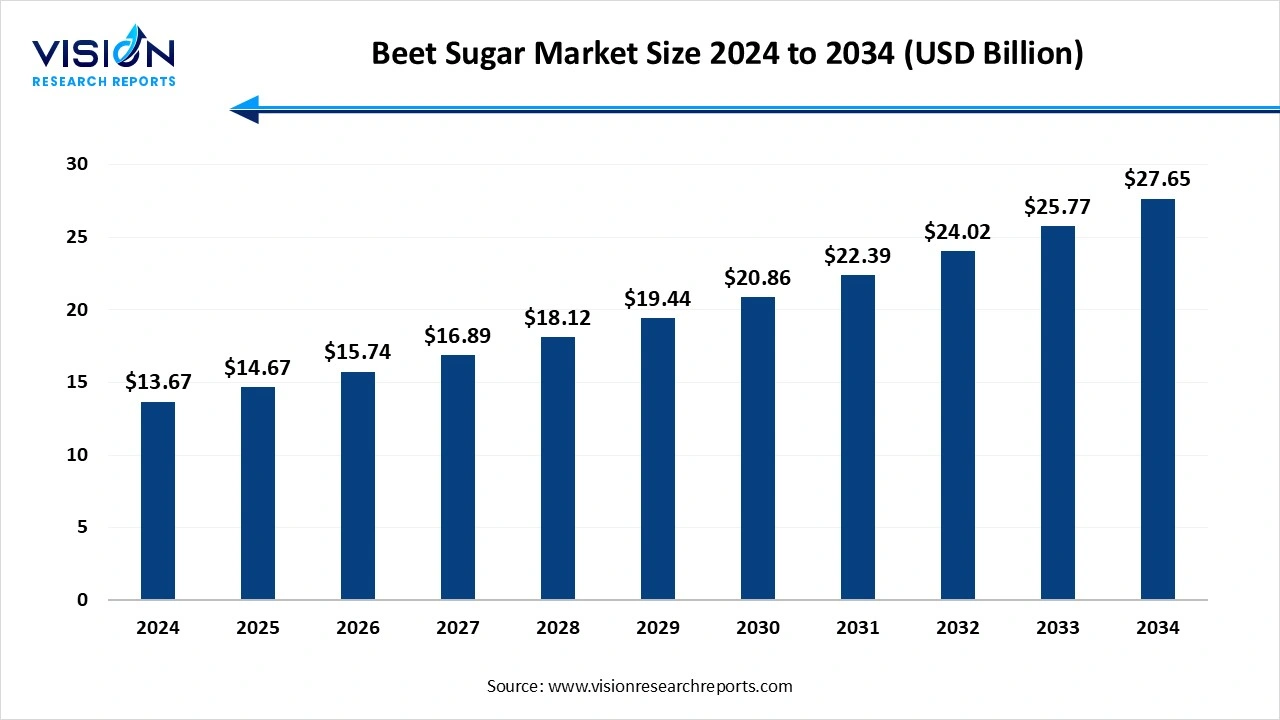

The global beet sugar market size was surpassed at around USD 13.67 bn in 2024 and it is projected to hit around USD 27.65 bn by 2034, growing at a CAGR of 7.30%

The beet sugar market plays a significant role in the global sugar industry, serving as a key alternative to cane sugar. Derived from sugar beets, this type of sugar offers a versatile and cost-effective source of sucrose, primarily produced in temperate regions such as Europe, North America, and parts of Asia. The market benefits from the steady cultivation of sugar beets, which thrive in cooler climates and allow for diversified sugar production across different geographies. Increasing demand for sweeteners in the food and beverage sector, combined with growing consumer preference for natural sugar alternatives, continues to drive the beet sugar market. Moreover, advances in agricultural practices and sugar extraction technologies are enhancing yield efficiency and product quality, supporting sustainable growth in the industry.

The beet sugar market is experiencing steady growth driven primarily by increasing global demand for natural and sustainable sweeteners. As consumers become more health-conscious and prefer natural ingredients over artificial alternatives, beet sugar has gained traction due to its natural origin and cleaner label appeal. Additionally, the expanding food and beverage industry, especially in sectors such as confectionery, baked goods, and beverages, is fueling the need for reliable and cost-effective sweetening agents. Improvements in agricultural practices, such as the development of high-yield and disease-resistant sugar beet varieties, are also boosting production efficiency, helping manufacturers meet the rising demand while reducing overall costs.

Favorable government policies and subsidies in key sugar beet-producing regions, particularly in Europe and North America, are supporting market growth by encouraging farmers to increase beet cultivation. The push towards sustainable agriculture and environmentally friendly farming methods aligns well with beet sugar production, as it often involves lower water usage and reduced carbon footprints compared to cane sugar cultivation.

The beet sugar market is witnessing a rising demand for organic and non-GMO products, driven by consumers’ increasing preference for natural and clean-label ingredients. This shift in consumer behavior is encouraging producers to adopt organic farming practices and sustainable cultivation methods to meet the growing market need. Alongside this, technological advancements in sugar extraction and refining processes are significantly enhancing production efficiency. Innovations that improve yield and purity allow manufacturers to deliver higher-quality beet sugar, which not only meets stringent quality standards but also appeals to health-conscious consumers and premium product segments.

