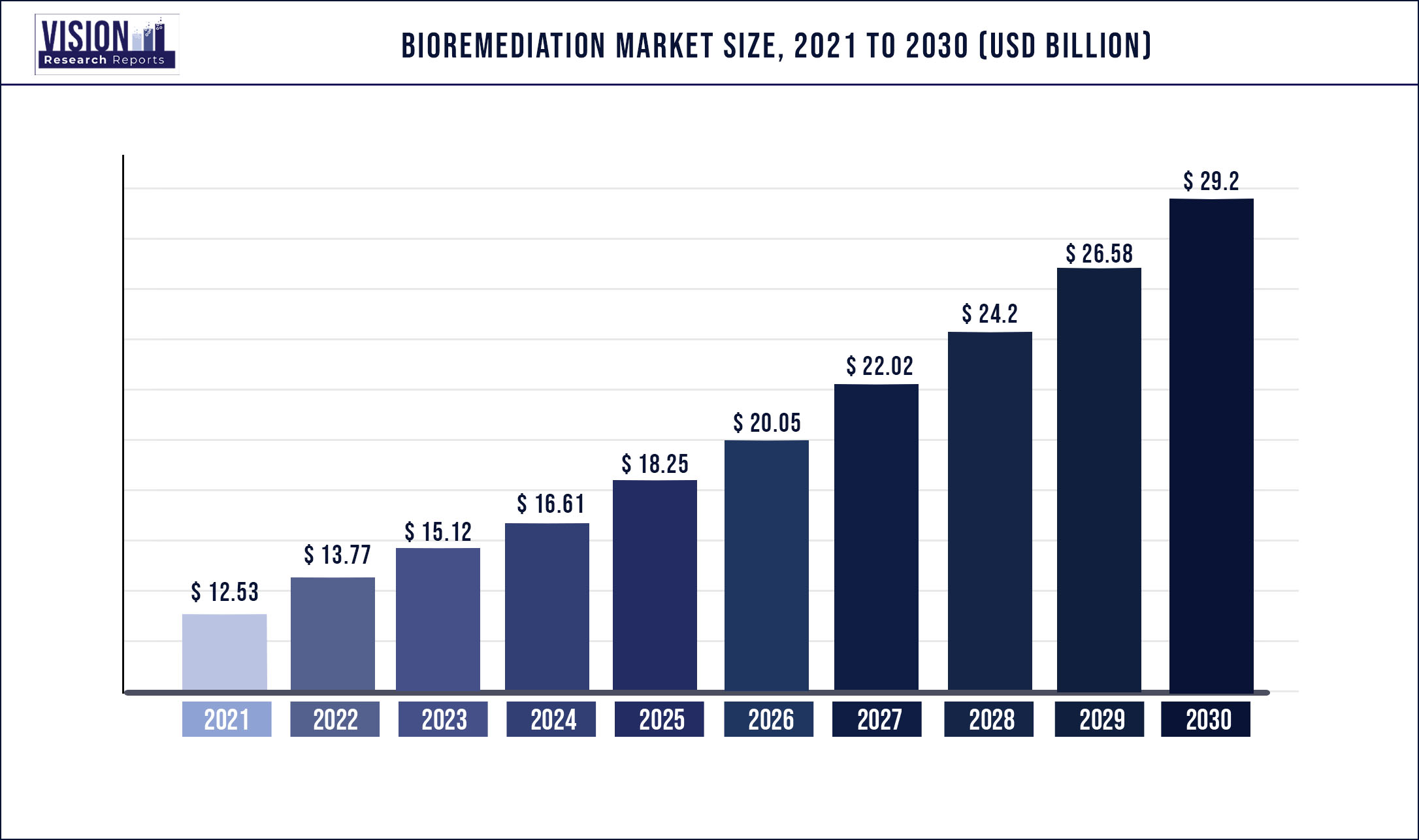

The global bioremediation market was surpassed at USD 12.53 billion in 2021 and is expected to hit around USD 29.2 billion by 2030, growing at a CAGR of 9.86% from 2022 to 2030

Report Highlights

Rapid growth in industrialization & increasing environmental deterioration, advancements in synthetic technologies, and increasing government support for bioremediation research and innovations are driving the market growth.Genome editing tools, such as CRISPR-Cas and TALEN, are facilitating metabolic engineering applications for the production of optimized enzymes and metabolic pathways that aid in the biodegradation process. Similarly, quorum sensing-based microbial interactions can be effectively used for designing gene circuits and microbial biosensors for the detection and degradation of persistent recalcitrant pollutants.

