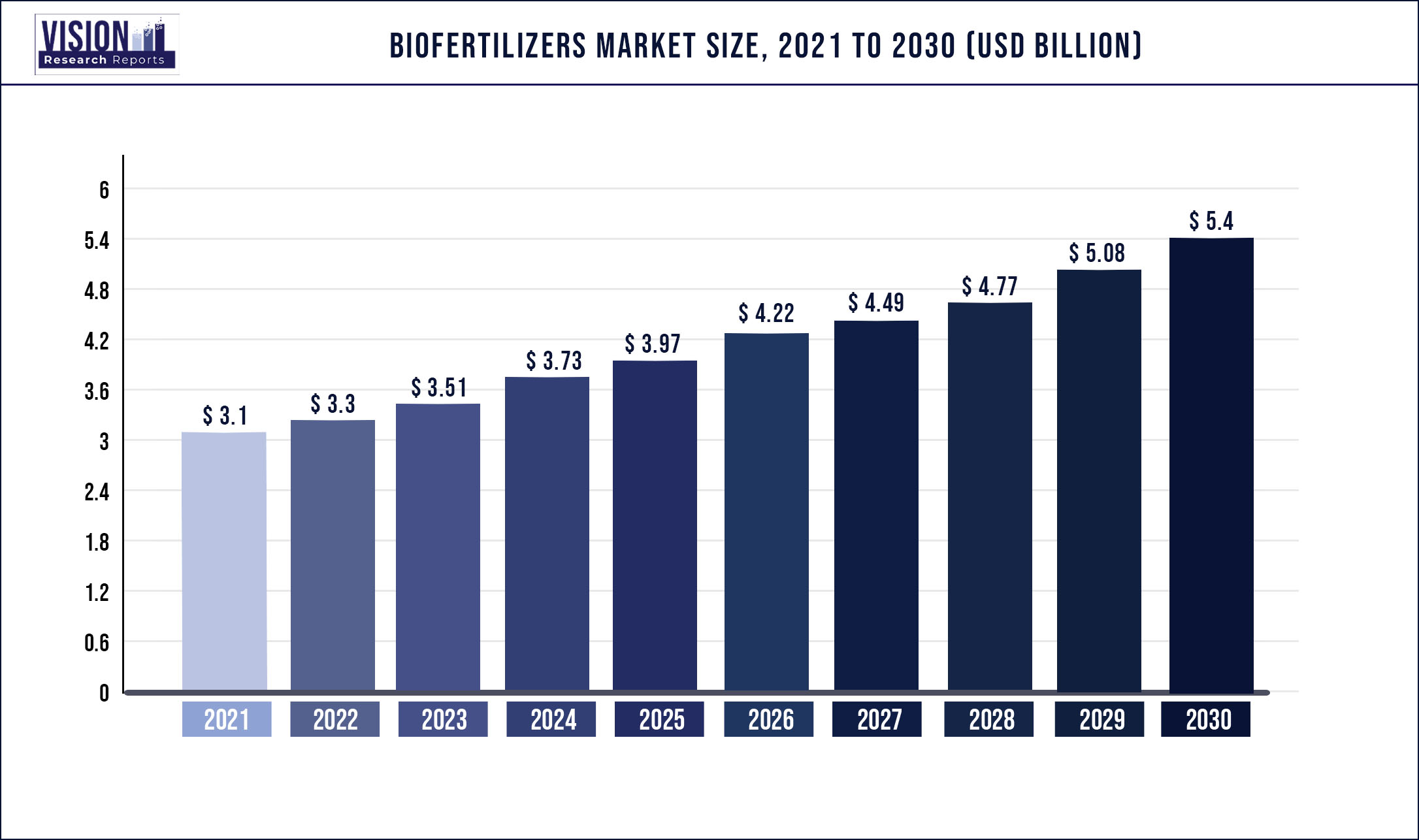

The global biofertilizers market size was valued over US$ 3.1 billion in 2021 and is projected to reach US$ 5.4 Bn by 2030 and estimated to expand at a CAGR of 12.4% from 2022 to 2030.

