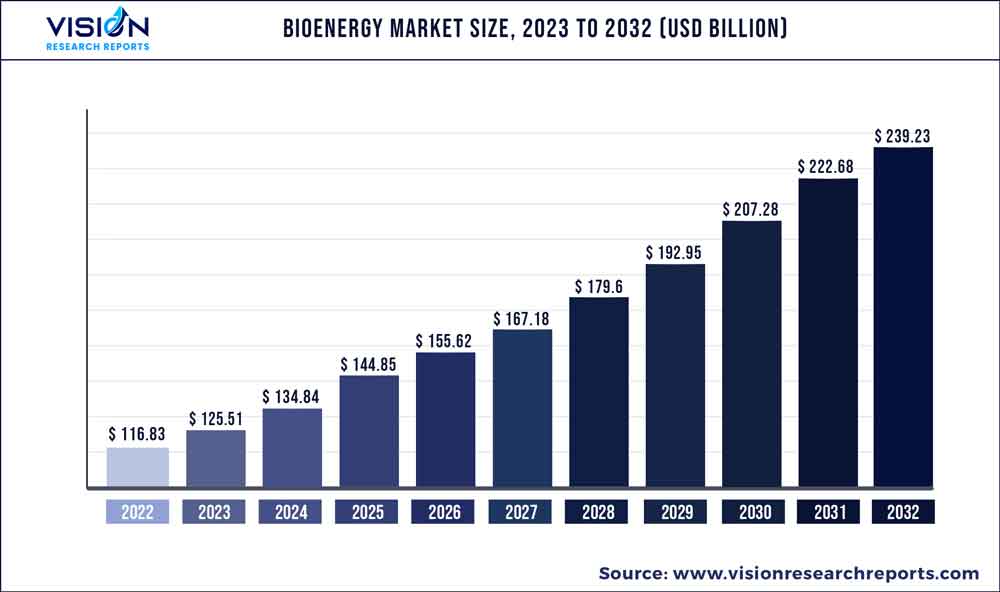

The global bioenergy market was estimated at USD 116.83 billion in 2022 and it is expected to surpass around USD 239.23 billion by 2032, poised to grow at a CAGR of 7.43% from 2023 to 2032.

Key Pointers

Report Scope of the Bioenergy Market

| Report Coverage | Details |

| Market Size in 2022 | USD 116.83 billion |

| Revenue Forecast by 2032 | USD 239.23 billion |

| Growth rate from 2023 to 2032 | CAGR of 7.43% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Ameresco Inc., MVV Energie AG, Enexor Energy, Drax Group, EnviTec Biogas AG, Pacific BioEnergy Corp., Lignetics, Enerkem, Green Plains Inc., Enviva |

The sustainable provision of future energy demand can be significantly aided by biomass. It currently contributes the most renewable energy to the world's energy mix, and there is tremendous room for growth in the generation of heat, power, and transportation fuels. By utilizing the considerable amount of wasted residues and garbage, it is possible to significantly increase the usage of bioenergy.

A wide range of sources produce bioenergy. Certain bioenergy sources are byproducts of industrial processes that would have happened otherwise, such as black liquor produced during the manufacturing of paper. Unlike to other sources of energy, bioenergy is more frequently derived from specially cultivated plants or trees, which requires a lot of land. Therefore, the rising awareness related to sustainable energy sources is expected to bolster the demand of bioenergy during the forecasted years.

Bioenergy is advantageous because there is versatility in the contexts and industries it can be utilized in, from solid bioenergy and biogases used for power and heat in houses and industrial operations to liquid biofuels used in cars, ships, and airplanes. Additionally, it frequently makes use of already-built infrastructure; for instance, biomethane can use existing natural gas pipes and end-user technology.

Furthermore, Policies like the Renewable Energy Directive (RED) and the Fuel Quality Regulation of the European Union region, which have controlled the necessary biofuel share for the transport sector, have contributed to the huge increase in the demand for biofuel over the past decade.

