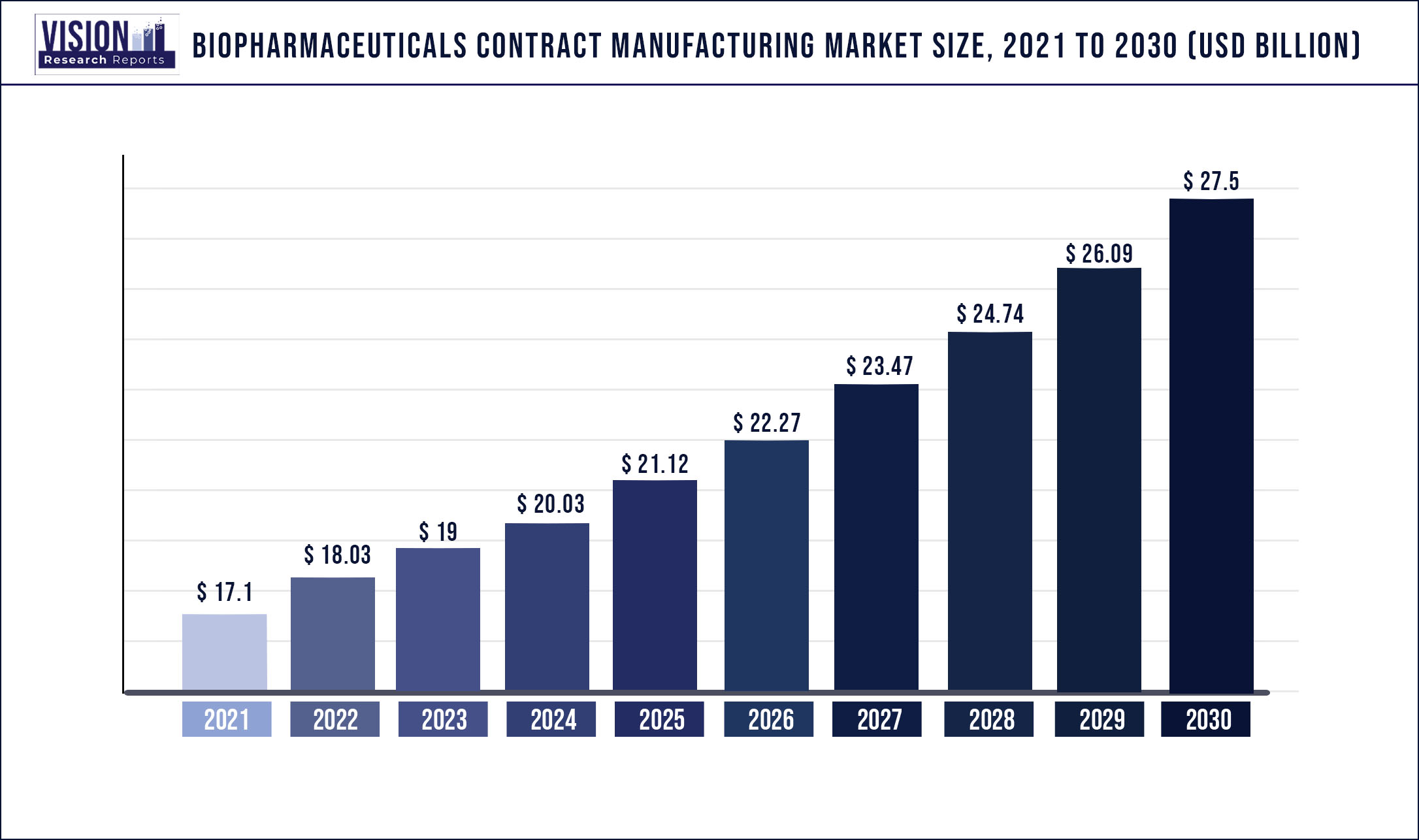

The global biopharmaceuticals contract manufacturing market was surpassed at USD 17.1 billion in 2021 and is expected to hit around USD 27.5 billion by 2030, growing at a CAGR of 5.42% from 2022 to 2030.

Report Highlights

Growing biopharmaceutical pipeline and lack of adequate manufacturing capabilities are two key factors that are driving partnership between large molecule manufacturers and Contract Manufacturing Organizations (CMOs). Contract manufacturers are engaged in broadening their service portfolio to meet the companies' demands with respect to regulatory standards and new services. The pandemic has, however, also had some negative knock-on effects as budgets and resources are diverted to “COVID products” at the expense of other biologics projects in development for other therapeutic areas.

