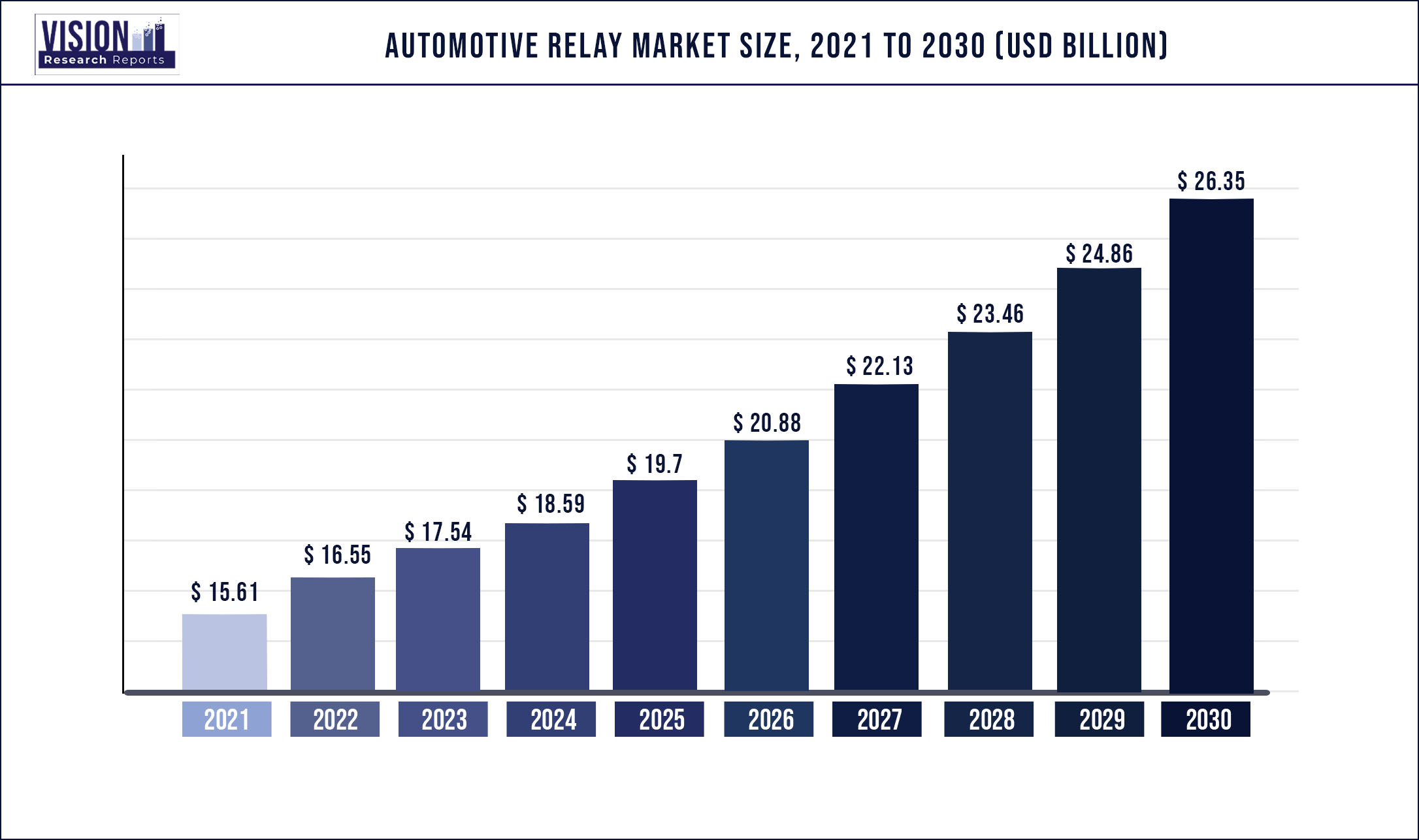

The global automotive relay market size was estimated at around USD 15.61 billion in 2021 and it is projected to hit around USD 26.35 billion by 2030, growing at a CAGR of 5.99% from 2022 to 2030.