Biofertilizers are living microbes that enhance plant nutrition either by mobilizing or increasing nutrient availability in soils. Various microbial taxa, including beneficial bacteria and fungi, are currently used as biofertilizers, as they successfully colonize the rhizosphere, rhizoplane, or root interior.

Biofertilizers fix atmospheric nitrogen in the soil and root nodules of legume crops and make it available to the plant. When applied to seed or soil, biofertilizers increase the availability of nutrients and improve the yield by 10% to 25% without adversely affecting the soil and environment.

Manufacturers in the biofertilizers market are boosting their local production capabilities to reduce dependence on other countries for raw materials amid the ongoing COVID-19 pandemic. However, biofertilizers are linked with a much shorter shelf life in comparison with chemical fertilizers and require specific machinery for its application. Hence, companies in the biofertilizers market should increase awareness about advantages of biofertilizers such as reduced toxicity in the environment and cost efficiency for farmers. Biofertilizers help increase the nutrient absorbing surface area beyond the depletion zone of the root. Benefits of biofertilizers include longer shelf life, less contamination, better survival on seeds & soil, high commercial revenues, and export potentials.

The rise in global demand for cereals & grains has led to significant growth in the usage of biofertilizers. The increase in production of cereals and grains is expected to be the primary driver for growth of the market. Biofertilizers help promote the growth of plants by supplying adequate amount of nutrients, thus improving the quality & yield of crops.

Market Dynamics:

Drivers:

Growth in the organic food industry is driving the growth of the Biofertilizers Market during the forecast period. The increasing initiative taken by the government agencies and the growth in awareness associated with the need for sustainability in modern agriculture is the major factor expected to drive the growth of Biofertilizers Market in the years to come. The rise in the adoption of precision farming and protected agriculture, increase in the utilization of Biofertilizers Market in private and ranch farms, and increase in environmental concerns are some of the other factors driving the growth of the Biofertilizers Market during the forecast period.

Challenges:

The lower adoption rate of Biofertilizers Market due to lack of awareness is the major challenge limiting the growth of the Biofertilizers Market. Unfavorable regulatory standards and the increase in the supply of counterfeit and fewer effective products are hindering the Biofertilizers Market growth during the forecast period. An increase in technical and environmental restrictions and high initial investments along with poor infrastructure are also prime factors impeding the Biofertilizers Market growth during the forecast period.

Rising Concern over Declining Soil Quality to Augment Growth

The use of chemicals and acidic fertilizers such as calcium nitrate, monoammonium phosphate, and others has resulted in degradation of soil quality. Over the years, this has led to less crop cultivation, eventually leading to the land getting barren. This has propelled the need for organic fertilizers, thereby augmenting the global biofertilizers market growth. Besides this, biofertilizers consist of living microorganisms that help the plants to grow naturally by supplying essential nutrients. It also helps to increase the fertility of the soil. The aforementioned factors are also contributing to the growth of the market.

On the contrary, biofertilizers have high production costs and this may pose a major challenge to the farmers, thereby causing hindrance to the growth of the market. In addition to this, they have a lower shelf-life as compared to chemical fertilizers and have lower versatility. This may also hamper the growth of the market in the forecast years.

Nevertheless, government support in terms of agricultural awareness programs and promotion and distribution of bio-fertilizers are expected to create lucrative growth opportunities for the market in the coming years.

