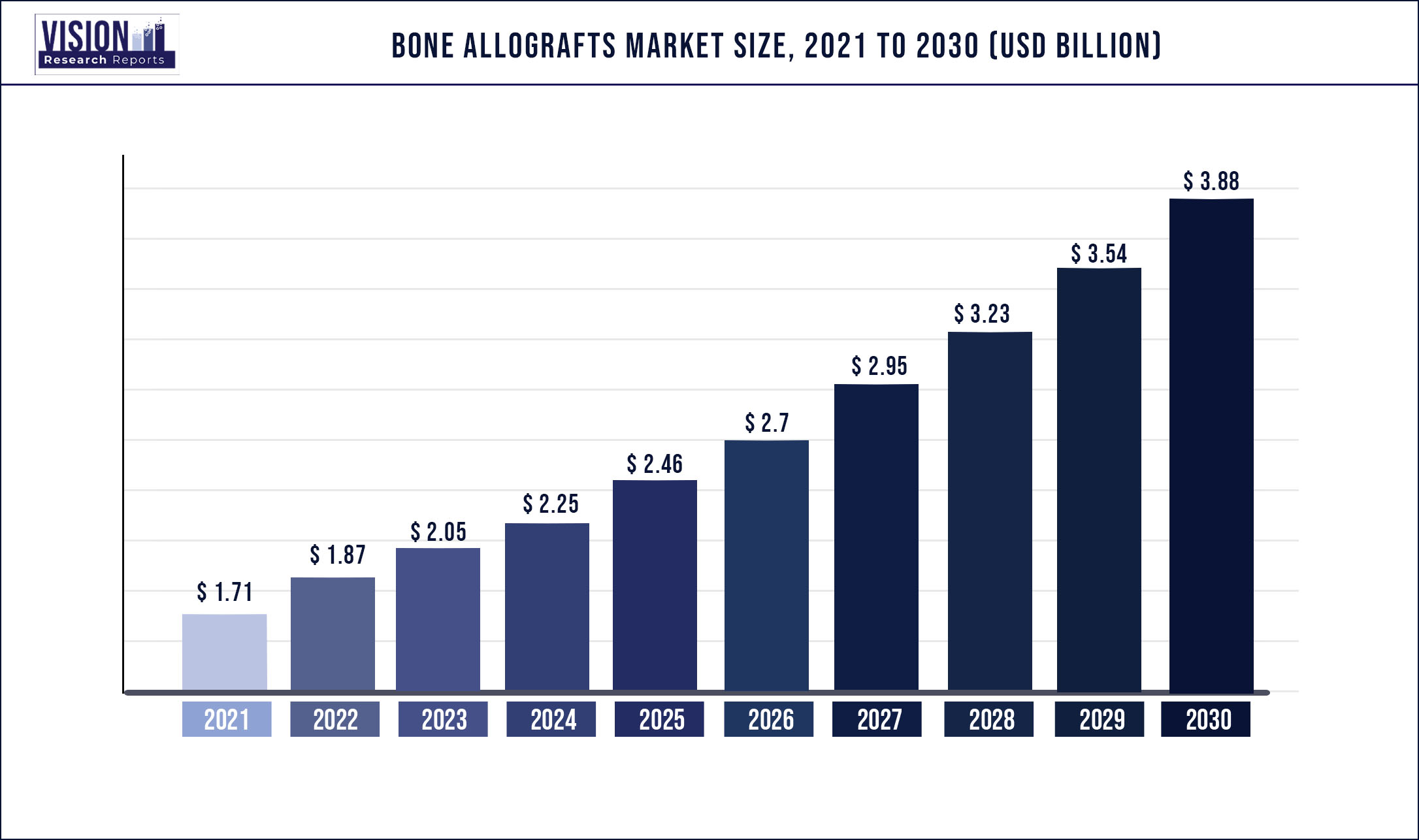

The global bone allografts market was surpassed at USD 1.71 billion in 2021 and is expected to hit around USD 3.88 billion by 2030, growing at a CAGR of 9.53% from 2022 to 2030.

Report Highlights

The rising prevalence of dental problems, ongoing product commercialization, market accessibility & product affordability, rising elderly population, and increasing public awareness regarding preventative care are the major factors driving the demand for dental bone allografts. For instance, about 530 million children experience caries of their primary teeth, according to the World Health Organization (2020), which further estimates that nearly 3.5 billion people are affected by oral disorders. Furthermore, the growing demand for minimally-invasive procedures will also support market growth.

As Minimally Invasive Spine Surgery (MISS) does not require a big incision, it reduces the risk of major injury to the muscles surrounding the spine and allows the surgeon to see only the area of the spine where the problem arises. Due to these approaches, such as using fewer devices, the surgical field (also known as exposure) is smaller, resulting in less pain and a speedier recovery. These factors are expected to drive the overall industry. The industry had a decline in 2020 as a result of the COVID-19 pandemic. All elective surgeries, including spine surgery, were postponed, and the hospitals were transformed into recognized COVID-19 treatment facilities. Such elements consequently hampered the industry expansion.

The expansion of treatment access in many developing countries is likely to increase the demand for healthcare-related products, notably those connected to spinal surgery. The market would expand as a result of the rising demand for these goods, as major developing regions’ economies become more prosperous. Furthermore, due to the temporary shutdown of dental clinics and the fact that all healthcare providers were occupied with COVID-19, dental procedure volumes were substantially decreased. Access was limited to only the most basic care. For instance, the American Dental Association (ADA) advised delaying elective dental surgeries until April 6, 2020, and dental offices should only offer emergency dental care. These factors severely impacted the supply chains of dental bone graft substitute producers.