Increasing vehicular safety regulations in various regions across the globe is driving the automotive relay market. Further, increasing adoption of electric vehicles amongst passenger car segment end users has made automotive electronics including the automotive relay industry to gain significant market share.

Systems such as advanced driver assistance systems (ADAS), electronic stability control, electronic steering systems, brake-by-wire systems, and airbags are gaining momentum across the globe, owing to their safety and comfort benefits. Strict safety guidelines employ substantial pressure on Tier-1 suppliers and the OEMs to design improved safety systems for automobiles. According to General Safety Regulation (EC) No 661/2009 of Europe, from 1 November 2014, several new safety features have been made obligatory for light trucks, heavy commercial vehicles, and new passenger cars. Furthermore, there is a growing demand for enhanced comfort and convenience in automobiles.

Many governments provide lucrative offers to promote the selling and usage of Electric Vehicles EVs. Tax benefits are provided at the time of purchase. However, the extent of the exemption depends on the size of the batteries used in the vehicle. In the United States, insurance companies provide discounts on insurance policies to customers, and utility companies are offering low electricity rates. Also, few states offer credits to electric vehicle manufacturers and buyers for their costs and purchase of charging equipment. Many European countries follow incentive-based programs for promoting EVs. Countries, like Germany and Austria, offer tax exemptions and reductions.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 15.61 billion |

| Revenue Forecast by 2030 | USD 26.35 billion |

| Growth rate from 2022 to 2030 | CAGR of 5.99% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, application, vehicle type, and regions |

| Companies Covered |

ABB Group; American Zettler Inc. (subsidiary of Zettler Components, Inc.); Beta Electric Industry Co. Ltd.; Coto Technology; Crydom (A subsidiary of Sensata Technologies Holdings N.V); Deltrol Controls (A subsidiary of Deltrol Corporation); Denso Corporation; Eaton Corporation plc; Fujitsu Limited; Good Sky Electric Co., Ltd.; IDEC Corporation; Hella KGaA Hueck & Co. (HELLA); Littelfuse Inc.; LS Automotive Corporation; Megatone Electronics Corp. |

Product Insights

PCB relay is estimated to have the largest share in this market. It's used in a majority of electronic applications such as ABS, cruise control, doors, power steering, power windows, and sunroof. In regions such as Europe and North America, they are used majorly. However, in regions such as Asia-Oceania and RoW, Tier-1 manufacturers and OEMs still prefer plug-in versions.

Plug-in relays are used where the switching operation is performed under extreme vibrations, temperatures, and voltage fluctuations. They are used in fuel injection systems, heating control, and air-conditioning (HVAC) systems, and switching fuel pumps. The demand for these components is more, owing to their compact size that saves considerable space in the junction box. This phenomenon, in turn, helps in reducing the overall weight of the junction box. Increasing electronic control modules coupled with electronic components have generated the demand for smaller devices that are capable of carrying greater current loads.

High voltage relays are also estimated to increase in the future as they have many applications in electric and hybrid electric vehicles. Automotive manufacturers and OEMs integrate the relays in the vehicle’s circuit, based on the respective applications. They form tie-ups and alliances with service centers to ensure proper maintenance and replacement of components

Vehicle Type Insights

The global passenger vehicle automotive relay market was valued over USD 6 billion in 2021. Many governments provide lucrative offers to promote the selling and usage of EVs. A positive factor responsible for the growth of the segment is the increasing demand for electronic e-fuse over the electromagnetic alternative due to the modernization of vehicles

Many European countries follow incentive-based programs for promoting EVs. Countries, like Germany and Austria, offer tax exemptions and reductions. France and the UK offered bonus payments to EV buyers and discounts on insurance. The electric vehicles segment is estimated to witness the highest growth as compared to other segments over the forecast period. Many governments provide lucrative offers to promote the selling and usage of EVs. Tax benefits are provided at the time of purchase. Further, the extent of the exemption depends on the size of the batteries used in the vehicle.