Regional Trends:

North America is estimated as the fastest-growing market during the forecast period globally. North America is expected to dominate the market owing to the growth in the demand for organic products, rising adoption of Biofertilizers Market among regular farmers during the forecast period. Moreover, the higher adoption of advanced irrigation systems like drip and sprinkler irrigation for fertigation by the farmers in various developing and developed countries and regions are increasing the growth of Biofertilizers Market during the forecast period. The severe regulatory environment in addition to a growing preference for the utilization of Biofertilizers Market products and has led to the considerable growth of the Biofertilizers Market. Moreover, growing concerns affecting the excessive use of chemical fertilizers and nitrate emissions are some of the prime factors expected to contribute to the growth of the Biofertilizers Market during the forecast period.

Mexico is projected to witness growth in the demand for Biofertilizers Market as the prime agricultural products are exported to other countries like the United States, Canada, and Netherland.

Phosphate Mobilizing & Nitrogen Fixing Biofertilizers Help Support Plant Growth

Among product types, the revenue share of nitrogen fixing dominated the global biofertilizers market in 2021. This can be primarily ascribed to the increase in demand for nitrogen fixing in biofertilizers in various applications, including cereals & grains, fruits & vegetables, oil seeds & pulses, and others.

Nitrogen fixing biofertilizers contain microorganisms such as rhizobium, actinobacteria, azotobacter, and azospirillum. They help transform nitrogen into organic compounds. Biological nitrogen fixation is one way of converting elemental nitrogen into a usable form for the plants.

The revenue share of phosphate mobilizing biofertilizers also accounted for a large share of the global market in 2021. Phosphate mobilizing includes phosphate-solubilizing bacteria (PSB) and phosphate-solubilizing microorganisms (PSMs) such as bacillus, pseudomonas, and aspergillus. These bacteria do not provide plant nutrients, but they enhance plant growth and performance.

Biofertlizers an Essential Commodity amid COVID-19 Outbreak

Since agriculture is one of the most essential industries similar to healthcare, manufacturers in the biofertilizers market have been working at break-neck speeds to ensure robust supply chains for end-products. The reopening of country borders is helping resolve transport and logistic issues, owing to stringent regulations for transportation of raw materials for the biofertilizers market. The import & export of biofertilizers is projected to rise, owing to increase in shipment and demand for vascular snares. Manufacturers in the biofertilizers market are diversifying their product portfolio since a specific biofertilizer caters to only specific crops instead of all crops in general.

Biofertilizers Suitable for Cultivation of Cereals & Grains

In terms of value, the cereals & grains segment is estimated to dominate the global biofertilizers market during the forecast period. Increase in demand for biofertilizers in cereals & grains application is anticipated to drive the segment in the near future.

Biofertilizers help to fix atmospheric nitrogen in the soil and root nodules of legume crops. Rhizobium is used as a crop enhancer and biofertilizer for increased cereal production. It has been found that rhizobia can make an association with gramineous plants such as rice, wheat, maize, barley, millets, and other cereals without forming any nodule-like structure or causing any disease symptoms.

Rise in concerns over declining soil quality due to overuse of chemical fertilizers and their potential ill-effects on human health has encouraged governments across various economies to promote the use of biofertilizers. Governments across several agri-dominant countries are opting for various plans, schemes, and other initiatives to encourage the adoption of biofertilizers among farmers.

Report Highlights

Recent Developments

Key Players

CBF China Biofertilizers

Lallemand Inc.

Novozymes A/S

Fertilizers USA LLC

AgriLife

Symborg SL

Market Segmentation

By Product

Nitrogen Fixing

Phosphate Solubilizing

Others

By Application

Seed Treatment

Soil Treatment

By Crop Type

Cereals & Grains

Oilseeds & Pulses

Fruits & Vegetables

Others

By Form

By Microorganism

By Region

North America

U.S.

Canada

Mexico

Europe

Germany

U.K.

France

Italy

Asia Pacific

China

India

Japan

Latin America

Brazil

Argentina

Middle East & Africa

The Biofertilizers market research report covers definition, classification, product classification, product application, development trend, product technology, competitive landscape, industrial chain structure, industry overview, national policy and planning analysis of the industry, the latest dynamic analysis, etc., and also includes major. The study includes drivers and restraints of the global market. It covers the impact of these drivers and restraints on the demand during the forecast period. The report also highlights opportunities in the market at the global level.

