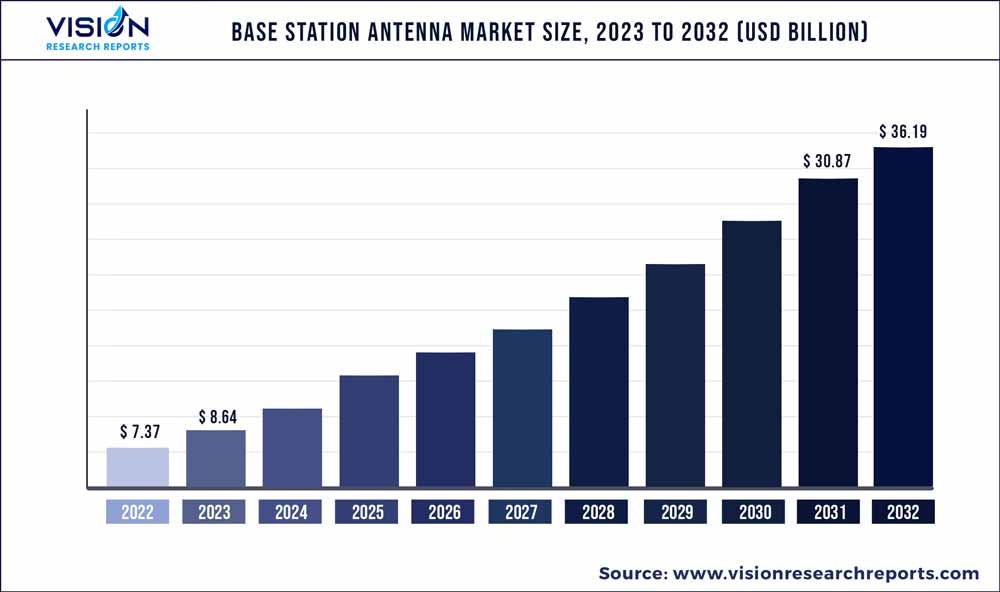

The global base station antenna market was surpassed at USD 7.37 billion in 2022 and is expected to hit around USD 36.19 billion by 2032, growing at a CAGR of 17.25% from 2023 to 2032. The base station antenna market in the United States was accounted for USD 1.7 billion in 2022.

Key Pointers

Report Scope of the Base Station Antenna Market

| Report Coverage | Details |

| Revenue Share of Asia Pacific in 2022 | 32% |

| Revenue Forecast by 2032 | USD 36.19 billion |

| Growth Rate from 2023 to 2032 | CAGR of 17.25% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | CommScope Holding Company, Inc.; Huawei Technologies Co., Ltd.; Amphenol Antenna Solutions; ACE Technologies Corp.; Comba Telecom Systems Holdings Ltd.; PCTEL Inc; Tongyu Communication Inc; Radio Frequency Systems (RFS); Telefonaktiebolaget LM Ericsson; Kaelus |

The market growth can be attributed to the rising deployment of 5G networks, which drives the demand for advanced base station antennas capable of supporting the higher frequency bands and complex beamforming techniques associated with 5G technology. Additionally, there is a growing emphasis on energy efficiency and sustainability, with the development of base station antennas that consume less power and integrate renewable energy sources. Furthermore, the rise of smart cities and IoT applications fuels the need for base station antennas that can handle the massive connectivity requirements of these interconnected systems.

Several base station antenna solution providers across the globe are focusing on launching omnidirectional antennas for 5G networks with better connectivity. For instance, in May 2022, Pasternack Enterprises, Inc., a supplier of microwave and RF products, launched the newest line of omnidirectional outdoor antennas that support LTE, 4G, 5G, and CBRS bands. The new 5G omnidirectional antenna series provides range expansion and easy deployment for WLAN and cellular communications networks, as well as private networks. These collinear omnidirectional antennas with Type-N connections and low-cost polycarbonate or ABS choices are appropriate for SISO or MIMO operations.

