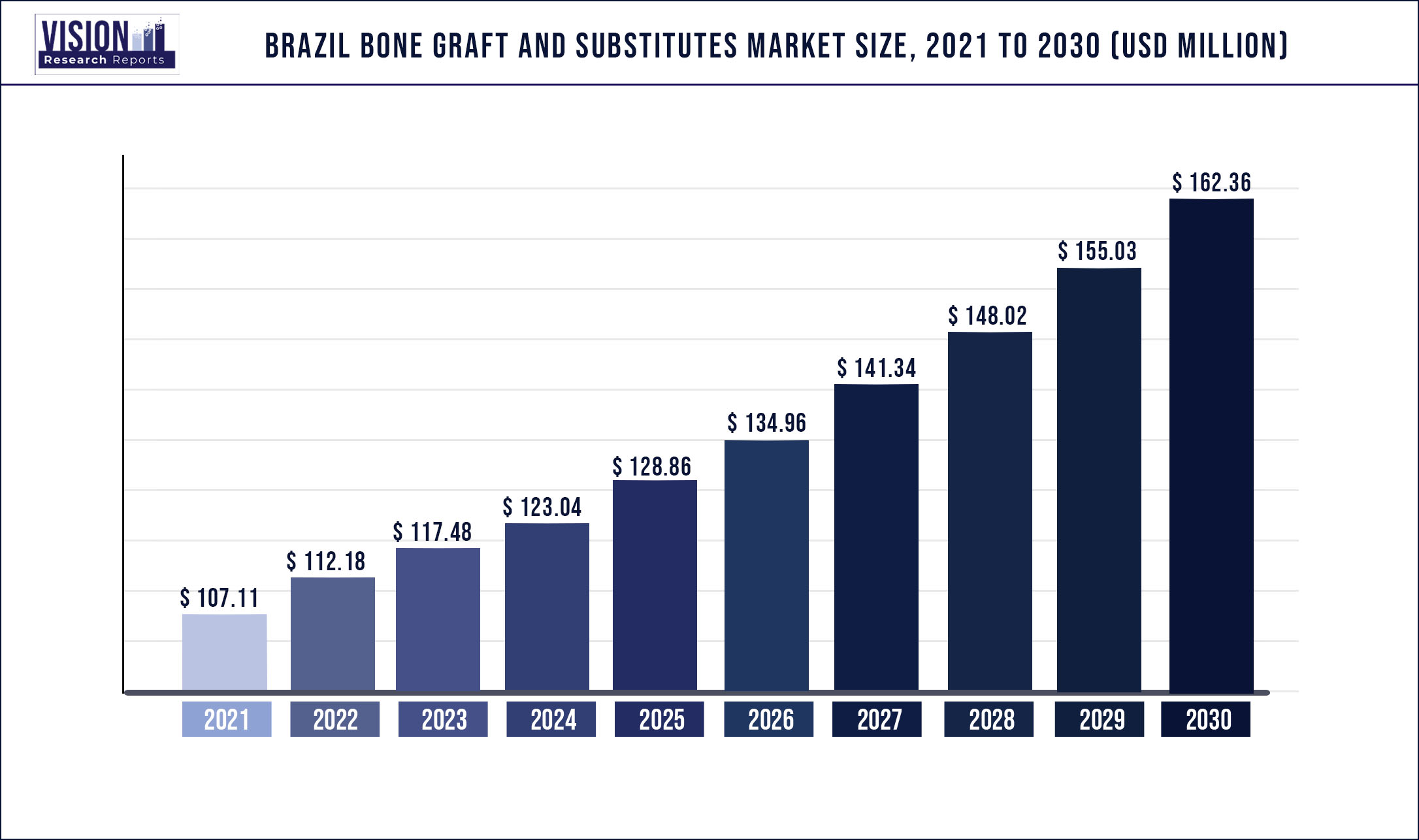

The Brazil bone graft and substitutes market was valued at USD 107.11 million in 2021 and it is predicted to surpass around USD 162.36 million by 2030 with a CAGR of 4.73% from 2022 to 2030.

Allografts and synthetic materials are included in the material type segment. Allografts are further classified as demineralized bone matrix and others. Synthetic materials are subdivided into bone morphogenetic proteins (BMP), polymers, composites, and ceramics. In 2021, the synthetic segment held the largest revenue market share in Brazil, primarily owing to the advantages of synthetics over allografts. For instance, synthetic bone grafts can enable repairs over a larger area of bone since it is more readily available.

