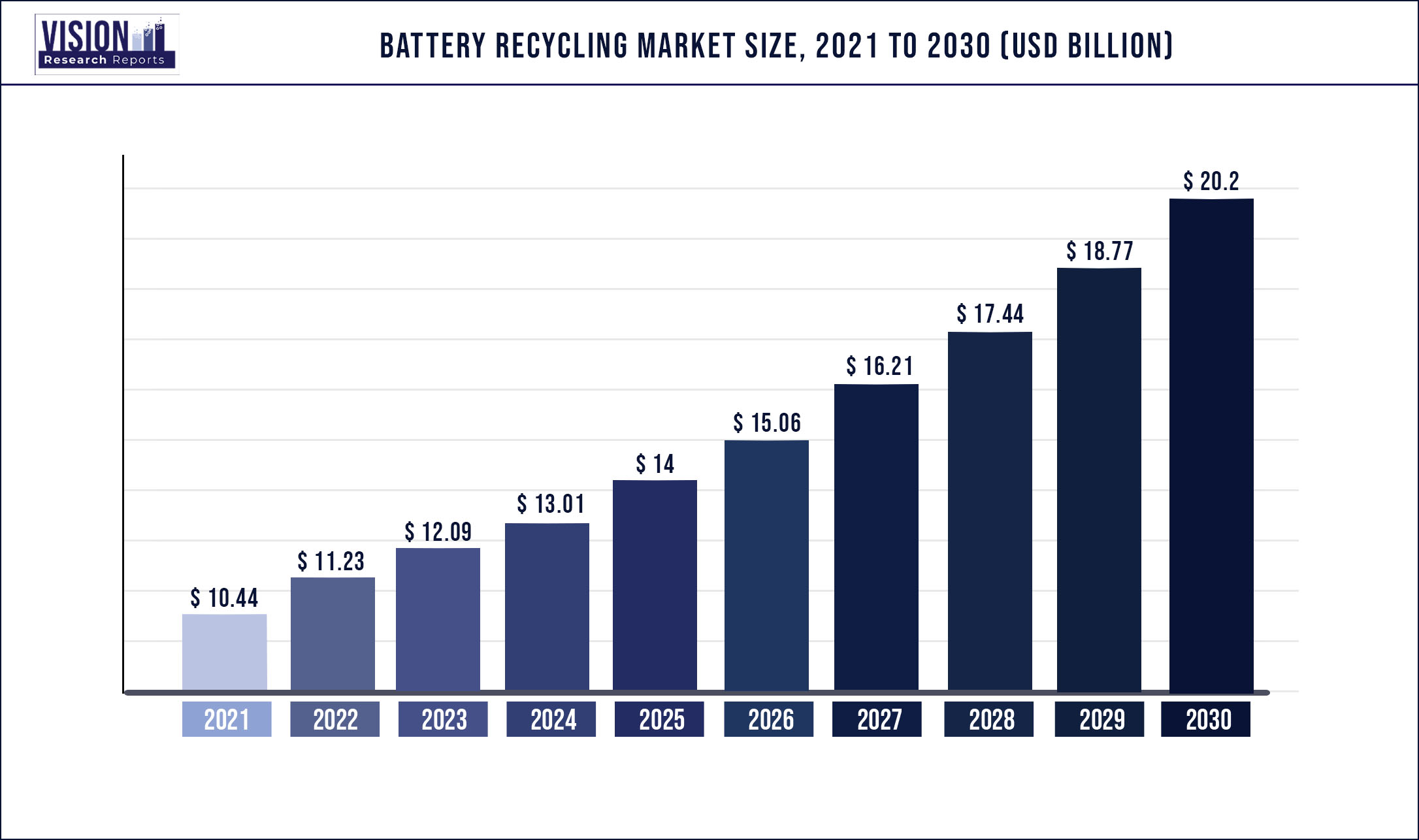

The global battery recycling market was valued at USD 10.44 billion in 2021 and it is predicted to surpass around USD 20.2 billion by 2030with a CAGR of 7.61% from 2022 to 2030

Report Highlights

The presence of stringent government regulations is expected to have a positive impact on the market during the coming years.

Transportation application is expected to witness rapid growth in the battery recycling market. Growing demand for lithium-ion batteries in electric vehicles and portable devices, on account of their high efficiency, long life, and low maintenance is expected to positively impact the demand for recycled products.

The industry is price-driven, which in turn is expected to restrain the market growth during the forecast period. Price becomes a key differentiating factor as most recyclers make use of more or less the same technology. High competition among the players does not allow large variation in the prices, thereby reducing the profitability of recycling firms.

Companies are making efforts to improve their competitiveness by setting up new collection centers and recycling plants. Moreover, new processes are being developed to bring down costs & combat environmental pollution. ECOBAT has developed its own collection system to gather spent batteries. Furthermore, new processes are being developed to reduce costs and prevent environmental pollution.

For instance, in January 2021, Li-cycle began construction of a Li-ion battery recycling facility in New York, U.S. When operational, the facility is expected to have a capacity of 25.0 metric kilotons of battery waste, retrieving 95.0% or more of the lithium, nickel, cobalt, and other precious components with the zero-emissions and wastewater process.

Lockdowns implemented due to the COVID-19 led to a temporary halt on import and export along with manufacturing and processing activities, across multiple industries, reducing demand for the batteries from a variety of automotive and non-automotive end-users.

