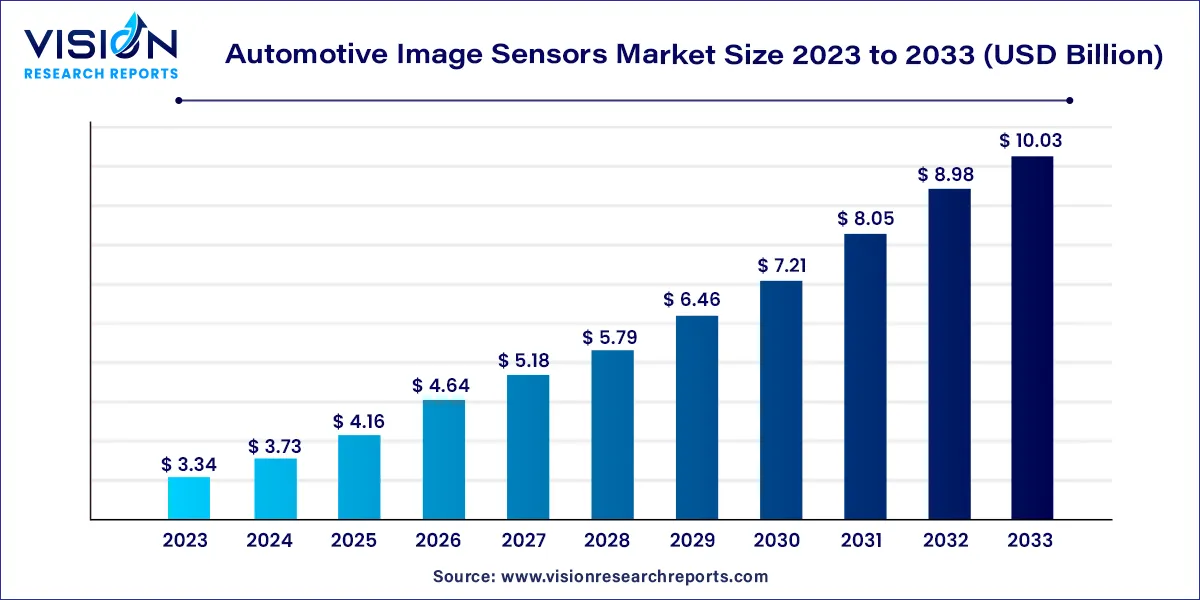

The global automotive image sensors market size was estimated at around USD 3.34 billion in 2023 and it is projected to hit around USD 10.03 billion by 2033, growing at a CAGR of 11.62% from 2024 to 2033.

The automotive industry stands on the precipice of a transformative era, with technological advancements reshaping the driving experience. At the heart of this revolution lie automotive image sensors, critical components that have redefined vehicle safety and functionality. These sensors, capable of capturing and processing visual data, have become integral to the development of advanced driver-assistance systems (ADAS), enabling features like lane departure warnings, adaptive cruise control, and automated parking.

The growth of the automotive image sensors market is propelled by several key factors. One of the primary drivers is the increasing demand for advanced driver-assistance systems (ADAS) in vehicles, mandated by stringent safety regulations globally. These systems heavily rely on image sensors, fostering their widespread adoption. Additionally, the growing consumer awareness regarding vehicle safety and the rising trend towards autonomous driving experiences contribute significantly to market expansion. Rapid technological advancements, especially the development of smaller, more efficient sensors with enhanced capabilities, further fuel the market growth. Moreover, the integration of image sensors in parking assistance and collision avoidance systems amplifies their demand, ensuring a positive trajectory for the market in the foreseeable future.

| Report Coverage | Details |

| Revenue Share of Asia Pacific in 2023 | 55% |

| CAGR of Middle East & Africa from 2024 to 2033 | CAGR of 13.07% |

| Revenue Forecast by 2033 | USD 10.03 billion |

| Growth Rate from 2024 to 2033 | CAGR of 11.62% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The CMOS technology segment accounted for the largest revenue share of 81% in 2023. CMOS image sensors have gained significant traction in the automotive industry due to their versatility and lower production costs. They offer advantages such as lower power consumption, faster data readouts, and seamless integration with other electronic components. CMOS sensors are highly adaptable, allowing for the integration of multiple functions on a single chip. This versatility has facilitated their integration into various automotive applications, including rearview cameras, lane-departure warning systems, and adaptive headlights.