The reliance of companies on CMOs for the production of biologics and biosimilars is expected to rise during the forecast period as a consequence of changes adopted by the CMOs. This is evident through growing investment in collaborations of companies with CMOs as well as continuous efforts taken up for expanding the service portfolio. The supply chain of biopharmaceuticals remained robust and was largely unaffected worldwide during the coronavirus outburst. Also, biopharmaceutical contract manufacturers are observing increased demand related to COVID-19 vaccine and therapeutics. Thus, the future holds numerous opportunities for the market. For instance, in 2020, AstraZeneca and Oxford Biomedica signed a one-year clinical and commercial supply agreement for the manufacturing of AstraZeneca’s COVID-19 vaccine candidate, AZD1222.

The future growth of the market is highly dependent on the promising opportunities offered by the biopharmaceutical industry, bioprocessing industry, and contract service industry. Expansion of fill-and-finish services and increasing robustness of venture capital investments for the life science sector are two important opportunities that are anticipated to drive the market. For instance, in 2019, Shanghai HaiHe Biopharma Co. Ltd. raised USD 146.6 million as venture capital for its large cancer drug portfolio, which it shall utilize along with its outsourcing partner Zhejiang Jiuzhou Pharmaceutical Co., Ltd.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 17.1 billion |

| Revenue Forecast by 2030 | USD 27.5 billion |

| Growth rate from 2022 to 2030 | CAGR of 5.42% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Source, service, product, region |

| Companies Covered | Boehringer Ingelheim GmbH; Lonza; Inno Biologics Sdn Bhd; Rentschler Biotechnologie GmbH; JRS Pharma; AGC Biologics; ProBioGen; Fujifilm Diosynth Biotechnologies U.S.A., Inc.; Toyobo Co., Ltd.; Samsung BioLogics; Thermo Fisher Scientific, Inc.; Binex Co., Ltd.; WuXi Biologics; AbbVie, Inc. |

Source Insights

The mammalian source segment led the market in 2021 and accounted for the highest share of 59.1%. Based on the source, the market is dived into mammalian and non-mammalian-based contract manufacturing. The intensive investigation that is being carried out on the usage of various sources and species for biopharmaceutical development is expected to drive market growth. The main objective of these investigations is to enhance the productivity and efficiency of biopharmaceutical manufacturing. Mammalian-based biomanufacturing contributed to a higher revenue share owing to the higher cost associated with obtaining products from these sources. Companies engaged in providing contract services using mammalian cell culture include AbbVie Contract Manufacturing, AMRI, Avid Bioservices, Boehringer Ingelheim Biopharmaceuticals Gmbh, and Catalent Pharma Solutions.

In addition to this, a major percentage of biopharmaceutical products that are in pipeline are mammalian expressed, hence expecting to maintain the dominance over the forecast period as well. Consequently, companies like Lonza and Charles River are making significant investments in the expansion of their mammalian cell culture manufacturing facilities for biologics and biosimilar development. For instance, in October 2017 Lonza acquired a clinical-stage mammalian manufacturing site in the United States from Shire plc. The plant is equipped with single-use bioreactors of 1,000L and 2,000L capacities, coupled with downstream purification capabilities.

Non-mammalian cell line -E. Coli is recognized as the widely adopted non-mammalian cell culture for biopharmaceutical production owing to its rapid access and cost-effective cultivation. The development of a transgenic non-mammalian expression system holds a great promise for the significant growth of this segment throughout the forecast period. Abbott Bioresearch, Avecia Biotechnology, BioReliance, Biovitrum AB, Dow Pharmaceutical, and Celltrion are a few companies working as CMOs using microbial cultures.

Service Insights

Process development services led the global market in 2021 and accounted for a share of about 33.2%. This is due to high capital expenditure in downstream processing. Moreover, downstream operations demand vigorous attention for final product recovery and purification steps to maintain product quality and prevent wastage. CMOs have provided biopharma players with a wide array of services ranging from cell cultivation to the final packaging of the product. The manufacturing services offered by CMOs are process development, fill & finish operations, analytical & QC studies, and packaging.

Process development services dominated in 2021 with respect to revenue with downstream processing leading the market. This is due to high capital expenditure in downstream processing. Moreover, downstream operations demand vigorous attention for final product recovery and purification steps, to maintain product quality and prevent wastage. With growing quality concerns and regulatory changes for biopharmaceutical development, analytical & QC studies are expected to grow lucratively during the forecast period. New regulations are being introduced for the production of biologics by CMOs in compliance with regulatory standards to maintain product purity and safety.

