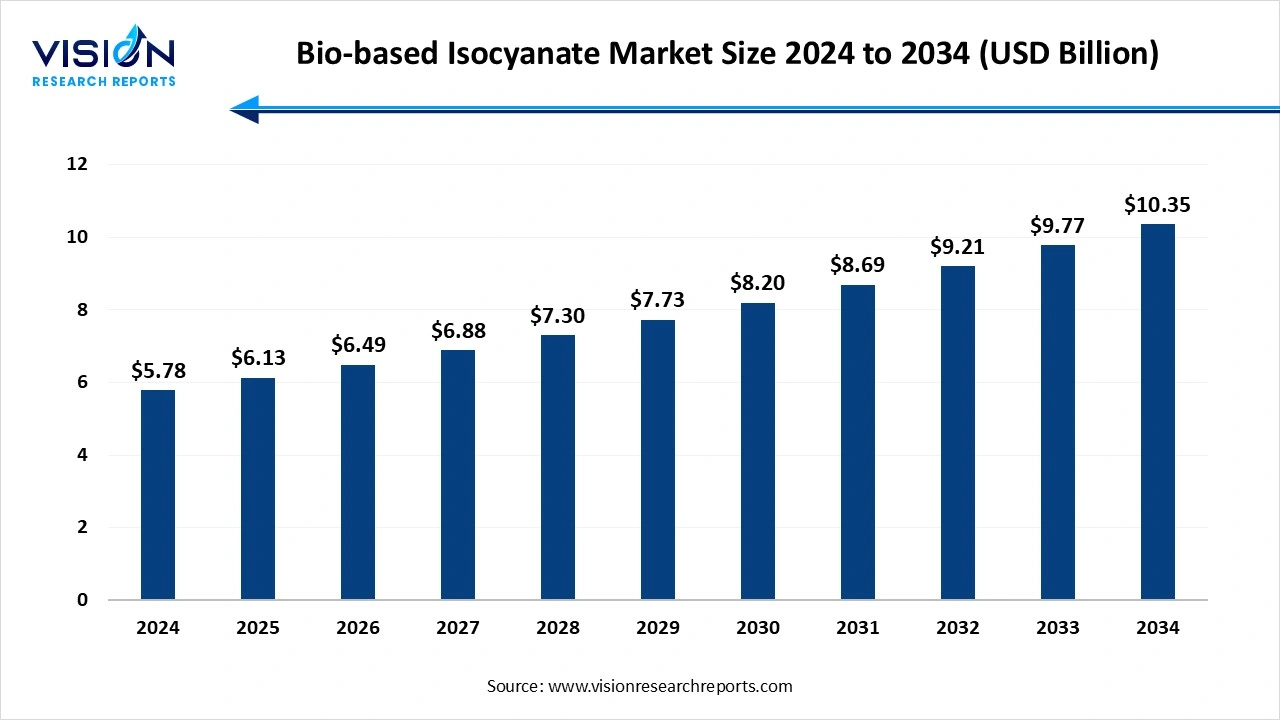

The global bio-based isocyanate market size was estimated at around USD 5.78 billion in 2024 and it is projected to hit around USD 10.35

billion by 2034, growing at a CAGR of 6% from 2025 to 2034.

The bio-based isocyanate market is witnessing steady growth driven by increasing environmental awareness and the global shift toward sustainable and eco-friendly materials. Derived from renewable resources, bio-based isocyanates serve as a green alternative to their petroleum-based counterparts, primarily in the production of polyurethanes used in coatings, adhesives, sealants, and elastomers. With rising regulatory pressure to reduce carbon emissions and the toxicity associated with conventional isocyanates, industries such as automotive, construction, and furniture are actively adopting bio-based solutions. Technological advancements, combined with growing R&D investments, are further enhancing the performance and scalability of these materials, making them a viable component in sustainable product innovation.

One of the primary growth factors for the bio-based isocyanate market is the increasing demand for sustainable and environmentally friendly materials across various industries. As governments and regulatory bodies worldwide enforce stricter environmental regulations, companies are under pressure to reduce their carbon footprint and adopt greener alternatives. Bio-based isocyanates, derived from renewable sources such as vegetable oils and sugars, provide an attractive solution for manufacturers aiming to meet these sustainability goals. The push toward circular economy models and the growing consumer preference for eco-conscious products are further propelling the market forward.

Advancements in biotechnology and material science are significantly enhancing the feasibility and performance of bio-based isocyanates. Innovations in fermentation and enzymatic processes are improving yield and cost-efficiency, making bio-based alternatives more competitive with petroleum-based isocyanates. Moreover, sectors such as automotive, construction, and electronics are investing heavily in green technologies, thereby creating increased application opportunities for bio-based isocyanates in polyurethane foams, coatings, adhesives, and elastomers.

