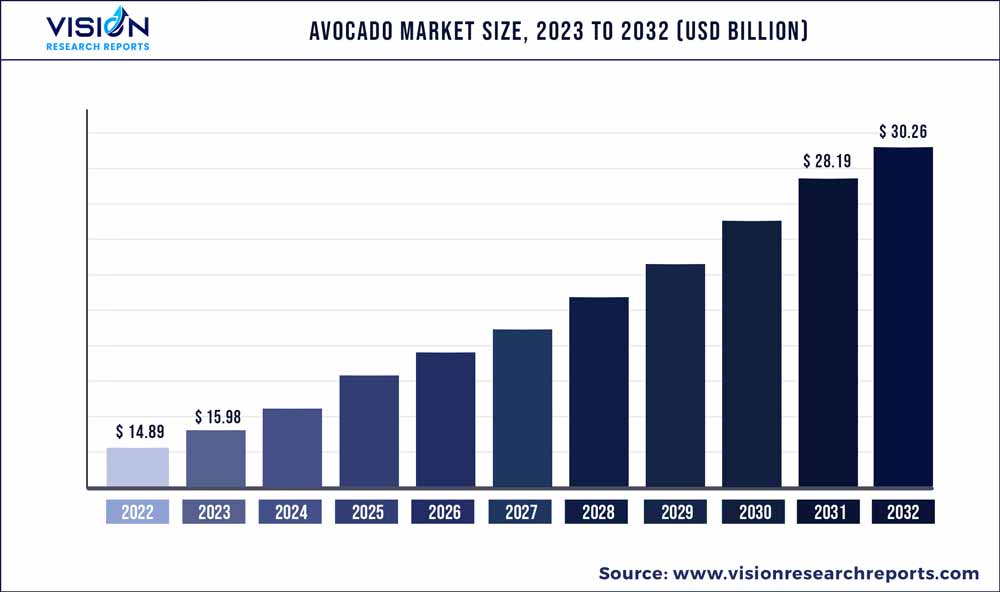

The global avocado market was estimated at USD 14.89 billion in 2022 and it is expected to surpass around USD 30.26 billion by 2032, poised to grow at a CAGR of 7.35% from 2023 to 2032. The avocado market in the United States was accounted for USD 3.4 billion in 2022.

Key Pointers

Report Scope of the Avocado Market

| Report Coverage | Details |

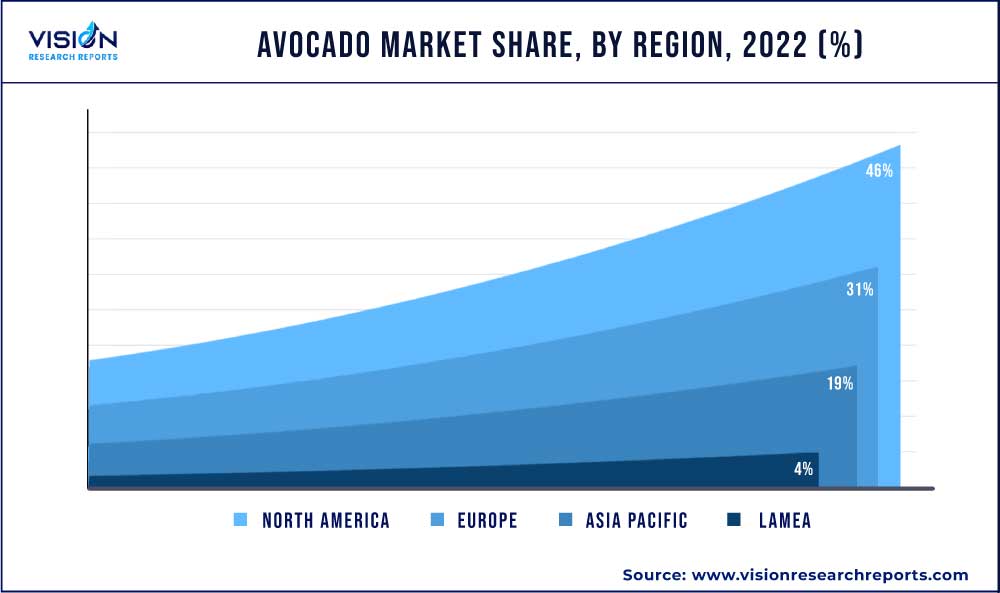

| Revenue Share of North America in 2022 | 46% |

| Revenue Forecast by 2032 | USD 30.26 billion |

| Growth Rate from 2023 to 2032 | CAGR of 7.35% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Calavo Growers, Inc.; West Pak Avocado, Inc.; Westfalia Fruit; Mission Produce, Inc.; EMPACADORA AVEHASS S.A. DE C.V.; Aguacates JBR; Propal; Duclos Farms; AustChilli Group; Simpson Farms |

Increasing focus on a healthy lifestyle and a growing number of buyers for healthy food products are impelling market growth. Moreover, increasing awareness about nutritional values, a growing middle-class population, and rising import demand is expected to boost industry growth. Advanced markets for processed avocados are also estimated to drive industry growth. The COVID-19 pandemic has adversely affected the market in various regions.

The market for avocados has been affected by the pandemic, majorly due to the closure of the hospitality industry consisting of hotels, restaurants, and cafes. However, staying at home due to various government guidelines and lockdown scenarios drew more awareness and attention from consumers toward healthy eating. In addition, consumers' preferences also shifted to homemade and self-prepared meals made from fresh fruits and vegetables. Since avocados are high in nutrients, consumers started excluding processed foods such as instant noodles and pizza and started incorporating healthy foods such as avocados. Initially, a huge loss of plants occurred in the nurseries due to the non-circulation of producers and farmers owing to quarantine.

