The global bioinsecticides market was surpassed at USD 90.51 million in 2022 and is expected to hit around USD 257.69 million by 2032, growing at a CAGR of 11.03% from 2023 to 2032. The bioinsecticides market in the United States was accounted for USD 26.9 million in 2022.

Key Pointers

Report Scope of the Bioinsecticides Market

| Report Coverage | Details |

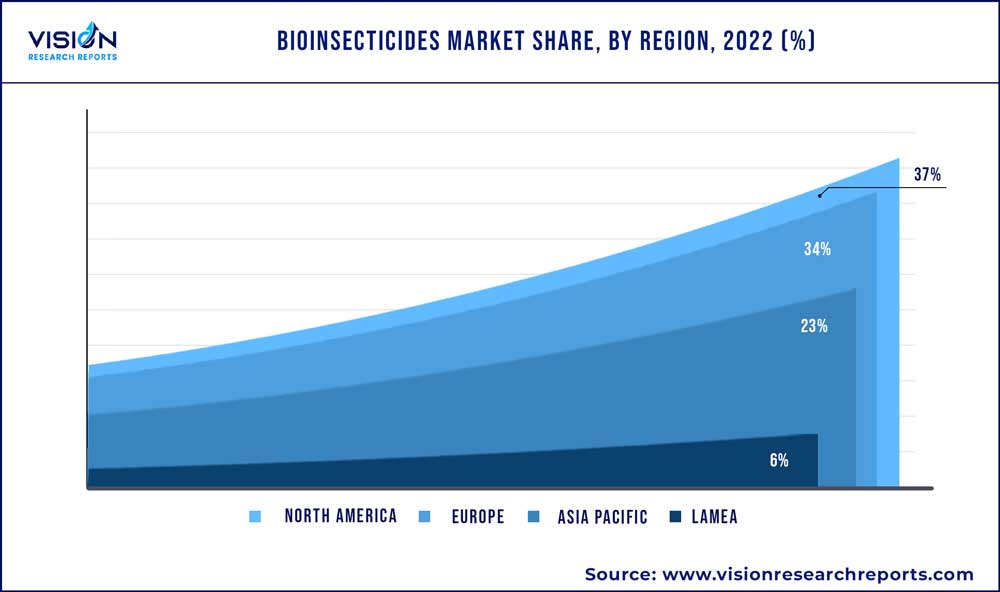

| Revenue Share of North America in 2022 | 37% |

| Revenue Forecast by 2032 | USD 257.69 million |

| Growth Rate from 2023 to 2032 | CAGR of 11.03% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | BASF SE, Bayer AG, Certis USA L.L.C., Novozymes, Marrone Bio Innovations, Syngenta, Nufarm, VALENT BioSciences, BioWorks, Vestaron Corporation |

This is attributed to the adoption of organic farming practices, government policies promoting biocontrol products, and the need for sustainable modes of pest control. The adoption of organic practices of farming is due to the harmful environmental and health impacts of synthetic pesticides.

The two major sources involved in the production of Bioinsecticides include microbes and plants. The microbial source includes the biological agents that are derived from living organisms such as bacteria, fungi, viruses, and plants. Whereas the plant source includes the oils extracted from them. For example, neem oil is extracted from the seeds of the neem tree and is effective against a wide range of pests.

Pyrethrum, derived from the flowers of Chrysanthemum cinerariaefolium, is another commonly used Bioinsecticides, which is effective in controlling aphids, whiteflies, thrips, and other pests. Thus, Bioinsecticidess offer a safer and more sustainable way of controlling pests without harming the environment and human health.

Bioinsecticidess work by controlling pests in different ways compared to synthetic pesticides. For example, some Bioinsecticidess contain spores or toxins that target specific pest species or life stages, while others may alter the behavior of the pest in a way that makes it easier to control or reduce pest populations by disrupting mating behavior.

One of the main advantages of product is that it has a low environmental impact compared to synthetic chemical pesticides. Bioinsecticidess are selective in their effect, and they tend to target the pest species of interest, thus reducing the risk of affecting non-target organisms. Additionally, when Bioinsecticidess are applied, they do not leave harmful residues in the environment.

Source Insights

Microbial segment dominated the market with the highest revenue share of 55% in 2022. This is due to it’s due to their broader range of target pests and generally higher effectiveness. Microbial insecticides are derived from living microorganisms such as bacteria, viruses, and fungi, and work by infecting and killing target pests, without harming non-target organisms.

One of the most commonly used microbial insecticides is Bacillus thuringiensis (Bt), a bacterium that produces a protein that is toxic to insects, including caterpillars and mosquitoes. Bt is an effective, eco-friendly and sustainable way of controlling pests, and it has been used in organic farming for many years. Another microbial insecticide is Beauveria bassiana, a fungus that infects and kills soil-dwelling pests such as termites, ants and beetles. Metarhizium anisopliae is another fungus that is used to control pests such as grasshoppers and locusts.

Microbial insecticides are highly effective when used correctly, but they require specific conditions to work. For example, the temperature and humidity levels must be within a certain range, and the application must be timed correctly for optimal results. Additionally, microbial insecticides do not offer immediate control of pests like synthetic pesticides, and multiple applications may be required for effective control.