The regulatory authorities and major manufacturers are also stepping up by observing the potential and surging demand of bioenergy, for instance, The advanced clean energy storage project, which is anticipated to be the largest industrial green hydrogen production and storage facility in the world, has received a conditional commitment from the U.S. Department of Energy's (DOE) Loan Programs Office for up to USD 504.4 million in debt financing. The project's other partners include Mitsubishi Power Americas, Inc., Magnum Development, LLC, and Haddington Ventures, LLC.

Product Type Insights

Based on product type, the market is trifurcated into solid biomass, liquid biofuel, biogas, and others. The solid biomass segment is projected to lead the global market. Solid biomass includes wood chips, wood pellets, and fuelwood for cooking and heating etc. Governments of several countries provide incentives and subsidies to consumers using wood pellets for heating applications. Recently, the UK government launched the Domestic Renewable Heat Incentive (Domestic RHI) scheme for promoting the use of renewable heat. Furthermore, solid biomass is widely used in developing countries, mainly for cooking, heating water, and domestic space heating.

Liquid biofuels are another major product type segment of the market. Global production of liquid biofuels increased by nearly 7% in 2018 compared to that in 2017, reaching 154 billion liters in 2018. The U.S. and Brazil are the largest ethanol producers in the world. Together, these countries accounted for 84% share of the global ethanol production in 2018. On the other hand, Europe is the largest producer and consumer of biodiesel in the world. The region alone produces around 35% of the total global biodiesel production.

The biogas segment is expected to grow at a significant pace during the forecast period. The ongoing transition toward a sustainable circular economy coupled with an increasing focus toward cost-effective waste management practices would fuel the installation of biogas plants. Europe is the largest producer of biogas across the globe. According to the European Biogas Association, more than 18,202 biogas plants are operating in Europe.

Feedstock Insights

Based on feedstock, the market can be grouped into agricultural waste, wood and woody biomass, solid waste, and others. The wood and woody biomass segment is projected to lead the global bioenergy market share. Woody biomass includes trees or parts of trees, such as trunks, branches, bark, and tops. It contains more lignin than herbaceous feedstock or tree leaves. This type of feedstock is largely used for heat and grid electricity production. Wood continues to be an important fuel in many countries, especially for cooking and heating in developing countries. In 2018, about 2% of total U.S. annual energy consumption was from wood and wood waste.

Agricultural waste includes all organic waste matter generated in agricultural activities. Various types of wastes and residues such as straw, green mass from crops, farming residues, forest waste, plant waste, and landscape waste are utilized as feedstock for biogas and biomethane plants. According to Global Statistics, energy generation from agricultural residues could meet about 3-14% of the total energy supply globally. The solid waste consists of waste materials generated by households and similar waste produced by commercial, industrial, or institutional entities.

Application Insights

Based on application, the market can be segmented into power generation, heat generation, transportation, and others. The heat generation segment is projected to lead the market because biofuels are primarily used to generate heat, particularly in Europe and the Middle East & Africa region. Bioenergy for heat in the European Union is anticipated to increase by around 8% by 2023 to reach 3.5 exajoules (EJ). Most biomass heat is used in buildings. The voluntary target within the updated Renewable Energy Directive (RED) for member states to increase renewable energy in heating and cooling by 1.3 percentage points/year should open up opportunities for biomass heating. In the European Union (EU), more than 15 million tonnes of wood pellets were consumed for heating applications in 2018.

Transportation is another major application segment of the market. Transportation is a major source of carbon emissions. Enactment of stringent government regulations regarding carbon emissions across the globe is boosting the demand for alternative fuels. IRENA’s Renewable Energy Roadmaps shows that liquid biofuels, including conventional and advanced forms of ethanol and biodiesel, are expected to account for 10% share of energy usage in the transport sector by 2032. Electricity generation is expected to grow at a significant pace during the forecast period. Increasing demand for electricity across the globe due to rapid industrialization and urbanization is also driving the growth of the market.

