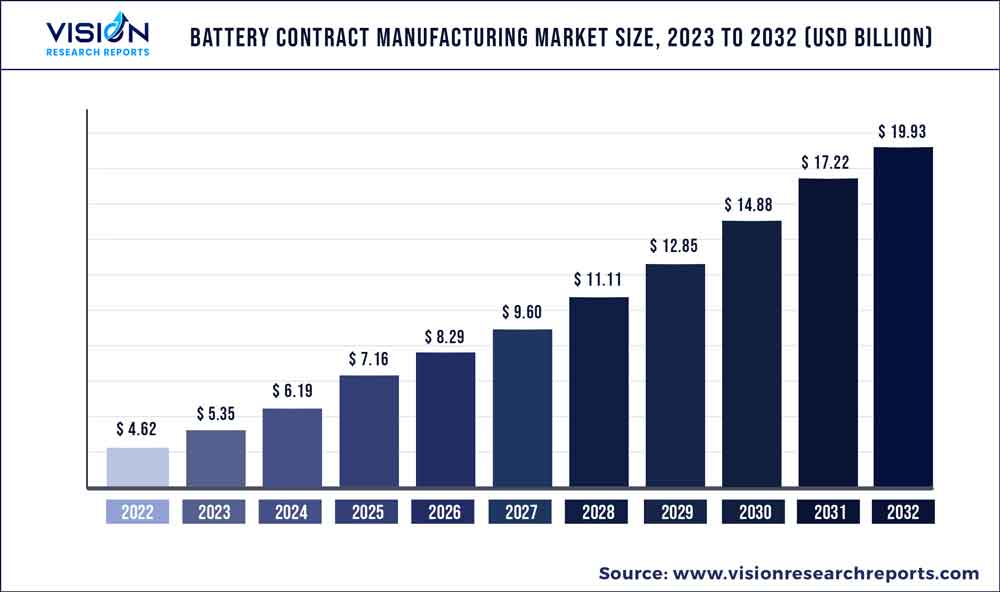

The global battery contract manufacturing market size was estimated at around USD 4.62 billion in 2022 and it is projected to hit around USD 19.93 billion by 2032, growing at a CAGR of 15.74% from 2023 to 2032. The battery contract manufacturing market in the United States was accounted for USD 1.4 billion in 2022.

Key Pointers

Report Scope of the Battery Contract Manufacturing Market

| Report Coverage | Details |

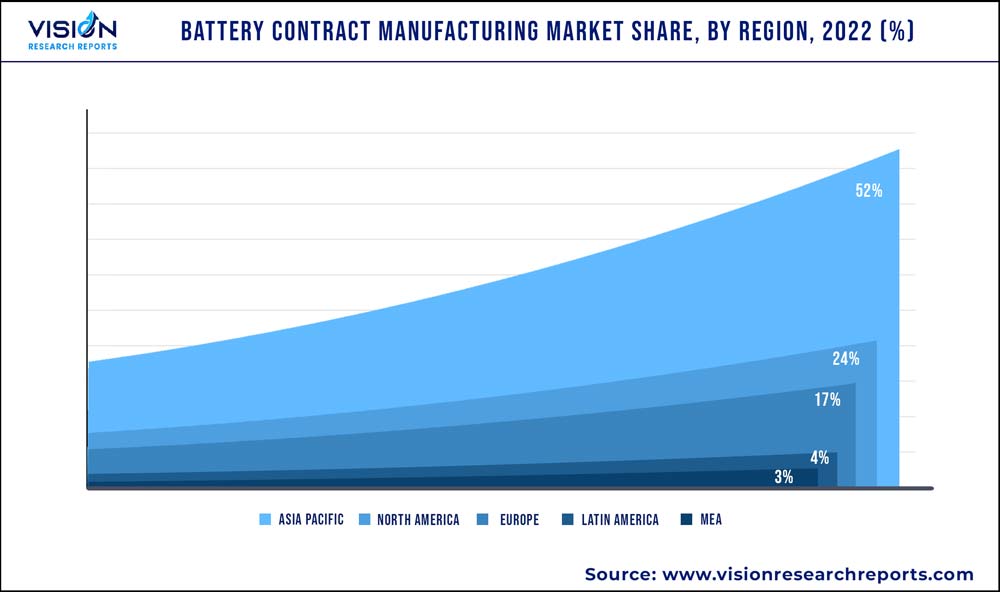

| Revenue Share of Asia Pacific in 2022 | 52% |

| Revenue Forecast by 2032 | USD 19.93 billion |

| Growth Rate from 2023 to 2032 | CAGR of 15.74% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Rose Batteries; Ttek Assemblies Inc.; PH2; Johnson Controls; Valmet Automotive; Tiger Electronics; Inc.; Coulometrics; LLC |

Battery contract manufacturing refers to the practice of outsourcing the production of batteries to third-party manufacturers. This is often done by companies that require large quantities of batteries for their products, but do not have the resources or expertise to manufacture them in-house. The electric vehicle application is expected to witness significant growth owing to the low cost of lithium-ion batteries for contract manufacturing.

In 2022, the U.S. constituted as the largest market for battery contract manufacturing in North America. Rising EV sales in the country owing to supportive government regulations along with the presence of key players in the U.S. market are expected to drive the demand for battery contract manufacturing.