5G networks rely on the massive MIMO technology, which utilizes a large number of antennas to increase capacity, enhance spectral efficiency, and improve network performance. Base station antennas with a high number of elements are being developed to support massive MIMO deployments, enabling the transmission and reception of multiple data streams simultaneously. Moreover, massive MIMO employs advanced beamforming techniques to create highly directional beams that can be steered towards specific users or areas. By focusing the signal energy towards the intended receiver and reducing interference in other directions, beamforming enhances signal quality, coverage, and overall network performance.

The increasing adoption of smartphones, coupled with the availability of high-speed mobile networks, has led to a surge in mobile data consumption. Users are increasingly relying on their mobile devices for various activities, including web browsing, social media, streaming media, online gaming, and app usage. The proliferation of data-intensive applications and content contributes to the continuous growth of mobile data traffic. Base station antennas play a critical role in expanding network capacity and coverage to accommodate the increasing data demands. The exponential growth in mobile data traffic, fueled by the rising adoption of smartphones, tablets, and other connected devices, is also driving the need for enhanced wireless communication infrastructure.

The integration of AI and machine learning capabilities in IoT devices, enabling autonomous operation, predictive analytics, and intelligent automation is a significant factor contributing to the growth of the market. IoT devices are becoming more energy-efficient, with advancements in low-power wireless technologies, allowing for longer battery life and sustainable operation. Additionally, there is a growing emphasis on data security and privacy in IoT devices, with the integration of robust encryption, authentication, and access control mechanisms. These emerging trends in IoT devices for the base station antenna market are driving the development of advanced base station antenna solutions to support the increasing connectivity needs, data traffic, and seamless integration of IoT devices into wireless networks.

Offering Insights

The hardware segment dominated the market in 2022 and accounted for more than 69% share of the global revenue. The development of advanced antenna designs and technologies to meet the growing demands of 5G networks is a significant factor contributing to segment growth. This includes the use of Massive MIMO (Multiple Input Multiple Output) technology, which involves deploying antenna arrays with a large number of elements to increase capacity, enhance spectral efficiency, and improve network performance. At the same time, the integration of beamforming capabilities in base station antennas is also contributing to the segment growth. Beamforming allows for the precise targeting of wireless signals, optimizing coverage and capacity by focusing the transmission toward specific user locations. Moreover, there is a growing focus on compact and lightweight antenna designs to facilitate easier installation and reduce tower load.

The services segment is projected to witness remarkable growth over the forecast period owing to the increasing demand for installation and deployment services. As network operators strive to expand their coverage and upgrade their infrastructure, there is a growing need for professional services to ensure the proper installation and integration of base station antennas. This includes site surveys, antenna installation, testing, and optimization services. Moreover, network operators are also seeking external expertise to manage their antenna systems, including monitoring, maintenance, and performance optimization. Managed service providers offer proactive monitoring, troubleshooting, and network management to ensure optimal performance and reliability of base station antennas.

Technology Insights

The 4G/LTE segment dominated the market in 2022 and accounted for more than 61% share of the global revenue. The increasing demand for higher frequencies and wider bandwidths to accommodate the ever-growing data traffic is a significant factor contributing to the growth of the segment. Many regions and areas still rely heavily on 4G networks for wireless communication, and hence base station antennas supporting 4G/LTE are essential for providing reliable and high-speed connectivity to users. As users consume more bandwidth-intensive applications and services, there is a need for advanced base station antennas capable of handling the increased capacity requirements. Additionally, the deployment of small cell solutions to enhance coverage and capacity in densely populated urban areas. Additionally, there is a focus on improving energy efficiency and reducing power consumption in 4G/LTE base station antennas.

The 5G segment is projected to witness significant growth over the forecast period. The adoption of Massive MIMO (Multiple Input Multiple Output) technology in 5G base station antennas is a major factor contributing to the segment growth. At the same time, the development of mmWave (millimeter-wave) base station antennas to accommodate the higher frequencies utilized in 5G networks is contributing to the growth of the segment. These antennas operate in the millimeter-wave spectrum and provide substantially higher data throughput and reduced latency.