In addition to improvements in production, the beet sugar market is experiencing a strategic shift towards sustainable agriculture. Producers are increasingly focusing on environmentally friendly cultivation techniques that reduce water consumption and minimize the use of chemical inputs, aligning with global efforts to promote sustainability. Moreover, the applications of beet sugar are diversifying beyond traditional food and beverage sectors. The ingredient is gaining traction in pharmaceuticals, cosmetics, and bio-based industries, broadening its market potential and opening new avenues for growth. This expansion highlights the versatility of beet sugar and its increasing relevance across multiple industries.

The beet sugar market faces significant challenges stemming from the volatility of raw material prices. The costs associated with sugar beet cultivation are highly sensitive to fluctuating weather conditions and changes in the prices of agricultural inputs such as fertilizers and labor. These variations can lead to unpredictable production expenses, ultimately affecting market stability and profitability for producers. Additionally, the market contends with fierce competition from alternative sweeteners, including high-fructose corn syrup, cane sugar, and artificial sweetening agents. These substitutes often offer cost advantages or perceived health benefits, posing a considerable threat to the demand for beet sugar.

Regulatory constraints are increasingly impacting the growth prospects of the beet sugar market. Governments worldwide are implementing stricter policies, including sugar taxes and consumption limits, aimed at addressing public health concerns related to excessive sugar intake. Such regulations can restrict market expansion by discouraging sugar consumption across various industries. Environmental concerns also present challenges, as sugar beet cultivation requires substantial land and water resources. Unsustainable farming practices may contribute to soil degradation, water scarcity, and ecological imbalances, prompting calls for more responsible agricultural methods. These factors collectively create hurdles that the beet sugar industry must navigate to sustain long-term growth.

The Europe beet sugar market dominated the global industry, capturing approximately 66% of the revenue share in 2024. Countries such as France, Germany, and Russia are leading producers, supported by government policies that encourage beet farming and sustainable practices. The European market benefits from high consumer awareness about natural and organic products, driving demand for beet sugar in both industrial and retail sectors.

This growth is largely supported by the country’s rapidly expanding food and beverage industry, which increasingly favors clean-label and healthier sweetening options. Rising consumer awareness about the advantages of beet sugar such as its lower glycemic index and enhanced nutritional benefits compared to refined cane sugar is contributing to higher demand. Additionally, government initiatives promoting sustainable farming practices and investments in advanced processing technologies have significantly boosted production efficiency. Innovation in flavored beet sugar blends and natural sweetener products, targeted at health-conscious consumers and home bakers, is further fueling steady market expansion.

The white beet sugar market led the industry, capturing over 73% of the revenue share in 2024. It is extensively used as a sweetening agent in confectioneries, baked goods, beverages, and dairy products, owing to its neutral flavor and excellent solubility. The production of white beet sugar involves advanced refining processes that remove impurities and molasses content, resulting in a crystalline, bright white product favored for its aesthetic appeal and consistent sweetness. This product’s versatility and purity make it a preferred choice among manufacturers aiming for high-quality finished goods.

The demand for brown beet sugar is projected to increase at a CAGR of 7.5% during the forecast period. It is often utilized in specialty food items, baking applications, and traditional recipes where a deeper caramel-like taste is desirable. Brown beet sugar is appreciated for its natural and less processed qualities, appealing to consumers who seek alternatives to fully refined sugars. Despite representing a smaller share of the market compared to white beet sugar, brown beet sugar is gaining traction in niche markets focused on organic, artisanal, and health-conscious products.

The offline sales distribution channel accounted for approximately 69% of the revenue share in 2024.This channel benefits from established supply chain networks and longstanding relationships between manufacturers, distributors, and retailers, ensuring wide accessibility of beet sugar products to end consumers. Offline distribution is particularly crucial in regions where consumers prefer in-person shopping experiences, allowing them to inspect product quality and make immediate purchases.

The online distribution channel has witnessed rapid growth in recent years, driven by increasing digital penetration and evolving consumer purchasing habits. E-commerce platforms, including specialized food and grocery websites as well as major online marketplaces, have become convenient avenues for purchasing beet sugar products. The online channel offers the advantage of greater product variety, competitive pricing, and doorstep delivery, catering especially to younger and tech-savvy consumers. Moreover, manufacturers and brands are increasingly adopting direct-to-consumer (DTC) online sales models, allowing them to build stronger customer engagement and gather valuable market insights. While currently smaller than offline sales in volume, the online channel is expected to expand significantly, shaping the future landscape of beet sugar distribution worldwide.

The bakery segment accounted for 38% of the revenue share in 2024. In the global beet sugar market, the bakery industry represents one of the most significant applications due to the essential role sugar plays in baking processes. Beet sugar is widely used in a variety of baked goods, including bread, cakes, pastries, cookies, and muffins, where it not only imparts sweetness but also contributes to texture, moisture retention, and browning during baking. The consistent quality and fine granule size of beet sugar make it an ideal ingredient for achieving desired product characteristics, such as tenderness and volume.

