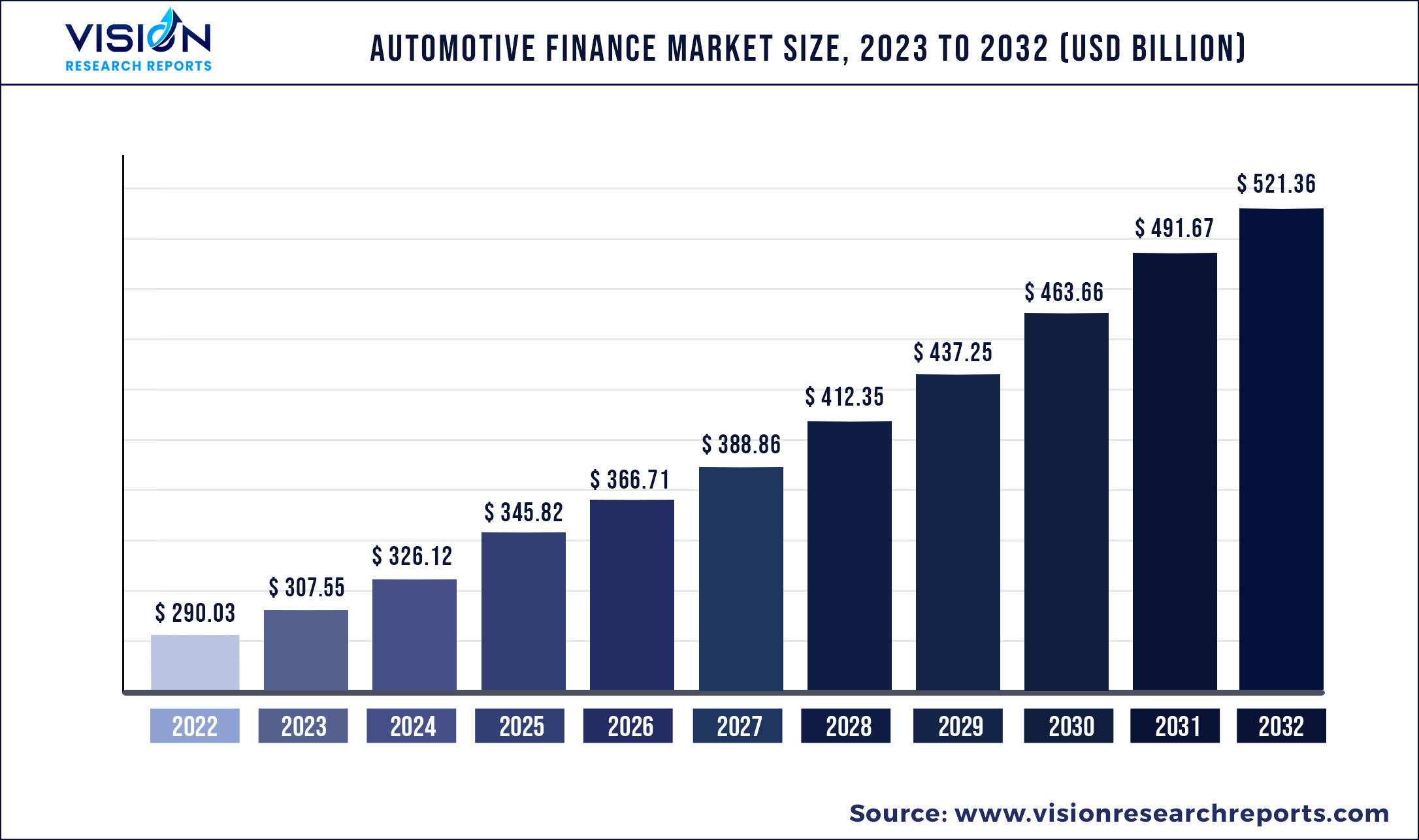

The global automotive finance market size was estimated at around USD 290.03 billion in 2022 and it is projected to hit around USD 521.36 billion by 2032, growing at a CAGR of 6.04% from 2023 to 2032.

Key Pointers

Report Scope of the Automotive Finance Market

| Report Coverage | Details |

| Market Size in 2022 | USD 290.03 billion |

| Revenue Forecast by 2032 | USD 521.36 billion |

| Growth rate from 2023 to 2032 | CAGR of 6.04% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Ally Financial; Bank of America; Capital One; Chase Auto Finance; Daimler Financial Services; Ford Motor Credit Company; GM Financial Inc.; Hitachi Capital; Toyota Financial Services; Volkswagen Financial Services |

The increasing global demand for electric vehicles is one of the major factors, expected to drive market growth. According to the Experian’s State of the Automotive Finance report, electric vehicles comprised 4.56% of new vehicle financing in Q4 2021, up from 2.25% in Q4 2020 and 1.34% in Q4 2019 in the U.S. According to this report, consumers in the U.S. are more likely to purchase new electric vehicles rather than lease them.

The growing importance of captive automotive finance worldwide is creating new opportunities for market growth. Captive finance is a subsidiary of an automaker that provides loans and financial services to the company's customers. The benefits of starting a captive finance company include personalized finance options for the customers, and equipment rental programs, among others. The companies such as Honda Finance, Ford, Infiniti, and Nissan are seeing strong growth in captive finance.

