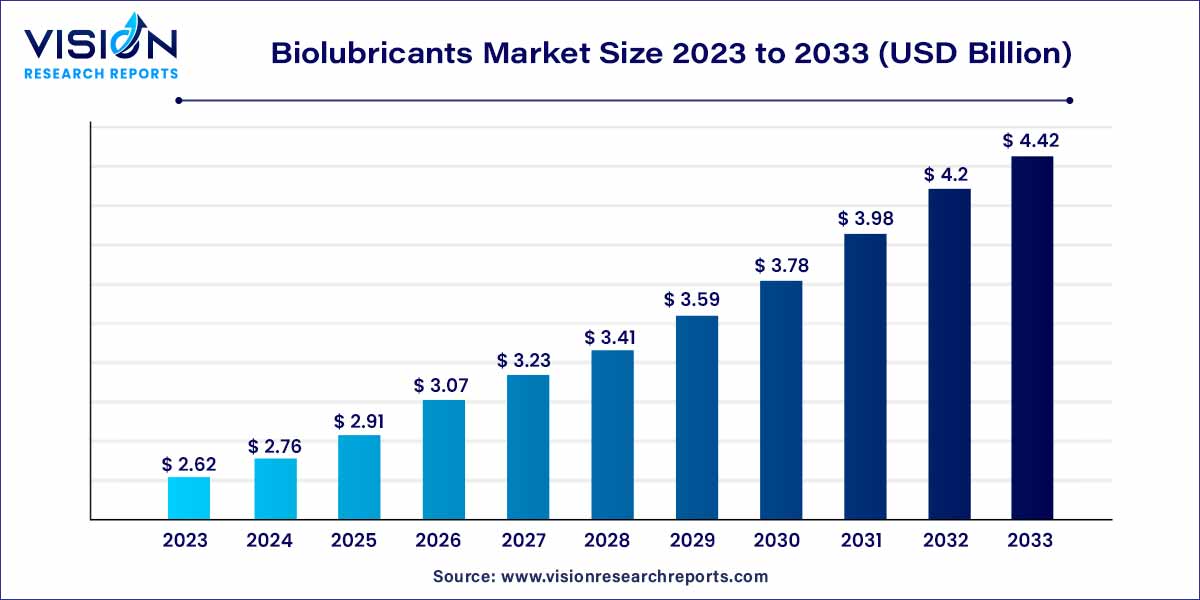

The global biolubricants market size was estimated at around USD 2.62 billion in 2023 and it is projected to hit around USD 4.42 billion by 2033, growing at a CAGR of 5.36% from 2024 to 2033. The biolubricants market is driven by an increasing environmental awareness, favourable growth in a variety of industrial applications, ongoing advancements in technology and manufacturing processes, investments in R&D activities, emphasis on green Initiatives, and increasing awareness and demand for bio-based products.

The global biolubricants market has witnessed substantial growth in recent years, propelled by an increasing emphasis on sustainable and eco-friendly solutions across various industries. Biolubricants, derived from renewable sources such as vegetable oils and animal fats, have emerged as a viable alternative to conventional petroleum-based lubricants. This paradigm shift is driven by a growing awareness of environmental issues and a collective effort to adopt greener practices in industrial and commercial applications.

The growth of the biolubricants market is underpinned by several key factors. Firstly, a heightened focus on environmental sustainability across industries has led to an increased demand for eco-friendly alternatives, positioning biolubricants as a compelling choice. Derived from renewable resources such as vegetable oils and animal fats, these lubricants contribute to a reduced carbon footprint, aligning with global efforts toward a more sustainable future. The inherent biodegradability and lower toxicity of biolubricants further enhance their appeal, particularly in applications where environmental safety is paramount. Additionally, ongoing research and development initiatives aimed at improving the performance characteristics of biolubricants, including thermal stability and oxidation resistance, are driving innovation in the market. As regulatory frameworks increasingly favor sustainable practices, the biolubricants sector is poised for continued growth, with partnerships, collaborations, and advancements in feedstock development further contributing to its expansion.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 4.42 billion |