Provision Insights

The urban segment dominated the market in 2022 and accounted for more than 4% s7hare of the global revenue. Increasing deployment of small cell solutions in urban areas is a major factor contributing to the growth of the segment. Small cells, including microcells and picocells, are being installed in dense urban environments to enhance network coverage and capacity. These compact base station antennas help address the high data demand in urban centers by offloading traffic from macrocell networks and providing localized coverage, improving network performance and user experience. Additionally, with the rise of smart cities and the Internet of Things (IoT), there is an increasing demand for base station antennas that support a wide range of wireless communication technologies and frequencies.

The rural segment is projected to expand at the highest CAGR over the forecast period. One significant trend is the increasing deployment of long-range base station antennas in rural areas to improve coverage and connectivity. These antennas have higher gain and longer reach, enabling network operators to extend their network coverage to underserved rural regions. Another emerging trend is the utilization of innovative technologies like Fixed Wireless Access (FWA) and satellite-based solutions to bridge the connectivity gap in remote rural areas. Base station antennas are being designed and deployed specifically for FWA and satellite communications, providing high-speed internet access to areas where traditional wired infrastructure is not feasible. Additionally, there is a growing focus on energy-efficient base station antennas in rural environments.

Application Insights

The mobile communication segment dominated the market in 2022 and accounted for more than 26% share of the global revenue. The rapid expansion of 5G networks and the corresponding demand for advanced base station antennas to support the increased data speeds and capacity requirements is a significant factor contributing to the segment growth. As 5G technology continues to roll out globally, there is a growing need for Massive MIMO (Multiple Input Multiple Output) antennas that can handle the high-frequency bands and enable beamforming to enhance network performance and user experience. With the proliferation of Internet of Things (IoT) devices and the coexistence of different generations of mobile networks, antennas are being developed to support multi-band and multi-technology deployments, enabling seamless connectivity and efficient spectrum utilization.

The military and defense segment is expected to grow significantly over the forecast period. The growing need for rugged and durable base station antennas that can resist tough settings and function in extreme situations is a crucial element driving the segment's growth. Military and defense applications frequently necessitate antennas that are robust to stress, vibration, and environmental conditions such as moisture, dust, and temperature changes. Another rising trend is the use of upgraded antenna technology to boost communication capabilities. This involves the use of high-gain antennas, beamforming, and electrically steerable arrays to improve signal range, directionality, and anti-jamming capabilities. Furthermore, there is an increasing emphasis on the integration of secure communication protocols and encryption techniques to safeguard critical military and defense communications from illegal access or surveillance.

Regional Insights

The Asia Pacific region dominated the market in 2022 and accounted for more than 32% share of the global revenue. Countries in the Asia Pacific region, such as China, South Korea, and Japan, are at the forefront of 5G adoption, driving the demand for advanced base station antennas that can support the high-frequency bands and enable the ultra-fast speeds and low latency offered by 5G technology. With the high population density in many urban areas, there is a need to enhance network capacity and coverage. This is driving the deployment of small cells and other solutions that require specialized base station antennas for effective implementation. Additionally, the Asia Pacific region is witnessing a surge in smart city initiatives and IoT deployments. Base station antennas are essential components for enabling the connectivity and communication infrastructure required for smart city applications, including intelligent transportation systems, smart energy grids, and public safety networks.

The North America region is anticipated to emerge as the fastest-growing segment over the forecast period. North America, particularly the U.S., is at the forefront of 5G technology adoption, fueling demand for sophisticated base station antennas capable of supporting high-frequency bands and advanced 5G network capabilities like beamforming and Massive MIMO. With data traffic growing at an exponential rate, network operators are looking for novel solutions to increase network performance, boost coverage, and provide high-speed access. This is encouraging the development of technologies like as small cells, and carrier aggregation, which necessitate the use of specialized base station antennas for effective and reliable deployment.

Base Station Antenna Market Segmentations:

By Offering

By Technology

By Provision

By Application

By Regional

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others