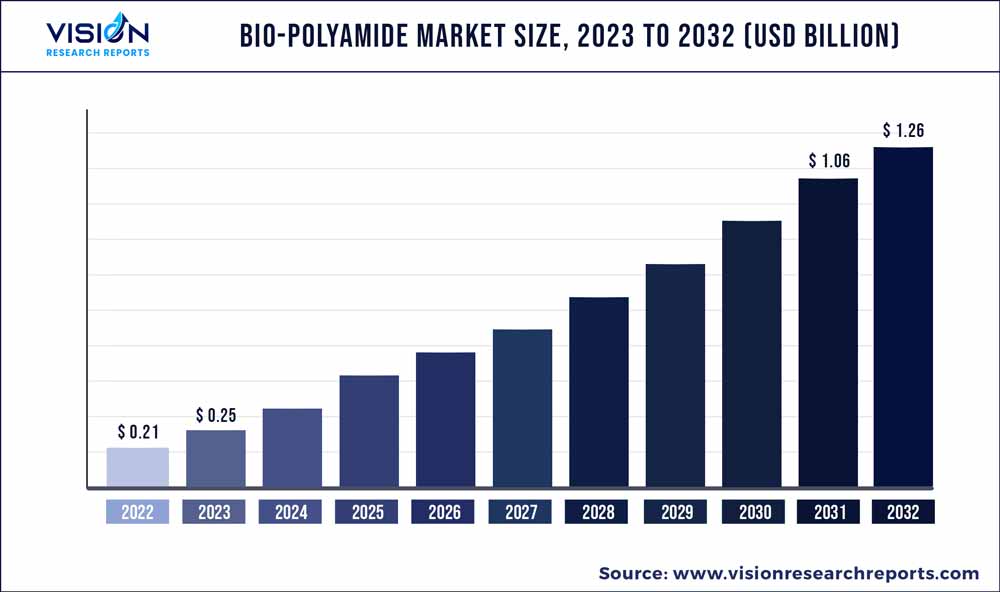

The global bio-polyamide market was valued at USD 0.21 billion in 2022 and it is predicted to surpass around USD 1.26 billion by 2032 with a CAGR of 19.65% from 2023 to 2032. The bio-polyamide market in the United States was accounted for USD 28.9 million in 2022.