The increased popularity of nutritious snacks among millennials due to the increased health consciousness is expected to bolster the demand in the upcoming years. According to an article published by Yahoo Finance in August 2019, about 80% of millennials bought avocados more than once in 2018, while 77% of non-millennials made repeat purchases. Furthermore, the year-round availability of avocados due to imports in the U.S. has increased its consumption, which is expected to support the positive outlook over the forecast period.

In recent years, consumers have been opting for snacks referred to as superfoods, including high levels of mono-saturated fat, potassium, fiber, folate, essential vitamins, and minerals. Hence, manufacturers are innovating existing avocado-based snacks to relaunch them in different flavors for consumers. For instance, in November 2020, Earnest Eats launched a new snacking line made with frozen slices of real avocado seasoned with sea salt and spices. The new line of avocado snacks is available in three flavors: Sea Salt, Sea Salt Lime, and Roasted Chipotle. Such innovations will provide consumers with options to choose from according to their tastes and preferences, which is expected to support market growth in the coming years.

The growing popularity of high-nutrients food has been boosting the adoption of avocados worldwide. According to a survey conducted by Tetra Pak in February 2021, consumers prefer avocado-based snacks with attributes such as healthy (56%), nutritious (51%), high in protein (40.8%), and calcium content (41.2%). The rising trend of snacking is also expected to boost the market globally in the coming years. In addition, rising urbanization, deployment of modern retail, and developments in the cold chain have increased product penetration.

The consumption of avocados varies considerably across the globe. Avocados are a primary source of protein for millennials who intentionally or not-skip their meals. Furthermore, countries with a large working population and time constraints are opting for avocado-based snacks. India, China, Brazil, Turkey, South Africa, Italy, Germany, the U.S., and Russia are among the leading consumers of such snacks.

Form Insights

The fresh form accounted for the highest revenue share of 79% in 2022. Global manufacturers are using new technologies in production as a result of the rising demand for raw fruit. The popularity of fresh avocados among consumers can be attributed to the growing consumption of fresh foods and easy product availability. The high fiber content of fresh form helps with digestion, prevents constipation, maintains the health of the gastrointestinal tract, and reduces the risk of colon cancer.

Although processed avocados are gaining popularity, avocados are mainly eaten in their fresh form. The rising disposable income levels and changing lifestyles are also among the major factors driving the growth of this segment. Consumers don’t have to worry about wastage or unusable fruit with processed products. Additionally, according to an April 2022 article in The Produce News, vegetarian salads account for 67.43% of the global packaged salad market, attributed to the desire for protein-enriched salads. Innovative new product launches and flavor possibilities in the category fuel the demand for processed fresh avocados.

Distribution Channel Insights

The B2B segment is anticipated to witness a prominent growth rate of 8.34% during the forecast period. The B2B segment includes the processing industry and foodservice industries. Avocado continues to gain popularity owing to its nutritional value. Due to rising health consciousness, particularly among the young population, consumers are increasingly opting for nutritious food in the form of sandwiches, salads, and healthy chips such as avocado chips at cafés and restaurants.

Additionally, several cafes are capitalizing on the work from café trend. An increasing number of working professionals are opting to work from cafes and restaurants. Since they most likely spend the majority of their day in the cafe, they would also order a significant amount of food throughout the day. This, coupled with the health and wellness trend, is expected to drive the demand for nutritional ingredients such as fresh avocadoes.

The B2C segment dominated the market in 2022 owing to the increased consumer demand for fresh avocados through these channels. The B2C channel can be categorized as e-commerce, supermarkets & hypermarkets, convenience stores, specialty stores, and other retail stores. Due to changing food preferences, consumers are willing to pay higher prices for a variety of high-quality items that are fresh, safe, and convenient. Retail stores have a strong influence on how fruits and vegetables are displayed and are diversifying their assortment of ready-to-eat fruits and fresh-cut products to increase sales.

Regional Insights

North America dominated the market revenue share in 2022, accounting for 46% of the total revenue. The demand for fresh avocados has been strong across North America. According to an article published by the University of California in November 2021, the per capita consumption of fresh avocados was pegged at 8.0 pounds in 2019. The increased demand for nutritious food will continue to drive the consumption of fresh avocados in the coming years.

Asia Pacific is forecast to grow with a significant CAGR of 10.43% from 2023 to 2032. The growth of the Asian-Pacific market is facilitated by the growing popularity of Western cuisine in major cities in China and other Asian countries. Moreover, the continued growth of the middle-class population of China and India is expected further to increase the demand for avocados in Asia Pacific. The growing demand from Asian consumers is creating a healthy environment for the manufacturers and suppliers of fresh fruits to extend their footprint in this region. This may propel the avocado market growth over the upcoming years.

Avocado Market Segmentations:

By Form

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Avocado Market

5.1. COVID-19 Landscape: Avocado Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Avocado Market, By Form

8.1. Avocado Market, by Form, 2023-2032

8.1.1. Fresh

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Processed

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Avocado Market, By Distribution Channel

9.1. Avocado Market, by Distribution Channel, 2023-2032

9.1.1. B2B

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. B2C

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Avocado Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Form (2020-2032)

10.1.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Form (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Form (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Form (2020-2032)

10.2.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Form (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Form (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Form (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Form (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Form (2020-2032)

10.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Form (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Form (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Form (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Form (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Form (2020-2032)

10.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Form (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Form (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Form (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Form (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Form (2020-2032)

10.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Form (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Form (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 11. Company Profiles

11.1. Calavo Growers, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. West Pak Avocado, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Westfalia Fruit

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Mission Produce, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. EMPACADORA AVEHASS S.A. DE C.V.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Aguacates JBR

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Propal

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Duclos Farms

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. AustChilli Group

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Simpson Farms

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others