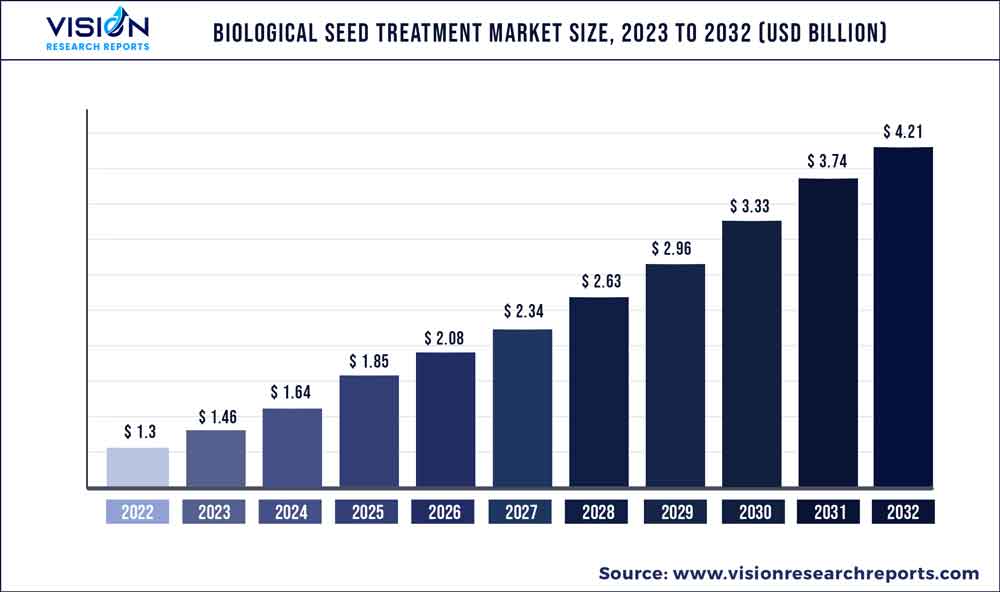

The global biological seed treatment market was surpassed at USD 1.3 billion in 2022 and is expected to hit around USD 4.21 billion by 2032, growing at a CAGR of 12.46% from 2023 to 2032. By product segment, the biological seed treatment market in the United States was accounted for USD 0.5 billion in 2022.

Key Pointers

Report Scope of the Biological Seed Treatment Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 40.01% |

| CAGR of Asia Pacific | 13.23% |

| Revenue Forecast by 2032 | USD 4.21 billion |

| Growth rate from 2023 to 2032 | CAGR of 12.46% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Bayer CropScience; Syngenta AG; BASF SE; Monsanto Company.; Italpollina S.p.A.; Koppert Biological Systems; Incotec; Plant Health Care plc; Precision Laboratories, LLC; Verdesian Life Sciences; Valent Biosciences LLC |

Rising inclination of consumers toward pesticide-free crops is likely to drive the market growth over the forecast period. Biological treatment uses naturally-derived raw materials to protect seeds from various pests and diseases.

According to a research conducted by The Energy and Resources Institute (TERI), New Delhi, India, biological seed treatment of corn, soybeans, cotton, and cereal grains has resulted in an increased yield of up to 10.0%. The treatment acts as a biostimulant and helps facilitate early growth rate. It promotes microorganisms to colonize the roots, thus protecting the crops during the entire growth season.

Biological seed treatment is garnering more importance as compared to chemical treatment due to the shifting preference of consumers toward healthy and organic food. The harmful side effects resulting from excessive usage of chemical products have led to rising awareness related to biobased products. In most of the developing countries, farmers have started adopting organic farming, which has directly impacted market penetration.

Biofungicides and bioinsecticides are mainly used for seed protection while biofertilizers and biostimulants are used for seed enhancement to boost harvesting yield and quality. Among these, biofungicides are likely to witness relatively higher growth rate and the segment is anticipated to grow at a CAGR of 12.1%, in terms of revenue, from 2019 to 2025.

Europe was the largest product consumer with a market share of over 38.8%, in terms of volume, in 2018. The region is anticipated to grow at a CAGR of 10.0% from 2019 to 2025. The growing agriculture industry aided by land availability and government support is likely to pave the way for growth of the European market. Various regulations have been established by multiple agencies against the excessive use of synthetic agricultural chemicals in the region, which are in turn projected to benefit the market growth.

Product Insights

Based on product, the market has been segmented into microbial (bacterial and fungi) and botanicals & others. The microbial segment dominated the market with a revenue share of over 65.03% in 2022 and is expected to grow at a CAGR of 11.82% from 2023 to 2032. In microbial treatment, bacteria, such as Rhizobia, Bacillus, Pseudomonas, and Streptomyces, and fungi, such as mycorrhizae, Penicillium bilaii, and Trichoderma harzianum, are used to eradicate the pathogens and improve seed health. These are highly effective in protecting crops from drought, insects, pests, and plant diseases.

Bacteria found in the soil are beneficial to plants and many of them are biocontrol species, which are harmful to pathogens. Bacteria eradicate pathogens and perform numerous beneficial functions that help in improving the physiological performance of a plant.

Some bacteria such as Rhizobacteria, perform nitrogen fixation, release antibiotics to kill pathogens, increase the availability of phosphorous, induce systematic resistance to plant pathogens, and are essential for the wellbeing of a plant. Bacteria, such as Streptomyces Bacillus and Pseudomonas, release soluble phosphorous and decrease the dependency of crops on phosphate-based fertilizers.

In botanical treatment, seeds are treated with plant extracts to get rid of pathogens, reduce infection, and increase their germination rate. The method is usually preferred owing to the low cost and easy availability of plant extracts.

