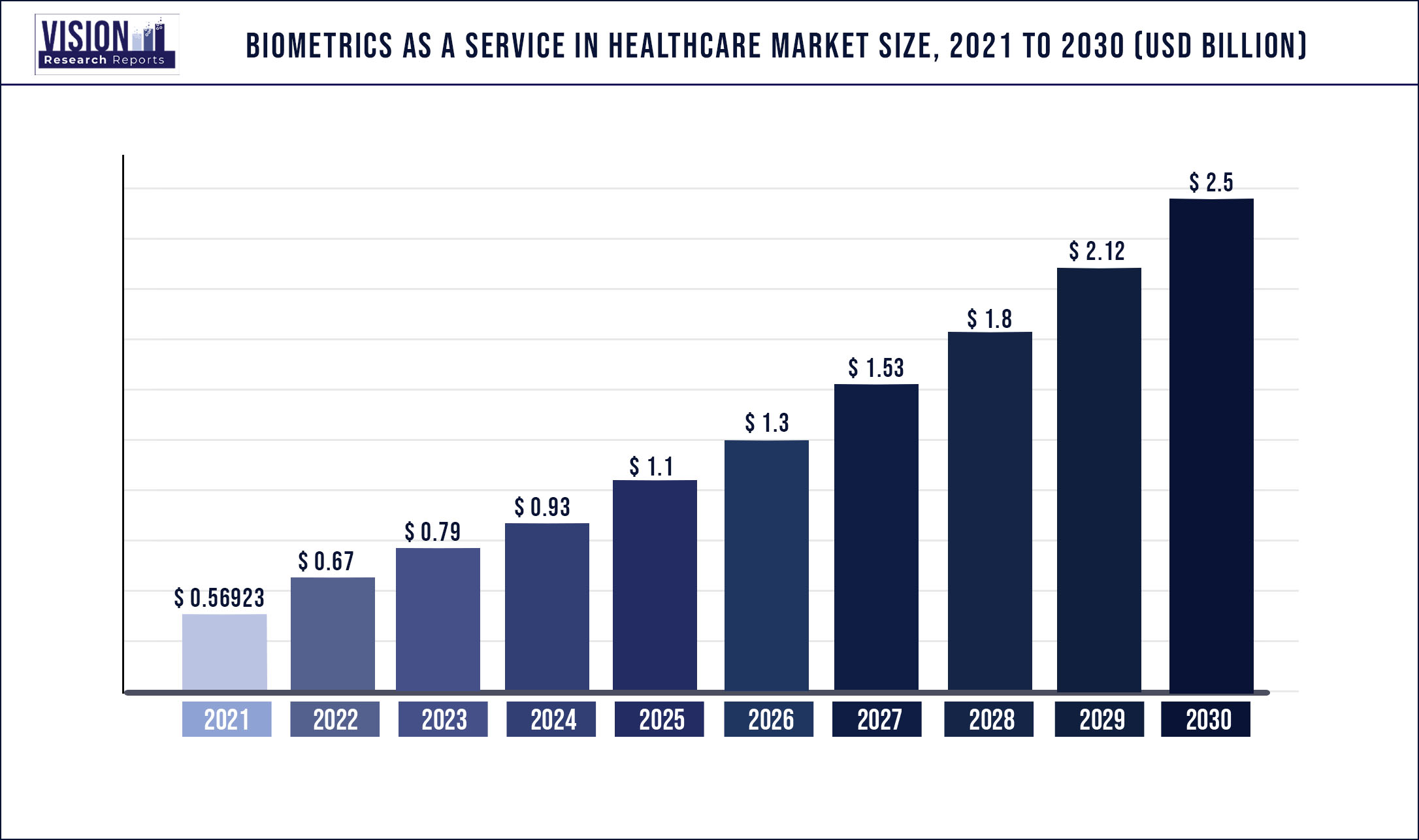

The global biometrics as a service in healthcare market was surpassed at USD 569.23 million in 2021 and is expected to hit around USD 2.5 billion by 2030, growing at a CAGR of 17.87% from 2022 to 2030.