| Growth Rate from 2024 to 2033 | CAGR of 5.36% |

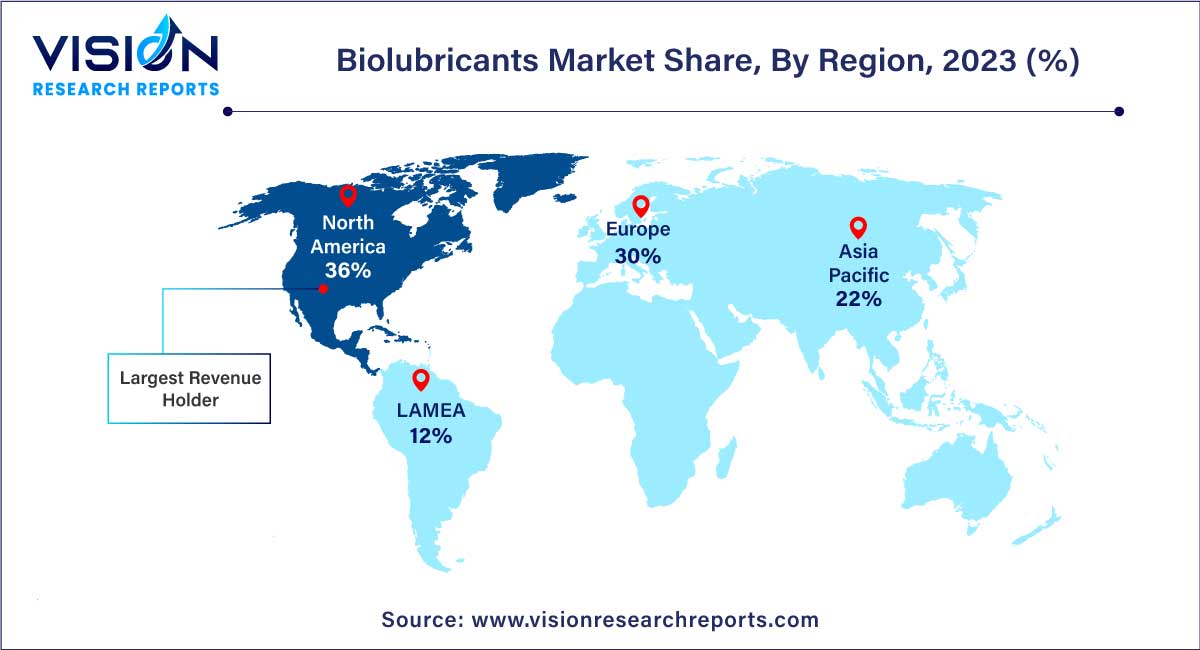

| Revenue Share of North America in 2023 | 36% |

| CAGR of Asia Pacific from 2024 to 2033 | 5.68% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Biolubricants Market Drivers

Biolubricants Market Restraints

Biolubricants Market Opportunities

The vegetable oil category dominated the revenue landscape with a substantial 90% share in 2023. Biolubricants sourced from vegetable oils and animal fats are gaining considerable popularity, primarily owing to their eco-friendly attributes and widespread acceptance. Industries are increasingly embracing these lubricants for their recognized positive impact on the environment. Vegetable oils, in particular, exhibit exceptional lubricity, surpassing that of mineral oil, and boast additional properties such as a high viscosity index and a high flash point.

The animal oil sector is anticipated to register a fastest CAGR of 3.25% over the forecast period. Derived from renewable sources, such as rendered fats or oils from animal byproducts, animal oil emerges as an environmentally sustainable choice for biolubricants. Opting for animal oil contributes to reducing reliance on non-renewable resources. Biolubricants based on animal oil demonstrate commendable lubricating properties, ensuring compatibility with diverse applications and equipment. They stand out for their ability to deliver effective lubrication, protection, and durability, thereby promoting optimal performance and curbing maintenance requirements.

The transportation sector secured the highest revenue share of 63% in 2023. Among the various components within this sector, automotive engine oils reign supreme, surpassing the performance benchmarks set by conventional engine oils. Bio-based engine oils, in particular, exhibit a superior inherent biodegradation rate, low toxicity to aquatic organisms, and minimal bioaccumulation, factors that contribute to their increasing adoption in the automotive industry.

