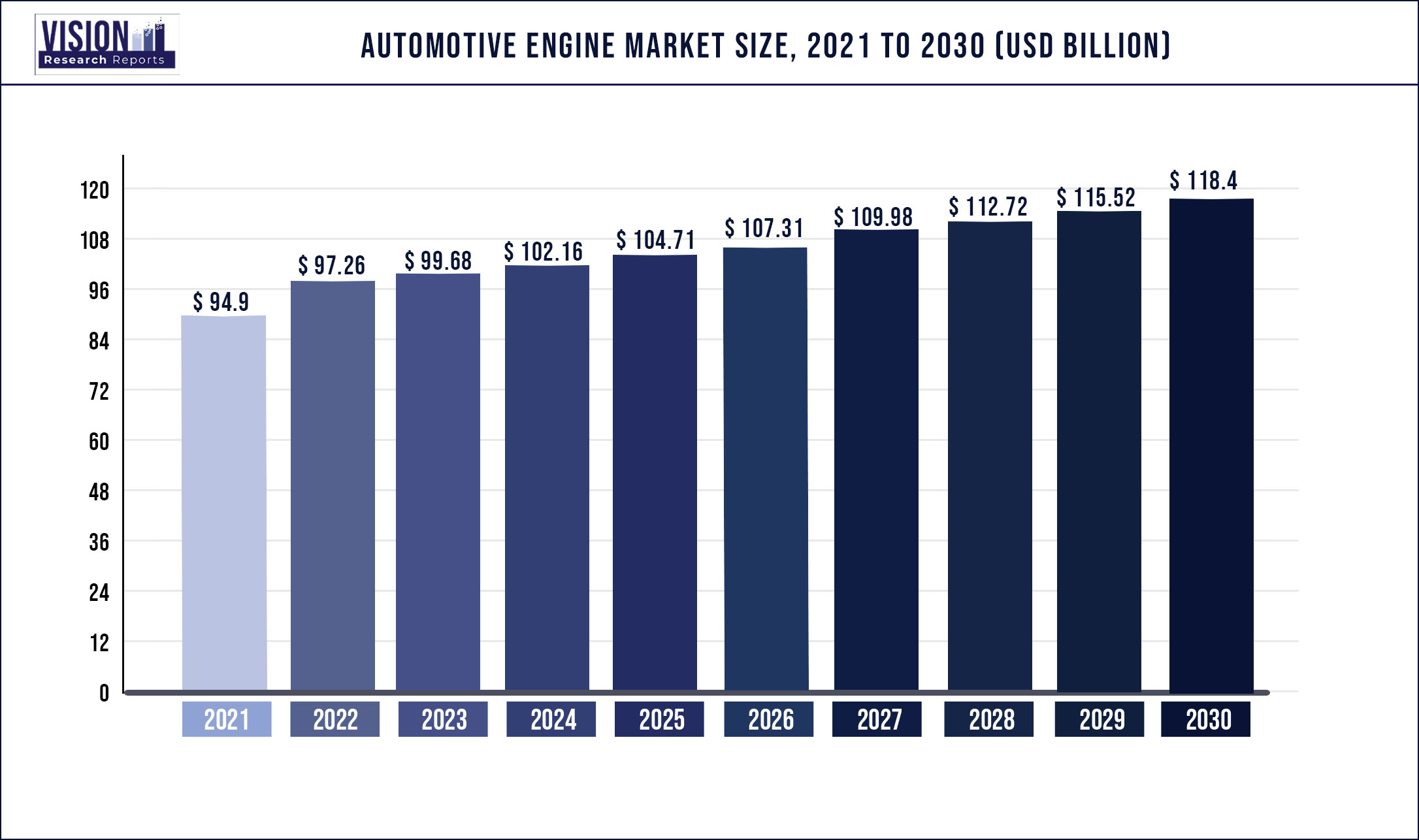

The global automotive engine market size was estimated at around USD 94.9 billion in 2021 and it is projected to hit around USD 118.4 billion by 2030, growing at a CAGR of 2.49% from 2022 to 2030.

The consumer inclination for high-performing automobiles in the mid and high-end segment vehicles is prompting the manufacturers to develop prototypes of engines that are fuel-efficient and have higher torque. Regulatory standards for fuel efficiency and the development of technologically advanced powered engines for improved automobile performance are the major factors driving the demand in the market. The increasing sales of commercial and passenger cars in developing countries are propelling the demand for automobile engines in the region.