Report Highlights

The market is propelled by the increasing adoption of biometrics across healthcare organizations due to its cost-effectiveness, ease of deployment, and data security management. The demand for biometrics as a service in healthcare is expected to constantly rise as healthcare organizations are realizing the need to digitize their operations and move on from the traditional method of patient record management.

Biometrics as a service helps healthcare organizations integrate their operations and services with cloud technology and also modify these services according to their convenience. An increase in the number of cyber-attacks and medical data theft has been one of the driving factors in the market. Although, the privacy of the biometric data being stored on the cloud is a rising concern, especially in the case of public cloud deployment.

The adoption of biometrics as a service increased significantly during the COVID-19 pandemic. The spread of the COVID virus was a constant risk to patients and healthcare professionals during the pandemic. Hence, the use of contactless biometrics gained popularity in a rush to contain the spread of and secure healthcare premises. Consumer apps, surveillance, remote access, and pharmacy dispensing are some of the major healthcare tools integrated into cloud-based biometrics. As a result of limitations to physical interactions, many of the patients require remote treatment/monitoring. This resulted in the adoption of biometric solutions for remote identification on a large scale.

The biometric system can supplement the user's verification to healthcare IT frameworks (online and local) and support the institution's Identity and Access Management (IAM) strategies. User verification concerning fast identity online (FIDO) specifications gives a lot less complex and far more secure system, than password-based verification, and is structured given privacy compliance for scalable and open frameworks across sites and applications.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 569.23 million |

| Revenue Forecast by 2030 | USD 2.5 billion |

| Growth rate from 2022 to 2030 | CAGR of 17.87% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Type, application, scanner type, region |

| Companies Covered |

Thales,Fujitsu,Aware, Inc.,BIO-key International,MorphoTrust USA,NextGate, Imprivata, Inc.,Suprema,Imageware,M2SYS Technology |

Type Insights

Based on type, the market is segmented into unimodal and multimodal. The multimodal segment dominated the market with the largest market share of 54.92% in 2021, as multimodal biometric systems reduce data distortion, it is cost-effective and more accurate than unimodal ones. The demand for multimodal systems is increasing as multimodal biometric systems are extremely difficult to replicate. Even if one biometric identification is compromised, the individual can be authenticated using the other biometric identifier.

The multimodal segment is also expected to witness the fastest growth with a CAGR of 18.24% during the forecast period. Multimodal biometrics has a significantly greater verification rate as compared to unimodal biometrics and hence is more popular among healthcare organizations. Multimodal biometrics uses a combination of two identification traits, for example, fingerprint and face or fingerprint and iris. This increases the accuracy and performance of the identification process.

Application Insights

Based on application, the mobile application segment held the dominant share of over 41.13% in 2021 and is also expected to witness the fastest growth during the forecast period with a CAGR of 19.44% from 2022 to 2030. The rising need for appropriate authentication techniques in mobiles is driving the mobile application segment in the market. Additionally, the increasing frequency of cyber-attacks is also expected to the expansion of the mobile biometric business.

The industrial convergence on developing biometric intelligence in mobile devices is driving the mobile application segment various companies have launched biometrics-enabled phones in the past few years. Moreover, government initiatives for biometric adoption, the introduction of e-passports, an increase in mobile transactions, and a growing number of smartphone suppliers choosing biometric capabilities are factors fueling the growth of the segment.

Scanner Type Insights

Based on scanner type, the market is segmented into fingerprint recognition, iris recognition, palm recognition, facial recognition, voice recognition, and others. The fingerprint recognition segment held the largest market share of 49.55% in 2021. The need for a highly accurate and dependable technique for securing important healthcare information and preventing mistakes that might mean the difference between life and death is driving the segment's growth. Fingerprints are the most accurate method of identification, as every individual has distinct sets of fingerprints. Fingerprint biometrics assists hospitals in meeting government rules such as the Health Insurance Portability and Accountability Act (HIPAA) and other legislation across the world that require the protection of patient privacy.

