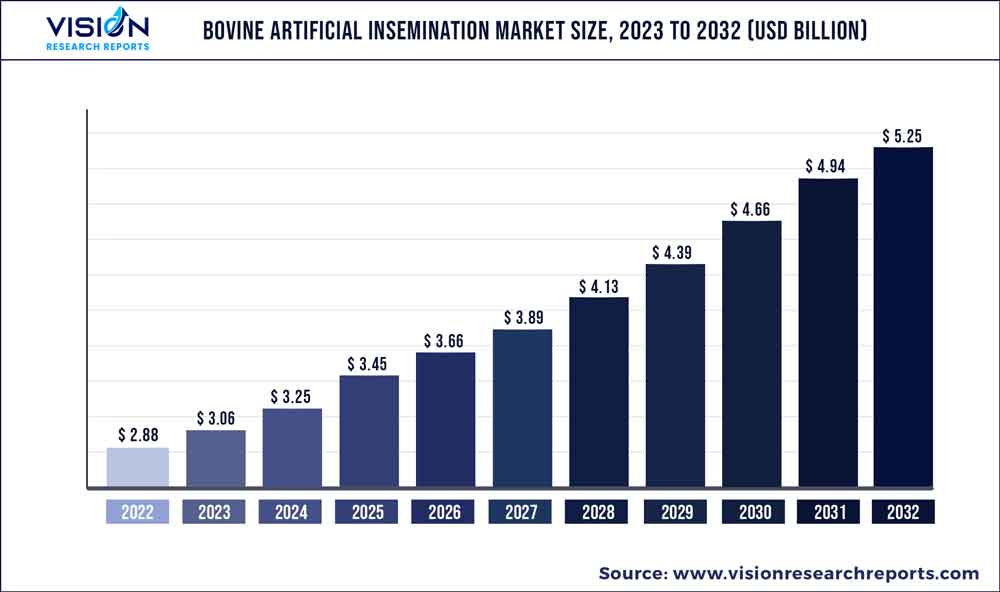

The global bovine artificial insemination market was surpassed at USD 2.88 billion in 2022 and is expected to hit around USD 5.25 billion by 2032, growing at a CAGR of 6.19% from 2023 to 2032. The bovine artificial insemination market in the United States was accounted for USD 0.77 billion in 2022.

Key Pointers

Report Scope of the Bovine Artificial Insemination Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 30.04% |

| CAGR of Asia Pacific from 2023 to 2032 | 7.02% |

| Revenue Forecast by 2032 | USD 5.25 billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.19% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Genus plc; IMV Technologies; SEMEX; Jorgensen Laboratories; URUS Group; STgenetics; National Dairy Development Board; Munster Bovine; World Wide Sires, Ltd.; Cogent Breeding Ltd. |

The market is driven by increasing demand for high-quality beef and dairy products, a focus on improving the genetic traits of bovines, as well as advancements in breeding technology. Artificial insemination facilitates animal owners to select the best sires for their cows, resulting in offspring with desirable traits such as increased milk production or meat yield.

As per OECD 2020-29 estimates, about 80% of the world’s milk production comprises cow milk. By 2029, India and Pakistan are projected to contribute to over 30% of the worldwide milk production. This is expected to propel the demand for bovine AI solutions to ensure efficient breeding programs. The COVID-19 pandemic limited access to artificial insemination solutions such as equipment, semen, and services. This led to dampened growth and reduced sales across the market. However, the market has recovered gradually since then, owing to unchanged underlying drivers.

For instance, advances in breeding technology have made artificial insemination a more efficient and affordable option for farmers. Semen can be collected from top-performing bulls and stored for use later, allowing farmers to access superior genetics without having to purchase expensive bulls or maintain them on their farms. Governments in many countries are also supporting the use of artificial insemination as a means of improving livestock productivity and reducing the environmental impact of animal agriculture.

Initiatives to ensure the highest possible genetic progress in bovines, such as cattle and buffaloes, are expected to fuel market growth. In December 2020, Evolution, VikingGenetics, and Masterrind came together to form a dairy and beef genetic cooperative - Arcowin. It is aimed at ensuring the highest possible and the most sustainable genetic progress. The leading stakeholders: Evolution, VikingGenetics, and Masterrind, are key cooperatives within cattle breeding, with strong bases in Finland, France, Germany, Denmark, and Sweden. The formation of Arcowin enabled the 3 organizations to use their genetic resources and investments better.

Solutions Insights

By solutions, the services segment dominated the market with a share of around 39.03% in 2022. The semen segment, on the other hand, is anticipated to advance at the highest CAGR of 6.89% during the forecast period. This is due to the growing awareness and adoption of bovine artificial insemination solutions across key markets. For example, Urus Group, one of the leading players in the market, has sold over 31.5 million straws of semen across the globe.

Within the semen segment, normal semen accounted for the larger share of the market in 2022, while the sexed semen segment is projected to grow at the fastest rate of 8.79%. The use of sexed semen allows farmers to improve the genetics in their herds as well as increase their chances of a heifer calf. In fact, as per VikingGenetics, over 70% of the VikingJersey semen sold by the company in 2020 was sexed semen. Thus, growing initiatives by market stakeholders and awareness about the benefits of sexed semen are estimated to fuel segment growth in the coming years.