As a result, there was a negative impact on the market growth in 2020. However, the market has been gradually recovering since 2021 due to a significant increase in use and demand for consumer electronics such as smartphones, tablets, and laptops, during the pandemic. Furthermore, globally increased demand for electric vehicles is expected to drive the transportation application segment of the battery recycling market during the forecast period.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 10.44 billion |

| Revenue Forecast by 2030 | USD 20.2 billion |

| Growth rate from 2022 to 2030 | CAGR of 7.61% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Chemistry, Application, Regional |

| Companies Covered | EnerSys, G&P Batteries, Exide Technologies, Aqua Metals,ECOBAT, Call2Recycle |

Application Insights

The transportation segment accounted for a share of 64.52% in 2021 Battery is widely used in an automobile owing to its ability to deliver high power to start an engine. In 2021, the global automobile sector sold 58.0 million vehicles, representing a 3.9% increase over the previous year. Globally increasing income levels, a renewed desire for electric cars and other vehicles, favorable electric infrastructure growth, and continued technological innovations are the factors expected to drive demand for the battery-powered vehicles in the future. In January 2019, Call2Recycle, Inc. partnered with Cell Block Fire Containment Systems to enhance its safe battery transportation, handling, and collection.

Various government regulatory agencies have implemented policies to support the electric vehicle market. Environmental issues such as increasing pollution, energy depletion, global warming, and biological hazards are expected to facilitate a shift in consumer preferences toward electric vehicles, thereby augmenting the demand for recycled batteries.

The industrial segment is expected to register a CAGR of 7.32% from 2022 to 2030. Lead acid batteries find application in Uninterruptible Power Supply (UPS) systems as they provide high power density and enhanced life expectancy. The UPS market is expected to witness considerable growth during the forecast period on account of the growing demand for high power range systems. The increasing adoption of UPS systems as an essential power backup device is projected to impact the market growth throughout the forecast period.

Rapid infrastructural development coupled with the expansion of commercial sectors such as IT, solar UPS systems, retail, and hospitality is anticipated to drive the demand for UPS systems, which is likely to further increase the utilization of the recycled products during the forecast period.

Chemistry Insights

The lead-acid segment dominated the market with a share of 90.93% in 2021 on account of cost efficiency, reliability, high capacity, safety, and wide application scope. Lead acid batteries are highly recyclable in nature and over 95.0% of lead can be recycled during the process. These advantageous properties of lead acid battery recycling are anticipated to drive the demand in the coming years.

Lithium-ion batteries are majorly used in electric vehicles. The growing automotive and transportation industries along with increasing use of these batteries in numerous applications are the factors expected to increase the consumption of recycled batteries during the coming years.

Nickel metal hydride batteries are key substitutes to nickel cadmium, which poses environmental hazards due to the presence of cadmium heavy metal. These batteries are ideally suitable for use in electric vehicles and portable devices such as mobile handsets, cameras, and other consumer electronics appliances. The improper disposal of nickel cadmium batteries can result in the leak of toxic materials into landfills and underground water. Such environmental concerns are expected to boost the battery recycling market throughout the forecast period.

Moreover, the growing demand for rechargeable products in the automotive sector is expected to augment the demand during the coming years. For instance, in June 2021, BASF announced that it would begin constructing a new battery recycling prototype facility at its Cathode Active Materials facility in Schwarzheide, Germany. The company intends to use the improved solution to extract nickel, manganese, cobalt, and lithium from lithium-ion batteries that have reached the end of their useful life.

Regional Insights

Europe accounted for a significant market share of 31.05% in 2021. The European government's recycling efficiency targets are expected to enhance the battery recycling rate. The guidelines state that around 75.0%, 65.0%, and 50.0% weight of batteries must be recovered as recycled material for nickel-cadmium, lead-acid, and other chemistries respectively.

The recycling rate of spent lead acid batteries in North America is about 100.0%. In the U.S., around 99.0% of lead is reclaimed from spent products. Moreover, the increasing demand for UPS systems in commercial infrastructure, growing demand for electric vehicles, and the presence of key recyclers including Call2Recycle; Aqua Metals; Enersys; and Battery Solutions, Inc. are anticipated to drive the demand during the forecast period.

Central and South America is expected to demonstrate considerable market growth due to the rise in foreign investments in the region. For instance, in 2017, GS Yuasa Corporation installed a large-scale lithium-ion battery storage system in the Cochrane Coal-fired Power Plant, Chile. Large-scale passenger, as well as commercial car production in Latin America, is expected to drive the consumption of lithium batteries during the forecast period.

Asia Pacific is expected at the fastest CAGR of 8.77% throughout the forecast period. Countries such as China, India, and Japan are expected to witness high growth rates owing to the rising demand from end-use industries such as automotive.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Battery Recycling Market

5.1. COVID-19 Landscape: Battery Recycling Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Battery Recycling Market, By Chemistry

8.1. Battery Recycling Market, by Chemistry, 2022-2030

8.1.1. Lithium-ion

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Lead-acid

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Nickel

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Battery Recycling Market, By Application

9.1. Battery Recycling Market, by Application, 2022-2030

9.1.1. Transportation

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Consumer electronics

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Industrial

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Battery Recycling Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Chemistry (2017-2030)

10.1.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Chemistry (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Chemistry (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Chemistry (2017-2030)

10.2.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Chemistry (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Chemistry (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Chemistry (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Chemistry (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Chemistry (2017-2030)

10.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Chemistry (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Chemistry (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Chemistry (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Chemistry (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Chemistry (2017-2030)

10.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Chemistry (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Chemistry (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Chemistry (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Chemistry (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Chemistry (2017-2030)

10.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Chemistry (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Chemistry (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

Chapter 11. Company Profiles

11.1. EnerSys

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. G&P Batteries

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Exide Technologies

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Aqua Metals

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. ECOBAT

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Call2Recycle

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others