The growing importance of cryptocurrency across the automotive finance industry is expected to drive market growth. Various automotive technology providers are adopting cryptocurrency-based payments to enhance their offerings. For instance, in March 2022, Car Now, an automotive industry’s digital retailing company, announced its partnership with Cion Digital, a blockchain orchestration platform. Through this partnership, Car Now will offer auto dealers compliant and fast crypto payment and lending solutions.

Artificial intelligence technology is increasingly being used in the automotive finance sector, in order to improve the credit underwriting process, analyze the data, accurately predict whether the applicant can turn delinquent, and thus enhance the approval process. Various automotive artificial intelligence technology providers are making efforts to develop AI-enabled lending platforms. For instance, in October 2021, Upstart, a leading AI lending platform, announced the launch of Upstart Auto Retail software. This software includes AI-enabled financing features which enable the lenders to improve their customer experience.

The growing global demand for automotive refinancing is also one of the major factors, creating new opportunities for market growth. The demand for refinancing is growing due to its benefits, such as lower monthly car payments, reduced interest rates, and shortened loan terms. According to the statistics provided by Rate Genius, a fintech company, 16.0% more additional Americans applied to refinance their automotive loans in 2020 as compared to 2019. As compared to 2019, as many as 17.0% of additional borrowers refinanced their car loans successfully in 2020, as compared to 2019.

The outbreak of COVID-19 is anticipated to have an adverse impact on the market. The economic uncertainty has forced car buyers to postpone their purchase of a new vehicle. Despite the slowdown in car sales, auto lenders will have to accommodate an upsurge in servicing activity, such as refinancing and extensions. Auto lenders are adopting digital tools to expedite the service processes, remotely.

Automotive Finance Market Segmentations:

| By Provider Type | By Finance Type | By Purpose Type | By Vehicle Type |

|

Banks OEMs Other Financial Institutions |

Direct Indirect |

Loan Leasing Others |

Commercial Vehicles Passenger Vehicles |

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive Finance Market

5.1. COVID-19 Landscape: Automotive Finance Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive Finance Market, By Provider Type

8.1. Automotive Finance Market, by Provider Type, 2023-2032

8.1.1. Banks

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. OEMs

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Other Financial Institutions

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Automotive Finance Market, By Finance Type

9.1. Automotive Finance Market, by Finance Type, 2023-2032

9.1.1. Direct

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Indirect

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Automotive Finance Market, By Purpose Type

10.1. Automotive Finance Market, by Purpose Type, 2023-2032

10.1.1. Loan

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Leasing

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Automotive Finance Market, By Vehicle Type

11.1. Automotive Finance Market, by Vehicle Type, 2023-2032

11.1.1. Commercial Vehicles

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Passenger Vehicles

11.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Automotive Finance Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Provider Type (2020-2032)

12.1.2. Market Revenue and Forecast, by Finance Type (2020-2032)

12.1.3. Market Revenue and Forecast, by Purpose Type (2020-2032)

12.1.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Provider Type (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Finance Type (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Purpose Type (2020-2032)

12.1.5.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Provider Type (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Finance Type (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Purpose Type (2020-2032)

12.1.6.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Provider Type (2020-2032)

12.2.2. Market Revenue and Forecast, by Finance Type (2020-2032)

12.2.3. Market Revenue and Forecast, by Purpose Type (2020-2032)

12.2.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Provider Type (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Finance Type (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Purpose Type (2020-2032)

12.2.5.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Provider Type (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Finance Type (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Purpose Type (2020-2032)

12.2.6.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Provider Type (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Finance Type (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Purpose Type (2020-2032)

12.2.7.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Provider Type (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Finance Type (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Purpose Type (2020-2032)

12.2.8.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Provider Type (2020-2032)

12.3.2. Market Revenue and Forecast, by Finance Type (2020-2032)

12.3.3. Market Revenue and Forecast, by Purpose Type (2020-2032)

12.3.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Provider Type (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Finance Type (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Purpose Type (2020-2032)

12.3.5.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Provider Type (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Finance Type (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Purpose Type (2020-2032)

12.3.6.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Provider Type (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Finance Type (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Purpose Type (2020-2032)

12.3.7.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Provider Type (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Finance Type (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Purpose Type (2020-2032)

12.3.8.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Provider Type (2020-2032)

12.4.2. Market Revenue and Forecast, by Finance Type (2020-2032)

12.4.3. Market Revenue and Forecast, by Purpose Type (2020-2032)

12.4.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Provider Type (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Finance Type (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Purpose Type (2020-2032)

12.4.5.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Provider Type (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Finance Type (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Purpose Type (2020-2032)

12.4.6.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Provider Type (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Finance Type (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Purpose Type (2020-2032)

12.4.7.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Provider Type (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Finance Type (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Purpose Type (2020-2032)

12.4.8.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Provider Type (2020-2032)

12.5.2. Market Revenue and Forecast, by Finance Type (2020-2032)

12.5.3. Market Revenue and Forecast, by Purpose Type (2020-2032)

12.5.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Provider Type (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Finance Type (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Purpose Type (2020-2032)

12.5.5.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Provider Type (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Finance Type (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Purpose Type (2020-2032)

12.5.6.4. Market Revenue and Forecast, by Vehicle Type (2020-2032)

Chapter 13. Company Profiles

13.1. Ally Financial

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Bank of America

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Capital One

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Chase Auto Finance

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Daimler Financial Services

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Ford Motor Credit Company

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. GM Financial Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Hitachi Capital

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Toyota Financial Services

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Volkswagen Financial Services

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others