These factors can accelerate the adoption of bioremediation techniques and fuel market growth. Furthermore, synthetic biology also enables the designing of biological molecules with the desired chemical composition that can be used for the degradation of target contaminant molecules. Several enzyme modification approaches have been developed in this domain, such as enzyme immobilization, using magnetic nanoparticles, production of designer enzymes, and generation of single enzyme nanoparticles, among others. Therefore, the use of synthetic technology for utilizing the bio-degradative capabilities of enzymes is expected to drive the industry.In addition, government authorities are raising awareness about the implementation of bioremediation strategies to drive the adoption of the technique.

For instance, in June 2020, the Indian Government issued an advisory for the treatment and disposal of solid waste through the bioremediation process for reclamation of landfill sites. The advisory was directed toward Urban Local Bodies and signified the increasing attention drawn by bioremediation in the country.The COVID-19 pandemic has led to increased awareness about disinfection, sterilization, and remediation of contaminated areas in public spaces and homes. Furthermore, as the SARS-CoV-2 virus continues to undergo mutations, causing recurrent waves of infection cases around the globe, demand for bioremediation services for reducing the risk of contamination is expected to rise. Similarly, large quantities of Personal Protective Equipment (PPE) and face masks used have led to new challenges in the disposal and treatment of medical waste, which present new growth opportunities for bioremediation.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 12.53 billion |

| Revenue Forecast by 2030 | USD 29.2 billion |

| Growth rate from 2022 to 2030 | CAGR of 9.86% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Type, technology, service, region |

| Companies Covered | Newterra Ltd.; Sumas Remediation Service Inc.; Probiosphere, Inc.; Drylet, Inc.; Xylem, Inc; Regenesis Corporation; Aquatech International Corp.; Envirogen Technologies, Inc.; MicroGen Biotech Ltd.; Oil Spill Eater International Inc. |

Type Insights

The in-situ type segment dominated the industry in 2021 and accounted for the largest share of 56.2% of the global revenue. The technique refers to the treatment of contaminations at the original site without the need to excavate or pump out the contaminated materials. It involves the use of technologies, such as bio-venting, bio slurping, bio sparging, natural attenuation, and others. The technique can be controlled by the manipulation of factors, such as aeration, nutrient concentration, moisture content, etc., to enhance the activity of organisms and accelerate the degradation rate.

Hence, the method is highly suitable for applications, such as the treatment of groundwater with low contaminant concentrations, where oxygen availability can be increased by pumping air into the soil subsurface. On the other hand, ex-situ bioremediation involves the use of composting, landfarming, soil bio piles, and slurry reactors to treat the contaminated materials away from the original location. The technique is widely used for the treatment of contaminated soil for the removal of hydrocarbons. However, excavation of contaminated materials can lead to additional expenses in the remediation process, which can limit the growth of the segment.

Technology Insights

On the basis of technologies, the global market has been further categorized into bio stimulation, phytoremediation, bioreactors, fungal remediation, bioaugmentation, and land-based treatments. The phytoremediation segment accounted for the largest share of more than 30.06% of the global revenue in 2021. The demand for the technology is fuelled by its applications for the removal of heavy metals, radionuclides, organic contaminants, and pesticides with help of plants. It involves the use of techniques, such as rhizodegradation, rhizofiltration, phytovolatilization,phytoextraction, and phytostabilization, among others, for the treatment of pollutants.

The segment is anticipated to grow further due to the low costs of phytoremediation as compared to other technologies, and the ability to sustainably remove organic and inorganic pollutants from soil and water. Fungal remediation is expected to grow at the fastest CAGR during the forecast period as fungi can demonstrate a wide range of metabolic capacities and can tolerate high concentrations of polluting agents. Fungi represent a promising option for the degradation of recalcitrant pollutants by the production of a variety of intracellular and extracellular enzymes, such as cytochrome P450 and peroxidases, respectively. These factors are likely to accelerate the adoption of fungal remediation technologies in the near future.