Despite these limitations, microbial insecticides offer a sustainable solution for pest control and have numerous benefits. They reduce the use of harmful synthetic pesticides, which are known to have negative impacts on human health and the environment. They are biodegradable, and they do not leave behind harmful residues that can contaminate soil and water sources. Furthermore, their specificity and selectivity make them less likely to harm non-target organisms, such as beneficial insects that play a vital role in pollination and pest control.

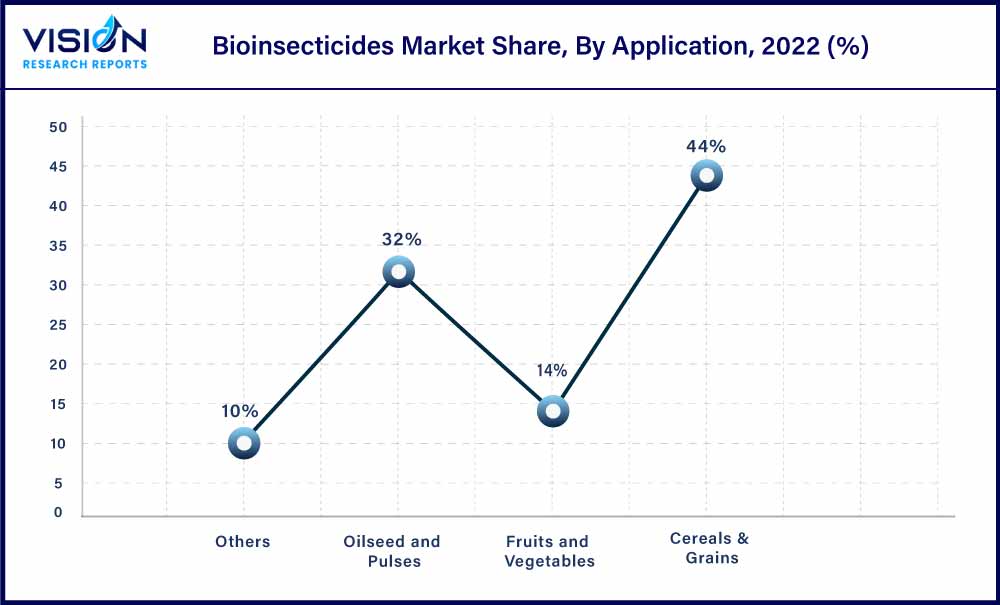

Application Insights

Cereals and grains dominated the product market with the highest revenue share of 44% in 2022. This is attributed to the increasing consumption of cereals & grains, such as rice, barley, corn, oats, wheat and sorghum due to their nutritional benefits. The majority of the market share for Bioinsecticides is anticipated to belong to the cereals and grains segment. Due to the extensive wheat and corn cultivation in China and the U.S., Bioinsecticidess are primarily used for cereals and grains in Asia Pacific and North America. Crop protection agents are typically advised for cereals and grains.

Moreover, the Bioinsecticides market is projected to benefit from the increasing focus of farmers on oilseeds production. Oilseeds and pulses comprise a diverse range of seeds, including sunflower seeds, soybean, and leguminous seeds (pulses).

The United States Department of Agriculture (USDA) reported an increase of one million metric tons in global oilseed production in 2020/2021 due to the revised soybean harvest in Brazil for 2021. Leading oilseed producers are Brazil, China, and the U.S. Thus, high demand for Bioinsecticides is expected from these countries in the near future.

Regional Insights

North America dominated the product market with the highest revenue share of 37% in 2022. This is attributed to the increasing demand for sustainable and eco-friendly pest management solutions in the region. Moreover, North America is also home to a number of companies that specialize in the development and production of Bioinsecticidess. These companies are constantly working to develop new and improved products that are more effective and easier to use.

Moreover, according to the Organization for Economic Co-operation and Development (OECD) and Food and Agricultural Organization (FAO), Asia Pacific is the largest producer of agricultural commodities and is expected to account for 53% of the global output of agricultural products by 2030. The arable land in the region is shrinking and the food demand is increasing owing to the increasing population in the region. Thus, farmers are increasingly utilizing Bioinsecticides to enhance the crop yield.

The region is characterized by the availability of cheap labor and abundant raw materials. However, water scarcity, climate change, and land degradation are some of the major challenges faced by agricultural industry in Asia Pacific. Additionally, owing to unhygienic conditions in some of the under-developed countries, such as Nepal and Sri Lanka, the crops are often subject to rodent attacks. This has increased the demand for Bioinsecticidess in the region.

Bioinsecticides Market Segmentations:

By Source

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Bioinsecticides Market

5.1. COVID-19 Landscape: Bioinsecticides Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Bioinsecticides Market, By Source

8.1. Bioinsecticides Market, by Source, 2023-2032

8.1.1. Microbials

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Plants

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Bioinsecticides Market, By Application

9.1. Bioinsecticides Market, by Application, 2023-2032

9.1.1. Cereals & Grains

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Oilseed and Pulses

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Fruits and Vegetables

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Bioinsecticides Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Source (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Source (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Source (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Source (2020-2032)

10.2.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Source (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Source (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Source (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Source (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Source (2020-2032)

10.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Source (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Source (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Source (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Source (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Source (2020-2032)

10.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Source (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Source (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Source (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Source (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Source (2020-2032)

10.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Source (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Source (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. BASF SE

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Bayer AG

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Certis USA L.L.C.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Novozymes

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Marrone Bio Innovations

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Syngenta

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Nufarm

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. VALENT BioSciences

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. BioWorks

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Vestaron Corporation

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others