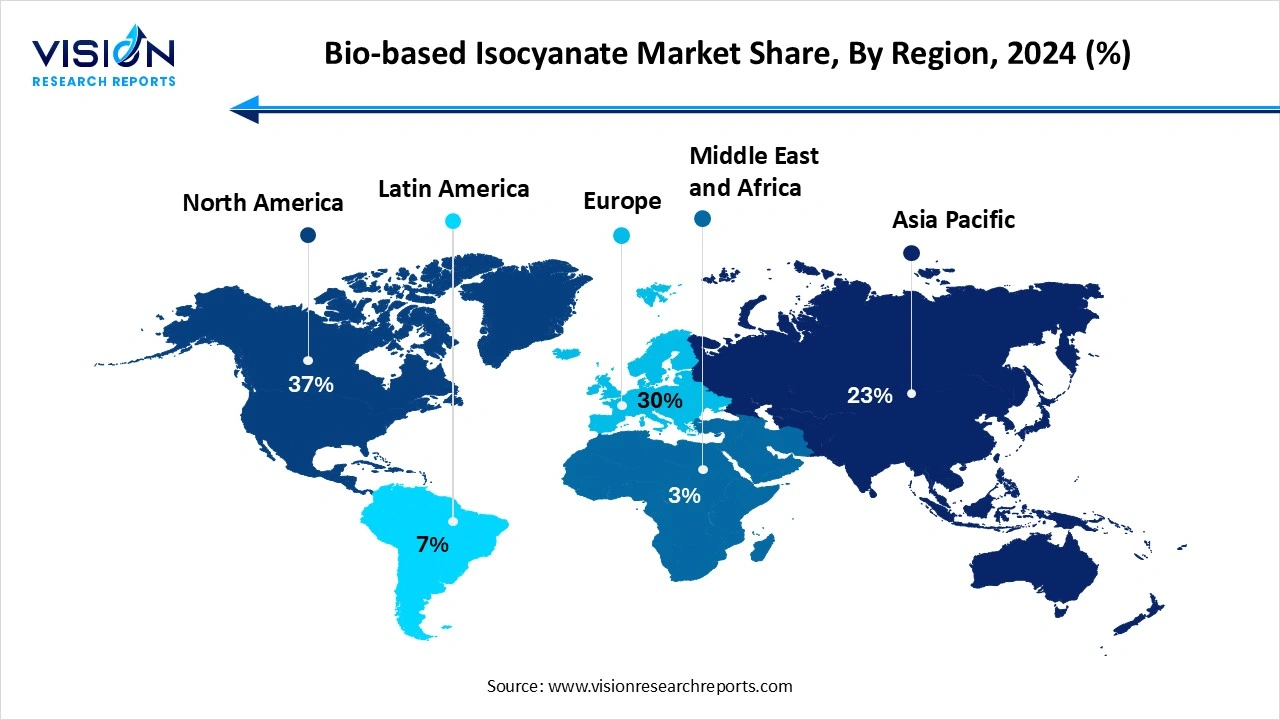

North America accounted for the largest share of revenue in the bio-based isocyanate industry, capturing 37% of the market in 2024. This growth is primarily fueled by rising environmental awareness and the increasing demand for sustainable alternatives across various sectors. With a strong emphasis on lowering carbon emissions, both consumers and businesses are turning toward eco-friendly materials like bio-based isocyanates. Additionally, supportive government regulations and strict environmental policies aimed at reducing reliance on petroleum-based chemicals are creating a conducive landscape for the expansion of the bio-based isocyanate market in the region.

The construction industry serves as a key driver of regional growth, propelled by rapid urbanization and extensive infrastructure developments. There is a growing demand for energy-efficient and sustainable building materials, such as bio-based foams for insulation, as countries implement green building policies to achieve energy-saving targets. Likewise, the automotive sector in the Asia Pacific region plays a crucial role in market expansion. With rising vehicle production and a focus on lightweight, fuel-efficient designs, bio-based isocyanates are increasingly utilized in vehicle interiors, seating, and cushioning.

The paints and coatings segment accounted for the largest revenue share, exceeding 32% in 2024. Bio-based isocyanates offer an environmentally friendly substitute to traditional petrochemical-derived materials, significantly reducing volatile organic compound (VOC) emissions while maintaining essential performance characteristics such as durability, adhesion, and chemical resistance. This makes them highly suitable for use in architectural, automotive, and industrial coatings where environmental compliance and performance are critical.

The foams segment is expected to experience substantial growth, with a CAGR of 5.9% throughout the forecast period. With increasing awareness of environmental impact and energy efficiency, the demand for bio-based polyurethane foams has surged across construction, automotive, and furniture industries. These foams not only help reduce dependence on fossil fuels but also offer thermal insulation and lightweight properties essential in modern applications. As research continues to enhance the structural and thermal properties of bio-based foams, their adoption is expected to grow steadily, making them a key component in the shift toward sustainable material innovation.

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Bio-based Isocyanate Market

5.1. COVID-19 Landscape: Bio-based Isocyanate Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Bio-based Isocyanate Market, By Application

8.1.Bio-based Isocyanate Market, by Application Type

8.1.1. Foams

8.1.1.1. Market Revenue and Forecast

8.1.2. Adhesives & Sealants

8.1.2.1. Market Revenue and Forecast

8.1.3. Paints & Coatings

8.1.3.1. Market Revenue and Forecast

8.1.4. Others

8.1.4.1. Market Revenue and Forecast

Chapter 9. Global Bio-based Isocyanate Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Application

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Application

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Application

9.2. Europe

9.2.1. Market Revenue and Forecast, by Application

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Application

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Application

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Application

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Application

9.3. APAC

9.3.1. Market Revenue and Forecast, by Application

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Application

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Application

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Application

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Application

9.4. MEA

9.4.1. Market Revenue and Forecast, by Application

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Application

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Application

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Application

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Application

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Application

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Application

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Application

Chapter 10. Company Profiles

10.1. Covestro AG

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. BASF SE

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Dow Inc.

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Huntsman Corporation

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Mitsui Chemicals, Inc.

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Evonik Industries AG

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Tosoh Corporation

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Wanhua Chemical Group Co., Ltd.

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

10.9. LANXESS AG

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. Lubrizol Corporation

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others