The facial recognition segment is expected to witness the fastest growth during the forecast period with a CAGR of 20.93% from 2022 to 2030. The demand for the segment is expected to increase in coming years as no physical contact is necessary, unlike fingerprint or other security methods, facial recognition provides an automated, rapid, and seamless verification experience. Favorable government initiatives are projected to have a positive impact on the segment's growth. Furthermore, facial recognition offers various applications in healthcare including attendance tracking, Patient check and check out, access control, Patient monitoring and diagnosis, security and surveillance, and Caretaking robots

Regional Insights

In 2021, North America dominated the market in terms of the revenue share of 48.73% owing to the growing adoption of biometrics as a service in healthcare across various verticals within the healthcare industry. Moreover, increased demand during COVID-19 accelerated the growth of the market. Furthermore, the increasing implementation of biometrics in different sectors such as homeland security, law, and military, among others, is driving market expansion in the U.S. Large-scale financed initiatives and staff access monitoring in buildings are driving revenue development in this region. Rapid development in online transactions, an increase in complex cyber-attacks, and high IT security spending are all important reasons driving this region's BaaS industry. In addition, the adoption of sophisticated biometrics in different IoT-based devices in this area has increased the demand for biometrics-as-a-service.

Asia Pacific is projected to witness a promising growth rate during the forecast period with a CAGR of 19.03% from 2022 to 2030. Increased terror risks and rising government expenditure on security are two main drivers driving access control solution sales in the Asia Pacific region. Furthermore, China's expanding economy produces a large need for security solutions. The development of the market in the APAC region is fueled by increasing cyber-attacks, as well as the difficulty of big and small enterprises in this region to manage and mitigate the risks connected with identity-related intrusions. A rise in government investments in biometric initiatives such as national ID cards and e-passports, as well as the development of smart cities and connected devices, are likely to impact the growth of the Asia-Pacific biometrics-as-a-service market.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Biometrics As A Service In Healthcare Market

5.1. COVID-19 Landscape: Biometrics As A Service In Healthcare Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Biometrics As A Service In Healthcare Market, By Type

8.1. Biometrics As A Service In Healthcare Market, by Type, 2022-2030

8.1.1 Unimodal

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Multimodal

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Biometrics As A Service In Healthcare Market, By Application

9.1. Biometrics As A Service In Healthcare Market, by Application, 2022-2030

9.1.1. Site Access Control

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Time Recording

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Mobile Application

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Web and Workplace

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Biometrics As A Service In Healthcare Market, By Scanner Type

10.1. Biometrics As A Service In Healthcare Market, by Scanner Type, 2022-2030

10.1.1. Fingerprint Recognition

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Iris Recognition

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Palm Recognition

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Facial Recognition

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Voice Recognition

10.1.5.1. Market Revenue and Forecast (2017-2030)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Biometrics As A Service In Healthcare Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.3. Market Revenue and Forecast, by Scanner Type (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.4.3. Market Revenue and Forecast, by Scanner Type (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Scanner Type (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.3. Market Revenue and Forecast, by Scanner Type (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.4.3. Market Revenue and Forecast, by Scanner Type (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Scanner Type (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Scanner Type (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Scanner Type (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.3. Market Revenue and Forecast, by Scanner Type (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.4.3. Market Revenue and Forecast, by Scanner Type (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Scanner Type (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Scanner Type (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Scanner Type (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.3. Market Revenue and Forecast, by Scanner Type (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.4.3. Market Revenue and Forecast, by Scanner Type (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Scanner Type (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Scanner Type (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Scanner Type (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.3. Market Revenue and Forecast, by Scanner Type (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.4.3. Market Revenue and Forecast, by Scanner Type (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Scanner Type (2017-2030)

Chapter 12. Company Profiles

12.1. Thales

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Fujitsu

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Aware, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. BIO-key International

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. MorphoTrust USA

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. NextGate, Imprivata, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Suprema

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Imageware

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. M2SYS Technology

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others