Key Pointers

Report Scope of the Bio-polyamide Market

| Report Coverage | Details |

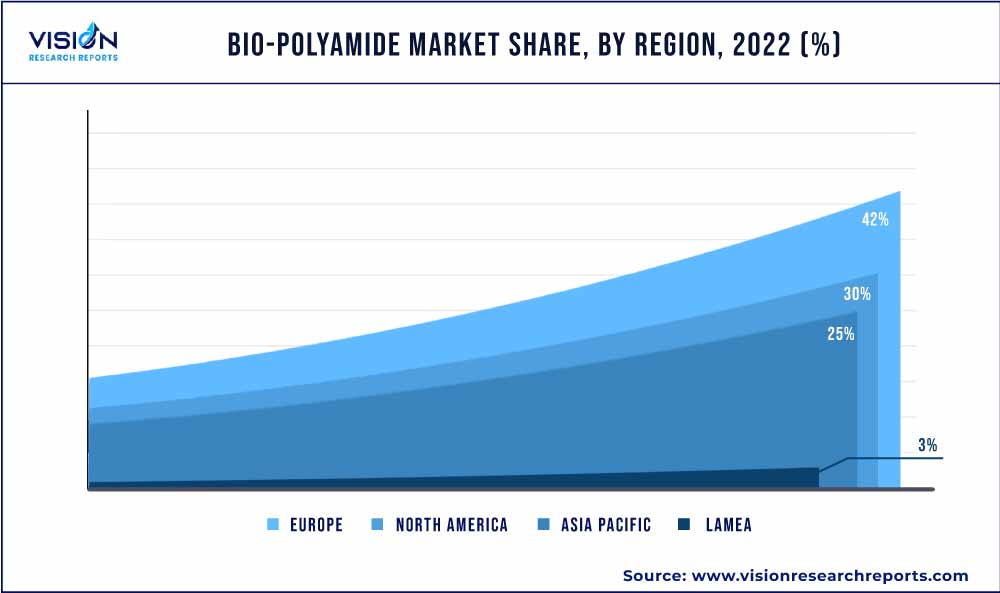

| Revenue Share of Europe in 2022 | 42% |

| Revenue Forecast by 2032 | USD 1.26 billion |

| Growth Rate from 2023 to 2032 | CAGR of 19.65% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Evonik Industries AG; Huntsman International LLC; LANXESS; BASF SE; UBE Corporation; INVISTA; DOMO Chemicals GmbH; Arkema, Asahi Kasei Corporation; Honeywell International Inc.; DSM; Toray Industries, Inc.; Radici Partecipazioni SpA; DuPont; SolvayZig Sheng Industrial Co. Ltd.; Quadrant Group Limited; Lealea Enterprise Co. Ltd.; Ems Chemie Holding AG |

The significant consumer demand along with increasing regulations such as global warming initiatives and plastic bag bans, are driving market opportunity for bio-based plastics is expected to augment the demand for polylactic acid over the forecast period.

Limited availability and increasing cost of fossil resources have forced manufacturers to shift their focus toward bio-based products. Bio-based polymers generally have lower CO2 footprint and are associated with efforts to create more sustainable and environmentally friendly products. One of the main reasons for the increasing level of interest in bio-based products is the fact that these products may contribute to a more efficient use of natural resources, which is a necessary condition for creating a more sustainable economy.

Bio-polyamide is very effective owing to its characteristic for reducing the carbon footprint due to its high bio-content. It offers mechanical strength, ductility, flexibility, and abrasion resistance. These factors make it an alternative to traditional plastics such as Polyamide, polylactic acid, polyethylene terephthalate, acrylonitrile butadiene styrene, and polybutylene terephthalate and are preferred for automotive interiors and engine compartments.

The U.S. dominated the regional market in 2022 and is anticipated to maintain its dominance over the forecast period. Technological advancement in electrical & electronics, textile, and automotive industry is expected to create demand for bio-polyamide over the forecast period. Rising demand for compact products with higher performance efficiency is anticipate to boost the demand for bio-polyamide in the electrical & electronics and automotive segment. Electrical and electronics segment is anticipated to grow at the fastest CAGR over the forecast period within this region owing rapid technological advancement and growing use of energy efficient products.

The favorable government regulations implemented in the country related to the production of bio-polyamide, along with the easy availability of raw materials for the synthesis of bio-polyamide, are projected to fuel the growth of the market in the U.S. from 2022 to 2030. Growth in global automobile market with increasing focus on fuel efficiency and improvement in vehicle performance is driving this market. Textile industry development owing to growth in fashion, clothing and apparel sector is anticipated to increase the demand for environment friendly products.

The rapid growth of the global healthcare sector is likely to trigger the demand for medical equipment such as gloves, bandages, masks, and other products, thereby positively influencing the demand for flexible packaging. This is anticipated to fuel market expansion over the forecast period.

End-use Insights

The automotive sector dominated the end-use segment and accounted for the largest market share of over 35% in terms of revenue in 2022. Bio-polyamide are used in automobile industry for various application such as transmission cross beams, air intake manifolds, crashworthy engine covers, oil pan, etc. From dashboard to complicated ABS and engines, these polyamides have diversified applications which provide improved specification and features with reduction in weight and size. Technological advancements in the automobile field with improvement in infrastructure is creating more demand for automobile products.

Textile is one of the major end-use industry of bio-polyamide market. Growing consumer awareness towards the product regarding its aesthetics, recyclability and impact on environment is a major driver for environment friendly products. Energy conservation practices coupled with changed social orientation towards product & services is pushing the bio-polyamide market towards growth.

Electrical and electronics is another major industry with a large market penetration and growth rate. Demand for these consumer electronics such as mobiles, LED’s, and others are developing rapidly because of rise in disposable income, technological adoption, and awareness about benefits of using these modern electronic products.

The growing use of electronic products has escalated the use of plastics in electrical equipment, resulting in an increased production of bio-polyamide. Furthermore, to reduce the use of single-use plastics in order to control pollution, especially in the oceans, alternative packaging materials are likely to boost the growth of the bio-polyamide market globally.

