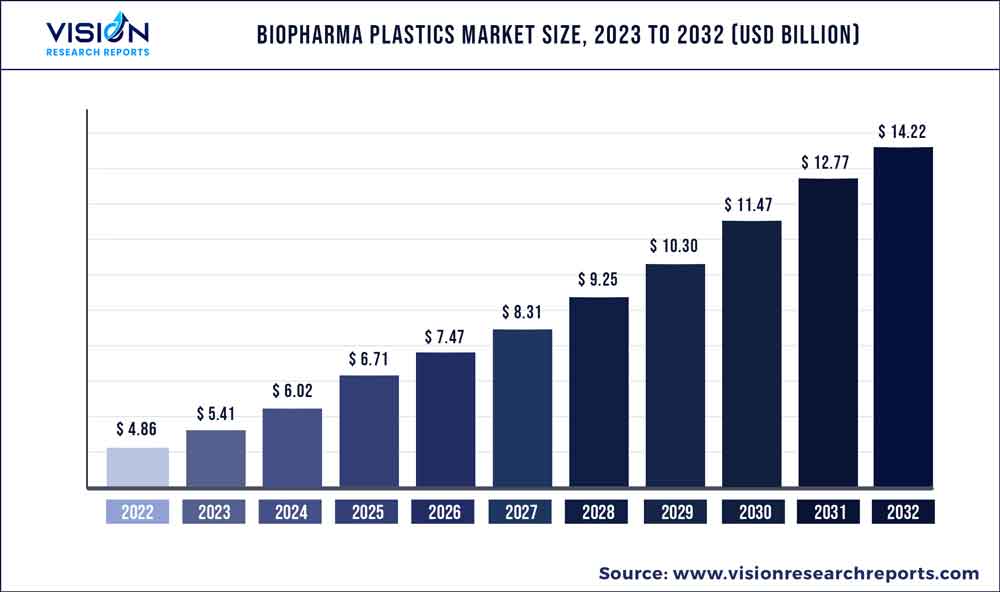

The global biopharma plastics market was estimated at USD 4.86 billion in 2022 and it is expected to surpass around USD 14.22 billion by 2032, poised to grow at a CAGR of 11.33% from 2023 to 2032. The biopharma plastics market in the United States was accounted for USD 448.5 million in 2022.

