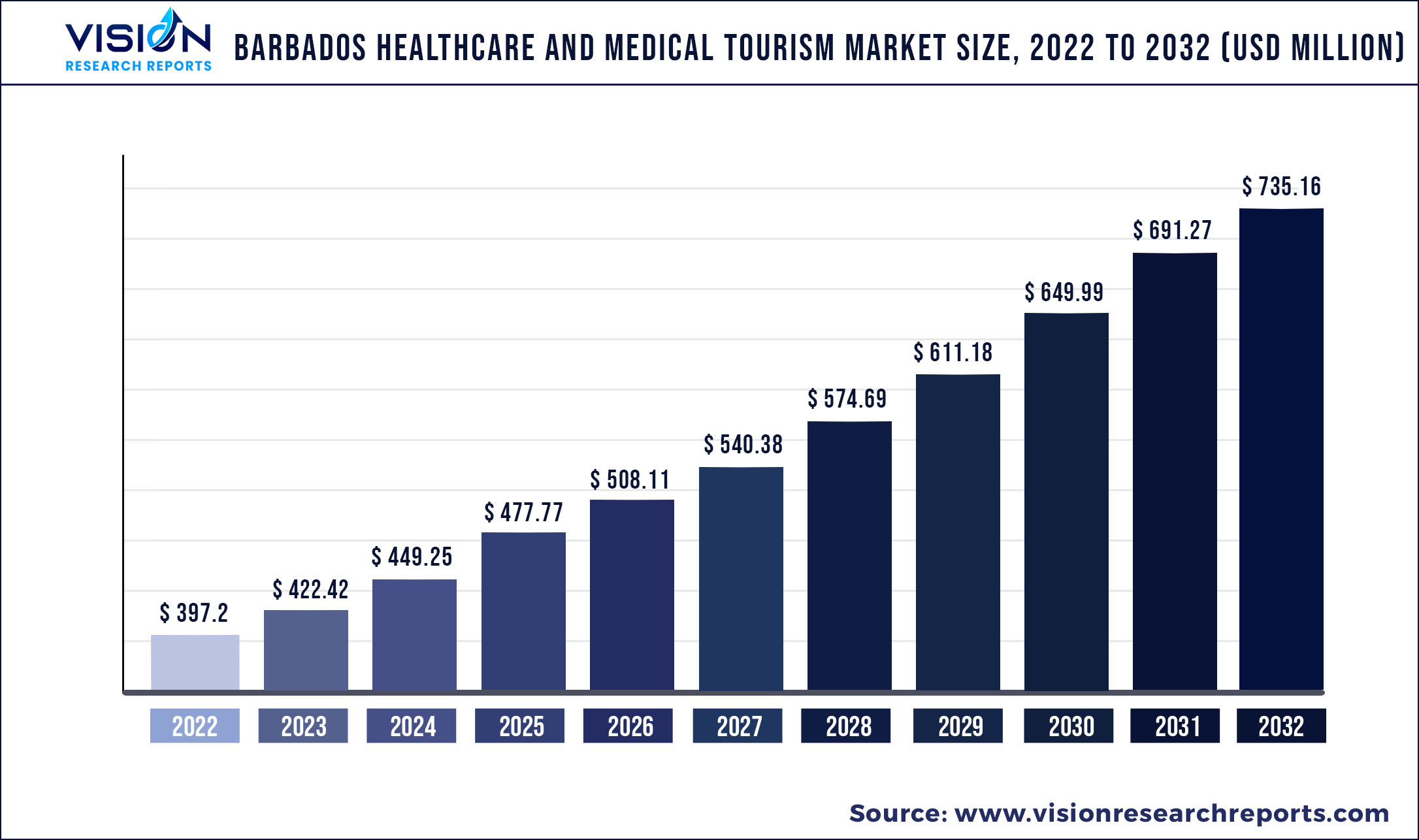

The global barbados healthcare and medical tourism market size was estimated at around USD 397.2 million in 2022 and it is projected to hit around USD 735.16 million by 2032, growing at a CAGR of 6.35% from 2023 to 2032.

Barbados is recognized in the Eastern Caribbean for its superior medical facilities, which include facilities for decompression chambers, open heart surgery, and dialysis centers. It is a highly popular tourist destination with a large English-speaking resident population and is rapidly gaining popularity as a medical tourism destination. Since 2002, the JCI-accredited Barbados Fertility Center has attracted international fertility patients. As patients from the U.S., U.K., and Canada seek treatment from physicians in Barbados, its medical tourism sector is expected to expand rapidly.

The country invests more in public and private healthcare than any other country in the Caribbean and Central America. Every citizen is entitled to universal health coverage. Approximately 65% of healthcare institutions are administered by the public sector. The remaining 35% of the healthcare facilities are private. Successive governments have prioritized healthcare expenditures to the extent that Barbados is one of the region's highest spenders per capita.

The government has also led numerous attempts to promote medical tourism in the country. The Barbados Fertility Centre benefited from the extension of the Tourism Development Act, which permits the duty-free importation of medical equipment. In addition, the government enabled the clinic to use Barbados in its facility name, a marketing advantage generally reserved for publicly held corporations.