The report provides size (in terms of volume and value) of Biofertilizers market for the base year 2019 and the forecast between 2020 and 2027. Market numbers have been estimated based on form and application. Market size and forecast for each application segment have been provided for the global and regional market.

This report focuses on the global Biofertilizers market status, future forecast, growth opportunity, key market and key players. The study objectives are to present the Biofertilizers market development in United States, Europe and China.

It is pertinent to consider that in a volatile global economy, we haven’t just conducted Biofertilizers market forecasts in terms of CAGR, but also studied the market based on key parameters, including Year-on-Year (Y-o-Y) growth, to comprehend the certainty of the market and to find and present the lucrative opportunities in market.

In terms of production side, this report researches the Biofertilizers capacity, production, value, ex-factory price, growth rate, market share for major manufacturers, regions (or countries) and type.

In terms of consumption side, this report focuses on the consumption of Biofertilizers by regions (countries) and application.

Buyers of the report will have access to verified market figures, including global market size in terms of revenue and volume. As part of production analysis, the authors of the report have provided reliable estimations and calculations for global revenue and volume by Type segment of the global Biofertilizers market. These figures have been provided in terms of both revenue and volume for the period 2016 to 2027. Additionally, the report provides accurate figures for production by region in terms of revenue as well as volume for the same period. The report also includes production capacity statistics for the same period.

With regard to production bases and technologies, the research in this report covers the production time, base distribution, technical parameters, research and development trends, technology sources, and sources of raw materials of major Biofertilizers market companies.

Regarding the analysis of the industry chain, the research of this report covers the raw materials and equipment of Biofertilizers market upstream, downstream customers, marketing channels, industry development trends and investment strategy recommendations. The more specific analysis also includes the main application areas of market and consumption, major regions and Consumption, major Chinese producers, distributors, raw material suppliers, equipment providers and their contact information, industry chain relationship analysis.

The research in this report also includes product parameters, production process, cost structure, and data information classified by region, technology and application. Finally, the paper model new project SWOT analysis and investment feasibility study of the case model.

Overall, this is an in-depth research report specifically for the Biofertilizers industry. The research center uses an objective and fair way to conduct an in-depth analysis of the development trend of the industry, providing support and evidence for customer competition analysis, development planning, and investment decision-making. In the course of operation, the project has received support and assistance from technicians and marketing personnel in various links of the industry chain.

The Biofertilizers market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to Biofertilizers market.

Prominent players in the market are predicted to face tough competition from the new entrants. However, some of the key players are targeting to acquire the startup companies in order to maintain their dominance in the global market. For a detailed analysis of key companies, their strengths, weaknesses, threats, and opportunities are measured in the report by using industry-standard tools such as the SWOT analysis. Regional coverage of key companies is covered in the report to measure their dominance. Key manufacturers of Biofertilizers market are focusing on introducing new products to meet the needs of the patrons. The feasibility of new products is also measured by using industry-standard tools.

Key companies are increasing their investments in research and development activities for the discovery of new products. There has also been a rise in the government funding for the introduction of new Biofertilizers market. These factors have benefited the growth of the global market for Biofertilizers. Going forward, key companies are predicted to benefit from the new product launches and the adoption of technological advancements. Technical advancements have benefited many industries and the global industry is not an exception.

New product launches and the expansion of already existing business are predicted to benefit the key players in maintaining their dominance in the global market for Biofertilizers. The global market is segmented on the basis of region, application, en-users and product type. Based on region, the market is divided into North America, Europe, Asia-Pacific, Latin America and Middle East and Africa (MEA).