Several companies, such as Ford Motor Corporation, Fiat Automobiles S.p.A., Honda Motor Company, Ltd., and General Motors, are developing compact engines with higher torque and lower emissions. The demand for improved engine performance and higher fuel efficiency to comply with government regulations to reduce vehicle emissions has led to the development of engines producing lesser carbon emissions. These developments are further impacting the market growth. Automobile manufacturers' competitive pricing of cars offering the different features in the same segment has boosted demand for passenger cars in emerging countries leading to more refined engine technology development.

Asia Pacific is projected to grow substantially over the forecast period owing to the technological advancements in automotive, rising ownership of automobiles, and an increase in the per capita income of people. The improved living standards in the Asia Pacific region prompt car manufacturers to launch mid and high-end segment cars with powerful engines and budget-friendly prices. Stringent government regulations and emission norms have been implemented in this region. All these factors bode well for the growth of the market.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 94.9 billion |

| Revenue Forecast by 2030 | USD 118.4 billion |

| Growth rate from 2022 to 2030 | CAGR of 2.49% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Placement type, fuel type, vehicle type, region |

| Companies Covered | AB Volvo; Cummins Inc.; Fiat Automobiles S.p.A; Volkswagen AG; Ford Motor Company; Mitsubishi Heavy Industries, Ltd.; General Motors; Honda Motor Co., Ltd.; Mercedes-Benz; Renault Group |

Placement Type Insights

The in-line segment held the highest market share of 45.04% in 2021. In-line engines are the most common type of engine for passenger cars. These engines can be seen in family-level hatchbacks cars to luxury sedans like BMW and Mercedes due to their easy and inexpensive manufacturing along with their easy installation process. Thus, making it a preferred choice for OEM.

The W-engine segment is expected to register a CAGR of 3.3% from 2022 to 2030. In W-engine, three or four sets of cylinders can be coupled to one or two crankshafts. Because W-engines take up less space and produce greater power, they are employed in heavy-duty trucks and luxury cars. The V-type engine is the most used in all high-performance vehicles. Almost all high-performance car manufacturers such as Ferrari, Alfa Romeo, and Mercedes Benz opt for the V-engine layout.

The in-line engines are the most common engines used in passenger cars, mostly seen in family-level hatchbacks cars to luxury sedans like BMW and Mercedes due to their easy and inexpensive manufacturing along with their easy installation process. Thus, making them a preferred choice for OEM.

Fuel Type Insights

Gasoline held the highest market share of over 35% in 2021, attributed to the benefits offered by gasoline engines, such as less noise and vibration, as well as low fuel prices. Gasoline engines are most commonly used in passenger vehicles due to their advantages, such as efficiency, cost-effectiveness, and lightweight. High in acceleration, gasoline engines are less noisy. Thus, these are the major growth drivers for the adoption of gasoline engines.

Diesel is expected to expand at a CAGR of 3.1% over the forecast period. Diesel engines are used in various equipment and vehicles, from medium-duty trucks to overseas cruise ships and power generators. Factors such as high fuel efficiency resulting in low operating costs and reliability have made diesel engines a preferred option. As diesel engines run at a much slower Revolution per Minute (RPM), less wear and tear results in a longer engine life cycle. These technical advantages have made diesel engines a preferred choice among manufacturers; driving the growth of the segment.

Vehicle Type Insights

Passenger car held the highest market share of more than 65% in 2021. As the ownership of vehicles increases around the world, OEMs are developing various engines based on different kinds of passenger car segments. Multi-fuel engines, Variable Valve Technology (VVT), turbocharger technology, and Common Rail Direct Injection (CRDI) are examples of technological breakthroughs in automobile engines that deliver the high power and torque necessary for luxury category vehicles.

OEMs are developing engines that are lightweight and capable of producing high power. Deployment of advanced engines in passenger cars and growing demand for passenger car sales are among the factors propelling the market growth of the vehicle type segment.

Commercial vehicle segment is expected to grow at a CAGR of around 3.0% over the forecast period. The growth can be attributed to the rising demand for trucks across the logistics sectors. Logistics is one of the key industries which is used to transport goods. The use of trucks and trailers to transport goods has increased significantly. With changing lifestyles and growing urbanization, people are more inclined to get the goods and products delivered to them. All these factors bode well for the market growth.