Technology Insights

By technology, the global bioenergy market is segmented into Gasification, Fast Pyrolysis, Fermentation, and Other Technologies. Fermentation dominated the bioenergy market, with over 34.05% of the total bioenergy installed capacity in 2022. Furthermore, it will likely dominate the market during the forecast period due to its mature and widely accepted technology worldwide. Owing to extensive use in the industry and process requiring low temperature and pressure, fermentation produces over 98% yield with alternative feedstock options on the rise, such as Jatropha, animal fats, sludge, or waste cooking oil, coupled with a commercial value of co-products and tax incentives on biodiesel; these technologies are tracing popularity in the initial years of the forecast period itself. The critical market consumers for the biomass gasification segment are the small to large industries, the commercial sector, and rural communities. Asia-Pacific is anticipated to witness major growth attributable to industrialized economies like Japan, South Korea, India, and China. The impact of this growth is increased by changes in energy consumption, as half of the world population locates in this region. A significant share lives in rural areas, where biomass has been a predominant energy source, mainly for domestic use. Small-scale biomass gasification is found to supply electricity in rural areas. For example, in India, the Ministry of New and Renewable Energy (MNRE) has developed several biomass and bagasse cogeneration policies that widely use gasification for power generation. These government incentives have driven the demand for gasification over the forecast period. The Fast Pyrolysis segment in the boiler is expected to boost as the usage of pyrolysis oil can reduce carbon emissions by 90%. It can substitute natural gas and heavy & light fuel oils, thus increasing the demand for the market studied. Additionally, using pyrolysis in gas turbines and diesel engines to generate heat and power is likely to provide significant potential for the market. There are financial benefits to rural industry and agriculture for implementing distributed plants that can process biomass. Markets for biomass pyrolysis products are emerging, particularly in Asia and Europe. However, the growing application for pyrolysis technology in replacing a significant amount of fossil carbon is expected to boost the demand for the said market during the forecast period.

Regional Insights

By region, the global bioenergy market is segmented into North America, Europe, Asia-Pacific, South America, and the Middle East and Africa. North America dominated the bioenergy market, with over 35.11% of the total bioenergy installed capacity in 2022. In the United States, the increasing consumption of biofuels and supportive government policies is anticipated to spur the market. Several initiatives have been taken by NREL (National Renewable Energy Laboratory) and the US Department of Energy in the sphere of the bioenergy sector. In July 2020, the Department of Energy (DOE) announced more than USD 97 million in funding for 33 projects, which would enhance research and development. The projects will improve the performance and reduce the cost and risk of technologies that can generate biofuels, biopower, and bioproducts from biomass and waste resources. Therefore, the bioenergy market is further expected, supported by technological advancements. Asia-Pacific is the fastest-growing region of the bioenergy market, with over 33.06% share of the total bioenergy installed capacity in 2022. China and India are expected to be significant renewable energy players due to their massive populations and increasing demand for energy. As of 2019, China is the global leader in renewable energy deployment. In July 2020, China joined the IEA Bioenergy Technology Programme (TCP) to lead a new era of bioenergy development in the country, which is expected to boost the share of bioenergy in the total renewable energy mix of the country. Japan is one of the largest renewable energy markets in Asia-Pacific. Solar, hydro, wind, and bioenergy are the primary renewable energy sources in the country. The country's bioenergy sources include methane, unutilized or waste wood, ordinary wood and agricultural waste, and a biogenic fraction of waste. Factors like supportive government policies and schemes, and renewable energy targets, are expected to drive the bioenergy installed capacity in Japan during the forecast period. Europe is the third-largest market, with over 16% of the total bioenergy installed capacity in 2022. Germany is one of the largest bioenergy markets in Europe in terms of installed capacity. The bioenergy installed capacity in Germany reached 8.92 GW in 2019, representing an increase of 3.8% compared to the previous year's value. Moreover, the only positive factor that can influence the growth in Germany's bioenergy sector is the phase-out of all nuclear facilities in the country by 2022. The country's plans to decommission all the nuclear power plants and elevate the share of renewable energy in the total power production mix are expected to drive the bioenergy sector in Germany during the forecast period.

