers strive to meet regulatory standards and consumer expectations for fuel efficiency and reduced environmental impact. The integration of advanced sensor technologies has not only improved diagnostic capabilities but also enabled predictive maintenance, ensuring optimal performance and longer engine life.

The gasoline engines segment accounted for the largest share of the automotive engine management system market in 2024. These engines rely heavily on precise engine management systems to control ignition timing, fuel injection, air-fuel ratios, and emission outputs. The demand for enhanced performance, improved fuel economy, and compliance with increasingly stringent emission regulations has led to the integration of sophisticated electronic control units and sensor networks in gasoline-powered vehicles.

The hybrid engines segment is expected to witness the highest CAGR during the forecast period. Engine management systems in hybrid vehicles are more complex, as they must seamlessly coordinate between internal combustion engines and electric motors. These systems regulate the power split, manage battery performance, and optimize energy recuperation while maintaining engine efficiency. As governments around the world implement incentives and policies to encourage electrification, the hybrid segment is expected to witness significant growth. This, in turn, is propelling demand for advanced engine management systems capable of supporting multi-source propulsion technologies and ensuring a smooth transition between energy modes to deliver both performance and environmental compliance.

The passenger cars segment led the automotive engine management system market in 2024. Engine management systems in passenger cars are designed to optimize engine operation, reduce emissions, and improve overall drivability. With the growing focus on stringent emission norms and rising fuel costs, manufacturers are investing heavily in advanced engine control technologies to meet regulatory standards and consumer expectations. Innovations such as real-time diagnostics, adaptive control algorithms, and integration with infotainment and safety systems are becoming common features, enhancing the driving experience while supporting sustainability goals.

The two-wheelers segment is anticipated to register a notable CAGR throughout the forecast period. As governments tighten emission regulations for two-wheelers, manufacturers are increasingly incorporating electronic control units and sensor-based systems to improve fuel injection precision and combustion efficiency. The demand for lightweight, compact, and cost-effective engine management solutions tailored for two-wheelers is rising, enabling these vehicles to achieve better mileage and lower emissions.

By Component

By Engine Type

By Vehicle Type

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Component Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive Engine Management System Market

5.1. COVID-19 Landscape: Automotive Engine Management System Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive Engine Management System Market, By Component

8.1. Automotive Engine Management System Market, by Component

8.1.1 Electronic Control Unit (ECU)

8.1.1.1. Market Revenue and Forecast

8.1.2. Sensors

8.1.2.1. Market Revenue and Forecast

8.1.3. Fuel Pump

8.1.3.1. Market Revenue and Forecast

8.1.4. Actuators

8.1.4.1. Market Revenue and Forecast

8.1.5. Others

8.1.5.1. Market Revenue and Forecast

Chapter 9. Global Automotive Engine Management System Market, By Engine Type

9.1. Automotive Engine Management System Market, by Engine Type

9.1.1. Gasoline Engines

9.1.1.1. Market Revenue and Forecast

9.1.2. Diesel Engines

9.1.2.1. Market Revenue and Forecast

9.1.3. Hybrid Engines

9.1.3.1. Market Revenue and Forecast

9.1.4. Electric Engines

9.1.4.1. Market Revenue and Forecast

Chapter 10. Global Automotive Engine Management System Market, By Vehicle Type

10.1. Automotive Engine Management System Market, by Vehicle Type

10.1.1. Passenger Cars

10.1.1.1. Market Revenue and Forecast

10.1.2. Light Commercial Vehicles (LCVs)

10.1.2.1. Market Revenue and Forecast

10.1.3. Heavy Commercial Vehicles (HCVs)

10.1.3.1. Market Revenue and Forecast

10.1.4. Two-Wheelers

10.1.4.1. Market Revenue and Forecast

Chapter 11. Global Automotive Engine Management System Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Component

11.1.2. Market Revenue and Forecast, by Engine Type

11.1.3. Market Revenue and Forecast, by Vehicle Type

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Component

11.1.4.2. Market Revenue and Forecast, by Engine Type

11.1.4.3. Market Revenue and Forecast, by Vehicle Type

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Component

11.1.5.2. Market Revenue and Forecast, by Engine Type

11.1.5.3. Market Revenue and Forecast, by Vehicle Type

11.2. Europe

11.2.1. Market Revenue and Forecast, by Component

11.2.2. Market Revenue and Forecast, by Engine Type

11.2.3. Market Revenue and Forecast, by Vehicle Type

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Component

11.2.4.2. Market Revenue and Forecast, by Engine Type

11.2.4.3. Market Revenue and Forecast, by Vehicle Type

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Component

11.2.5.2. Market Revenue and Forecast, by Engine Type

11.2.5.3. Market Revenue and Forecast, by Vehicle Type

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Component

11.2.6.2. Market Revenue and Forecast, by Engine Type

11.2.6.3. Market Revenue and Forecast, by Vehicle Type

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Component

11.2.7.2. Market Revenue and Forecast, by Engine Type

11.2.7.3. Market Revenue and Forecast, by Vehicle Type

11.3. APAC

11.3.1. Market Revenue and Forecast, by Component

11.3.2. Market Revenue and Forecast, by Engine Type

11.3.3. Market Revenue and Forecast, by Vehicle Type

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Component

11.3.4.2. Market Revenue and Forecast, by Engine Type

11.3.4.3. Market Revenue and Forecast, by Vehicle Type

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Component

11.3.5.2. Market Revenue and Forecast, by Engine Type

11.3.5.3. Market Revenue and Forecast, by Vehicle Type

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Component

11.3.6.2. Market Revenue and Forecast, by Engine Type

11.3.6.3. Market Revenue and Forecast, by Vehicle Type

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Component

11.3.7.2. Market Revenue and Forecast, by Engine Type

11.3.7.3. Market Revenue and Forecast, by Vehicle Type

11.4. MEA

11.4.1. Market Revenue and Forecast, by Component

11.4.2. Market Revenue and Forecast, by Engine Type

11.4.3. Market Revenue and Forecast, by Vehicle Type

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Component

11.4.4.2. Market Revenue and Forecast, by Engine Type

11.4.4.3. Market Revenue and Forecast, by Vehicle Type

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Component

11.4.5.2. Market Revenue and Forecast, by Engine Type

11.4.5.3. Market Revenue and Forecast, by Vehicle Type

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Component

11.4.6.2. Market Revenue and Forecast, by Engine Type

11.4.6.3. Market Revenue and Forecast, by Vehicle Type

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Component

11.4.7.2. Market Revenue and Forecast, by Engine Type

11.4.7.3. Market Revenue and Forecast, by Vehicle Type

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Component

11.5.2. Market Revenue and Forecast, by Engine Type

11.5.3. Market Revenue and Forecast, by Vehicle Type

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Component

11.5.4.2. Market Revenue and Forecast, by Engine Type

11.5.4.3. Market Revenue and Forecast, by Vehicle Type

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Component

11.5.5.2. Market Revenue and Forecast, by Engine Type

11.5.5.3. Market Revenue and Forecast, by Vehicle Type

Chapter 12. Company Profiles

12.1. Bosch (Robert Bosch GmbH).

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Denso Corporation.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Continental AG.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Delphi Technologies (now part of BorgWarner).

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Magneti Marelli (now part of Calsonic Kansei Corporation).

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Hitachi Automotive Systems

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. ZF Friedrichshafen AG.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Hyundai Mobis

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Keihin Corporation.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Visteon Corporation

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others