The global bioplastic packaging market size was estimated at around USD 16.9 billion in 2023 and it is projected to hit around USD 80.81 billion by 2033, growing at a CAGR of 16.94% from 2024 to 2033.

The growth of the bioplastic packaging market is propelled by a confluence of factors that collectively contribute to its expanding influence. One primary driver is the escalating global awareness of environmental issues, prompting a shift towards sustainable practices. Consumers and businesses alike are increasingly prioritizing eco-friendly alternatives, driving demand for bioplastic packaging solutions. Stringent regulatory measures aimed at curbing the environmental impact of traditional plastics further accelerate this market's growth, fostering a favorable environment for the adoption of biodegradable, compostable, and bio-based plastics. Additionally, corporate sustainability initiatives play a pivotal role, with companies recognizing the importance of integrating environmentally responsible packaging into their operations. The continuous evolution of technology and the development of innovative materials contribute to the market's dynamism, offering new and improved bioplastic packaging solutions. As these growth factors intersect, the bioplastic packaging market emerges as a key player in shaping the future of sustainable packaging practices on a global scale.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 80.81 billion |

| Growth Rate from 2024 to 2033 | CAGR of 16.94% |

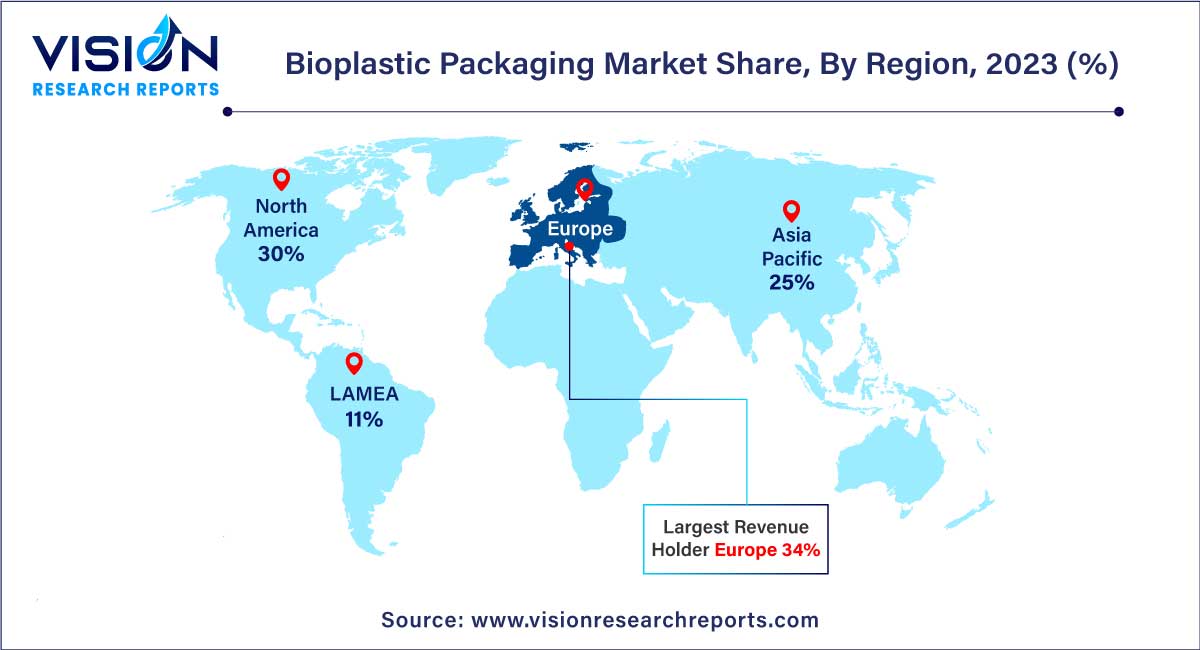

| Revenue Share of Europe in 2023 | 34% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Advancements in Bioplastic Technology:

Increased Investment in Bioplastic Production:

Collaborations and Partnerships:

Rising Popularity of Bio-Based Feedstocks:

Focus on Circular Economy:

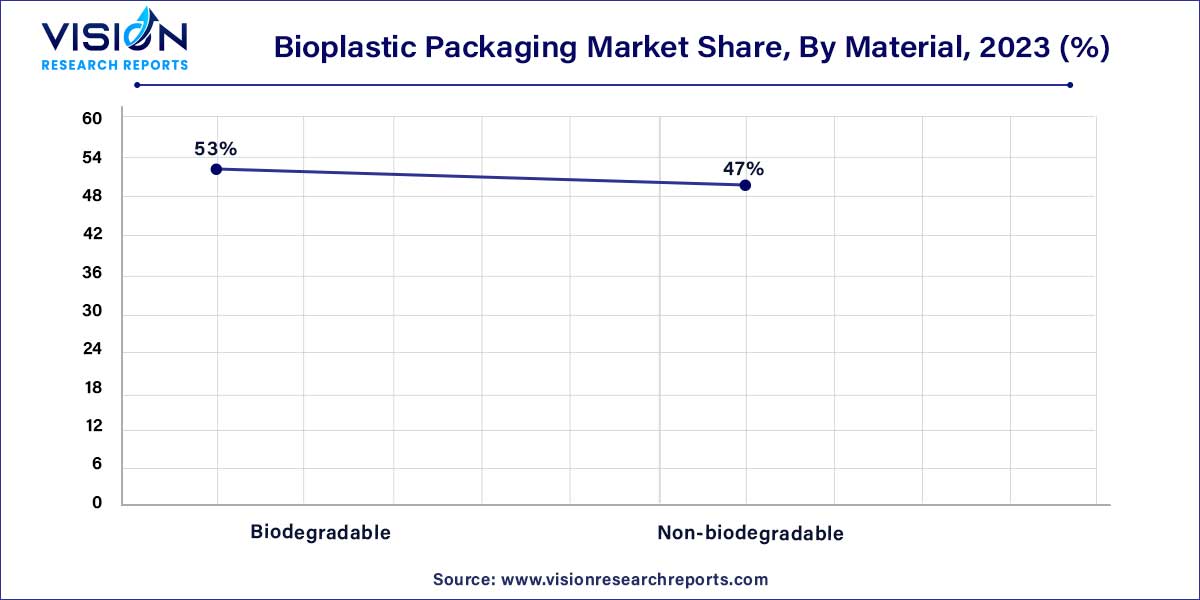

Based on material, the biodegradable held the largest revenue share of 53% in 2023, owing to the rising demand for bio-based plastics in various end-use industries, which is expected to drive their demand during the assessment period. Biodegradable plastics include polylactic acid, starch blends, PBAT, PBS, PHA, polycaprolactone, and cellulose acetate. Among them, starch blends and PBAT were the largest biodegradable product segment, in terms of revenue, in 2023.

Starch-based plastics are produced from widely available natural resources such as potato, tapioca, wheat, rice, and corn. The abundant availability of resources makes starch blends an ideal alternative to conventional plastics. However, polylactic acid (PLA) is poised to be the fastest-growing segment during the forecast period. The segment growth is anticipated to be driven by the growing product demand in various applications, including packaging, transportation, agriculture, electronics, and textiles.

Low carbon emission by polylactic acid as compared to conventional plastics is significantly fueling the demand for polylactic acid globally. For instance, producing 1 kg of polylactic acid releases approximately 0.5 kg of carbon footprint, whereas the production of conventional polycarbonate, polystyrene, polyethylene terephthalate, polypropylene, and low-density polyethylene releases 5.0 kg, 2.2 kg, 2.0 kg, 1.7 kg, and 1.7 kg carbon footprint, respectively.

Based on type, the flexible packaging segment commanded the largest share of 57% in 2023. Developments in the production of bioplastic technologies, the use of case-ready packaging, and improved packaging practices are anticipated to drive the demand for bioplastics in flexible packaging. Furthermore, the demand for flexible packaging is high, especially for snack foods and beverages.

The surge in demand can be attributed to technological improvements, lifestyle changes of consumers, modern retail trades, and the increasing popularity of quick-service restaurants. For example, consumers, particularly in North America and Europe, prefer packaging that is light and aesthetically appealing. This is likely to increase the use of bioplastic-based flexible packaging in the coming years.

Based on application, the food and beverages segment had the largest market share of 59% in 2023. The factors that drive the market are the rising demand for packaged food and the popularity of quick-service restaurants. The growing demand for packaged foods is anticipated to prompt manufacturers to increase production capacity, thereby augmenting the market for flexible packaging during the forecast period.

In addition, the rising prominence of nutritional food, along with the European Commission’s initiatives to regulate the use of polymers in food packaging applications, is projected to propel the growth of the bioplastic packaging market. Bioplastic packaging is widely utilized for manufacturing bottles, jars, and containers, as well as for fresh food packaging.

PLA plastic bottles are durable, disposable, and possess properties such as transparency and gloss. Polylactic acid can be easily composted compared to petroleum-based products and does not emit toxic gases on incineration. Thus, its demand in the food packaging segment is expected to remain significantly high during the forecast period.

The Europe region dominated the market with the largest market share of 34% in 2023. The region is further anticipated to witness substantial growth in the coming years, owing to the presence of stringent environment-friendly laws, and increasing environmental concerns among consumers.

In addition, government initiatives, such as the decision of the EU to minimize the overall consumption of single-use plastic products, are anticipated to propel the demand for bioplastics during the assessment period. In 2019, the members of the European Parliament voted to ban single-use plastic products such as cutlery and straws as part of a sweeping law against plastic waste that spoils beaches and pollutes oceans. The ban on single-use plastics is expected to come into effect in July 2022.

Bioplastics are broadly used in various essential applications such as refuge bags, shopping bags, loose packaging, agricultural mulch films, and bottles, among others. Approximately, 100 billion bags are used per year in the European Union. The general consumer acceptability of bioplastics is witnessing a rise across all European countries.

By Material

By Type

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Material Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Bioplastic Packaging Market

5.1. COVID-19 Landscape: Bioplastic Packaging Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Bioplastic Packaging Market, By Material

8.1. Bioplastic Packaging Market, by Material, 2024-2033

8.1.1 Biodegradable

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Non-biodegradable

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Bioplastic Packaging Market, By Type

9.1. Bioplastic Packaging Market, by Type, 2024-2033

9.1.1. Flexible

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Rigid

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Bioplastic Packaging Market, By Application

10.1. Bioplastic Packaging Market, by Application, 2024-2033

10.1.1. Food & Beverages

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Consumer Goods

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Cosmetic & Personal Care

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Pharmaceuticals

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Others

10.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Bioplastic Packaging Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Material (2021-2033)

11.1.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Material (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Material (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Material (2021-2033)

11.2.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Material (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Material (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Material (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Material (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Material (2021-2033)

11.3.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Material (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Material (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Material (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Material (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Material (2021-2033)

11.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Material (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Material (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Material (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Material (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Material (2021-2033)

11.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Material (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Material (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. Amcor Plc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Amcor Plc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. NatureWorks, LLC.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Coveris.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Sealed Air.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Alpha Packaging

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Constantia Flexibles.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Mondi

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Transcontinental Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. ALPLA

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others