In this study, the years considered to estimate the market size of Biofertilizers are as follows:

Reasons to Purchase this Report:

- Market segmentation analysis including qualitative and quantitative research incorporating the impact of economic and policy aspects

- Regional and country level analysis integrating the demand and supply forces that are influencing the growth of the market.

- Market value USD Million and volume Units Million data for each segment and sub-segment

- Competitive landscape involving the market share of major players, along with the new projects and strategies adopted by players in the past five years

- Comprehensive company profiles covering the product offerings, key financial information, recent developments, SWOT analysis, and strategies employed by the major market players

Research Methodology:

In-depth interviews and discussions were conducted with several key market participants and opinion leaders to compile the research report.

This research study involved the extensive usage of both primary and secondary data sources. The research process involved the study of various factors affecting the industry, including the government policy, market environment, competitive landscape, historical data, present trends in the market, technological innovation, upcoming technologies and the technical progress in related industry, and market risks, opportunities, market barriers and challenges. The following illustrative figure shows the market research methodology applied in this report.

Market Size Estimation

Top-down and bottom-up approaches are used to estimate and validate the global market size for company, regional division, product type and application (end users).

The market estimations in this report are based on the selling price (excluding any discounts provided by the manufacturer, distributor, wholesaler or traders). Market share analysis, assigned to each of the segments and regions are achieved through product utilization rate and average selling price.

Major manufacturers & their revenues, percentage splits, market shares, growth rates and breakdowns of the product markets are determined through secondary sources and verified through the primary sources.

All possible factors that influence the markets included in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The market size for top-level markets and sub-segments is normalized, and the effect of inflation, economic downturns, and regulatory & policy changes or others factors are accounted for in the market forecast. This data is combined and added with detailed inputs and analysis from Vision Research Reports and presented in this report.

Market Breakdown and Data Triangulation

After complete market engineering with calculations for market statistics; market size estimations; market forecasting; market breakdown; and data triangulation. Extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. In the complete market engineering process, both top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform market estimation and market forecasting for the overall market segments and sub-segments listed in this report.

Secondary Sources

Secondary Sources occupies approximately 25% of data sources, such as press releases, annual reports, Non-Profit organizations, industry associations, governmental agencies and customs data, and so on. This research study includes secondary sources; directories; databases such as Bloomberg Business, Wind Info, Hoovers, Factiva (Dow Jones & Company), TRADING ECONOMICS, and avention; Investing News Network; statista; Federal Reserve Economic Data; annual reports; investor presentations; and SEC filings of companies.

Primary Sources

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include product manufacturers (and their competitors), opinion leaders, industry experts, research institutions, distributors, dealer and traders, as well as the raw materials suppliers and producers, etc.

The primary sources from the demand side include industry experts such as business leaders, marketing and sales directors, technology and innovation directors, supply chain executive, end users (product buyers), and related key executives from various key companies and organizations operating in the global market.

The study objectives of this report are:

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Biofertilizers Market

5.1. COVID-19 Landscape: Biofertilizers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Biofertilizers Market, By Product

8.1. Biofertilizers Market, by Product, 2022-2030

8.1.1. Nitrogen Fixing

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Phosphate Solubilizing

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Biofertilizers Market, By Application

9.1. Biofertilizers Market, by Application, 2022-2030

9.1.1. Seed Treatment

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Soil Treatment

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Biofertilizers Market, By Crop Type

10.1. Biofertilizers Market, by Crop Type, 2022-2030

10.1.1. Cereals & Grains

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Oilseeds & Pulses

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Fruits & Vegetables

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Biofertilizers Market, By Form

11.1. Biofertilizers Market, by Form, 2022-2030

11.1.1. Liquid

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Carrier-based

11.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Biofertilizers Market, By Microorganism

