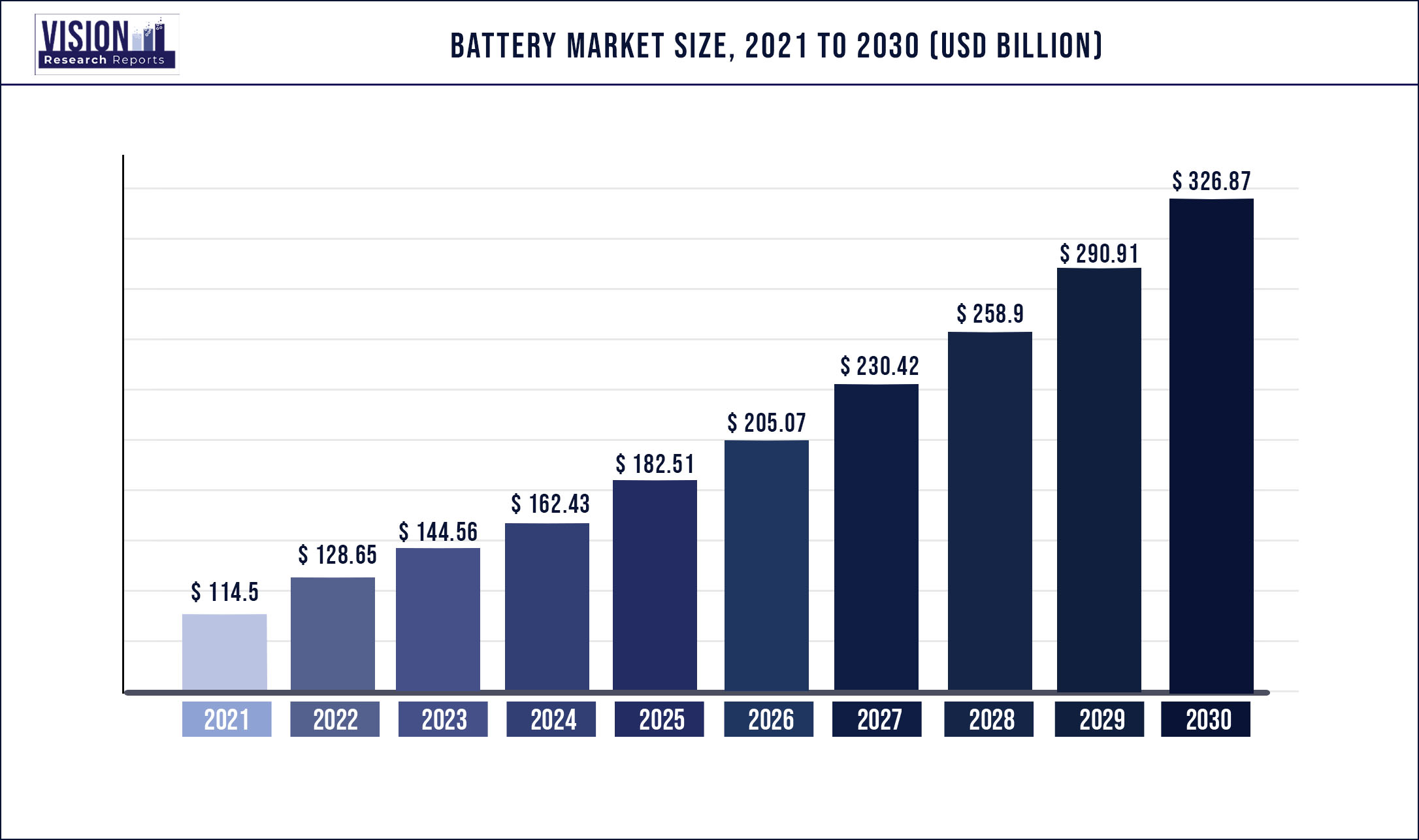

The global battery market was surpassed at USD 114.5 billion in 2021 and is expected to hit around USD 326.87 billion by 2030, growing at a CAGR of 12.36% from 2022 to 2030.

Report Highlights

Technological advancements in terms of enhanced efficiency and cost reduction are likely to open new paths for the global market over the estimated period.

Increasing use in aircraft emergency systems in case of non-availability of auxiliary power units (APUs) for ground operations, restarting, and braking the auxiliary power units is expected to propel high capacity battery demand. High density and low cost of the lead-acid battery will support use in grid storage and emergency power supply applications, thus augmenting the market growth.

The automotive sector is witnessing high growth in plug-in HEVs and EVs segment, which is expected to boost demand. Additionally, successful lucrative incentives and commercialization have been reassuring OEMs to introduce new electric vehicles and hybrid electric vehicles models in the market across the region in upcoming years.

Nickel-cadmium batteries find applications in portable battery devices, such as cordless handsets, and an increase in their usage will propel battery demand. Mounting application scope in the railway sector for locomotive starting, emergency braking, air-conditioning, coach power, and lighting for signaling will further fuel the growth of the market.

The industrial application segment accounted for 29.4% share of the global revenue in 2021. Industrial applications include wheelchairs, aviation, golf carts, satellites, forklifts, power tools, and grid storage batteries. Growing energy requirements have resulted in augmented usage of storage applications in off grid and on grid areas, which has directly impacted the demand for battery storage devices.