Due to its widespread acceptability among dentists in Brazil, dental application is expected to dominate others. Off-label sales are still a strong trend in the country; off-label products draw in a large customer base by promising high quality at a significantly lower price than branded variants

Furthermore, increasing obesity rates among Brazilians because of population aging and rising incidences of orthopedic disorders, including spinal fusions, are factors boosting the market growth. For instance, according to the Brazilian Institute of Geography and Statistics (IBGE), 17.4% of people in Brazil will likely be aged 65 & above by 2040, an increase from the current 9.2%. Brazil's elderly population is projected to reach 25.5% of the total population by 2060, thereby increasing the prevalence of chronic orthopedic illnesses.

Due to the pricing competitiveness that local manufacturers confront, overseas players are subject to intense competition. Moreover, companies like Johnson & Johnson and Medtronic are able to maintain a competitive market position owing to the continued availability of DBM products and the customers' brand loyalty.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 107.11 million |

| Revenue Forecast by 2030 | USD 162.36 million |

| Growth rate from 2022 to 2030 | CAGR of 4.73% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Material type, application |

| Companies Covered |

Depuy Synthes (J&J); Medtronic; Nuvasive, Inc.; Orthofix Medical, Inc.; Smith & Nephew, Inc.; Stryker; Zimmer Biomet; Geistlich Pharma AG; BAUMER; GMReis;Einco Biomaterial;Bionnovation; Ceramisys (Distributor: Asher Medical Products); Osseocon Biomateriais; NEOORTHO |

Material Type Insights

Allografts and synthetic bone substitutes are the two broad categories based on the material type segment. Allografts are further subdivided into the demineralized bone matrix and others. Ceramics, composites, polymers, and bone morphogenetic proteins are examples of synthetic bone grafts. In surgery, the usage of bone replacements is growing. Allografts, or banked bone, are osteoconductive and mildly osteoinductive. This sub-segment still faces challenges in pricing, donor availability, and residual infections. Bone grafting is the second most common tissue transplant, immediately after a blood transfusion.

Moreover, synthetic material types account for more than 54% of the revenue market share in 2021, with the expansion of this segment being aided by rising demand for ceramic material types. For instance, according to the responses of the study published by Acta Odontológica Latinoamericana in December 2020, it was found that ceramic compositions were the most frequently recommended, followed by composite compositions.

Application Insights

On the basis of application, dental is anticipated to dominate the market during the forecast period, with a maximum share of over 31.05% in 2021. T+his is attributed to dentists' increasing adoption of ceramics and other synthetic materials. Furthermore, the ceramic-based synthetic materials segment, which is anticipated to grow at the fastest CAGR of 5.02% throughout the forecast period, supports the dental application segment.

The majority of the market's space is controlled by the smaller rivals, many of which are Brazilian. Alongside the expansion of the manufacturing industry, new competitors are acquiring market share by offering competitive prices. The two exceptions to this trend, Geistlich and Straumann Group, are high-end, international businesses. As a result of the dentists' early exposure to their products during the training process, they have been able to maintain a strong presence through R&D and brand placement.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Brazil Bone Graft And Substitutes Market

5.1. COVID-19 Landscape: Brazil Bone Graft And Substitutes Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Brazil Bone Graft And Substitutes Market, By Material Type

8.1. Brazil Bone Graft And Substitutes Market, by Material Type, 2022-2030

8.1.1. Allograft

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Synthetic

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Brazil Bone Graft And Substitutes Market, By Application

9.1. Brazil Bone Graft And Substitutes Market, by Application, 2022-2030

9.1.1. Craniomaxillofacial

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Dental

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Foot & Ankle

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Joint Reconstruction

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Long Bone

9.1.5.1. Market Revenue and Forecast (2017-2030)

9.1.6. Spinal Fusion

9.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Brazil Bone Graft And Substitutes Market, Regional Estimates and Trend Forecast

10.1. Brazil

10.1.1. Market Revenue and Forecast, by Material Type (2017-2030)

10.1.2. Market Revenue and Forecast, by Application (2017-2030)

Chapter 11. Company Profiles

11.1. Depuy Synthes (J&J) Depuy Synthes (J&J)

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Medtronic

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Nuvasive, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Orthofix Medical, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Smith & Nephew, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Stryker

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Zimmer Biomet

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Geistlich Pharma AG

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. BAUMER

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. GMReis

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others