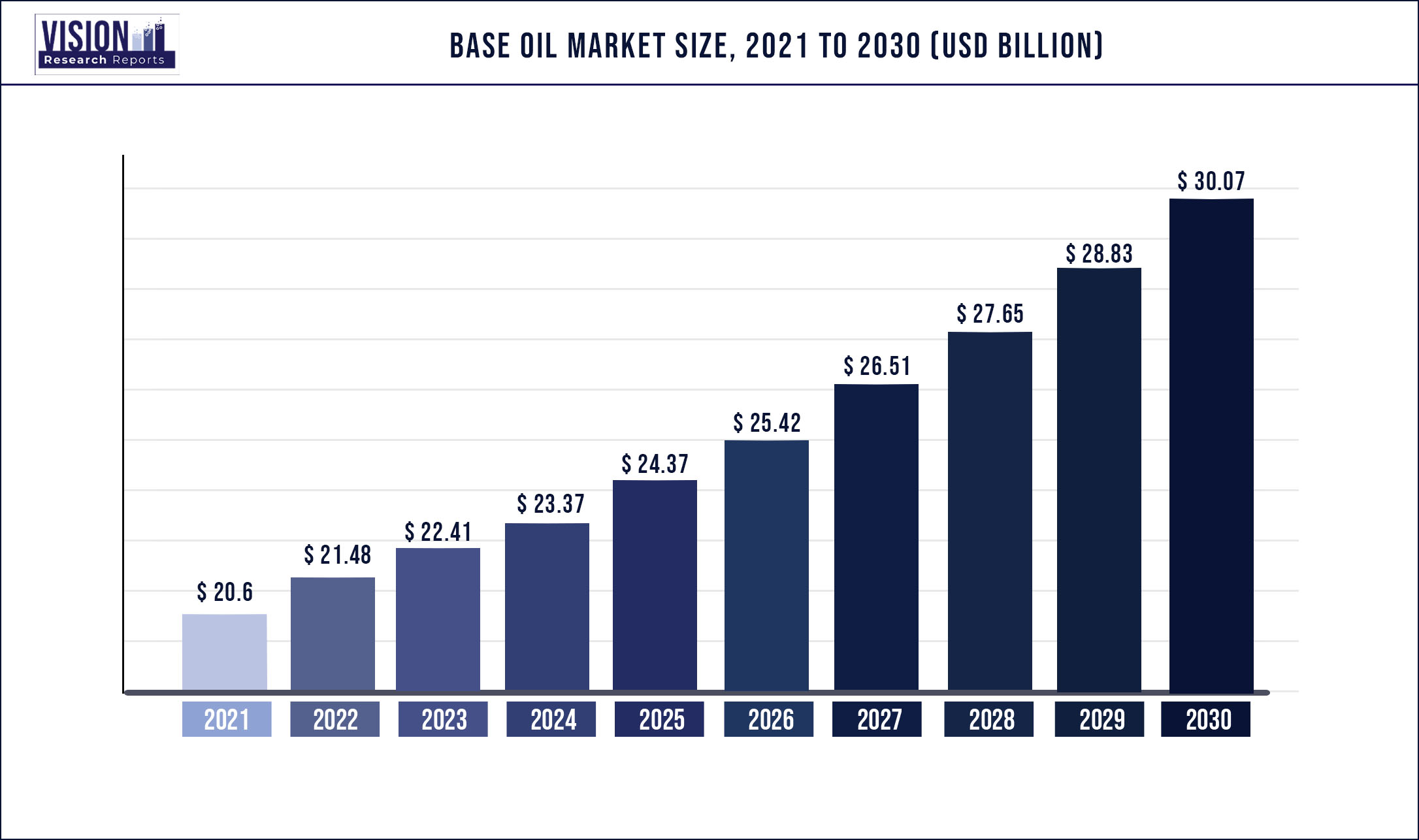

The global base oil market was surpassed at USD 20.6 billion in 2021 and is expected to hit around USD 30.07 billion by 2030, growing at a CAGR of 4.29% from 2022 to 2030.

Report Highlights

Lubricants are mainly used in gearboxes, lubricants & transmission oils, and diesel engine oils, in various automotive applications including commercial vehicles, motorcycles, and passenger cars. The automotive industry is one of the largest consumers of base oils that are growing at a faster pace.

This industry is currently facing massive shifts in terms of production from group I to group II and III. Although the shift in the sector is gradual, various factors including government directives, feedstock choices, and demand patterns play a major role in propelling the market. Also, key industry participants are expanding their businesses in the Asia Pacific region, owing to the rising industrial and automotive sectors in this region, which can further contribute to group II product demand.

