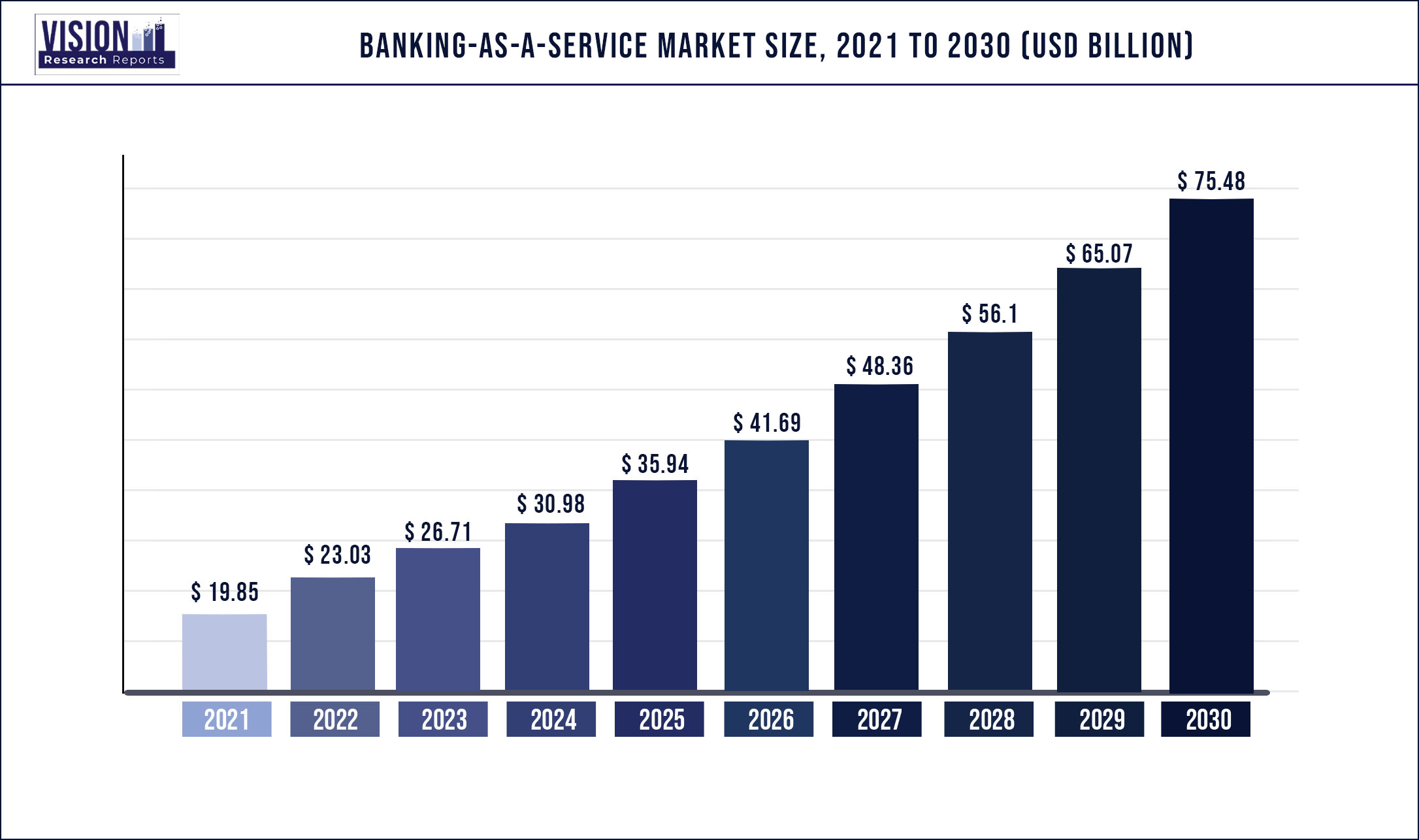

The global banking-as-a-service market was valued at USD 19.85 billion in 2021 and it is predicted to surpass around USD 75.48 billion by 2030 with a CAGR of 16.0% from 2022 to 2030.

Report Highlights

The global industry is accelerating due to the growing digitalization in banks and the simplification of financial services. In addition, the expansion of the Banking-as-a-Service (BaaS) industry is positively impacted by advancements in fund transaction services across the U.S. and several emerging countries. For instance, in October 2021, a Brazilian fintech company, Dock acquired BPP Payment Institution SA (Brasil Pré-Pagos), an e-payments service provider. With this acquisition, Dock will strengthen its payments and digital banking services in Brazil.

The acquisition of BPP Payment Institution SA is expected to increase the competitiveness of its full-stack Banking-as-a-Service (BaaS) offering and speed up integrations. Moreover, in June 2022, Raisin Bank, a German BaaS operator, agreed to purchase Bankhaus August Lenz unit, a German private bank. With this acquisition, Raising Bank enters into the payments business. Raisin Bank will be able to provide its partners and their clients with electronic payment transactions in addition to cash solutions. Working with large bank-independent operators as well as merchants, restaurants, and gas station chains, the company will have access to more than 4500 ATMs in Germany.

