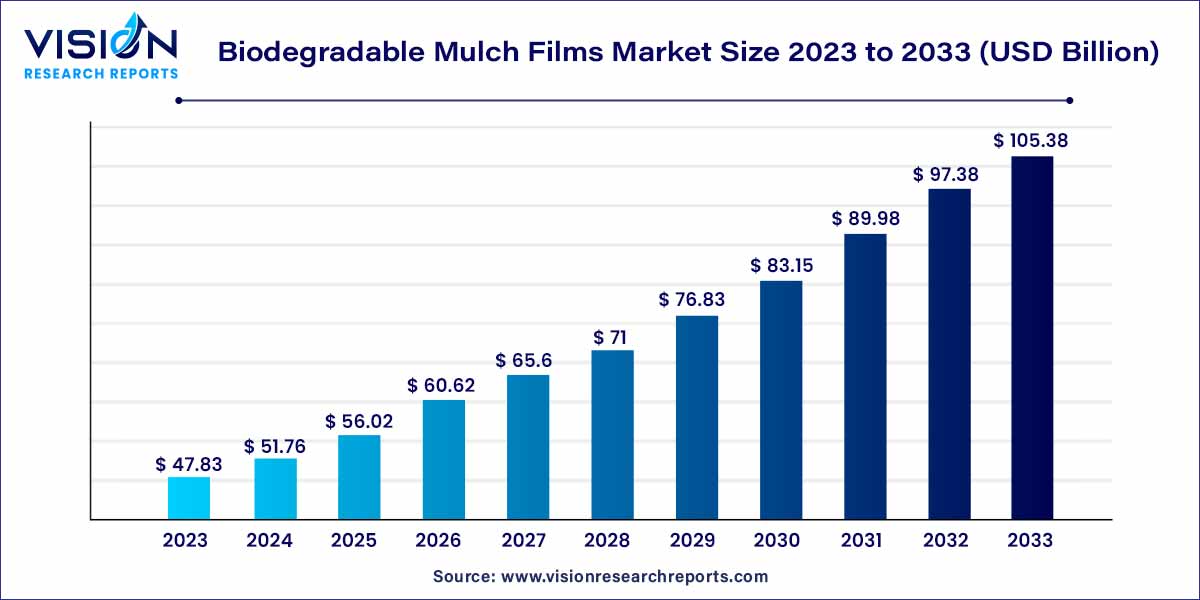

The global biodegradable mulch films market size was estimated at around USD 47.83 billion in 2023 and it is projected to hit around USD 105.38 billion by 2033, growing at a CAGR of 8.22% from 2024 to 2033. The biodegradable mulch films market is witnessing significant growth and transformation, driven by a growing global awareness of environmental sustainability and the need for eco-friendly agricultural practices.

Mulch films, traditionally made from plastic, have been widely used in agriculture to enhance crop productivity. However, the environmental repercussions of plastic waste have led to a paradigm shift towards biodegradable alternatives.

The growth of the biodegradable mulch films market can be attributed to several key factors. Firstly, increasing environmental concerns and stringent regulations against plastic usage in agriculture have driven the demand for eco-friendly alternatives. Biodegradable mulch films, being made from organic materials, provide an effective solution without harming the environment. Secondly, the rising awareness among farmers and agricultural communities about sustainable practices has led to the widespread adoption of these films. Their ability to improve soil quality, conserve moisture, and control weeds, while simultaneously decomposing naturally, makes them an attractive choice. Additionally, the ongoing research and development efforts in the field have resulted in the creation of advanced biodegradable materials, enhancing the durability and efficacy of these films. Moreover, collaborations between industry players and educational institutions have further accelerated market growth, fostering innovation and expanding the product range. These factors combined are propelling the biodegradable mulch films market towards a promising and sustainable future.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 8.22% |

| Market Revenue by 2033 | USD 105.38 billion |

| Revenue Share of Asia Pacific in 2023 | 65% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

Fruits & vegetables segment contributed the largest market share of 51% in 2023. In the fruits and vegetables sector, biodegradable mulch films are proving to be transformative. By enhancing soil quality and preventing weed growth, these films ensure that fruits and vegetables receive optimal nutrients and sunlight, leading to increased yields and improved crop quality. Additionally, they play a crucial role in regulating soil temperature and moisture, safeguarding delicate crops from extreme weather conditions and ensuring consistent growth. Farmers are increasingly recognizing the economic benefits of these films in terms of higher productivity and reduced need for chemical interventions, aligning with the trend towards sustainable farming.