Transmission fluids also play a pivotal role in the biolubricants market, serving as key components for enhancing brake band friction, valve operation, gear lubrication, and torque conversion. Additionally, these fluids find utility as hydraulic fluids and lubricants in power steering and 4WD transfer cases, indicating a broad spectrum of applications. The heightened use of transmission fluids in automotive manufacturing is anticipated to positively influence market growth.

In the industrial segment, a robust CAGR of 4.85% over the forecast period. Notably, process oils constitute a substantial portion of this segment, finding extensive use in technical and chemical industries to enhance production processes. The increasing demand for specialty chemicals, particularly in the emerging economies of the Asia Pacific region, is expected to be a driving force behind the heightened consumption of these oils.

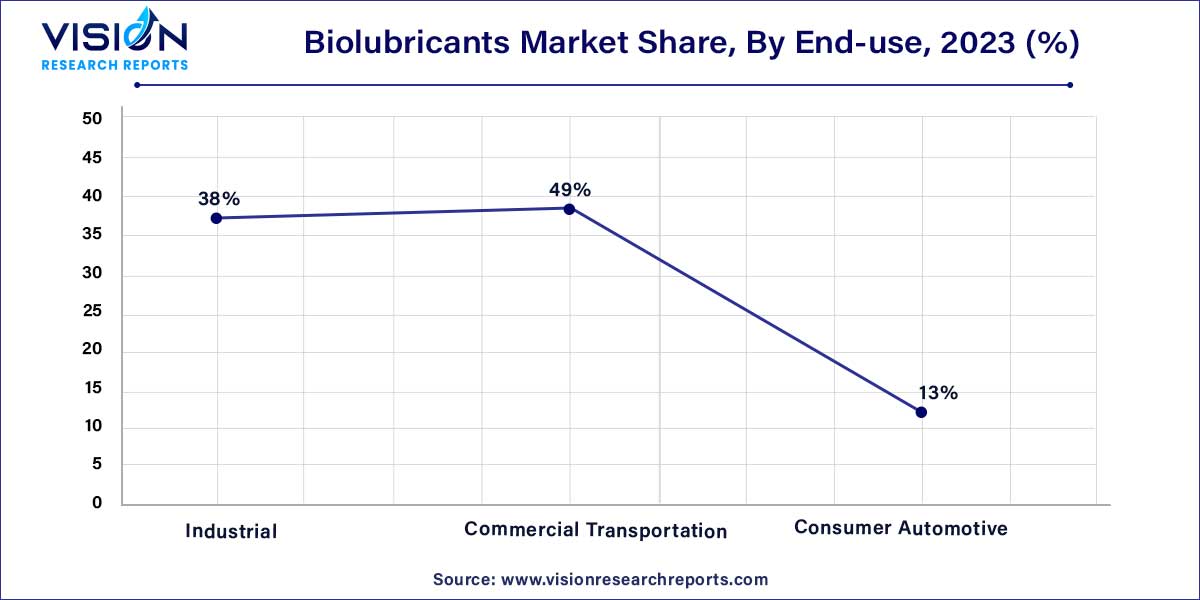

The commercial transportation sector held the largest revenue share of 49% in 2023, driven by a heightened awareness of fuel efficiency and maintenance practices in both heavy and light-duty trucks. The direct correlation between vehicle quality improvement and a reduction in the environmental impact of these vehicles has significantly elevated the popularity of biolubricants within this segment.

The consumer automotive segment is anticipated to experience the fastest CAGR of 4.98% during the forecast period, the consumer automotive segment is propelled by the escalating sales of passenger cars in emerging economies. In response to fuel efficiency regulations, consumers are increasingly investing in advanced technologies and performance-enhancing products. Moreover, private sector investments and initiatives by numerous automobile companies to manufacture ultra-low emission vehicles, aligning with evolving regulatory standards, are poised to further drive the demand for biolubricants in the foreseeable future.