The utilization of e-commerce platforms has significantly increased since the outbreak of the COVID-19 pandemic, which has augmented the demand for online payment technologies to share financial information with consumers. In addition, banks and fintech companies are becoming more interested in BaaS platforms to improve their core processes and offer secure contactless payments to expedite their transaction process. Moreover, the demand for BaaS is anticipated to rise as the bank and fintech sectors are inclined toward streamlining their operations to improve clients’ digital experiences post-pandemic.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 19.85 billion |

| Revenue Forecast by 2030 | USD 75.48 billion |

| Growth rate from 2022 to 2030 | CAGR of 16.0% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Component, product type, enterprise size, end-use, region |

| Companies Covered |

Green Dot Bank; Solarisbank AG; PayPal Holdings, Inc.; Fidor Solutions AG; Moven Enterprise; The Currency Cloud Ltd.; Treezor; Bnkbl Ltd.; MatchMove Pay Pte Ltd.; Block, Inc. |

Component Insights

The platform component segment dominated the global industry in 2021 and accounted for the largest share of more than 58.21% of the overall revenue. Banking-as-a-Service platforms enable companies to embed financial services traditionally offered by the banks. The services include opening a monetary account, issuing cards, and even loans. BaaS platforms can integrate these services directly into the company’s existing software. The BaaS platforms enable customers to manage cash flows, pay bills, and access funding through the company’s website. The enhanced customer experience, increase in brand loyalty, and product branding & marketing are a few of the BaaS platform’s benefits, which contribute to the segment growth.

The services segment is anticipated to witness a significant growth rate during the forecast period. BaaS is reshaping the value chain of banking by enabling distributors to offer banking products and services through third-party platforms. Services provided by BaaS usually include integration, deployment, and maintenance of the platform, which comes with cloud storage, database management, hosting platforms, user authentication, and push notifications. BaaS providers offer services streamlining the software process while offering clients end-to-end support. The efficiency and simplicity of use provided by the services are expected to drive their adoption over the forecast period.

Product Type Insights

The cloud-based BaaS segment dominated the industry in 2021 and accounted for the maximum share of more than 58.17% of the global revenue. The segment is also anticipated to register the fastest growth rate during the forecast period. Along with promptly bringing new digital features into users’ hands, the BaaS cloud provides other advantages. Consistent policy enforcement, automatic provisioning, and traffic monitoring can also assist digital businesses more effectively in satisfying their stringent service commitments. Utilizing cloud technology to streamline digital operations can lessen reputational harm from service interruptions, which is anticipated to provide unique opportunities for the segment’s growth.

The API-based BaaS segment is anticipated to grow significantly over the forecast period. BaaS API allows secure data exchange between a fintech company and the bank. This enables companies to offer banking services to the users on their interfaces of the app or web, which is expected to provide opportunities for segment growth. The strong efforts being made by different fintech companies to improve the BaaS ecosystem are also driving the segment’s growth. For instance, in September 2021, a leading payment startup, Cashfree, unveiled its BaaS API offering called Accounts. This API is designed to assist neo-banks and fintech platforms in integrating banking services into their products easily.

Enterprise Size Insights

The large enterprises segment dominated the global industry in 2021 and accounted for the largest share of more than 61.35% of the overall revenue. To provide consumers with supplementary financial solutions, many large enterprises are investing in banking capabilities. Finastra, a provider of financial IT software, conducted interviews with 50 top corporate executives and a poll of 1,600 more people, finding that 85% of respondents had already implemented or intended to deploy BaaS capabilities. In addition, BaaS enhances the platforms and products that businesses use daily with contextualized, integrated banking services that are likely to drive segment growth.

The small & medium enterprises segment is expected to register a significant CAGR over the forecast period. The advantage of integrated finance, from an SME’s point of view, is that they can use the financial services whenever they need them, without having to open another app or website to initiate a bank transfer or complete a loan application. In addition, the embedded finance solution offered by a platform might also include value-added services like financial management and analytics tools. SMEs are more interested in financial products that don’t require a significant financial decision, like overdrafts and loans, than they are in transactional embedded finance products, such as accounts and cards.

End-use Insights

The banks segment dominated the global industry in 2021 and accounted for the maximum share of more than 35.15% of the overall revenue. BaaS can assist banks with cost-saving measures in addition to revenue generation. Banks are not required to spend money on technical advancement. Consequently, they can benefit from collaborations with other parties as they already have access to ready-to-go solutions. Strategic partnerships are anticipated to support banks in future investments and profit projections. Moreover, the dominance can also be attributed to the fact that banks have access to enormous funding capacity and the trust of their customers.

The Non-Banking Financial Companies (NBFC) end-use segment is anticipated to grow at the fastest CAGR over the forecast period. The NBFCs are increasingly adopting BaaS platforms to offer payment services. Due to significant capital requirements to obtain a banking license, the NBFCs are more inclined to integrate BaaS platforms into their products. Moreover, not everyone has access to the resources needed to maintain legacy systems and follow legal requirements. The BaaS model helps by linking directly with a bank and enables non-bank players and businesses to get around banking licensing regulations. Financial startups may get off the ground much faster without having to contend with a bank’s IT infrastructure, creating a positive outlook for segment growth.