Product Insights

The biologics product segment led the market in 2021 with a share of over 81.06%. Contract manufacturers have played a vital role in the success of both biologics and biosimilars. This is majorly due to the huge commercial success of biologics, which is depicted through the presence of a large number of FDA-approved biologics in the market.

Among all the biologics, Monoclonal Antibodies (MAb) have captured the largest share in 2021. A high capital requirement for the construction of a MAb plant has accelerated the uptake of contract services for Mab production, thereby contributing to the major share of this segment.

However, biosimilars production is considered one of the key strategies for business expansion in comparison with biologics because investment in biosimilars manufacturing helps in the fast market reach of the biopharmaceuticals. Moreover, biosimilars have supported the biopharmaceutical CMO industry with respect to cost-saving advantages.

Regional Insights

With a high number of biomanufacturing facilities in the U.S., North America dominated with the largest revenue share of 34.2% in 2021. Furthermore, revenue from biopharmaceutical-based R&D activities held a major percentage of the total R&D carried out in various sectors in the U.S. Furthermore, interventions & conferences conducted in the region for pertinent technologies and issues in the application of biologics for the treatment of various chronic conditions are anticipated to positively influence regional growth.

However, Asian countries are expected to emerge as the attractive outsourcing location for the biomanufacturing of large molecules. Low manufacturing and operating cost offered by countries, like China & India, is one key factor driving the Asian market. Faster growth in the Korean market is expected to boost revenue generation from the APAC region.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Biopharmaceuticals Contract Manufacturing Market

5.1. COVID-19 Landscape: Biopharmaceuticals Contract Manufacturing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Biopharmaceuticals Contract Manufacturing Market, By Source

8.1. Biopharmaceuticals Contract Manufacturing Market, by Source, 2022-2030

8.1.1 Mammalian

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Non-mammalian

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Biopharmaceuticals Contract Manufacturing Market, By Service

9.1. Biopharmaceuticals Contract Manufacturing Market, by Service, 2022-2030

9.1.1. Process Development

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Fill & Finish Operations

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Analytical & QC studies

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Packaging

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Biopharmaceuticals Contract Manufacturing Market, By Product

10.1. Biopharmaceuticals Contract Manufacturing Market, by Product, 2022-2030

10.1.1. Biologics

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Biosimilars

10.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Biopharmaceuticals Contract Manufacturing Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Source (2017-2030)

11.1.2. Market Revenue and Forecast, by Service (2017-2030)

11.1.3. Market Revenue and Forecast, by Product (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Source (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Service (2017-2030)

11.1.4.3. Market Revenue and Forecast, by Product (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Source (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Service (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Product (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Source (2017-2030)

11.2.2. Market Revenue and Forecast, by Service (2017-2030)

11.2.3. Market Revenue and Forecast, by Product (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Source (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Service (2017-2030)

11.2.4.3. Market Revenue and Forecast, by Product (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Source (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Service (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Product (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Source (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Service (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Product (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Source (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Service (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Product (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Source (2017-2030)

11.3.2. Market Revenue and Forecast, by Service (2017-2030)

11.3.3. Market Revenue and Forecast, by Product (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Source (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Service (2017-2030)

11.3.4.3. Market Revenue and Forecast, by Product (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Source (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Service (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Product (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Source (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Service (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Product (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Source (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Service (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Product (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Source (2017-2030)

11.4.2. Market Revenue and Forecast, by Service (2017-2030)

11.4.3. Market Revenue and Forecast, by Product (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Source (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Service (2017-2030)

11.4.4.3. Market Revenue and Forecast, by Product (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Source (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Service (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Product (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Source (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Service (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Product (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Source (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Service (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Product (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Source (2017-2030)

11.5.2. Market Revenue and Forecast, by Service (2017-2030)

11.5.3. Market Revenue and Forecast, by Product (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Source (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Service (2017-2030)

11.5.4.3. Market Revenue and Forecast, by Product (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Source (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Service (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Product (2017-2030)

Chapter 12. Company Profiles

12.1. Boehringer Ingelheim GmbH

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Lonza

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Inno Biologics Sdn Bhd

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Rentschler Biotechnologie GmbH

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. JRS PHARMA

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. AGC Biologics

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. ProBioGen

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. FUJIFILM Diosynth Biotechnologies U.S.A., Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Toyobo Co. Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Samsung BioLogics

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others