Additionally, the potential implementation of a vehicle scrappage program, increased budgetary allocation towards the development of infrastructure in rural sectors, stringent implementation of regulatory norms, particularly related to vehicle length & overloading, and recommencement of mining activities in certain areas leading to increasing demand for a commercial vehicle. The developing infrastructure sector, coupled with the rising disposable incomes of consumers, is propelling the demand for commercial vehicles.

Regional Insights

North America accounted for a revenue share of more than 30% in 2021. North America is home to developed economies, such as the U.S. and Canada. The growth in the market is majorly driven by of existence of long-established original equipment manufacturers, providing a firm foundation for the region's robust development and expansion of the market.Rising infrastructure investment, innovation in terms of drive technologies, and the ongoing expansion from local to global supply chain networks are anticipated to drive the demand for commercial vehicles in North America.

Asia Pacific is expected to grow at a CAGR of 3.2% over the forecast period. The evolving automotive industry in emerging economies such as China and India will drive market growth. The Make In India campaign is expected to draw substantial investment in the automotive sector, as there are several benefits in India, such as cheaper raw materials and low-cost labor. Furthermore, countries such as China and India comprise large logistics networks & supply chains and are among the fastest-growing economies globally. All these factors will bode the demand for an automotive engine.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive Engine Market

5.1. COVID-19 Landscape: Automotive Engine Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive Engine Market, By Placement Type

8.1. Automotive Engine Market, by Placement Type, 2022-2030

8.1.1 In-line Engine

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. V-type Engine

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. W Engine

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Automotive Engine Market, By Fuel Type

9.1. Automotive Engine Market, by Fuel Type, 2022-2030

9.1.1. Gasoline

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Diesel

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Other Fuel

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Automotive Engine Market, By Vehicle

10.1. Automotive Engine Market, by Vehicle, 2022-2030

10.1.1. Passengers Car

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Commercial Vehicle

10.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Automotive Engine Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Placement Type (2017-2030)

11.1.2. Market Revenue and Forecast, by Fuel Type (2017-2030)

11.1.3. Market Revenue and Forecast, by Vehicle (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Placement Type (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Fuel Type (2017-2030)

11.1.4.3. Market Revenue and Forecast, by Vehicle (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Placement Type (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Fuel Type (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Vehicle (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Placement Type (2017-2030)

11.2.2. Market Revenue and Forecast, by Fuel Type (2017-2030)

11.2.3. Market Revenue and Forecast, by Vehicle (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Placement Type (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Fuel Type (2017-2030)

11.2.4.3. Market Revenue and Forecast, by Vehicle (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Placement Type (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Fuel Type (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Vehicle (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Placement Type (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Fuel Type (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Vehicle (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Placement Type (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Fuel Type (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Vehicle (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Placement Type (2017-2030)

11.3.2. Market Revenue and Forecast, by Fuel Type (2017-2030)

11.3.3. Market Revenue and Forecast, by Vehicle (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Placement Type (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Fuel Type (2017-2030)

11.3.4.3. Market Revenue and Forecast, by Vehicle (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Placement Type (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Fuel Type (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Vehicle (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Placement Type (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Fuel Type (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Vehicle (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Placement Type (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Fuel Type (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Vehicle (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Placement Type (2017-2030)

11.4.2. Market Revenue and Forecast, by Fuel Type (2017-2030)

11.4.3. Market Revenue and Forecast, by Vehicle (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Placement Type (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Fuel Type (2017-2030)

11.4.4.3. Market Revenue and Forecast, by Vehicle (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Placement Type (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Fuel Type (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Vehicle (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Placement Type (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Fuel Type (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Vehicle (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Placement Type (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Fuel Type (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Vehicle (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Placement Type (2017-2030)

11.5.2. Market Revenue and Forecast, by Fuel Type (2017-2030)

11.5.3. Market Revenue and Forecast, by Vehicle (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Placement Type (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Fuel Type (2017-2030)

11.5.4.3. Market Revenue and Forecast, by Vehicle (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Placement Type (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Fuel Type (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Vehicle (2017-2030)

Chapter 12. Company Profiles

12.1. AB Volvo

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Cummins Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Fiat Automobiles S.p.A

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Volkswagen AG

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Ford Motor Company

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Mitsubishi Heavy Industries, Ltd.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. General Motors

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Honda Motor Co., Ltd.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Mercedes-Benz

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Renault Group

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others