Sector Insights

The dairy sector dominated the bovine artificial insemination market in 2022 with around 62.06% revenue share. It is also projected to expand at the fastest CAGR of 6.67% from 2023 to 2032. Increasing production of milk, rising consumption of dairy and dairy products, and the need to obtain animal protein sustainably are some of the key factors accounting for the share of the segment.

For instance, according to the 2022 OECD-FAO Agricultural Outlook, milk production across the world is estimated to increase from 901,646 kt pw in 2022 to 1,059,850 kt pw in 2031. Additionally, global consumption of fresh dairy products is projected to increase from 453,492 kt pw in 2022 to 555,998 kt pw in 2031.

The meat sector also held a significant share of the market in 2022, owing to increasing initiatives to ensure the safety of food sources and initiatives by market players.NuEra Genetics from ABS Global is an exclusive beef genetic program comprising SimAngus hybrid composite sires specifically selected for traits important to the beef supply chain- feed efficiency, growth, and carcass merit. It was developed to improve profitability through focused terminal genetic selection.

Distribution Channel Insights

In terms of distribution channel, the private segment held the highest share of 55.68% of the market in 2022. The segment is also estimated to witness the fastest growth of 6.75% during the projection period. Most companies operating in the market engage in direct sales activities or indirect sales via distribution partnerships. For instance, Genex (Urus Group) provides online shopping for bovine genetics and several herd care products. Customers can browse through product options from the company’s online catalog.

STgenetics too offers online catalogs, such as its Colored Breeds Specialist Catalog and Beef Add On Specialist Catalog for April 2023, to provide a comfortable shopping experience for its customers. Similar online shopping options are offered by other key players such as ABS. For instance, dairy semen options offered by ABS include Brown Swiss, Holstein, Jersey, Norwegian Red, St. Jacob’s, and Ayrshire. The public channel segment is also expected to hold a notable share of the market over the forecast period owing to various supportive initiatives deployed by governments.

Regional Insights

By region, North America held the largest share of over 30.04% of the global market for bovine artificial insemination in 2022. This share is attributed to the high adoption of artificial insemination solutions across the region as well as the increasing need to meet animal protein demand more sustainably. With artificial insemination, farmers have better control over the genetic traits of their bovines. They can choose sires with specific traits such as high milk production, disease resistance, or meat yield, and use them to breed cows that will produce offspring with similar characteristics.

Asia Pacific is estimated to expand at the highest CAGR of more than 7.02% from 2023 to 2032. This is due to rising awareness about the benefits of artificial insemination in bovines, the presence of local players, and supportive government initiatives. As per the National Dairy Development Board, India, bovine artificial insemination coverage in the country is about 30%, which amounts to around 80 million inseminations per year. Efforts to increase coverage include the breeding infrastructure formed under NDP I and RGM Scheme of the Indian government. This is expected to fuel regional growth.

Bovine Artificial Insemination Market Segmentations:

By Solutions

By Sector

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Solutions Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Bovine Artificial Insemination Market

5.1. COVID-19 Landscape: Bovine Artificial Insemination Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Bovine Artificial Insemination Market, By Solutions

8.1. Bovine Artificial Insemination Market, by Solutions, 2023-2032

8.1.1 Equipment & Consumables

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Semen

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Bovine Artificial Insemination Market, By Sector

9.1. Bovine Artificial Insemination Market, by Sector, 2023-2032

9.1.1. Meat

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Dairy

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Bovine Artificial Insemination Market, By Distribution Channel

10.1. Bovine Artificial Insemination Market, by Distribution Channel, 2023-2032

10.1.1. Private

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Public

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Bovine Artificial Insemination Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Solutions (2020-2032)

11.1.2. Market Revenue and Forecast, by Sector (2020-2032)

11.1.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Solutions (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Sector (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Solutions (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Sector (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Solutions (2020-2032)

11.2.2. Market Revenue and Forecast, by Sector (2020-2032)

11.2.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Solutions (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Sector (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Solutions (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Sector (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Solutions (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Sector (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Solutions (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Sector (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Solutions (2020-2032)

11.3.2. Market Revenue and Forecast, by Sector (2020-2032)

11.3.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Solutions (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Sector (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Solutions (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Sector (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Solutions (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Sector (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Solutions (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Sector (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Solutions (2020-2032)

11.4.2. Market Revenue and Forecast, by Sector (2020-2032)

11.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Solutions (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Sector (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Solutions (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Sector (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Solutions (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Sector (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Solutions (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Sector (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Solutions (2020-2032)

11.5.2. Market Revenue and Forecast, by Sector (2020-2032)

11.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Solutions (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Sector (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Solutions (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Sector (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 12. Company Profiles

12.1. Genus plc

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. IMV Technologies

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. SEMEX

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Jorgensen Laboratories

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. URUS Group

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. STgenetics

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. National Dairy Development Board

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Munster Bovine

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. World Wide Sires, Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Cogent Breeding Ltd.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others