Service Insights

The soil remediation segment dominated the market in 2021 and accounted for the maximum share of more than 38.9% of the global revenue. The service involves the removal of soil contaminants originating from sources, such as dumping of chemicals, improper waste disposal, pipe leaks & spills, and others. Demand for soil remediation is supported by the high extent of soil degradation caused by industrial pollutants, agrochemicals, and municipal waste. For instance, according to the United Nations, globally over 3.2 billion people are affected by the degradation of land and soils. As a result, the increasing need for soil remediation is expected to significantly contribute to market growth.

Oilfield remediation is projected to grow at the fastest CAGR over the forecast period due to the rapid expansion of the crude oil industry and the development of eco-friendly oilfield remediation options. Surging oil prices in recent months have led to high pressure for increasing oil production in countries, such as the U.S. Moreover, recent advancements in omics technologies, such as metagenomics & metatranscriptomics, have enabled the use of microbial-based oilfield remediation strategies. Similarly, the use of biosurfactants for increasing the bioavailability of oil constituents has accelerated the adoption of oilfield bioremediation activities.

Regional Insights

North America accounted for the largest share of more than 41.12% of the global revenue in 2021 due to the presence of sophisticated infrastructure, high industrial growth & waste production, and presence of key market players, such as Regenesis Corp., Probiosphere, Inc., and Xylem, Inc. In addition, the region hosts substantial research potential for bioremediation that is likely to drive advancements in technology and promote industry growth. For instance, a study published in the journal of Applied and Environmental Microbiology in September 2021, demonstrated the presence of marine bacteria in the Canadian Arctic region that are capable of degrading hydrocarbons, such as oil and diesel.

Asia Pacific, on the other hand, is estimated to grow at the fastest CAGR during the forecast period. This high growth can be attributed to the production of large quantities of hazardous waste due to the rising economic development and the increasing awareness about environmental protection in the APAC region. Furthermore, the region consists of a large population and relatively under-developed waste management systems in developing countries, such as Pakistan, Cambodia, and others. These factors can lead to a worsening of contamination issues and, thus, are anticipated to accelerate the industry growth.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Bioremediation Market

5.1. COVID-19 Landscape: Bioremediation Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Bioremediation Market, By Type

8.1. Bioremediation Market, by Type, 2022-2030

8.1.1 In Situ Bioremediation

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Ex Situ Bioremediation

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Bioremediation Market, By Technology

9.1. Bioremediation Market, by Technology, 2022-2030

9.1.1. Bio stimulation

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Phytoremediation

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Bioreactors

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Fungal Remediation

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Bioaugmentation

9.1.5.1. Market Revenue and Forecast (2017-2030)

9.1.6. Land-based Treatment

9.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Bioremediation Market, By Service

10.1. Bioremediation Market, by Service, 2022-2030

10.1.1. Soil Remediation

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Oilfield Remediation

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Wastewater Remediation

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Bioremediation Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.2. Market Revenue and Forecast, by Technology (2017-2030)

11.1.3. Market Revenue and Forecast, by Service (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.1.4.3. Market Revenue and Forecast, by Service (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Service (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.3. Market Revenue and Forecast, by Service (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.4.3. Market Revenue and Forecast, by Service (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Service (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Service (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Service (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.3. Market Revenue and Forecast, by Service (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.4.3. Market Revenue and Forecast, by Service (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Service (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Service (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Service (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.3. Market Revenue and Forecast, by Service (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.4.3. Market Revenue and Forecast, by Service (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Service (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Service (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Service (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.5.3. Market Revenue and Forecast, by Service (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.5.4.3. Market Revenue and Forecast, by Service (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Service (2017-2030)

Chapter 12. Company Profiles

12.1. Newterra Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Sumas Remediation Service, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Probiosphere, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Drylet, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Xylem, Inc

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Regenesis Corp.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Aquatech International Corp.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Envirogen Technologies, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. MicroGen Biotech Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Oil Spill Eater International, Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others