The COVID-19 pandemic negatively impacted the medical tourism industry of the country. Long-stay and cruise ship arrivals decreased by 71% and 66%, respectively, as a result of COVID-19 restrictions in major international source markets. Further, an increase in domestic and foreign COVID-19 cases, as well as the emergence of new, more contagious variations, worsened the outlook for the tourism industry in the first half of 2021, forcing additional lockdowns or limitations to prevent the virus's spread. As a result, the tourism industry experienced a decline of 78.6% from 2019 to 2020.

| Report Coverage | Details |

| Market Size in 2022 | USD 397.2 million |

| Revenue Forecast by 2032 | USD 735.16 million |

| Growth rate from 2023 to 2032 | CAGR of 6.35% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segmentation | Specialty type |

| Companies Covered | The Queen Elizabeth Hospital; Bayview Hospital; Barbados Fertility Centre; Premiere Surgical Centre; The Sparman Clinic; FMH Emergency Medical; Sandy Crest Medical Centre |

Specialty Type Insights

Based on specialty type, the healthcare market is segmented into orthopedics, cardiology, cosmetics, general surgery, fertility and gynecology, and others. The general surgery segment accounted for the maximum share of 29.0% in 2022. This growth can be attributed to the rising prevalence of gastrointestinal diseases and the demand for laparoscopic procedures. As per the Barbados Ministry of Health and Wellness, a total of 1,052 general surgeries were reported in 2018.

The cardiology segment is expected to grow at the fastest rate during the forecast period. Cardiovascular diseases are the main cause of death in the country. As per the 2019 report on cardiovascular disease by Barbados National Registry (BNR), the country continues to see an increase in the prevalence of heart attack and stroke. For instance, in 2019, 547 people suffered from myocardial infarction. The increasing burden of CVDs and the opening of dedicated walk-in chest clinics are likely to drive segment growth. For instance, the Stroke Care and Cardiac Unit was recently established at Queen Elizabeth Hospital.

Orthopedic treatment is one of the most availed procedures in Barbados. The increasing prevalence of arthritis conditions, such as osteoarthritis, rheumatoid arthritis, and osteoporosis, is expected to drive the segment’s growth. For instance, according to data published by WHO in 2020, the age-adjusted death rate due to rheumatoid arthritis reached 0.73 per 100,000 population in Barbados, ranking the country 19th in the world. As per the Barbados Ministry of Health and Wellness, a total of 809 cosmetic surgeries were registered in 2018.

Factors such as the rising awareness about cosmetic procedures and the influence of social media are propelling the growth of the cosmetic segment. The others segment is anticipated to grow owing to the high prevalence of cancer and the growing geriatric population. According to the WHO, the number of new cancer cases in Barbados is expected to reach 133,000 in 2030. Further, neurology procedures are anticipated to witness moderate growth across the country owing to the availability of affordable surgeries and treatments performed by highly skilled surgeons.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on Barbados Healthcare And Medical Tourism Market

5.1. COVID-19 Landscape: Barbados Healthcare And Medical Tourism Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. Global Barbados Healthcare And Medical Tourism Market, By Specialty Type

8.1.Barbados Healthcare And Medical Tourism Market, by Specialty Type Type, 2023-2032

8.1.1. General Surgery

8.1.1.1.Market Revenue and Forecast (2019-2032)

8.1.2. Orthopedics

8.1.2.1.Market Revenue and Forecast (2019-2032)

8.1.3. Cardiology

8.1.3.1.Market Revenue and Forecast (2019-2032)

8.1.4. Fertility & Gynecology

8.1.4.1.Market Revenue and Forecast (2019-2032)

8.1.5. Cosmetics

8.1.5.1.Market Revenue and Forecast (2019-2032)

8.1.6. Others

8.1.6.1.Market Revenue and Forecast (2019-2032)

Chapter 9. Global Barbados Healthcare And Medical Tourism Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Specialty Type (2019-2032)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Specialty Type (2019-2032)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Specialty Type (2019-2032)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Specialty Type (2019-2032)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Specialty Type (2019-2032)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Specialty Type (2019-2032)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Specialty Type (2019-2032)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Specialty Type (2019-2032)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Specialty Type (2019-2032)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Specialty Type (2019-2032)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Specialty Type (2019-2032)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Specialty Type (2019-2032)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Specialty Type (2019-2032)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Specialty Type (2019-2032)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Specialty Type (2019-2032)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Specialty Type (2019-2032)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Specialty Type (2019-2032)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Specialty Type (2019-2032)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Specialty Type (2019-2032)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Specialty Type (2019-2032)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Specialty Type (2019-2032)

Chapter 10.Company Profiles

10.1. The Queen Elizabeth Hospital

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2. Bayview Hospital

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3. Barbados Fertility Centre

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4. Premiere Surgical Centre

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5. The Sparman Clinic

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6. FMH Emergency Medical

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7. Sandy Crest Medical Centre

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others