Moreover, base oil manufacturing technologies adopted worldwide would further reinforce the demand for the products to suffice the growing demand for end-use utility productions. Meanwhile, prices and availability of crude oil are anticipated to largely affect the production processes globally. The turbulence in the sector has had a significant impact on multiple other dependent industries such as base oils, lubricants, and others. Since 2019, the petroleum market has faced critical challenges as vehicle efficiency measures taken by governments worldwide to curb carbon emissions led to lower consumption of transport fuel. However, the market witnessed a strong presence of key players that competes to dominate the market and to gain a strategic and competitive advantage over the other players.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 20.6 billion |

| Revenue Forecast by 2030 | USD 30.07 billion |

| Growth rate from 2022 to 2030 | CAGR of 4.29% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, application, region |

| Companies Covered |

CNOOC Limited; PetroCanada Lubricants Inc.; Petroleum & Chemical Corp. (SINOPEC); PETRONAS Lubricants International; PT Pertamina (Persero); PetroChina Co., Ltd.; Exxon Mobil Corporation; Abu Dhabi National Oil Company; Chevron Corporation; Shell plc; Indian Oil Corporation Ltd.; BP p.l.c; Saudi Arabian Oil Co.; Sepahan Oil; Bahrain Lube Base Oil Company; LUKOIL; SK Lubricants Co., Ltd.; H&R OWS Chemie GmbH & Co. KG; Bharat Petroleum Corporation Limited; GS Caltex Corporation; Neste; Repsol |

Product Insights

The group I product segment dominated the market and accounted for the largest revenue share of 42.03% in 2021. This is attributed to increasing usage in automotive, marine, and rail lubricants due to their affordability, simple processing, low volatility, high viscosity index, and lubrication properties. Group I products are classified as greater than 0.03% sulfur, less than 90% saturates, and viscosity range from 80 to 120. This group is characterized by its low aromatic compound content and paraffinic nature. The temperature range is from 32ËšF to 150ËšF. Compared to all other groups, group I is less refined and is a mixture of different hydrocarbon chains with little uniformity.

The group II product segment accounted for the second-largest revenue share in the year 2021. This is because of its easy availability and new capacity additions near the countries in Asia Pacific and Middle East region coupled with competitive prices. Globally, over 90% volume of lubricants can be formulated from group II type. The prices of the Group II type are close to that of group I, therefore, they have become common in the market.

Application Insights

The automotive oils application segment dominated the market and accounted for the largest revenue share of 43.16% in 2021. Its high share is attributable to increasing demand for greases, gear oil, engine oil, and others for lubricating automobile components. Globally, truck engines and automobiles are the major consumers, consuming over 20 million tons of lubricants per year, accounting for about half of the total lubricant use. With vehicle manufacturers pushing toward meeting pollution standards, the automobile market is anticipated to prompt oil companies to produce base oils.

The demand for automobile oils is anticipated to witness noteworthy growth over the forecast period due to the rising popularity of fragrance products for homes in developed economies such as Germany, the U.K., the U.S., and Canada. Blended, paraffin, bees base, palm, and soy base oils are the most commonly purchased automobile oils in the market. Process oil accounted for the second-largest revenue share globally because of its application in a wide variety of technical and chemical industries either as an aid to processing or as a raw material. They play a vital role in several applications such as polymer industry, foam control, agriculture, sealants, leather goods manufacture, textile production, civil explosive production, and others.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 50.89% in 2021. This is attributed to the presence of emerging economies and the increasing disposable income of people in the region making it an attractive market for lubricant manufacturers. Asia Pacific is one of the largest markets for base oil globally, with China being the dominant country in the region. China is projected to lead the Asia Pacific base oil market over the forecast period. The dominance is attributed to the increased use of automobiles and the rapid growth of the manufacturing industry in the country. The market in China is also supported by the accessibility of raw materials, increased foreign investments, rapid industrialization, and a growing population.

Similarly, the market in India is expected to witness a high growth rate owing to the strong presence of several base oil producers, and rapid infrastructure development undertaken by the government of India. Europe attributed for the second-largest revenue share globally for the year 2021. High consumption of lubricants is considered a key driver for the growth of the market in Europe, as lubricants are mainly composed of base oil. The high consumption of base oil is closely associated with the growth of the transportation and industrial sectors. In addition, the total number of passenger vehicles in use grew by 3.8%, and that of commercial vehicles grew by 3.7% from 2005 to 2015.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Base Oil Market

5.1. COVID-19 Landscape: Base Oil Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Base Oil Market, By Product

8.1. Base Oil Market, by Product, 2022-2030

8.1.1. Group I

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Group II

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Group III

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Group IV

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Group V

8.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Base Oil Market, By Application

9.1. Base Oil Market, by Application, 2022-2030

9.1.1. Automotive Oils

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Process Oils

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Hydraulic Oils

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Metalworking Fluids

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Industrial Oils

9.1.5.1. Market Revenue and Forecast (2017-2030)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Base Oil Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

Chapter 11. Company Profiles

11.1. CNOOC Limited

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. PetroCanada Lubricants Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Petroleum & Chemical Corp. (SINOPEC)

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. PETRONAS Lubricants International

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. PT Pertamina (Persero)

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. PetroChina Co., Ltd.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. ExxonMobil Corporation

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Abu Dhabi National Oil Company

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Chevron Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Shell plc

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others