Function Insights

The seed protection segment held the largest market share, accounting for over 67.02%, in terms of revenue, in 2022. Increased crop destruction due to factors such as infected seeds and biotic and abiotic stress is expected to drive industry growth over the coming years. Furthermore, the growing inclination of consumers toward organic food is anticipated to boost the popularity of biological protectants.

The seed enhancement segment is likely to witness considerable growth over the coming years. The growth is stimulated by the increasing usage of biological treatment, which improves seedling growth and germination. It involves the use of various techniques to amplify seed performance by increasing its ability to resist diseases and improve seed vigor, which, in turn, increases the harvest yield as well as the quality of crops.

Biofungicides are vital to seed coating as most of the pathogens are fungi. Several fungi cause seedling rot and black rot, which eventually reduce the germination rate and affect seedling vigor. Fusarium, Pythium, Phytophthora, and Rhizoctonia are the most common fungal pathogens. In order to overcome these fungal pathogens and ensure seed vitality, biofungicides are used for coating. Biofungicides containing active ingredients such as Bacillus pumilus, Gliocladium virens, Coniothyrium minitans, and Paecilomyces lilacinus are effective in controlling and eradicating fungal diseases.

Crop Type Insights

Based on crop type, the biological seed treatment market has been segmented into soybean, wheat, cotton, corn, sunflower, vegetable crops, and others. Among crop types, the vegetable crops segment accounted for the highest revenue share of over 25.1% in 2022. Wheat seeds are susceptible to diseases such as seedling blight caused by Pythium and Fusarium (fungus) and pink seed disease caused by Erwinia rhapontici (bacteria). Biological treatment is essential to avoid infestation by these pathogens. In soybean, seed-borne pathogens are one the crucial threats to the establishment of seedlings. Various seed-borne diseases, such as stem blight, purple seed stain disease, and reduction in the rate of seed germination are caused by fungal pathogens such as Phomopsis, Cercospora, Fusarium, and Aspergillus. In order to protect seeds from these diseases, they are treated using Bacillus pumilus and Coniothyrium minitans.

The vegetable crop segment is expected to grow at a CAGR of 12.75%, in terms of revenue, from 2023 to 2032. The increasing use of biopesticides for treating vegetable seeds, the rising inclination of consumers toward maintaining a healthy lifestyle, and the rising demand for chemical-free food products are expected to fuel the market growth over the forecast period.

Regional Insights

North America dominated the industry with a share of over 40.01%, in terms of revenue, in 2022. The region is expected to grow at a CAGR of 12.55% from 2023 to 2032. The rising adoption of organic farming in countries such as the U.S., Mexico, and Canada is anticipated to drive the industry in the future. Canada and Mexico are the major exporters of grains all over the world. To yield a substantial amount of crops, farmers use biological seed treatment to protect the seeds and crops from pathogens, pests, and nematodes.

The North America organic agriculture market witnessed growth in 2022. The organic food market witnessed an increase of 6% in the U.S. and 9% in Canada in the same year. More than 19,000 organic producers are present in North America out of which 14,000 alone are present in the U.S. and 4,800 in Canada. The number of organic producers has increased by 66% since 2004.

Asia Pacific is the fastest-growing region and is expected to accelerate at a CAGR of 13.23% over the forecast period. The strong growth of the agriculture sector in countries such as India, China, Bangladesh, and Sri Lanka is expected to drive product demand in the future. Furthermore, the growing population and rising income are expected to continue to drive the demand for food and agricultural commodities.

Biological Seed Treatment Market Segmentations:

By Product

By Function

By Crop Type

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Biological Seed Treatment Market

5.1. COVID-19 Landscape: Biological Seed Treatment Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Biological Seed Treatment Market, By Product

8.1. Biological Seed Treatment Market, by Product, 2023-2032

8.1.1 Microbials

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Botanicals & Others

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Biological Seed Treatment Market, By Function

9.1. Biological Seed Treatment Market, by Function, 2023-2032

9.1.1. Seed Protection

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Seed Enhancement

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Biological Seed Treatment Market, By Crop Type

10.1. Biological Seed Treatment Market, by Crop Type, 2023-2032

10.1.1. Corn

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Wheat

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Soybean

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Cotton

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Sunflower

10.1.5.1. Market Revenue and Forecast (2020-2032)

10.1.6. Vegetable Crops

10.1.6.1. Market Revenue and Forecast (2020-2032)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Biological Seed Treatment Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.2. Market Revenue and Forecast, by Function (2020-2032)

11.1.3. Market Revenue and Forecast, by Crop Type (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Function (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Crop Type (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Function (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Crop Type (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.2. Market Revenue and Forecast, by Function (2020-2032)

11.2.3. Market Revenue and Forecast, by Crop Type (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Function (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Crop Type (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Function (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Crop Type (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Function (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Crop Type (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Function (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Crop Type (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.2. Market Revenue and Forecast, by Function (2020-2032)

11.3.3. Market Revenue and Forecast, by Crop Type (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Function (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Crop Type (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Function (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Crop Type (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Function (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Crop Type (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Function (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Crop Type (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.2. Market Revenue and Forecast, by Function (2020-2032)

11.4.3. Market Revenue and Forecast, by Crop Type (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Function (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Crop Type (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Function (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Crop Type (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Function (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Crop Type (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Function (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Crop Type (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.2. Market Revenue and Forecast, by Function (2020-2032)

11.5.3. Market Revenue and Forecast, by Crop Type (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Function (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Crop Type (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Function (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Crop Type (2020-2032)

Chapter 12. Company Profiles

12.1. Bayer CropScience

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Syngenta AG

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Monsanto Company.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Italpollina S.p.A.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Koppert Biological Systems

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Incotec

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Plant Health Care plc

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Precision Laboratories, LLC

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Verdesian Life Sciences

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Valent Biosciences LLC

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others