In the United States, insurance companies are providing discounts on insurance policies to customers, and utility companies are offering low electricity rates. Also, few states offer credits to electric vehicle manufacturers and buyers for their costs and purchase of charging equipment. The Federal Government offers tax credits up to USD 7,500 for Plug-in Electric Vehicles (PEVs).

Application Insights

The capacitive load's segment is estimated to dominate the market in terms of revenue as compared to other segments over the forecast period. Automotive electronics consist of semiconductor devices that are used to do multiple functions in a car. Various safety and comfort systems in a car would not have been possible without electronics. Some of the basic applications in modern cars are driven by electronic systems and these require relay for their efficient operation. These include door lock system, power window, air conditioner, wiper, and fuel injection.

The electronic applications are more in the passenger car segment, as compared to the LCV segment. This is due to the increasing demand for premium cars with advanced features. Modern vehicles feature a multitude of intelligent systems which increase all safety aspects and driving comforts. Navigation systems with interactive traffic condition interfaces have become common even in the mid-sized car segment. Passive and active safety systems such as airbags, belt tensioners, and antiskid brake/traction control, have led to an increase in the average number of relays per vehicle.

In high-spec cars, the value of the electric and electronic component sums up to almost a quarter of the total vehicle value. The wiring length can reach several thousands of meters with as many connection systems between different harnesses, ECU’s and actuators. Reliable switching of lights, motors, heaters, ECUs is critical for the overall reliability of the vehicle

Regional Insights

Asia Pacific is a key revenue-generating region and captured a significant market share in 2021. The regional growth is due to the penetration of automobiles in developing economies such as China and the adoption of safety standards is expected to drive the market in several Asian countries. Asia Pacific exhibits a high growth potential, which may be attributed to high vehicle demand in this region. Increasing automobile demand in Asia Pacific, particularly China, and Japan is expected to drive regional market growth over the forecast period.

Growing demand for connectivity and car digitalization will favorably impact market growth over the forecast period. Further, high-growth potential across the compact car segment due to space constraints has also driven the auto wiring harness demand extensively. Stringent government regulations mandating the use of certain electronic safety systems such as the Anti-locking Braking System (ABS) and Electronic Stability Program (ESP) to reduce harmful fuel emissions offer avenues for market growth. In addition, the growing popularity of electric vehicles has also spurred the auto wiring harness market demand.

Europe is also expected to witness substantial growth owing to strong growth across the automotive sector. The leading companies in auto wiring harness market include Delphi Automotive, Sumitomo Electric, Furukawa Electric, Tianjin Jin-Zhu Wiring systems Co. Ltd., Prestolite Electric, Fujikura Ltd., Lear Corporation, and Leoni.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive Relay Market

5.1. COVID-19 Landscape: Automotive Relay Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive Relay Market, By Product

8.1. Automotive Relay Market, by Product, 2022-2030

8.1.1 PCB Relay

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Plug-in Relay

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. High Voltage Relay

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Automotive Relay Market, By Vehicle Type

9.1. Automotive Relay Market, by Vehicle Type, 2022-2030

9.1.1. Passenger vehicles

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Commercial vehicles

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Electric vehicles

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Automotive Relay Market, By Application

10.1. Automotive Relay Market, by Application, 2022-2030

10.1.1. Resistive loads

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Capacitive loads

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Inductive loads

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Automotive Relay Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.2. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.1.3. Market Revenue and Forecast, by Application (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.1.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.2. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.2.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.2.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Application (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.2. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.3.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.3.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Application (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.2. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.4.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Application (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.2. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.5.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Vehicle Type (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Application (2017-2030)

Chapter 12. Company Profiles

12.1. ABB Group

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. American Zettler Inc. (subsidiary of Zettler Components, Inc.)

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Beta Electric Industry Co. Ltd.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Coto Technology

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Crydom (A subsidiary of Sensata Technologies Holdings N.V)

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Deltrol Controls (A subsidiary of Deltrol Corporation)

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Denso Corporation

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Eaton Corporation plc

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Fujitsu Limited

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Good Sky Electric Co., Ltd.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others