The confectionery is another vital application area for beet sugar, where it serves as a primary sweetening agent in products like chocolates, candies, chewing gums, and other sweets. The purity and neutral taste of white beet sugar allow manufacturers to create confections with clean, balanced sweetness without altering the flavor of other ingredients. Furthermore, beet sugar’s crystalline structure is crucial in controlling the texture and mouthfeel of confectionery items, influencing factors such as hardness, chewiness, and gloss. The rising global consumption of confectionery products, supported by festive occasions and increasing disposable income, is driving the demand for high-quality beet sugar in this segment.

By Product

By Distribution Channel

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Beet Sugar Market

5.1. COVID-19 Landscape: Beet Sugar Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Beet Sugar Market, By Product

8.1. Beet Sugar Market, by Product

8.1.1 White Beet Sugar

8.1.1.1. Market Revenue and Forecast

8.1.2. Brown Beet Sugar

8.1.2.1. Market Revenue and Forecast

8.1.3. Liquid Beet Sugar

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Beet Sugar Market, By Distribution Channel

9.1. Beet Sugar Market, by Distribution Channel

9.1.1. Offline

9.1.1.1. Market Revenue and Forecast

9.1.2. Online

9.1.2.1. Market Revenue and Forecast

Chapter 10. Global Beet Sugar Market, By Application

10.1. Beet Sugar Market, by Application

10.1.1. Bakery

10.1.1.1. Market Revenue and Forecast

10.1.2. Beverages

10.1.2.1. Market Revenue and Forecast

10.1.3. Confectionary

10.1.3.1. Market Revenue and Forecast

10.1.4. Others

10.1.4.1. Market Revenue and Forecast

Chapter 11. Global Beet Sugar Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product

11.1.2. Market Revenue and Forecast, by Distribution Channel

11.1.3. Market Revenue and Forecast, by Application

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product

11.1.4.2. Market Revenue and Forecast, by Distribution Channel

11.1.4.3. Market Revenue and Forecast, by Application

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product

11.1.5.2. Market Revenue and Forecast, by Distribution Channel

11.1.5.3. Market Revenue and Forecast, by Application

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product

11.2.2. Market Revenue and Forecast, by Distribution Channel

11.2.3. Market Revenue and Forecast, by Application

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product

11.2.4.2. Market Revenue and Forecast, by Distribution Channel

11.2.4.3. Market Revenue and Forecast, by Application

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product

11.2.5.2. Market Revenue and Forecast, by Distribution Channel

11.2.5.3. Market Revenue and Forecast, by Application

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product

11.2.6.2. Market Revenue and Forecast, by Distribution Channel

11.2.6.3. Market Revenue and Forecast, by Application

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product

11.2.7.2. Market Revenue and Forecast, by Distribution Channel

11.2.7.3. Market Revenue and Forecast, by Application

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product

11.3.2. Market Revenue and Forecast, by Distribution Channel

11.3.3. Market Revenue and Forecast, by Application

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product

11.3.4.2. Market Revenue and Forecast, by Distribution Channel

11.3.4.3. Market Revenue and Forecast, by Application

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product

11.3.5.2. Market Revenue and Forecast, by Distribution Channel

11.3.5.3. Market Revenue and Forecast, by Application

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product

11.3.6.2. Market Revenue and Forecast, by Distribution Channel

11.3.6.3. Market Revenue and Forecast, by Application

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product

11.3.7.2. Market Revenue and Forecast, by Distribution Channel

11.3.7.3. Market Revenue and Forecast, by Application

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product

11.4.2. Market Revenue and Forecast, by Distribution Channel

11.4.3. Market Revenue and Forecast, by Application

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product

11.4.4.2. Market Revenue and Forecast, by Distribution Channel

11.4.4.3. Market Revenue and Forecast, by Application

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product

11.4.5.2. Market Revenue and Forecast, by Distribution Channel

11.4.5.3. Market Revenue and Forecast, by Application

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product

11.4.6.2. Market Revenue and Forecast, by Distribution Channel

11.4.6.3. Market Revenue and Forecast, by Application

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product

11.4.7.2. Market Revenue and Forecast, by Distribution Channel

11.4.7.3. Market Revenue and Forecast, by Application

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product

11.5.2. Market Revenue and Forecast, by Distribution Channel

11.5.3. Market Revenue and Forecast, by Application

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product

11.5.4.2. Market Revenue and Forecast, by Distribution Channel

11.5.4.3. Market Revenue and Forecast, by Application

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product

11.5.5.2. Market Revenue and Forecast, by Distribution Channel

11.5.5.3. Market Revenue and Forecast, by Application

Chapter 12. Company Profiles

12.1. Südzucker AG.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Nordzucker AG.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. British Sugar PLC (a division of Associated British Foods).

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Cristal Union

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Tereos S.A..

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Michigan Sugar Company

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Amalgamated Sugar Company LLC.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Czarnikow Group

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Finnsugar Oy.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Mitr Phol Group

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others