Bioenergy Market Segmentations:

By Product Type

By Feedstock

By Application

By Technology

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Bioenergy Market

5.1. COVID-19 Landscape: Bioenergy Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Bioenergy Market, By Product Type

8.1. Bioenergy Market, by Product Type, 2023-2032

8.1.1. Solid Biomass

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Liquid Biofuel

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Biogas

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Bioenergy Market, By Feedstock

9.1. Bioenergy Market, by Feedstock, 2023-2032

9.1.1. Agricultural waste

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Wood and Woody Biomass

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Solid Waste

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Bioenergy Market, By Application

10.1. Bioenergy Market, by Application, 2023-2032

10.1.1. Power generation

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Heat generation

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Transportation

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Bioenergy Market, By Technology

11.1. Bioenergy Market, by Technology, 2023-2032

11.1.1. Gasification

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Fast Pyrolysis

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Fermentation

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Bioenergy Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product Type (2020-2032)

12.1.2. Market Revenue and Forecast, by Feedstock (2020-2032)

12.1.3. Market Revenue and Forecast, by Application (2020-2032)

12.1.4. Market Revenue and Forecast, by Technology (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product Type (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Feedstock (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Application (2020-2032)

12.1.5.4. Market Revenue and Forecast, by Technology (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product Type (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Feedstock (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Application (2020-2032)

12.1.6.4. Market Revenue and Forecast, by Technology (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product Type (2020-2032)

12.2.2. Market Revenue and Forecast, by Feedstock (2020-2032)

12.2.3. Market Revenue and Forecast, by Application (2020-2032)

12.2.4. Market Revenue and Forecast, by Technology (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product Type (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Feedstock (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Application (2020-2032)

12.2.5.4. Market Revenue and Forecast, by Technology (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product Type (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Feedstock (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Application (2020-2032)

12.2.6.4. Market Revenue and Forecast, by Technology (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product Type (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Feedstock (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Application (2020-2032)

12.2.7.4. Market Revenue and Forecast, by Technology (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product Type (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Feedstock (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Application (2020-2032)

12.2.8.4. Market Revenue and Forecast, by Technology (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product Type (2020-2032)

12.3.2. Market Revenue and Forecast, by Feedstock (2020-2032)

12.3.3. Market Revenue and Forecast, by Application (2020-2032)

12.3.4. Market Revenue and Forecast, by Technology (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product Type (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Feedstock (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Application (2020-2032)

12.3.5.4. Market Revenue and Forecast, by Technology (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product Type (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Feedstock (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Application (2020-2032)

12.3.6.4. Market Revenue and Forecast, by Technology (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product Type (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Feedstock (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Application (2020-2032)

12.3.7.4. Market Revenue and Forecast, by Technology (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product Type (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Feedstock (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Application (2020-2032)

12.3.8.4. Market Revenue and Forecast, by Technology (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product Type (2020-2032)

12.4.2. Market Revenue and Forecast, by Feedstock (2020-2032)

12.4.3. Market Revenue and Forecast, by Application (2020-2032)

12.4.4. Market Revenue and Forecast, by Technology (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product Type (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Feedstock (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Application (2020-2032)

12.4.5.4. Market Revenue and Forecast, by Technology (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product Type (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Feedstock (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Application (2020-2032)

12.4.6.4. Market Revenue and Forecast, by Technology (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product Type (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Feedstock (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Application (2020-2032)

12.4.7.4. Market Revenue and Forecast, by Technology (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product Type (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Feedstock (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Application (2020-2032)

12.4.8.4. Market Revenue and Forecast, by Technology (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product Type (2020-2032)

12.5.2. Market Revenue and Forecast, by Feedstock (2020-2032)

12.5.3. Market Revenue and Forecast, by Application (2020-2032)

12.5.4. Market Revenue and Forecast, by Technology (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product Type (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Feedstock (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Application (2020-2032)

12.5.5.4. Market Revenue and Forecast, by Technology (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product Type (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Feedstock (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Application (2020-2032)

12.5.6.4. Market Revenue and Forecast, by Technology (2020-2032)

Chapter 13. Company Profiles

13.1. Ameresco Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. MVV Energie AG

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Enexor Energy

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Drax Group

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. EnviTec Biogas AG

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Pacific BioEnergy Corp.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Lignetics

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Enerkem

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Green Plains Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Enviva

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others