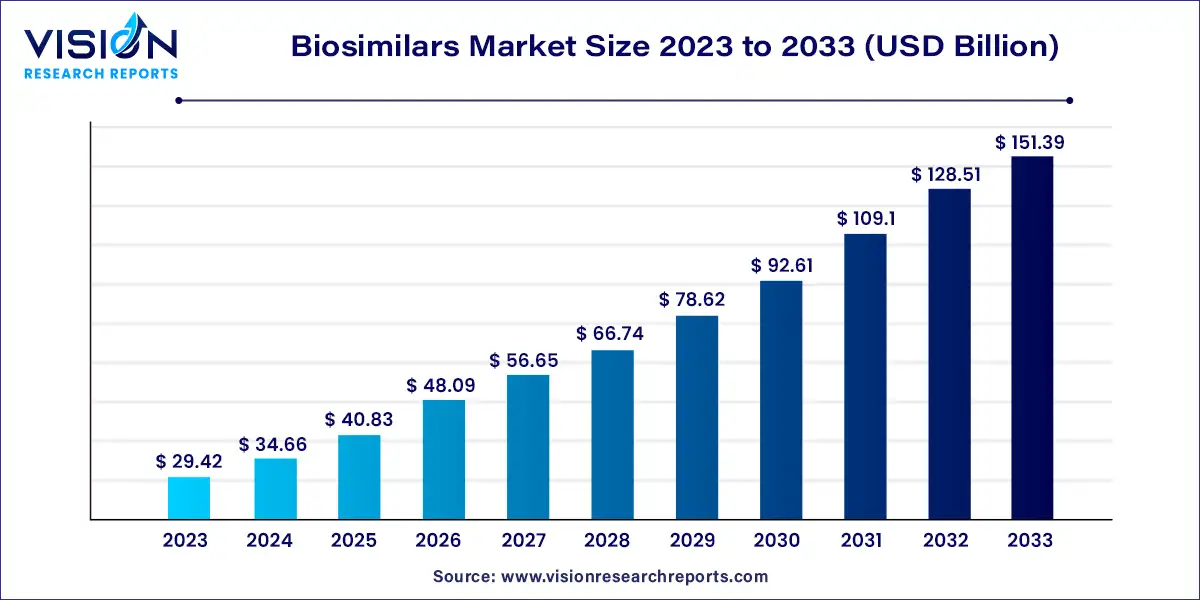

The global biosimilars market size was valued at USD 29.42 billion in 2023 and it is predicted to surpass around USD 151.39 billion by 2033 with a CAGR of 17.8% from 2024 to 2033. The biosimilars market is experiencing significant growth, driven by advancements in biotechnology and increasing healthcare needs. Biosimilars, which are highly similar to approved reference biologics, offer a cost-effective alternative and are becoming a crucial component of global healthcare strategies.

The biosimilars market is witnessing robust growth driven by the demand for cost-effective healthcare solutions, as biosimilars offer significant savings compared to their reference biologics. This cost advantage is particularly important in addressing the escalating global healthcare expenses. Additionally, the growing prevalence of chronic diseases such as cancer and diabetes fuels the need for biologic treatments, and as patents for major biologics expire, biosimilars provide a viable alternative. The supportive regulatory environment further accelerates market expansion, with regulatory agencies streamlining the approval processes for biosimilars. Advances in biotechnology and manufacturing techniques also contribute to the market's growth by enhancing the quality and production efficiency of biosimilars. Together, these factors create a favorable landscape for the continued expansion of the biosimilars market.