Application Insights

The engineering plastics sector dominated the application segment accounted for the largest market share based on revenue of 68% in 2022 owing to its wide scope of application. Development in energy saving and demand for environment friendly solutions is anticipated to augment market growth. These plastics are widely used in the electronic and automobile sector on account of its light weight and strength to weight ratio.

Development in automobile technology and changing consumers buying behavior is positively impacting this segment. Requirement for fuel efficient product & solutions coupled with stringent emission norms is pushing the end-use industry to use such products. Growing economy, rise in consumers spending power and technological innovation is creating a strong growth potential for this segment.

Fibers application segment is growing with a significant CAGR owing to its superior benefits such as light weight, less expensive than other substitutes, high electrical & mechanical resistivity and capability to withstand at high temperatures on account of its high tensile strength. It is used in many applications by various end use industries such as automobiles, electrical & electronics, manufacturing, aerospace, and others.

Product Insights

The PA-66 sector dominated the product segment and accounted for the largest revenue share of over 51% in 2022. Increasing applications in the electrical & electronics, automotive, aerospace and marine segment is expected to foster market demand. Strength and wear resistance of PA-66 makes it a suitable product in manufacturing of high quality cable ties. Its property of absorbing slightly less moisture than PA-6 gives it a competitive edge over other substitutes.

Growing end-use industries such as manufacturing, automobile, marine, electrical & electronics, and others are driving the product demand over the forecast period. Moreover, the presence of well-established film & coating companies, which is a major consumer of bio-based polyamide, is anticipated to drive the demand for the product across the globe.

Furthermore, the PA-6 product segment is anticipated to experience high growth owing to properties such as better ductility, long term thermal resistance, surface quality, creep resistance and UV resistance over other PA-66. PA-6 ability to provide resistance from impact in low temperatures and its low cost over other substitutes. It is widely used in various applications such as automotive, manufacturing, textiles, film & coating, and the electrical & electronics industry. In the automotive sector it is used as a cover for crash-active engine, oil pan, transmission cross beam and air intake manifold.

Regional Insights

Europe dominated the market and accounted for the largest regional share of over 42% in 2022. With the presence of developed auto industries, Europeans are currently experimenting the scope of material selection strategies, multi material architectures, light weighting opportunities of structural parts, engine, components, powertrain, innovative joining technologies, use of composites, thermoplastics, glass fibers, and material production methods with an intention of developing efficient and recyclable material.

Owing to technological advancement and presence of suitable infrastructure is expected to create demand for bio-polyamide in Germany. Stringent emission norms such as Euro 6 which is highly focused on reducing the emission of harmful pollutants such as hydrocarbons, nitrogen oxides, carbon monoxide, hazardous air pollutants and greenhouse gases is expected to propel market demand.

North America is predicted to grow at a significant rate over the forecast period owing to the growing awareness towards environment friendly product & solutions is anticipated to drive this market owing to the recyclability and green nature of bio-polyamide. Availability of huge immanent market and supportive government policies are boosting global bio-polyamide players to set up production and distribution facility in this region.

Bio-polyamide Market Segmentations:

By Product

By Application

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Bio-polyamide Market

5.1. COVID-19 Landscape: Bio-polyamide Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Bio-polyamide Market, By Product

8.1. Bio-polyamide Market, by Product, 2023-2032

8.1.1 PA-6

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. PA-66

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Specialty Polyamides

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Bio-polyamide Market, By Application

9.1. Bio-polyamide Market, by Application, 2023-2032

9.1.1 Fiber

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Engineering Plastics

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Bio-polyamide Market, By End-use

10.1. Bio-polyamide Market, by End-use, 2023-2032

10.1.1. Textile

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Automotive

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Film & Coating

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Consumer Goods

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Industrial

10.1.5.1. Market Revenue and Forecast (2020-2032)

10.1.6. Electrical & Electronics

10.1.6.1. Market Revenue and Forecast (2020-2032)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Bio-polyamide Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.3. Market Revenue and Forecast, by End-use (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.5.3. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 12. Company Profiles

12.1. Evonik Industries AG

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Huntsman International LLC.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. LANXESS.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. BASF SE.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. UBE Corporation

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. INVISTA

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. DOMO Chemicals GmbH.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Arkema, Asahi Kasei Corporation

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Honeywell International Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. DSM

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others