Key Pointers

Report Scope of the Biopharma Plastics Market

| Report Coverage | Details |

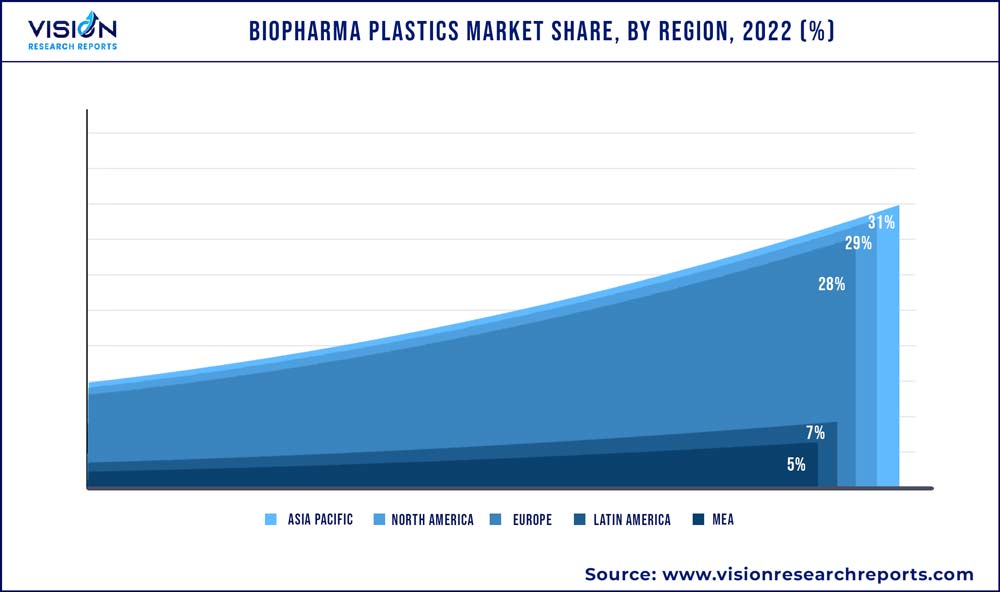

| Revenue Share of Asia Pacific in 2022 | 31% |

| CAGR of North America from 2023 to 2032 | 12% |

| Revenue Forecast by 2032 | USD 14.22 billion |

| Growth Rate from 2023 to 2032 | CAGR of 11.33% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | BASF SE; LyondellBasell Industries Holdings B.V.; SABIC; LG Chem; Toray Industries, Inc.; Solvay; Dow, Inc.; DuPont de Nemours, Inc.; Saint-Gobain Performance Plastics; Tekni-Plex; Chevron Phillips Chemical Co., LLC; Exxon Mobil Corporation; Formosa Plastics Corporation; Covestro AG; TEIJIN LIMITED; Mitsui & Co. Plastics Ltd.; INEOS Group; CHIMEI |

Factors such as the increase in global healthcare expenditure and increasing cases of cancer across the globe are expected to boost market growth during the forecast period. Biopharma plastics are widely utilized in the manufacturing of various healthcare products such as protective wear, containers, syringes, disposable connectors, and bioreactor bags owing to their properties including thermal stability, low chemical reactivity, and high resistivity. Due to their promising applications, polymer types such as polyethylene (PE), polypropylene (PP), acrylonitrile butadiene styrene (ABS), polyvinyl chloride (PVC), and polytetrafluoroethylene (PTFE) have witnessed a rise in the demand from the biopharma industry.To cater to the increasing growth in the healthcare industry, biopharma plastics are being utilized for providing higher stability to several applications including depth filters, syringes, and containers. The market offers opportunities for the usage of a variety of polymer types such as PP, PE, PET, PTFE, and ABS as these polymer types are used for manufacturing biopharma plastic components including personal equipment (PPE), face masks, gloves, and gowns.

The increasing per capita healthcare spending in the U.S. in the form of health insurance has been one of the major trends fueling the growth of the biopharma plastics market in North America as it is expected to augment the demand for generic drugs and biopharma plastic-based medical products in the region from 2022 to 2032.

Key initiatives such as the Affordable Care Act (ACA) and Medicaid undertaken by the U.S. government have provided a large percentage of the population to have access to effective and improved healthcare facilities and services. This has fueled demand for branded drugs, medical devices, and healthcare services in the U.S., thereby driving the consumption of biopharma plastics in the country for developing disposable medical connectors, syringes, depth filters, etc.

According to the American Cancer Society (ACS), breast cancer is the most common cancer that affects women in the U.S. It usually occurs in middle-aged and old women. The use of hormone therapy for the treatment of menopausal symptoms elevates estrogen levels in women. This is one of the major causes of breast cancer in women. Mastectomy performed to treat breast cancer is expected to result in a surged demand for biopharma plastic-based products such as syringes, valves, and medical disposable connectors. This, in turn, is expected to lead to the growth of the market for biopharma plastics in the U.S. in the coming years.

Polymer Type Insights

Polyvinyl chloride (PVC) dominated the global market and accounted for more than 22 % share of the overall revenue in 2022. Polyvinyl chloride can undergo many processes without breaking or cracking, which accounts for its multiple uses in the market. It is extremely flexible, resistant, and can easily withstand high temperatures, making it suitable for the production of syringes, disposable connectors, depth filters, and other applications of biopharma plastics.

Biopharma plastic polymers are used to provide a smooth durable finish having high resistance to UV and chemical exposure. Biopharma plastic polymers are also impressive for their oxidation resistance capacity, water-repellency with simultaneous vapor permeability, and outstanding mechanical properties. This ensures that the end product is durable, sustainable, and economical. The hydrophobic nature of biopharma polymers has led to the increased usage of biopharma plastics in protective wear in the healthcare industry.