Regional Insights

North America dominated the global industry in 2021 and accounted for the maximum share of more than 36.04% of the overall revenue. The growth is attributed to the efforts of technology companies present in the region, such as PayPal Holdings, Inc. and Green Dot Bank, among others, to establish the BaaS market. For instance, in April 2022, Finastra, a U.K.-based company, announced a BaaS collaboration with Microsoft to offer alternative lending solutions to Small and Medium Enterprises (SMEs). Through this collaboration, SME owners can easily and smoothly acquire pertinent and worthwhile business financing.

Asia Pacific is expected to register the fastest growth rate during the forecast period. The fast-paced growth of this region can be attributed to a rise in awareness levels about the advantages of BaaS in nations like China, India, and Japan. Various initiatives by organizations worldwide to promote BaaS in Asia Pacific are also anticipated to aid the region’s expansion. For instance, in July 2022, Finastra announced offering HSBC’s Foreign Exchange (FX) services to mid-tier banks in the Asia Pacific (APAC) region by utilizing its own FusionFabric.cloud platform under a BaaS experience.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Banking-as-a-Service Market

5.1. COVID-19 Landscape: Banking-as-a-Service Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Banking-as-a-Service Market, By Component

8.1. Banking-as-a-Service Market, by Component, 2022-2030

8.1.1. Platform

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Banking-as-a-Service Market, By Product Type

9.1. Banking-as-a-Service Market, by Product Type, 2022-2030

9.1.1. API-Based Banking-as-a-Service

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Cloud-Based Banking-as-a-Service

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Banking-as-a-Service Market, By Enterprise Size

10.1. Banking-as-a-Service Market, by Enterprise Size, 2022-2030

10.1.1. Large Enterprises

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Small & Medium Enterprises

10.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Banking-as-a-Service Market, By End-use

11.1. Banking-as-a-Service Market, by End-use, 2022-2030

11.1.1. Banks

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. NBFC

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Government

11.1.3.1. Market Revenue and Forecast (2017-2030)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Banking-as-a-Service Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Component (2017-2030)

12.1.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.1.3. Market Revenue and Forecast, by Enterprise Size (2017-2030)

12.1.4. Market Revenue and Forecast, by End-use (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Component (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.1.5.3. Market Revenue and Forecast, by Enterprise Size (2017-2030)

12.1.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Component (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.1.6.3. Market Revenue and Forecast, by Enterprise Size (2017-2030)

12.1.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Component (2017-2030)

12.2.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.3. Market Revenue and Forecast, by Enterprise Size (2017-2030)

12.2.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Component (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.5.3. Market Revenue and Forecast, by Enterprise Size (2017-2030)

12.2.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Component (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.6.3. Market Revenue and Forecast, by Enterprise Size (2017-2030)

12.2.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Component (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.7.3. Market Revenue and Forecast, by Enterprise Size (2017-2030)

12.2.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Component (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.8.3. Market Revenue and Forecast, by Enterprise Size (2017-2030)

12.2.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Component (2017-2030)

12.3.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.3. Market Revenue and Forecast, by Enterprise Size (2017-2030)

12.3.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Component (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.5.3. Market Revenue and Forecast, by Enterprise Size (2017-2030)

12.3.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Component (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.6.3. Market Revenue and Forecast, by Enterprise Size (2017-2030)

12.3.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Component (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.7.3. Market Revenue and Forecast, by Enterprise Size (2017-2030)

12.3.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Component (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.8.3. Market Revenue and Forecast, by Enterprise Size (2017-2030)

12.3.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Component (2017-2030)

12.4.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.3. Market Revenue and Forecast, by Enterprise Size (2017-2030)

12.4.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Component (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.5.3. Market Revenue and Forecast, by Enterprise Size (2017-2030)

12.4.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Component (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.6.3. Market Revenue and Forecast, by Enterprise Size (2017-2030)

12.4.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Component (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.7.3. Market Revenue and Forecast, by Enterprise Size (2017-2030)

12.4.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Component (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.8.3. Market Revenue and Forecast, by Enterprise Size (2017-2030)

12.4.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Component (2017-2030)

12.5.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.5.3. Market Revenue and Forecast, by Enterprise Size (2017-2030)

12.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Component (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.5.5.3. Market Revenue and Forecast, by Enterprise Size (2017-2030)

12.5.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Component (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.5.6.3. Market Revenue and Forecast, by Enterprise Size (2017-2030)

12.5.6.4. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 13. Company Profiles

13.1. Green Dot Bank

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Solarisbank AG

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. PayPal Holdings, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Fidor Solutions AG

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Moven Enterprise

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. The Currency Cloud Ltd.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Treezor

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Bnkbl Ltd.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. MatchMove Pay Pte Ltd.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Block, Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others