The advantages of battery contract manufacturing include lower costs, faster production times, and access to specialized expertise. By outsourcing battery production, companies can focus on their core competencies and leave the manufacturing process to the experts. These reasons are attributed to the growth of the battery contract manufacturing industry in the U.S. over the forecast period.

The federal policies include the American Recovery and Reinvestment Act of 2009, which established tax credits for purchasing electric vehicles. The new CAFE standards (Corporate Average Fuel Economy) mandated fuel economy standards for passenger cars and light commercial vehicles resulting in the expansion of electric drive technologies.

Increasing demand for lithium-ion batteries in smartphones owing to their extended shelf life and enhanced efficiency is expected to drive the market. In addition, increasing demand for electric vehicles owing to growing consumer awareness about reducing global carbon emissions is expected to fuel market growth.

However, companies may have less control over the quality of the batteries produced and may face supply chain risks if their manufacturing partner experiences disruptions and may pose a threat to market growth.

COVID-19 has been a major restraint in the market for battery contract manufacturing due to factors such as lower operating costs for end-users and interruptions in the availability of battery components due to slow manufacturing activities and logistical issues.

Product Insights

Based on product, the market is segregated into Lithium-ion, Lithium polymer, Lithium iron phosphate (LFP), Alkaline, Nickel Metal Hydride, and Nickel Cadmium. In terms of revenue, the lithium-ion segment accounted for the largest share of 38% in the global market in 2022. Several advantages to lithium-ion battery contract manufacturing is that it can provide flexibility in terms of production volume. A company can increase or decrease the number of batteries it requires without having to make significant changes to its production processes. Additionally, it can reduce the cost of production since the manufacturer can take advantage of economies of scale and reduce the cost of raw materials by purchasing them in bulk.

LFP batteries offer excellent safety and a long life span to the product. Rising demand for lithium iron phosphate batteries in portable and stationary applications as they require high load currents and endurance is expected to augment the market growth.

Rising demand for nickel cadmium batteries on account of its high specific energy, specific power, and long-life span is expected to augment the market growth over the forecast period. Nickel cadmium finds use in EV vehicles, medical devices, and industrial applications.

Application Insights

Based on application, the market has been segmented into electric vehicles, consumer electronics, defense/military, telecom towers, energy storage systems, mining, space, marine and sub-marines, and others. In terms of revenue, the electric vehicles segment led the market in 2022 by accounting for a share of 29% of the market. Battery contract manufacturing is also used in the production of consumer electronics such as smartphones, tablets, laptops, and other portable devices that use lithium-ion batteries as a product.

The energy storage system application in the battery contract manufacturing market is expected to be the fastest-growing application segment during the forecast period. Growing awareness of the benefits of energy storage systems, especially in emerging economies such as Asia Pacific, Europe, and North America, is expected to favor the growth of the application segment.

In addition, lithium-ion batteries are used in many industrial applications such as power tools, cordless tools, marine equipment and machinery, agricultural machinery, industrial automation systems, aviation, military and defense, electronics, civil infrastructure, and oil and gas. These factors are expected to witness the market growth over the forecast period.

Regional Insights

Asia Pacific is expected to account for the largest market share of 52% over the forecast period in terms of revenue in 2022. Contract manufacturing of batteries in this region is also becoming increasingly popular, as it provides a cost-effective and efficient way for companies to meet their battery production needs. Many companies in the Asia Pacific region offer contract manufacturing services for batteries. These companies can produce batteries for a wide range of applications, including consumer electronics, electric vehicles, and energy storage systems.

Germany market for battery contract manufacturing is expected to witness reasonable growth over the forecast period owing to the increasing use of lithium-ion batteries in energy storage systems, electric vehicles, and consumer electronics. Germany is the world’s leading market for energy storage systems as well as the development of renewable energies.

The growing electric vehicle market in Asia-Pacific countries such as India and China is one of the major factors positively impacting the demand for battery contract manufacturing. Moreover, rising environmental concerns have led China to ban traditional fossil fuel-powered scooters in all its major cities to reduce emissions, leading to increased sales of electric scooters.

Battery Contract Manufacturing Market Segmentations:

By Product

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Battery Contract Manufacturing Market

5.1. COVID-19 Landscape: Battery Contract Manufacturing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Battery Contract Manufacturing Market, By Product

8.1. Battery Contract Manufacturing Market, by Product, 2023-2032

8.1.1. Lithium Ion

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Lithium-polymer

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Lithium iron phosphate

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Alkaline

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Nickel Metal Hydride

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Nickel Cadmium

8.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Battery Contract Manufacturing Market, By Application

9.1. Battery Contract Manufacturing Market, by Application, 2023-2032

9.1.1. Electric vehicles

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Consumer Electronics

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Defense / Military

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Telecom Towers

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Energy Storage System

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Mining

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Space

9.1.7.1. Market Revenue and Forecast (2020-2032)

9.1.8. Marine and sub-marines

9.1.8.1. Market Revenue and Forecast (2020-2032)

9.1.9. Others

9.1.9.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Battery Contract Manufacturing Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. Rose Batteries

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Ttek Assemblies Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. PH2

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Johnson Controls

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Valmet Automotive

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Tiger Electronics

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Coulometrics

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. LLC

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others