Factors such as suitable demographics for production, increasing health concerns, and growth in healthcare expenditure are expected to drive the market for biopharma plastics along with polymers. Moreover, the presence of large-scale PP molding facilities and the manufacturing sector is projected to propel the market growth over the forecast period. Other polymer types such as polyethylene and polytetrafluoroethylene are mainly used in various applications owing to their properties such as gloss, durability, and detergent resistance. The aforementioned factors are likely to boost market growth over the forecast period.

Application Insights

Syringes dominated the market and accounted for more than 21% share in terms of revenue in 2022. Growth in the demand for prefilled syringes owing to their usage, convenience, low costs, minimal microbial contamination, low injection errors, and dilution errors is expected to boost the growth of the market.

Additionally, the surging adoption of advanced healthcare technologies, the growing production of large molecules, and the rising expenditure for the development of advanced healthcare facilities are fueling the growth. The growth of this segment can be attributed to the ease of usage and convenience offered by disposable biopharma plastic syringes.

The presence of well-developed healthcare infrastructure in various countries is also fueling the demand for these devices. This, in turn, is expected to have a positive impact on the demand for biopharma plastics used for developing different medical devices. In addition, the increasing demand for prefilled syringes owing to their usage convenience, low costs, minimal microbial contamination, low injection errors, and dilution errors is anticipated to contribute to the growth of the syringes segment of the biopharma plastics industry from 2023 to 2032.

Regional Insights

Asia Pacific dominated the market in 2022 and accounted for a revenue share of more than 31%. China led the market in 2022, in terms of both volume and revenue. The demand for high-quality biopharma plastic devices and components from hospitals is increasing in emerging economies such as China, India, and Japan on account of the rising population and expenditure on healthcare. This is boosting the market growth in the region.

North America is expected to register a CAGR of 12% in terms of revenue over the forecast period on account of a halt in the healthcare industry in this region. The U.S. has been spearheading the demand for biopharma plastics in this region. The presence of key manufacturers of biopharma plastics such as Celanese Corporation, Eastman Chemical Co., and DuPont can be regarded as one of the leading factors driving the market in the country.

Biopharma Plastics Market Segmentations:

By Polymer Type

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Biopharma Plastics Market

5.1. COVID-19 Landscape: Biopharma Plastics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Biopharma Plastics Market, By Polymer Type

8.1. Biopharma Plastics Market, by Polymer Type, 2023-2032

8.1.1. Polyethylene (PE)

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Polypropylene (PP)

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Acrylonitrile Butadiene Styrene (ABS)

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Polyethylene Terephthalate (PET)

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Polyvinyl Chloride (PVC)

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Polytetrafluoroethylene (PTFE)

8.1.6.1. Market Revenue and Forecast (2020-2032)

8.1.7. Polycarbonate (PC)

8.1.7.1. Market Revenue and Forecast (2020-2032)

8.1.8. Other

8.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Biopharma Plastics Market, By Application

9.1. Biopharma Plastics Market, by Application, 2023-2032

9.1.1. Protective Wear

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Containers

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Bioreactor Bags

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.3. Syringes

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.3. Depth Filters

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.3. Disposable Medical Connectors

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Biopharma Plastics Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Polymer Type (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Polymer Type (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Polymer Type (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Polymer Type (2020-2032)

10.2.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Polymer Type (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Polymer Type (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Polymer Type (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Polymer Type (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Polymer Type (2020-2032)

10.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Polymer Type (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Polymer Type (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Polymer Type (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Polymer Type (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Polymer Type (2020-2032)

10.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Polymer Type (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Polymer Type (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Polymer Type (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Polymer Type (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Polymer Type (2020-2032)

10.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Polymer Type (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Polymer Type (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. BASF SE

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. LyondellBasell Industries Holdings B.V.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. SABIC

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. LG Chem

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Toray Industries, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Solvay

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Dow, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. DuPont de Nemours, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Saint-Gobain Performance Plastics

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Tekni-Plex

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others