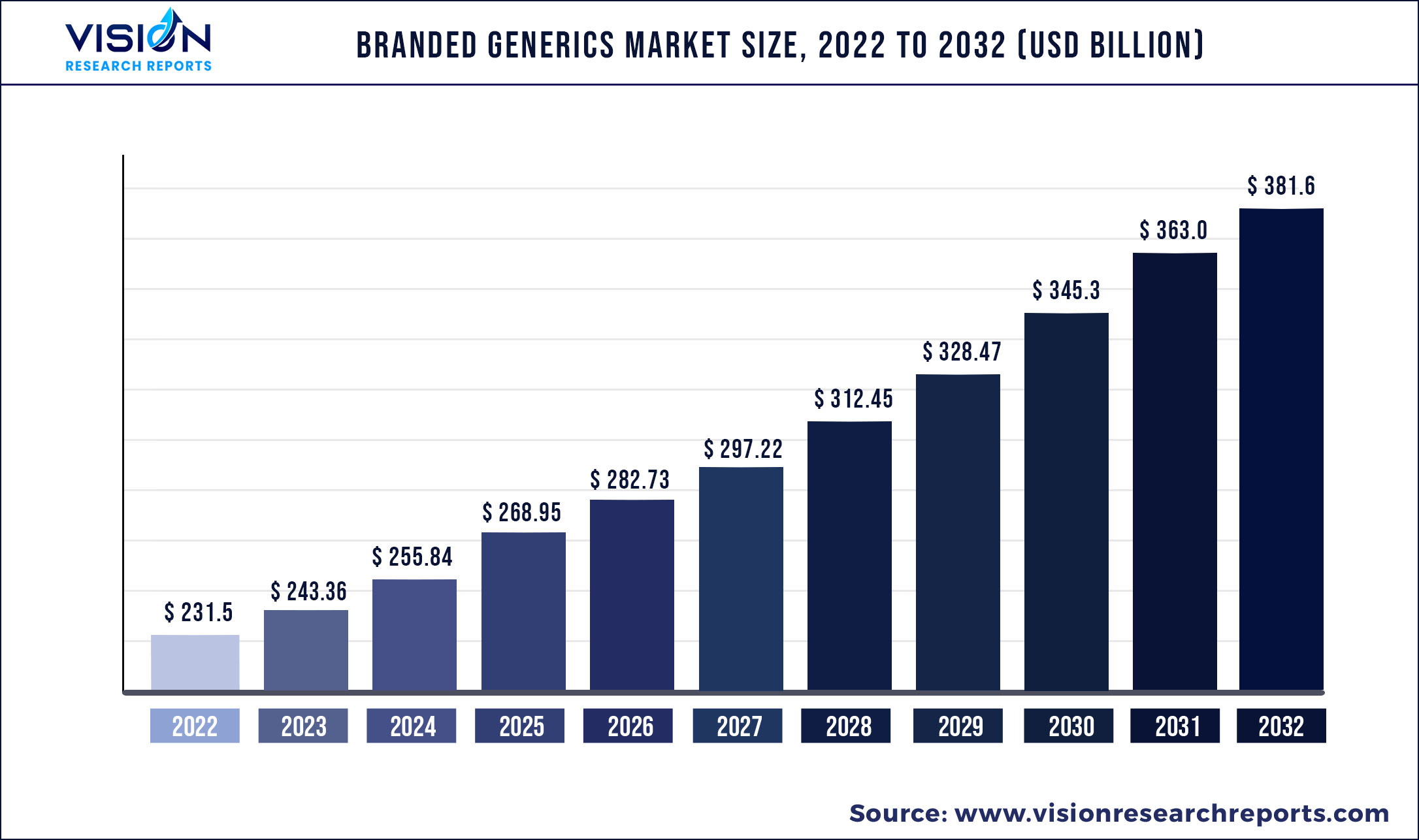

The global branded generics market size was valued at USD 231.5 billion in 2022 and is expected to reach around USD 381.6 billion by 2032 with a compound annual growth rate (CAGR) of 5.12% from 2023 to 2032.

Ket Pointers

The rising prevalence of chronic diseases, increasing penetration of branded generic drugs, increasing government initiatives to promote generic products, and patent expiry of major drugs are some of the primary industry growth drivers. The expiry of patent exclusivity of innovator drugs provides opportunities for generic manufacturers to introduce products at a reduced price. The low cost of generic drugs improves patients' affordability and helps reduce healthcare expenditure per capita. For instance, as the U.S. patent exclusivity period of Bristol-Myers Squibb Company proprietary Sprycel (Dasatinib) ended in 2020, generic companies such as Apotex and Dr. Reddy's Laboratories have filed ANDA for the launch of generic versions of the product.

Moreover, the high frequency of ANDA approvals and the launch of generic products is another crucial factor supporting market growth. According to the FDA’s annual report, in 2021, FDA approved 93 first generics, while the number was 72 in 2020. However, it can be observed that the number of ANDA approvals decreased from 1,014 in 2019 to 948 in 2020, and further decreased to 776 in 2021. Such a decrease in the trend of ANDA approvals for generic drugs could impede industry growth.

The market has been moderately impacted by the COVID-19 pandemic. During this period, a slowdown and disruption in the supply chain of pharmaceuticals was observed, due to the strategies designed to control the spread of the pandemic. In addition, regulatory operations were also affected, such as the authorization and the Health Technology Assessment process. Decisions on reimbursements have been de-prioritized. It also affected drug prescription and uptake rate moderately.

For instance, in the U.K., according to the NHS, approximately 20 million antidepressant medications were prescribed in March 2021; in January 2021, the number was around 20.5 million. However, the impact of COVID-19 reduced significantly by the end of 2020 in most countries. Whereas in some countries affected by the third wave of COVID-19, the effect lasted until the third quarter of 2021.

The growing burden of non-infectious & infectious diseases and the increasing geriatric population, which is more susceptible to chronic diseases, such as hypertension, diabetes, and obesity, are anticipated to positively impact the market growth. There were 537 million patients suffering from diabetes in 2021 globally. The prevalence rate of diabetes is growing rapidly in low- and middle-income countries. According to the International Diabetes Federation data for 2021, approximately 643 million people will be suffering from diabetes by 2030 and 783 million by 2045.

Companies are introducing novel products to strengthen their portfolio. For instance, in April 2020, Dr. Reddy's Laboratories Ltd. introduced Invista in India. This product is the branded generic version of Sprycel (dasatinib) indicated for the treatment of adult patients with Chronic Myeloid Leukemia (CML).

Branded Generics Market Segmentations:

| By Drug Class | By Application | By Route of Administration | By Distribution Channel |

| Alkylating Agents Antimetabolites Hormones Anti-hypertensive Lipid Lowering Drugs Anti-depressants Anti-psychotics Anti-Epileptics Others |

Oncology Cardiovascular Diseases Neurological Diseases Gastrointestinal Diseases Dermatological Diseases Acute And Chronic Pain Others |

Topical Oral Parenteral Others |

Hospital Pharmacy Retail Pharmacy Online Pharmacy |

Branded Generics Market Key Players and Regions Segmentations:

| Key Players | Geography |

| Teva Pharmaceutical Industries Ltd. Sun Pharmaceutical Industries, Ltd. Dr. Reddy's Laboratories Ltd. Endo International plc GlaxoSmithKline plc Lupin Sanofi Pfizer, Inc. Apotex, Inc. Viatris, Inc. |

North America Europe Asia-Pacific Latin America Middle East & Africa (MEA) |

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others