The CCD technology segment is expected to grow at the fastest CAGR of 0.57% during the forecast period. CCD image sensors, traditionally the preferred choice for high-quality imaging applications, have found their niche in automotive systems. Their ability to capture detailed images with low noise levels has made them integral in advanced driver-assistance systems (ADAS) and in enhancing the precision of collision avoidance and parking assistance technologies.

The passenger vehicles segment contributed more than 71% of revenue share in 2023. Passenger vehicles, image sensors play a pivotal role in enhancing both safety and convenience for drivers and passengers. Advanced driver-assistance systems (ADAS), such as lane departure warning, adaptive cruise control, and automatic emergency braking, heavily rely on image sensors. These sensors provide real-time data, enabling vehicles to make split-second decisions, thereby reducing the risk of accidents. Moreover, in passenger vehicles, image sensors are integral components of parking assistance systems, aiding drivers in navigating tight parking spaces with precision. Additionally, the integration of image sensors in passenger vehicles enhances the overall driving experience, providing features like 360-degree surround view, making parking and maneuvering easier and safer for drivers.

The commercial vehicles segment is anticipated to grow at the noteworthy CAGR of 11.06% during the forecast period. Commercial vehicles encompass a wide array of vehicles, including trucks, buses, and vans, each with unique operational requirements. In this segment, image sensors are essential for ensuring road safety, especially in large, cumbersome vehicles. These sensors are utilized for blind-spot detection, enabling drivers to detect nearby vehicles or obstacles that might not be visible through mirrors. For delivery trucks and buses, image sensors are crucial for enhancing passenger safety during boarding and alighting processes. Moreover, in logistics and transportation, image sensors are employed for cargo monitoring and management, ensuring the secure transportation of goods.

The Asia Pacific region captured the highest revenue share of over 55% in 2023. Asia-Pacific is a powerhouse in the automotive industry, with countries like China, Japan, South Korea, and India leading the market. In this region, the market growth is fueled by the expanding middle-class population, increasing disposable incomes, and a growing awareness of vehicle safety. The demand for cost-effective and efficient image sensor solutions is high in Asia-Pacific, driving technological advancements and fostering collaborations between local and international sensor manufacturers.

The Middle East & Africa region is anticipated to grow at the fastest CAGR of over 13.07% over the forecast period. Middle East and Africa present unique opportunities and challenges. While economic factors influence the market, the demand for advanced vehicles with cutting-edge safety technologies is increasing, driven by a burgeoning middle class and urbanization. However, infrastructural limitations and varying regulatory landscapes in different countries create complexities for market players. Despite these challenges, the region exhibits potential for growth, with a focus on adapting image sensor technologies to suit the specific needs of the local automotive market.

By Technology

By Vehicle Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive Image Sensors Market

5.1. COVID-19 Landscape: Automotive Image Sensors Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive Image Sensors Market, By Technology

8.1. Automotive Image Sensors Market, by Technology, 2024-2033

8.1.1. CCD Image Sensors

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. CMOS Image Sensors

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Automotive Image Sensors Market, By Vehicle Type

9.1. Automotive Image Sensors Market, by Vehicle Type, 2024-2033

9.1.1. Passenger Vehicles

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Commercial Vehicles

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Automotive Image Sensors Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Technology (2021-2033)

10.1.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Technology (2021-2033)

10.5.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

Chapter 11. Company Profiles

11.1. Samsung Electronics Co., Ltd.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Continental AG

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Infineon Technologies AG

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Semiconductor Components Industries, LLC

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. DENSO Corporation

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. OmniVision Technologies, Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Sharp Corporation

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. NXP Semiconductors N.V.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Gentex Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Sony Semiconductor Solutions Corporation

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others