Grains and oilseeds, biodegradable mulch films are fostering a revolution. Traditional plastic films often posed challenges in terms of soil aeration, leading to reduced crop yields. Biodegradable mulch films address this issue by naturally breaking down into the soil, improving aeration and overall soil health. For oilseed crops such as sunflower and soybeans, which require specific soil conditions, these films create an ideal environment for cultivation. Furthermore, the films act as a protective layer, preventing soil erosion and maintaining moisture levels crucial for the growth of grains and oilseeds. The eco-friendly nature of these films resonates well with environmentally conscious consumers, contributing to the rising demand for sustainably produced grains and oilseeds.

The thermoplastic starch (TPS) segment generated the maximum market share of 63% in 2023. TPS, derived primarily from renewable sources such as corn, wheat, or potatoes, stands out due to its biodegradable nature and versatility. Its ability to dissolve in water and decompose naturally makes it an eco-friendly choice for biodegradable mulch films. Farmers benefit from TPS-based films as they enhance soil fertility during decomposition, supporting the growth of subsequent crops.

The combination of starch with polylactic acid (PLA), a biodegradable thermoplastic derived from renewable resources like corn starch, offers a unique synergy. PLA enhances the mechanical strength of starch-based films, making them more durable and suitable for a broader range of agricultural applications. This blend addresses the challenge of durability often associated with pure starch films, ensuring longevity throughout the growing season. Additionally, PLA-starch blends exhibit excellent UV resistance, a crucial factor in maintaining film integrity under prolonged exposure to sunlight, a common condition in agriculture.

The Asia Pacific region dominated the global market with the largest market share of 65% in 2023. Asia-Pacific, encompassing countries like China, India, and Japan, represents a market with immense growth potential. The region’s vast agricultural landscape and a burgeoning population have intensified the need for sustainable farming practices. Biodegradable mulch films have gained traction, especially in densely populated countries where the demand for food production is high. Government initiatives promoting eco-friendly agriculture and investments in research and development are propelling the market forward. Additionally, rising consumer awareness about environmentally responsible products is fueling the adoption of biodegradable mulch films in the region.

Europe stands out as a key player in the global biodegradable mulch films market, driven by the European Union’s stringent regulations against plastic waste. Countries such as Germany, France, and the Netherlands are at the forefront of adopting biodegradable mulch films, primarily in organic farming practices. The region’s well-established agricultural sector coupled with a strong inclination towards sustainable solutions has contributed significantly to the market’s expansion. Additionally, collaborations between research institutions and manufacturers have led to the development of advanced biodegradable materials, further boosting the market’s growth trajectory.

By Crop

By Raw Material

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Biodegradable Mulch Films Market

5.1. COVID-19 Landscape: Biodegradable Mulch Films Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Biodegradable Mulch Films Market, By Crop

8.1. Biodegradable Mulch Films Market, by Crop, 2024-2033

8.1.1. Fruits & Vegetables

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Grains & Oilseeds

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Flowers & Plants

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Biodegradable Mulch Films Market, By Raw Material

9.1. Biodegradable Mulch Films Market, by Raw Material, 2024-2033

9.1.1. Thermoplastic Starch (TPS)

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Starch Blended with Polylactic Acid (PLA)

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Starch Blended with Polyhydroxyalkanoate (PHA)

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Aliphatic Aromatic Copolyesters (AAC)

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Biodegradable Mulch Films Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Crop (2021-2033)

10.1.2. Market Revenue and Forecast, by Raw Material (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Crop (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Raw Material (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Crop (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Raw Material (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Crop (2021-2033)

10.2.2. Market Revenue and Forecast, by Raw Material (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Crop (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Raw Material (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Crop (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Raw Material (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Crop (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Raw Material (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Crop (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Raw Material (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Crop (2021-2033)

10.3.2. Market Revenue and Forecast, by Raw Material (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Crop (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Raw Material (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Crop (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Raw Material (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Crop (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Raw Material (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Crop (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Raw Material (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Crop (2021-2033)

10.4.2. Market Revenue and Forecast, by Raw Material (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Crop (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Raw Material (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Crop (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Raw Material (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Crop (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Raw Material (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Crop (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Raw Material (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Crop (2021-2033)

10.5.2. Market Revenue and Forecast, by Raw Material (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Crop (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Raw Material (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Crop (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Raw Material (2021-2033)

Chapter 11. Company Profiles

11.1. BASF SE

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Kingfa Sci & Tech Co Ltd

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. BioBag International AS

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. AEP Industries Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. RKW SE

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. British Polythene Industries PLC

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Armando Alvarez

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Al-Pack Enterprises Ltd.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Novamont

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. AB Rani Plast OY

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others