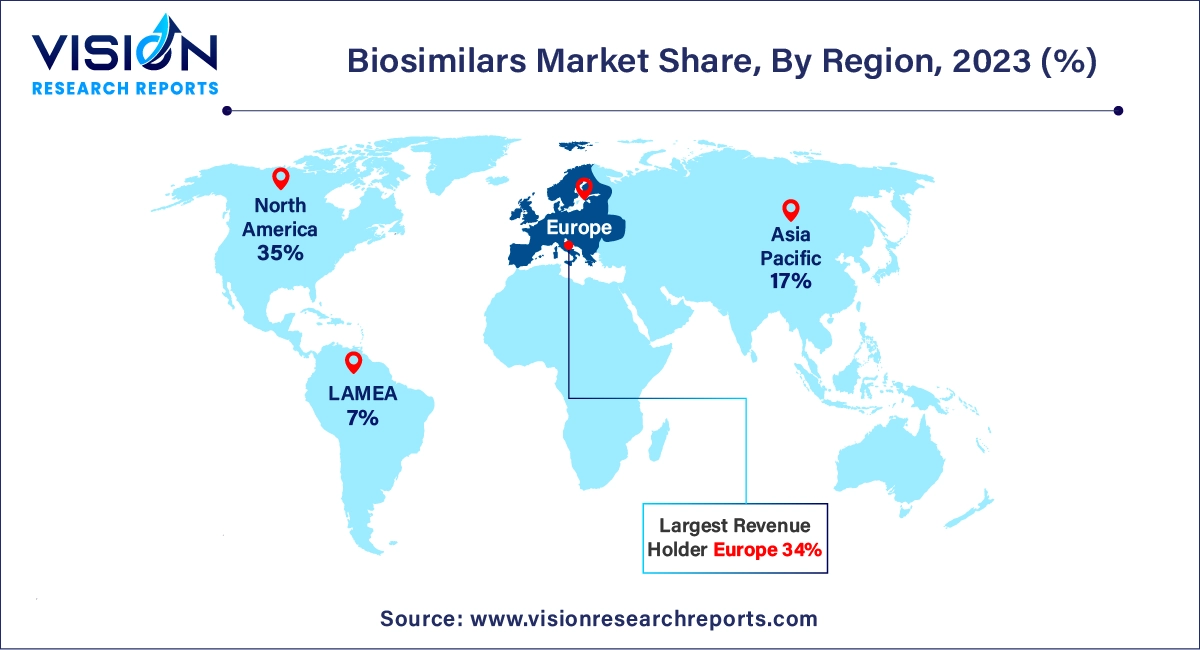

In 2023, Europe led the global market with the largest market share of 34% and is projected to maintain its leading position throughout the forecast period. This dominance is attributed to the increased adoption of biosimilars across the region and the proactive role of regulatory authorities. European regulators have implemented favorable changes to facilitate the approval of biosimilar drugs, further supporting market growth.

North America is expected to experience substantial growth during the forecast period. The growing acceptance of biosimilars and significant investments by numerous market players in research and development are anticipated to drive this growth. In 2020, the FDA approved around 20 biosimilars, including Pfizer’s Nyvepria, aimed at reducing infection rates. These developments are expected to boost the biosimilars market in North America.

In 2023, the monoclonal antibodies segment captured the largest revenue share. These antibodies are widely used for treating conditions such as cancer, rheumatoid arthritis, cardiovascular diseases, and multiple sclerosis. Their ability to target specific infected cells makes them particularly effective in cancer treatment, solidifying their position as the leading segment in the market.

The erythropoietin segment is anticipated to grow the fastest during the forecast period. Erythropoietin is crucial for stimulating red blood cell production in the bone marrow and is effective in treating anemia. The increasing incidence of kidney-related diseases is expected to drive growth in this segment.

The oncology segment was the largest revenue generator in the global biosimilars market in 2023 and is expected to continue leading throughout the forecast period. This dominance is due to the affordability of biosimilars for cancer treatment and the rising global incidence of cancer. According to the International Agency for Research on Cancer, there were approximately 19.3 million new cancer cases and 10 million cancer-related deaths globally in 2020. The prevalence of breast cancer, which accounted for 11.7% of new cases, followed by lung cancer at 11.4% and colorectal cancer at 10.0%, underscores the growing demand for biosimilars in oncology.

On the other hand, the growth hormonal deficiency segment is projected to be the fastest-growing. The increasing incidence of growth hormone deficiencies in children, with a reported 50% chance during pregnancy according to the National Organization for Rare Disorders, is expected to drive this segment’s growth.