12.1. Biofertilizers Market, by Microorganism, 2022-2030

12.1.1. Rhizobium

12.1.1.1. Market Revenue and Forecast (2017-2030)

12.1.2. Azotobacter

12.1.2.1. Market Revenue and Forecast (2017-2030)

12.1.3. Azospirillum

12.1.3.1. Market Revenue and Forecast (2017-2030)

12.1.4. Pseudomonas

12.1.4.1. Market Revenue and Forecast (2017-2030)

12.1.5. Bacillus

12.1.5.1. Market Revenue and Forecast (2017-2030)

12.1.6. VAM

12.1.6.1. Market Revenue and Forecast (2017-2030)

12.1.7. Others

12.1.7.1. Market Revenue and Forecast (2017-2030)

Chapter 13. Global Biofertilizers Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Product (2017-2030)

13.1.2. Market Revenue and Forecast, by Application (2017-2030)

13.1.3. Market Revenue and Forecast, by Crop Type (2017-2030)

13.1.4. Market Revenue and Forecast, by Form (2017-2030)

13.1.5. Market Revenue and Forecast, by Microorganism (2017-2030)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Product (2017-2030)

13.1.6.2. Market Revenue and Forecast, by Application (2017-2030)

13.1.6.3. Market Revenue and Forecast, by Crop Type (2017-2030)

13.1.6.4. Market Revenue and Forecast, by Form (2017-2030)

13.1.7. Market Revenue and Forecast, by Microorganism (2017-2030)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Product (2017-2030)

13.1.8.2. Market Revenue and Forecast, by Application (2017-2030)

13.1.8.3. Market Revenue and Forecast, by Crop Type (2017-2030)

13.1.8.4. Market Revenue and Forecast, by Form (2017-2030)

13.1.8.5. Market Revenue and Forecast, by Microorganism (2017-2030)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Product (2017-2030)

13.2.2. Market Revenue and Forecast, by Application (2017-2030)

13.2.3. Market Revenue and Forecast, by Crop Type (2017-2030)

13.2.4. Market Revenue and Forecast, by Form (2017-2030)

13.2.5. Market Revenue and Forecast, by Microorganism (2017-2030)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

13.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

13.2.6.3. Market Revenue and Forecast, by Crop Type (2017-2030)

13.2.7. Market Revenue and Forecast, by Form (2017-2030)

13.2.8. Market Revenue and Forecast, by Microorganism (2017-2030)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Product (2017-2030)

13.2.9.2. Market Revenue and Forecast, by Application (2017-2030)

13.2.9.3. Market Revenue and Forecast, by Crop Type (2017-2030)

13.2.10. Market Revenue and Forecast, by Form (2017-2030)

13.2.11. Market Revenue and Forecast, by Microorganism (2017-2030)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Product (2017-2030)

13.2.12.2. Market Revenue and Forecast, by Application (2017-2030)

13.2.12.3. Market Revenue and Forecast, by Crop Type (2017-2030)

13.2.12.4. Market Revenue and Forecast, by Form (2017-2030)

13.2.13. Market Revenue and Forecast, by Microorganism (2017-2030)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Product (2017-2030)

13.2.14.2. Market Revenue and Forecast, by Application (2017-2030)

13.2.14.3. Market Revenue and Forecast, by Crop Type (2017-2030)

13.2.14.4. Market Revenue and Forecast, by Form (2017-2030)

13.2.15. Market Revenue and Forecast, by Microorganism (2017-2030)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Product (2017-2030)

13.3.2. Market Revenue and Forecast, by Application (2017-2030)

13.3.3. Market Revenue and Forecast, by Crop Type (2017-2030)

13.3.4. Market Revenue and Forecast, by Form (2017-2030)

13.3.5. Market Revenue and Forecast, by Microorganism (2017-2030)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

13.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

13.3.6.3. Market Revenue and Forecast, by Crop Type (2017-2030)

13.3.6.4. Market Revenue and Forecast, by Form (2017-2030)

13.3.7. Market Revenue and Forecast, by Microorganism (2017-2030)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Product (2017-2030)