Thus, these data points suggest that during the COVID-19 pandemic, the demand for dental bone graft alternatives decreased. In dentistry, bone allografts are frequently used. A skilled clinician who can handle and position the allografts in the proper position is required for the preparation and processing for safe use and successful transplant material. The materials’ antigenicity and danger of disease transfer from donor to the recipient are the main issues. Other bone-related operations, from small flaws to significant bone loss following tumor removal, also use bone allografts. Furthermore, the increasing medical and dental tourism sector, burden of dental illnesses, and technical developments in the field of dentistry are also among the key factors contributing to the industry growth.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 1.71 billion |

| Revenue Forecast by 2030 | USD 3.88 billion |

| Growth rate from 2022 to 2030 | CAGR of 9.53% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Type, application, end-use, region |

| Companies Covered | Zimmer Biomet; Medtronic; Lynch Biologics, LLC; Biomatlante; Stryker; Royal Biologics; Johnsons & Johnsons; Smith & Nephew; Baxter |

Type Insights

On the basis of types, the global industry has been further sub-segmented into demineralized bone matrices, and cortical, cancellous, & corticocancellous bone allografts. The demineralized bone matrix segment dominated the industry in 2021 and accounted for the maximum share of more than 35.8% of the total revenue. A demineralized bone matrix is a form of bone allograft utilized in bone defects and spinal fusion. The segment is anticipated to see growth throughout the forecast period, due to factors such as rising frequency of orthopedic ailments, rising spinal fusion & dental surgery cases, and rising patient base due to population growth.

For a variety of purposes, including treating bone and joint diseases, the demineralized bone matrix is frequently employed in orthopedic procedures. The demand is expected to increase due to a rise in orthopedic problems brought on by weakening bones. The population of individuals aged over 60 years was 900 million in 2015, and the World Health Organization’s (WHO) population division predicts that this number will increase to 2 billion by 2050. As a result, the rising prevalence of orthopedic problems and the growing geriatric population will support the growth.

Application Insights

On the basis of applications, the global industry has been further sub-segmented into dental, spine, reconstruction & traumatology, and others. The reconstruction & traumatology application segment is estimated to register the fastest growth rate of more than 9.4% during the forecast period. The dental application segment dominated the global industry in 2021 and accounted for the maximum share of the overall revenue. The dental segment is estimated to expand further at the second-fastest growth rate, maintaining its dominant position in the market throughout the forecast period.

The primary driver fueling the segment expansion is the rising use of bone grafts in dental implant procedures. In addition, the increasing frequency of periodontal disorders, root caries, and edentulous support the growth. In addition, the ongoing commercialization of products, growing healthcare industry, and high-quality services are increasing consumer awareness and are anticipated to support market expansion. Furthermore, the rising success rate of these operations will support the growth. It is also anticipated that the expanding dental tourism industry in developing nations will drive industry expansion. The introduction of new products will also accelerate future growth.

End-use Insights

On the basis of end-uses, the global industry has been further sub-segmented into hospitals & dental clinics, orthopedic & trauma centers, and others. The hospitals & dental clinics end-use segment dominated the global industry and accounted for the largest share of more than 44.6% of the overall revenue in 2021. The high share of this segment can be attributed to the fact that most facilities and technologically advanced implants are available in hospitals & dental clinics for treating & diagnosing spine disorders. With the growing demand for bone grafts for patients with spine disorders and dental pain, the segment is estimated to witness steady growth.

The orthopedics and trauma centers end-use segment, on the other hand, is estimated to register the fastest growth rate during the forecast years. These centers provide end-to-end care and management for all types of bone and joint disorders. Many patients experience less pain in their daily activities as a result of these centers' professional and individualized surgical approach to bone and joint disorders. Furthermore, surgeons at these centers are highly specialized, combining decades of experience with cutting-edge research to provide the best possible care.

Regional Insights

The North America region dominated the global industry in 2021 and accounted for the maximum share of more than 39.06% of the global revenue. Growing awareness related to the commercially accessible innovative products, accessibility to a well-developed healthcare structure, and higher healthcare expenditure, are the major aspects contributing to the regional growth. For instance, the amount spent on healthcare increased to $4.1 trillion by 2020 from an estimated $1.4 trillion in 2000. Compared to the 4.3 % growth from 2018 to 2019, health spending climbed by 9.7% between 2019 and 2020.

Furthermore, the market in the U.S. is leading the North American as well as the global industry by generating the maximum product demand, as a result of the growing number of trauma-related injuries as well as cases of orthopedic diseases. Europe is estimated to advance at the fastest CAGR from 2022 to 2030. The increasing global geriatric population is one of the key factors driving the artificial disc industry. The improvement in quality of life and total life expectancy was largely attributed to improvements in health facilities and disposable money. The geriatric population makes up a sizable portion of the subpopulation that is vulnerable to several diseases and disorders, including degenerative spine diseases.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Bone Allografts Market

5.1. COVID-19 Landscape: Bone Allografts Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Bone Allografts Market, By Type

8.1. Bone Allografts Market, by Type, 2022-2030

8.1.1 Cortical Bone Allografts

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Cancellous Bone Allografts

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Corticocancellous Bone Allografts

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Demineralized bone Matrices

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Bone Allografts Market, By Application

9.1. Bone Allografts Market, by Application, 2022-2030

9.1.1. Dental

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Spine

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Reconstruction & Traumatology

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Bone Allografts Market, By End-use

10.1. Bone Allografts Market, by End-use, 2022-2030

10.1.1. Hospitals & Dental Clinics

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Orthopedic and Trauma Centers

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Bone Allografts Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 12. Company Profiles

12.1. Zimmer Biomet

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Medtronic

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Lynch Biologics, LLC

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Biomatlante

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Stryker

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Royal Biologics

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Johnsons & Johnsons

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Smith & Nephew

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Baxter

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Xtant Medical

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others