North America dominated the market with the largest market share of 36% in 2023. This was propelled by a resurgence in the automotive industry in the United States and Canada. Moreover, increased regulatory oversight from the U.S. government, specifying a minimum renewable content for various products, is anticipated to stimulate the consumption of bio-based lubricants in the region.

The U.S. Air Force's endorsement of plant-derived biodegradable products, as part of a strategic and fundamental approach to national security, serves as an additional driving force for the market in North America. The region is poised to benefit from the ample availability of soybean and rapeseed feedstock, owing to the high production of biodiesel in the area. These factors collectively position North America as a significant player in the biolubricants market, with a positive outlook for continued growth.

Asia Pacific is expected to expand at the highest CAGR of 5.68% during the forecast period. This region hosts some of the largest automobile manufacturing hubs globally, with countries like China, India, Indonesia, and Southeast Asia playing pivotal roles. The automotive industry in these nations is experiencing significant expansion, marked by an increasing focus on manufacturing and exporting passenger cars and other vehicles to developed regions. This growth trajectory positions Asia Pacific as a key player in the biolubricants market, with the potential for substantial contributions to industry advancements and market dynamics.

By Source

By End-Use

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Source Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Biolubricants Market

5.1. COVID-19 Landscape: Biolubricants Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Biolubricants Market, By Source

8.1. Biolubricants Market, by Source, 2024-2033

8.1.1 Vegetable Oil

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Animal Oil

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Biolubricants Market, By End-Use

9.1. Biolubricants Market, by End-Use, 2024-2033

9.1.1. Industrial

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Commercial Transportation

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Consumer Automotive

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Biolubricants Market, By Application

10.1. Biolubricants Market, by Application, 2024-2033

10.1.1. Transportation

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Industrial

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Biolubricants Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Source (2021-2033)

11.1.2. Market Revenue and Forecast, by End-Use (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Source (2021-2033)

11.1.4.2. Market Revenue and Forecast, by End-Use (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Source (2021-2033)

11.1.5.2. Market Revenue and Forecast, by End-Use (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Source (2021-2033)

11.2.2. Market Revenue and Forecast, by End-Use (2021-2033)

11.2.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Source (2021-2033)

11.2.4.2. Market Revenue and Forecast, by End-Use (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Source (2021-2033)

11.2.5.2. Market Revenue and Forecast, by End-Use (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Source (2021-2033)

11.2.6.2. Market Revenue and Forecast, by End-Use (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Source (2021-2033)

11.2.7.2. Market Revenue and Forecast, by End-Use (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Source (2021-2033)

11.3.2. Market Revenue and Forecast, by End-Use (2021-2033)

11.3.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Source (2021-2033)

11.3.4.2. Market Revenue and Forecast, by End-Use (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Source (2021-2033)

11.3.5.2. Market Revenue and Forecast, by End-Use (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Source (2021-2033)

11.3.6.2. Market Revenue and Forecast, by End-Use (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Source (2021-2033)

11.3.7.2. Market Revenue and Forecast, by End-Use (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Source (2021-2033)

11.4.2. Market Revenue and Forecast, by End-Use (2021-2033)

11.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Source (2021-2033)

11.4.4.2. Market Revenue and Forecast, by End-Use (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Source (2021-2033)

11.4.5.2. Market Revenue and Forecast, by End-Use (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Source (2021-2033)

11.4.6.2. Market Revenue and Forecast, by End-Use (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Source (2021-2033)

11.4.7.2. Market Revenue and Forecast, by End-Use (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Source (2021-2033)

11.5.2. Market Revenue and Forecast, by End-Use (2021-2033)

11.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Source (2021-2033)

11.5.4.2. Market Revenue and Forecast, by End-Use (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Source (2021-2033)

11.5.5.2. Market Revenue and Forecast, by End-Use (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. TotalEnergies.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Exxon Mobil Corporation.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Shell plc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. CASTROL LIMITED.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. PETRONAS Lubricants International.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Kluber Lubrication

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Emery Oleochemicals.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Chevron Corporation

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Albemarle Corporation.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. FUCHS

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others