By Product

By Application

By Manufacturer

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Biosimilars Market

5.1. COVID-19 Landscape: Biosimilars Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Biosimilars Market, By Product

8.1. Biosimilars Market, by Product

8.1.1 Monoclonal Antibodies

8.1.1.1. Market Revenue and Forecast

8.1.2. Somatropin

8.1.2.1. Market Revenue and Forecast

8.1.3. Insulin

8.1.3.1. Market Revenue and Forecast

8.1.4. Erythropoietin

8.1.4.1. Market Revenue and Forecast

8.1.5. Follitropin

8.1.5.1. Market Revenue and Forecast

8.1.6. Others

8.1.6.1. Market Revenue and Forecast

Chapter 9. Global Biosimilars Market, By Application

9.1. Biosimilars Market, by Application

9.1.1. Oncology

9.1.1.1. Market Revenue and Forecast

9.1.2. Growth Hormonal Deficiency

9.1.2.1. Market Revenue and Forecast

9.1.3. Blood Disorders

9.1.3.1. Market Revenue and Forecast

9.1.4. Chronic & Autoimmune Disorders

9.1.4.1. Market Revenue and Forecast

9.1.5. Infectious Disease

9.1.5.1. Market Revenue and Forecast

Chapter 10. Global Biosimilars Market, By Manufacturer

10.1. Biosimilars Market, by Manufacturer

10.1.1. Contract Research and Manufacturing Services

10.1.1.1. Market Revenue and Forecast

10.1.2. In-house

10.1.2.1. Market Revenue and Forecast

Chapter 11. Global Biosimilars Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product

11.1.2. Market Revenue and Forecast, by Application

11.1.3. Market Revenue and Forecast, by Manufacturer

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product

11.1.4.2. Market Revenue and Forecast, by Application

11.1.4.3. Market Revenue and Forecast, by Manufacturer

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product

11.1.5.2. Market Revenue and Forecast, by Application

11.1.5.3. Market Revenue and Forecast, by Manufacturer

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product

11.2.2. Market Revenue and Forecast, by Application

11.2.3. Market Revenue and Forecast, by Manufacturer

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product

11.2.4.2. Market Revenue and Forecast, by Application

11.2.4.3. Market Revenue and Forecast, by Manufacturer

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product

11.2.5.2. Market Revenue and Forecast, by Application

11.2.5.3. Market Revenue and Forecast, by Manufacturer

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product

11.2.6.2. Market Revenue and Forecast, by Application

11.2.6.3. Market Revenue and Forecast, by Manufacturer

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product

11.2.7.2. Market Revenue and Forecast, by Application

11.2.7.3. Market Revenue and Forecast, by Manufacturer

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product

11.3.2. Market Revenue and Forecast, by Application

11.3.3. Market Revenue and Forecast, by Manufacturer

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product

11.3.4.2. Market Revenue and Forecast, by Application

11.3.4.3. Market Revenue and Forecast, by Manufacturer

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product

11.3.5.2. Market Revenue and Forecast, by Application

11.3.5.3. Market Revenue and Forecast, by Manufacturer

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product

11.3.6.2. Market Revenue and Forecast, by Application

11.3.6.3. Market Revenue and Forecast, by Manufacturer

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product

11.3.7.2. Market Revenue and Forecast, by Application

11.3.7.3. Market Revenue and Forecast, by Manufacturer

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product

11.4.2. Market Revenue and Forecast, by Application

11.4.3. Market Revenue and Forecast, by Manufacturer

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product

11.4.4.2. Market Revenue and Forecast, by Application

11.4.4.3. Market Revenue and Forecast, by Manufacturer

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product

11.4.5.2. Market Revenue and Forecast, by Application

11.4.5.3. Market Revenue and Forecast, by Manufacturer

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product

11.4.6.2. Market Revenue and Forecast, by Application

11.4.6.3. Market Revenue and Forecast, by Manufacturer

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product

11.4.7.2. Market Revenue and Forecast, by Application

11.4.7.3. Market Revenue and Forecast, by Manufacturer

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product

11.5.2. Market Revenue and Forecast, by Application

11.5.3. Market Revenue and Forecast, by Manufacturer

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product

11.5.4.2. Market Revenue and Forecast, by Application

11.5.4.3. Market Revenue and Forecast, by Manufacturer

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product

11.5.5.2. Market Revenue and Forecast, by Application

11.5.5.3. Market Revenue and Forecast, by Manufacturer

Chapter 12. Company Profiles

12.1. Novartis.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Synthon Pharmaceuticals, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. TevaPharmaceutical Industries Ltd.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. LG Life Sciences.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Celltrion.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Biocon

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Hospira.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Merck Serono

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Biogen idec, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Genentech

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others