On account of the presence of key manufacturers in South Korea and Japan, the potential consumer electronics industry across India, Thailand, Singapore, and Malaysia is likely to generate high demand for li-ion batteries in the next few years. Growing automobile manufacturing in China and India is expected to drive demand for lead-acid batteries in the upcoming years.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 114.5 billion |

| Revenue Forecast by 2030 | USD 326.87 billion |

| Growth rate from 2022 to 2030 | CAGR of 12.36% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, application, region |

| Companies Covered |

GS Yuasa International Ltd.; BYD Company Ltd.; A123 Systems LLC; Hitachi Chemical Co., Ltd.; Duracell, Ltd.; Johnson Controls.; NEC Corporation; Panasonic Corporation; Samsung SDI Co., Ltd.; Toshiba Corporation; LG Chem Ltd.; Saft; Sony Corporation; Eveready Industries; Contemporary Amperex Technology Co. |

Product Insights

On the basis of product, the market is further segregated as Lead Acid, Lithium-ion, Nickle Metal Hydride, and Nickel-Cadmium. The lead-acid battery segment accounted for the largest share of 29.5% in 2021 on account of expanding applications in uninterrupted power supply (UPS), automotive, telecommunication, transport vehicles, and electric bikes. High use of uninterrupted power supply devices in the oil and gas, healthcare, and chemical sectors for constant power supply will drive demand for a lead-acid battery. These batteries are used in critical applications on account of their high reliability and low cost.

The lithium-ion product segment was valued at USD 33.4 billion in 2021 owing to its growing demand for electric vehicles (EVs) and grid storage as it offers high-energy density solutions and is lightweight. Hence, demand for the battery across the manufacturing, railway, and solar power sectors is likely to upsurge with the intensifying need for storage and power backup over the forecast period.

Li-ion batteries are expected to capture a substantial portion in the market over the projected period on account of their low energy density and high lead content. Lithium-ion batteries are expected to infiltrate lead-acid battery applications, such as storage and automobiles, plug-in electric vehicles, and electric vehicles, thus holding a majority market share by 2030. The adoption of Li-ion batteries in electric vehicles, energy storage systems, and portable devices is expected to rise at a fast pace owing to their low maintenance properties and higher energy densities. Nickel-cadmium and nickel-metal hydride batteries are the next major segments of the global market.

Application Insights

On the basis of application, the market is segregated as automotive, industrial, and portable. The automotive application segment led the market and accounted for a 34.3% share of the total revenue in 2021 on account of increasing demand for EVs, plug-in hybrid vehicles, and HEVs. Starting, lighting, and ignition (SLI) application in the automotive sector has contributed to high battery demand for SLI in vehicles. Industrial applications include forklifts with extra material handling equipment, telecom, energy storage, UPS, emergency lighting, security, road signs, medical, and control and switchgear.

High demand for consumer electronics is likely to drive the portable application segment. This segment is expected to observe substantial growth in terms of consignments, though, with low revenues and small size, it does not subsidize a major share in the market.

Batteries are mainly used in various industrial applications such as off-grid and grid energy storage systems, UPS, power backup, machinery and marine equipment, industrial automation systems, agricultural machinery, defense and aviation, electronics, oil and gas, and civil infrastructure. An increase in the usage of electric-powered forklifts and automation systems in industrial logistics and storage warehouses, workshops, large-scale facilities, and factories is expected to drive the consumption of industrial batteries during the estimated period.

Regional Insights

Asia Pacific held the largest revenue share of 35.02% in 2021. Asia Pacific is a major customer of batteries on account of growing automobile production, coupled with rapid development in the industrial sector, thus generating high demand across the region. India and China are the key producing countries in the consumer electronics segment owing to the low production and setup costs and availability of a skilled workforce.

North America is expected to witness significant growth during the projected period. Major factors driving the regional market include a decrease in the cost of Li-ion battery, increased sale of consumer electronics, rapid adoption of electric vehicles, and a growing renewable sector. Furthermore, North America remains an innovator in the research and invention of the global battery market and one of the largest consumers of batteries. For instance, California is one of the major plug-in car markets in the country, with nearly 670,000 plug-in EVs sold by 2021.

In the recent market situation, policy support plays a vital role in propelling the adoption of EVs. Policy support also permits market growth by making vehicles attractive to customers by decreasing risks for stakeholders and encouraging producers to develop EVs on a large scale.

Europe is likely to observe noteworthy growth on account of increasing electric vehicle production. Europe has been one of the foremost producers of automobiles in the historical years and will continue its supremacy in the future. The presence of key automotive producers, such as Audi, BMW, Volvo, Jaguar, Fiat, Volkswagen, Aston Martin, Ferrari, Mercedes Benz, Porsche, and Lamborghini, in the region will enhance the automobile industry growth, which, in turn, will propel the demand for industrial batteries over the projected period.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Battery Market

5.1. COVID-19 Landscape: Battery Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Battery Market, By Product

8.1. Battery Market, by Product, 2022-2030

8.1.1. Lead Acid

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Lithium Ion

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Nickel Metal Hydride

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Nickel Cadmium

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Battery Market, By Application

9.1. Battery Market, by Application, 2022-2030

9.1.1. Automotive Batteries

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Industrial Batteries

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Portable Batteries

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Battery Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

Chapter 11. Company Profiles

11.1. GS Yuasa International Ltd.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. BYD Company Ltd.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. A123 Systems LLC

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Hitachi Chemical Co., Ltd.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Duracell.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Johnson Controls

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. NEC Corporation,

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Panasonic Corporation

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Samsung SDI Co., Ltd.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Toshiba Corporation

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others