13.3.8.2. Market Revenue and Forecast, by Application (2017-2030)

13.3.8.3. Market Revenue and Forecast, by Crop Type (2017-2030)

13.3.8.4. Market Revenue and Forecast, by Form (2017-2030)

13.3.9. Market Revenue and Forecast, by Microorganism (2017-2030)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Product (2017-2030)

13.3.10.2. Market Revenue and Forecast, by Application (2017-2030)

13.3.10.3. Market Revenue and Forecast, by Crop Type (2017-2030)

13.3.10.4. Market Revenue and Forecast, by Form (2017-2030)

13.3.10.5. Market Revenue and Forecast, by Microorganism (2017-2030)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Product (2017-2030)

13.3.11.2. Market Revenue and Forecast, by Application (2017-2030)

13.3.11.3. Market Revenue and Forecast, by Crop Type (2017-2030)

13.3.11.4. Market Revenue and Forecast, by Form (2017-2030)

13.3.11.5. Market Revenue and Forecast, by Microorganism (2017-2030)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Product (2017-2030)

13.4.2. Market Revenue and Forecast, by Application (2017-2030)

13.4.3. Market Revenue and Forecast, by Crop Type (2017-2030)

13.4.4. Market Revenue and Forecast, by Form (2017-2030)

13.4.5. Market Revenue and Forecast, by Microorganism (2017-2030)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

13.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

13.4.6.3. Market Revenue and Forecast, by Crop Type (2017-2030)

13.4.6.4. Market Revenue and Forecast, by Form (2017-2030)

13.4.7. Market Revenue and Forecast, by Microorganism (2017-2030)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Product (2017-2030)

13.4.8.2. Market Revenue and Forecast, by Application (2017-2030)

13.4.8.3. Market Revenue and Forecast, by Crop Type (2017-2030)

13.4.8.4. Market Revenue and Forecast, by Form (2017-2030)

13.4.9. Market Revenue and Forecast, by Microorganism (2017-2030)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Product (2017-2030)

13.4.10.2. Market Revenue and Forecast, by Application (2017-2030)

13.4.10.3. Market Revenue and Forecast, by Crop Type (2017-2030)

13.4.10.4. Market Revenue and Forecast, by Form (2017-2030)

13.4.10.5. Market Revenue and Forecast, by Microorganism (2017-2030)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Product (2017-2030)

13.4.11.2. Market Revenue and Forecast, by Application (2017-2030)

13.4.11.3. Market Revenue and Forecast, by Crop Type (2017-2030)

13.4.11.4. Market Revenue and Forecast, by Form (2017-2030)

13.4.11.5. Market Revenue and Forecast, by Microorganism (2017-2030)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Product (2017-2030)

13.5.2. Market Revenue and Forecast, by Application (2017-2030)

13.5.3. Market Revenue and Forecast, by Crop Type (2017-2030)

13.5.4. Market Revenue and Forecast, by Form (2017-2030)

13.5.5. Market Revenue and Forecast, by Microorganism (2017-2030)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Product (2017-2030)

13.5.6.2. Market Revenue and Forecast, by Application (2017-2030)

13.5.6.3. Market Revenue and Forecast, by Crop Type (2017-2030)

13.5.6.4. Market Revenue and Forecast, by Form (2017-2030)

13.5.7. Market Revenue and Forecast, by Microorganism (2017-2030)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Product (2017-2030)

13.5.8.2. Market Revenue and Forecast, by Application (2017-2030)

13.5.8.3. Market Revenue and Forecast, by Crop Type (2017-2030)

13.5.8.4. Market Revenue and Forecast, by Form (2017-2030)

13.5.8.5. Market Revenue and Forecast, by Microorganism (2017-2030)

Chapter 14. Company Profiles

14.1. CBF China Biofertilizers

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Lallemand Inc.

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Novozymes A/S

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Fertilizers USA LLC

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. AgriLife

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Symborg SL

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others